false

0001526113

0001526113

2024-05-08

2024-05-08

0001526113

us-gaap:CommonStockMember

2024-05-08

2024-05-08

0001526113

us-gaap:SeriesAPreferredStockMember

2024-05-08

2024-05-08

0001526113

us-gaap:SeriesBPreferredStockMember

2024-05-08

2024-05-08

0001526113

us-gaap:SeriesDPreferredStockMember

2024-05-08

2024-05-08

0001526113

us-gaap:SeriesEPreferredStockMember

2024-05-08

2024-05-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 8, 2024

Global

Net Lease, Inc.

(Exact name of registrant as specified in its

charter)

| Maryland |

|

001-37390 |

|

45-2771978 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 650 Fifth Avenue, 30th Floor |

|

|

| New York, New York |

|

10019 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (332) 265-2020

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, $0.01 par value per share |

|

GNL |

|

New York Stock Exchange |

| 7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share |

|

GNL PR A |

|

New York Stock Exchange |

| 6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR B |

|

New York Stock Exchange |

| 7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par

value per share |

|

GNL PR D |

|

New York Stock Exchange |

| 7.375%

Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR E |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 7.01 Regulation FD Disclosure.

On May 8, 2024, Global

Net Lease, Inc. (the “Company”) hosted a conference call to discuss its financial and operating results for the quarter ended

March 31, 2024. A transcript of the pre-recorded portion of the conference call is furnished as Exhibit 99.1 to this Current Report on

Form 8-K. As previously disclosed, a replay of the entire conference call is available through August 8, 2024 by telephone as follows:

Domestic Dial-In (Toll Free): 1-844-512-2921

International Dial-In: 1-412-317-6671

Conference Number: 13745186

The information set forth

in Item 7.01 of this Current Report on Form 8-K and in the attached Exhibit 99.1 is deemed to be “furnished” and shall not

be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section. The information set forth in Item 7.01 of this Current Report on

Form 8-K, including Exhibit 99.1, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities

Act of 1933, as amended, regardless of any general incorporation language in such filing.

The statements in this Current Report on Form 8-K that are not historical

facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements involve risks and uncertainties that could cause the outcome to be materially different. The words such as “may,”

“will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,”

“projects,” “potential,” “predicts,” “plans,” “intends,” “would,”

“could,” “should” and similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties

and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from

the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated with realization

of the anticipated benefits of the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property

management and advisory functions; that any potential future acquisition or disposition by the Company is subject to market conditions

and capital availability and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although

not all risks and uncertainties, that could cause the Company’s actual results to differ materially from those presented in its

forward-looking statements are set forth in the Risk Factors and “Quantitative and Qualitative Disclosures About Market Risk”

sections in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and all of its other filings with the

U.S. Securities and Exchange Commission, as such risks, uncertainties and other important factors may be updated from time to time in

the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes

no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events

or changes to future operating results over time, unless required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number |

|

|

| 99.1 |

|

Transcript. |

| 104 |

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

GLOBAL NET LEASE, INC. |

| |

|

|

|

| Date: |

May 8, 2024 |

By: |

/s/ Edward M. Weil, Jr. |

| |

|

Name: |

Edward M. Weil, Jr. |

| |

|

Title: |

Chief Executive Officer and President (Principal Executive Officer) |

Exhibit 99.1

Operator

Good afternoon and welcome to the Global Net Lease

First Quarter 2024 Earnings Call. [Operator Instructions]. I would now like to turn the conference over to Jordyn Schoenfeld, Associate

at Global Net Lease. Please go ahead.

Jordyn Schoenfeld

Thank you. Good morning, everyone and thank you

for joining us for GNL's first quarter 2024 Earnings Call. Joining me today on the call is Mike Weil, GNL’s Chief Executive Officer

and Chris Masterson, GNL’s Chief Financial Officer.

The following information contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Please review the forward-looking and cautionary

statements section at the end of our first quarter 2024 earnings release for various factors that could cause actual results to differ

materially from forward-looking statements made during our call today. As stated in our SEC filings, GNL disclaims any intent or obligation

to update or revise these forward-looking statements except as required by law. Also, during today's call, we will discuss certain non-GAAP

financial measures, which we believe can be useful in evaluating the company's financial performance. Descriptions of those non-GAAP financial

measures that we use, such as AFFO and Net Debt to Adjusted EBITDA, and reconciliations of these measures to our results as reported in

accordance with GAAP are detailed in our earnings release and in our Quarterly Report on Form 10-Q for the First Quarter 2024.

I'll now turn the call over to our CEO, Michael

Weil. Mike?

Mike Weil

Thanks, Jordyn. Good morning and thank you all

for joining us today.

We are pleased to share with you the results of

a successful first quarter that included AFFO per share growth, strong leasing momentum, efficient balance sheet execution and continued

synergies and internalization savings.

As part of GNL’s Q4 2023 earnings release,

we shared our 2024 business strategy and full-year guidance, which we believe will increase long-term shareholder value by delevering

our balance sheet, reducing our exposure to variable rate debt and lowering Net Debt to Adjusted EBITDA. At the core of this strategy

is an asset disposition program, targeting $400 million to $600 million in total sale proceeds, at a cash cap rate between 7.0% and 8.0%

on occupied assets.

We are excited with the significant progress we

have achieved to date. As of May 1st, our closed dispositions plus pipeline totals $554

million at a cash cap rate of 7.2% on occupied assets and a weighted average remaining lease term of 3.9

years. This includes:

| • | $63 million of successfully closed dispositions at a cash cap rate of 6.8% on occupied assets; |

| • | $482 million of dispositions currently under PSA at a cash cap rate of 7.3% on occupied assets; and |

| • | $9 million of dispositions with executed LOIs at a cash cap rate of 7.0% on occupied assets. |

We are very pleased to have built this robust

pipeline in the early stages of our strategic disposition effort and expect to identify additional opportunities throughout the year.

We believe the 7.2% cash cap rate on the occupied dispositions referenced above offers proof of value of our primarily investment-grade

portfolio and represents a significant premium compared to where GNL is currently trading on an implied cap rate basis.

It’s important to note that these strategic

dispositions primarily consist of non-core assets and opportunistic sales, including assets with near-term debt or lease maturities. They

include the sale of 15 Truist properties totaling nearly $35 million for a cash cap rate of 6.6%. Additionally, we have nearly $132 million

of vacant property dispositions that are closed or under agreement that we expect will eliminate $3 million of annualized operating expenses,

assuming closing of the transactions contemplated by such agreements.

In addition to the significant progress we achieved

in our disposition program, we are also pleased to deliver a 6% growth in AFFO per share this quarter compared to last quarter. We will

continue focusing on earnings growth in addition to our disposition program, which is expected to be earnings neutral.

We’ve also achieved significant progress

on the capital markets front, completing a $237 million CMBS re-financing in April, secured by 20 U.S. industrial properties previously

financed under the Company’s corporate credit facility. This is a great accomplishment in the current real estate capital markets

environment that we believe reflects GNL’s strong and diversified portfolio. The financing is interest-only at a fixed all-in interest

rate of 5.74%, representing a substantial 159 basis points reduction compared to the current floating interest rate on the U.S. Dollar

portion of the Company’s corporate credit facility. It results in a reduction of over $3.5 million in annualized interest expense,

which will begin to benefit us in Q2 2024, and, notably, extends our weighted average debt maturity while increasing our exposure to fixed

rate debt.

This attractively priced financing also addresses

our near-term debt maturities by proactively increasing flexibility and capacity on our corporate credit facility. As of May 1st,

we have already addressed 62% of the debt that had scheduled maturities in 2024. Specifically, we refinanced two mortgages onto our credit

facility, including our $129 million McLaren Headquarters mortgage that matured in April, as well as $25 million of multi-tenant mortgage

debt. As mentioned on our fourth quarter 2023 earnings call, we recently completed an $80 million refinancing agreement with Nordea Bank

secured by multiple properties in Finland that extends debt maturities of these assets to 2029 at a 5.1% interest rate. We expect that

the remaining $155 million of debt maturing in 2024 will be addressed through our disposition strategy or placed onto our credit facility.

As for 2025 maturities, no debt is maturing until

the third quarter of next year and we intend on addressing it through disposition proceeds, permanent refinancing, bonds and/or availability

on the corporate credit facility in the later part of 2024 or early 2025, anticipating a slightly more favorable environment.

During the first quarter of 2024, we also showcased

our strong asset management capabilities through robust leasing activity and positive leasing spreads encompassing nearly 1.4 million

square feet with attractive renewal spreads that were 6.1% higher than expiring rents. New leases that were completed in the first quarter

of 2024 have a weighted average lease term of 10.2 years, while the renewals that were completed in the first quarter of 2024 have a weighted

average lease term of 5.8 years.

Notably, the single-tenant segment completed 13

new leases and renewals highlighted by an 11% renewal leasing spread, demonstrating the strong renewal demand for our mission critical

assets while adding $6.9 million in straight-line rent. The multi-tenant segment completed 65 new leases and renewals resulting in a 2%

renewal spread, consistent with the high demand we are experiencing at our suburban shopping centers, which increased straight-line rent

by $10.4 million.

Turning to our portfolio, as of the end of the

first quarter, we owned 1,277 properties spanning nearly 67 million square feet, with a gross asset value of $9.0 billion. We believe

the diverse composition of our net lease portfolio is unmatched across geography, asset type, tenant and industry, and positions

GNL to effectively navigate external macro challenges as we move ahead. The portfolio’s occupancy stands at 93% with a weighted

average remaining lease term of 6.5 years.

I want to note that our portfolio occupancy experienced

a short-term impact due to the vacancy of Klaussner, a furniture manufacturing tenant that originally occupied five properties at only

$2.13 of rent per square foot. We were able to re-lease two of the properties at the same rental rate with no downtime. The three remaining

vacant properties previously represented only 55 basis points of GNL’s total straight-line rent but caused a 2.5% short-term decline

in overall occupancy given that it occupied 1.7 million square feet. Two of the properties are already under contract to sell and are

expected to close in the second quarter. The last property is also on the market and we are actively engaged with potential buyers. I

want to reiterate the minimal impact this has on our straight-line rent, further illustrating our highly diversified portfolio with little

concentration risk.

Additionally, given the public disclosures regarding

Family Dollar’s intention to close some stores in 2024, I'd like to share that GNL’s exposure to Family Dollar represents

only 0.09% of SLR. We have not received any indication that any of the stores they currently lease from us are part of the early store

closures. This exposure is limited after GNL proactively disposed of $112 million of its Family Dollar holdings in 2019, as we anticipated

potential headwinds for this tenant. Furthermore, given the recent developments regarding Red Lobster’s financial troubles, we are

pleased to announce that GNL has no exposure to Red Lobster. We continue to monitor all our tenants and their business operations on a

regular basis. The minimal exposure to these retailers showcases the diversification of our portfolio and our strong underwriting, which

we believe limits our credit and concentration risk.

Geographically, 80% of our straight-line rent

is earned in North America, and 20% from Europe. The portfolio also features a stable tenant base and a high-quality of earnings with

an industry-leading 58% of tenants receiving an investment-grade or implied investment-grade rating. From a growth perspective, the portfolio

includes an average annual contractual rental increase of 1.3%. I would encourage everyone to look at our first quarter 2024 Investor

Presentation on our website for more details on each segment of our portfolio.

I’d like to take a moment to highlight the

addition of two independent and highly distinguished Board Members during the first quarter: Michael J. U. Monahan and Rob Kauffman. Mike

currently serves as a CBRE Vice Chair, and brings extensive real estate expertise, and Rob, a co-founder of Fortress Investment Group,

possesses a wealth of relevant capital market knowledge. Both have already brought invaluable insight and perspective to the Board, and

we look forward to their continued contributions in shaping GNL’s future.

Looking ahead, we remain committed to executing

on our systematic and prudent approach to achieving our financial objectives, which revolve around reducing our Net Debt to adjusted EBITDA

ratio while organically enhancing NOI through lease-up initiatives and contractual rent growth. Our asset disposition program, in which

we have made significant progress, is a pivotal component of this strategy and should provide us with incremental capital to deleverage

our balance sheet.

I'll turn the call over to Chris to walk through

the financial results and balance sheet matters in more detail. Chris?

Chris Masterson

Thanks, Mike. Please note that, as always, a reconciliation

of GAAP net income to the non-GAAP measures can be found in our earnings release, which is posted on our website.

For the first quarter 2024 we recorded

revenue of $206 million and a net loss attributable to common stockholders of $35 million, compared to $207 million and $60 million in

Q4 2023, respectively. Core FFO was up 17% to $57 million or $0.25

per share in Q1 2024, compared to $48 million, or $0.21 per share in Q4 2023. AFFO increased

5% to $75 million, or $0.33 per share in the first quarter of 2024, compared to $72

million, or $0.31 per share, in Q4 2023, representing a 6% AFFO per share increase

from last quarter. As discussed last quarter, following the successful completion of a European tax restructuring, we have seen a reduction

in income tax expense from $5.5 million in Q4 2023 to $2.4 million in Q1 2024.

Looking at our balance sheet, it’s important

to note that even though 84% of our debt is subject to fixed rates, the current sustained high interest rate environment does have a temporary

effect on the portion of our debt that isn’t fixed or swapped. To mitigate this, we have reduced our exposure to variable rate debt

through our new $237 million CMBS re-financing while also extending our weighted average debt maturity. To further increase our level

of fixed rate debt and lower our cost of capital, we have also taken the proactive approach of swapping $300 million of the U.S. Dollar

portion of our corporate credit facility at an interest rate that is 120 basis points lower than the current floating interest rate. This

swap was effective as of April 1, 2024, and is expected to reduce our annualized interest expense by $3.6 million. Additionally, we entered

into 200 million of GBP swaps on March 18, 2024 that are approximately 90 basis points lower than the 1-month SONIA and are expected to

decrease annualized interest expense by $2.2 million. We expect to realize the full benefit of these actions beginning in Q2 2024.

At the end of the first quarter, our Net Debt

to adjusted EBITDA ratio was 8.4x based on Net Debt of $5.2 billion. As expected, Net Debt to adjusted EBITDA remains unchanged from the

prior quarter, as the previous announced dividend reduction, which increases incremental cash used to lower debt, only occurred in April,

as well as the majority of our announced dispositions will close in Q2 or Q3 of 2024. Our weighted-average interest rate was 4.8%, and

we had liquidity of approximately $175 million and $190 million of capacity on our credit

facility.

Our debt comprises $1 billion in senior notes,

$1.8 billion on the multi-currency revolving corporate credit facility and $2.6 billion of outstanding gross mortgage debt. Our debt was

84% fixed rate, which includes floating rate debt with in-place interest rate swaps, and our interest coverage ratio was 2.4x. As of March

31, 2024 we had approximately 230.8 million common shares outstanding. On a weighted average basis, there were approximately 230.3 million

shares outstanding during the first quarter of 2024.

Turning to our outlook for the balance of 2024,

based on progress to date, we are reaffirming our AFFO per share guidance range of $1.30 to $1.40 and a Net Debt to adjusted EBITDA range

of 7.4x to 7.8x.

I'll now turn the call back to Mike for some closing

remarks.

Mike Weil

Thanks, Chris.

GNL executed well on our near-term strategic objectives

in the first quarter of 2024. We made significant progress on our strategic disposition plan, building a robust $554 million closed plus

disposition pipeline. The 7.2% cash cap rate we are achieving on the announced occupied assets represents a significant premium compared

to the implied value of this portfolio based on the current trading price. We are committed to increasing shareholder value and continuing

this disposition initiative until we close the gap between the value of our real estate and our stock price. I want to reiterate that

we plan on using the net proceeds received from these incremental dispositions to continue lowering our Net Debt to Adjusted EBITDA, bringing

it more in line with our peers.

In addition to our disposition program, we continue

to benefit from G&A synergies as a direct result of the merger and internalization. Through Q1 2024, we have realized over $70 million

of synergies and we remain on track to achieve the full $75 million annualized cost savings by Q3 2024. We will also benefit from the

$3 million reduction in annualized operating expenses through the sale of vacant assets, $3.5 million of annualized interest savings from

our CMBS refinance and $5.8 million of annualized interest savings from our corporate credit facility swaps. The AFFO per share growth,

continued leasing momentum, strong portfolio performance and significant disposition progress we achieved this quarter reflect our commitment

to enhancing our balance sheet, reducing leverage and positioning GNL for sustainable growth in the future, ultimately creating shareholder

value over the long term. As always, we’re available to answer any questions you may have on this quarter after the call.

Operator, please open the line for questions.

Question-and-Answer Session

Operator

[Operator Instructions]

v3.24.1.u1

Cover

|

May 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 08, 2024

|

| Entity File Number |

001-37390

|

| Entity Registrant Name |

Global

Net Lease, Inc.

|

| Entity Central Index Key |

0001526113

|

| Entity Tax Identification Number |

45-2771978

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

650 Fifth Avenue

|

| Entity Address, Address Line Two |

30th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

332

|

| Local Phone Number |

265-2020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value per share

|

| Trading Symbol |

GNL

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR A

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR B

|

| Security Exchange Name |

NYSE

|

| Series D Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par

value per share

|

| Trading Symbol |

GNL PR D

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.375%

Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR E

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

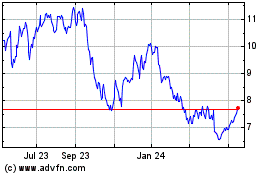

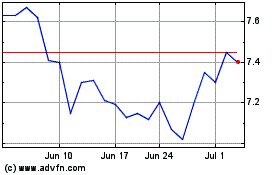

Global Net Lease (NYSE:GNL)

Historical Stock Chart

From Apr 2024 to May 2024

Global Net Lease (NYSE:GNL)

Historical Stock Chart

From May 2023 to May 2024