New members are enrolling in AMC Stubs at more

than 11 times the number of enrollments during the same period last

year

AMC Theatres® (NYSE:AMC) today announced that approximately two

months after enhancing the benefits of its paid membership tier and

adding a free tier to its rewards program, AMC Stubs, the Company

has added more than 1.2 million households, hitting an all-time

high of four million active member households.

Active memberships are defined as an enrollee or someone in an

enrollee's family having attended a movie at an AMC theatre within

the current or past calendar year.

Since the launching in July of a thoroughly re-designed program,

AMC Stubs’ two tiers, AMC Insider and AMC Premiere, combined to add

more than 1.2 million new active family memberships in the last few

weeks of the busy summer season. Given a continuation of this pace,

the AMC Stubs membership base is likely to more than double year

over year by the start of the 2017 summer movie season.

The number of new AMC Stubs members continues to climb daily at

a brisk pace. New members are enrolling in the new AMC Stubs

program at a rate more than 11 times the number of enrollments

during the same period last year.

“The new AMC Stubs has opened strong and to enthusiastic reviews

from our guests,” said Adam Aron, CEO and President, AMC Theatres.

“Moviegoers want to be recognized and rewarded for coming to

theatres, and the response to our new and improved AMC Stubs

program has far exceeded even our most optimistic

expectations.”

“The expansive growth of AMC Stubs provides AMC with a much

larger database of identified moviegoers, and a better insight into

their movie preferences,” said Stephen Colanero, Executive Vice

President and Chief Marketing Officer, AMC. “This enables AMC to

have both a larger and a more focused marketing capability to

support the movies of our Hollywood studio partners.”

In early July, AMC launched AMC Insider, a free tier to the

rewards program that is increasing the number of AMC guests who are

rewarded for simply coming to the movies. AMC Insider benefits

include free refills on large popcorn, up to $2 off tickets every

Tuesday, a free large popcorn birthday gift and 20 points earned

for every dollar spent.

The company’s paid tier, AMC Premiere, also saw a refresh that

included the addition of new guest benefits. For a $15 annual

membership fee, AMC Premiere members enjoy express service with

specially marked shorter lines at the box office and concession

stand, free size upgrades on popcorn and soda, a free refill on

large popcorn, up to $5 off movie tickets on Tuesdays, a birthday

gift (free large popcorn and soda), no online ticket fees and 100

reward points for every $1 spent.

Every AMC Stubs member earns $5 to spend at the box office and

concession stand for 5,000 points earned, and receives access to

exclusive offers, screenings and more. For information about AMC

Stubs and to sign up, guests can inquire at their local AMC theatre

or at amctheatres.com/amcstubs.

About AMC Theatres

AMC (NYSE: AMC) is the guest experience leader with 386

locations and 5,334 screens located primarily in the United States.

AMC has propelled innovation in the theatrical exhibition industry

and continues today by delivering more comfort and convenience,

enhanced food & beverage, greater engagement and loyalty,

premium sight & sound, and targeted programming. AMC operates

the most productive theatres in the country’s top markets,

including No. 1 market share in the top three markets (NY, LA,

Chicago) http://www.amctheatres.com.

Forward-Looking

Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “plan,” “estimate,” “will,” “would,” “project,”

“maintain,” “intend,” “expect,” “anticipate,” “strategy,” “future,”

“likely,” “may,” “should,” “believe,” “continue,” and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. Similarly,

statements made herein and elsewhere regarding the pending

acquisitions of Odeon & UCI and Carmike Cinemas (collectively

“the targets”) are also forward-looking statements, including

statements regarding the anticipated closing date of the

acquisitions, the source and structure of financing, management’s

statements about effect of the acquisitions on AMC’s future

business, operations and financial performance and AMC’s ability to

successfully integrate the targets into its operations. These

forward-looking statements are based on information available at

the time the statements are made and/or management’s good faith

belief as of that time with respect to future events, and are

subject to risks, trends, uncertainties and other facts that could

cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. These

risks, trends, uncertainties and facts include, but are not limited

to, risks related to: the parties’ ability to satisfy closing

conditions in the anticipated time frame or at all; obtaining

regulatory approval, including the risk that any approval may be on

terms, or subject to conditions, that are not anticipated;

obtaining the Carmike stockholders approval for the Carmike

transaction; the possibility that these acquisitions do not close,

including in circumstances in which AMC would be obligated to pay a

termination fee or other damages or expenses; related to financing

these transactions, including AMC’s ability to finance the

transactions on acceptable terms and to issue equity at favorable

prices; responses of activist stockholders to the transactions;

AMC’s ability to realize expected benefits and synergies from the

acquisitions; AMC’s effective implementation, and customer

acceptance, of its marketing strategies; disruption from the

proposed transactions- making it more difficult to maintain

relationships with customers, employees or suppliers; the diversion

of management time on transaction-related issues; the negative

effects of this announcement or the consummation of the proposed

acquisitions- on the market price of AMC’s common stock; unexpected

costs, charges or expenses relating to the acquisitions; unknown

liabilities; litigation and/or regulatory actions related to the

proposed transactions; AMC’s significant indebtedness, including

the indebtedness incurred to acquire the targets; execution risks

related to the integration of Starplex Cinemas into our business;

our ability to achieve expected synergies and performance from our

acquisition of Starplex Cinemas; AMC’s ability to utilize net

operating loss carry-forwards to reduce future tax liability;

increased competition in the geographic areas in which we operate

and from alternative film-delivery methods and other forms of

entertainment; continued effectiveness of AMC’s strategic

Initiatives; the impact of shorter theatrical exclusive release

windows; our ability to attract and retain senior executives and

other key personnel; the impact of governmental regulation,

including anti-trust investigations concerning potentially

anticompetitive conduct, including film clearances and

participation in certain joint ventures; unexpected delays and

costs related to our optimization of our theatre circuit; failure,

unavailability or security breaches of our information systems;

operating a business in markets AMC is unfamiliar with; the United

Kingdom’s exit from the European Union; and other business effects,

including the effects of industry, market, economic, political or

regulatory conditions, future exchange or interest rates, changes

in tax laws, regulations, rates and policies; and risks, trends,

uncertainties and other facts discussed in the reports AMC has

filed with the SEC. Should one or more of these risks, trends,

uncertainties or facts materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by the forward-looking

statements contained herein. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of

future performance or results, and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. For a detailed discussion of risks,

trends and uncertainties facing AMC, see the section entitled “Risk

Factors” in AMC’s Annual Report on Form 10-K, filed with the SEC on

March 8, 2016, and the risks, trends and uncertainties identified

in their other public filings. AMC does not intend, and undertakes

no duty, to update any information contained herein to reflect

future events or circumstances, except as required by applicable

law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160920005375/en/

AMC TheatresRyan Noonan,

913-213-2183rnoonan@amctheatres.com

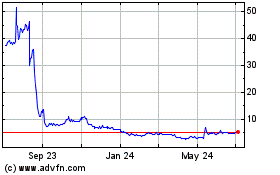

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2024 to May 2024

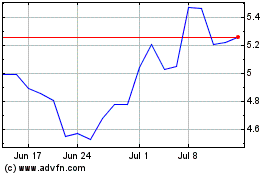

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From May 2023 to May 2024