LVMH Shares Climb on Strong Results, Confidence in China

February 03 2016 - 8:03AM

Dow Jones News

By Jason Chow

PARIS--Shares in LVMH Moët Hennessy Louis Vuitton SE jumped as

much as 7% on Wednesday as investors were encouraged by the French

luxury group's strong fourth-quarter revenue growth and Chief

Executive Bernard Arnault's confidence that Chinese consumers would

keep spending on expensive handbags and pricey liquor.

Shares were trading at EUR154.50 by midday, off a morning peak

but still 6% higher than the previous day's close.

LVMH reported Tuesday evening a 12% rise in fourth-quarter

revenues, fueled by strong demand for its fashion and leather goods

as well as its alcoholic drinks. The luxury bellwether--LVMH's

brand portfolio includes fashion, accessories, liquor, jewelry and

watches as well as the DFS duty-free chain and the Sephora

cosmetics label--showed signs of resilience amid weak global

economic growth and the Nov. 13 attacks in Paris that curbed

tourist flows to the French capital.

LVMH, which generated EUR10.38 billion ($11.3 billion) in sales

during the final three months of last year, was also optimistic

that it would continue to grow despite the unsteady economic

outlook and a major downturn in global stock markets.

Mr. Arnault said that fears about a slowdown in sales to Chinese

consumers--a demographic that experts say make up more than a third

of total overall global luxury spending--were overblown.

"Analysts underestimate the Chinese economy," he said Tuesday

evening. "The fundamentals are good. Household spending is still

increasing, and that's important to us."

Mario Ortelli, a luxury analyst at Sanford C. Bernstein, said he

was "encouraged by the company CEO's confidence going into 2016

despite the volatile economic environment."

However, not all in the luxury industry are faring well. Swatch

Group AG, which owns high-end brands including Longines, Breguet

and Omega, said Wednesday net profit fell to 1.09 billion Swiss

francs from 1.38 billion francs, hurt by the strength of the Swiss

currency and weak demand for expensive timepieces. The profit

figure was also below analysts' expectations.

That news sent shares in the Swiss watch company down as much as

4% in early trading, before rebounding later in the day. At midday,

the shares were trading at 333.20 francs, or about 2% lower than

Tuesday's close.

Swatch declined despite the company's decision to buy back 1

billion Swiss francs ($982 million) of its shares. Analysts at Citi

said there was "not much to cheer for" in the latest results, which

reflected "adverse macro and geopolitical environment, global price

gap distortion from [foreign-exchange] volatility and further

demand weakness for Swiss watches in Hong Kong."

John Revill in Zurich contributed to this article.

Write to Jason Chow at jason.chow@wsj.com

(END) Dow Jones Newswires

February 03, 2016 07:48 ET (12:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

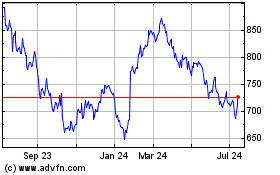

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Aug 2024 to Sep 2024

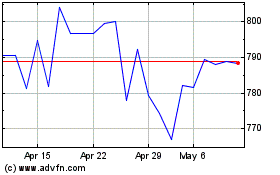

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Sep 2023 to Sep 2024