FSA Fines RBS, NatWest GBP2.8 Million For Complaint-Handling Lapses

January 11 2011 - 6:37AM

Dow Jones News

The U.K. Financial Services Authority on Tuesday said it fined

Royal Bank of Scotland Group PLC (RBS) and its National Westminster

Bank PLC (NWBD.LN) unit a total of GBP2.8 million due to "multiple

failings" in the way they handled customers' complaints.

The industry regulator said the banks responded inadequately to

more than half the complaints reviewed by the FSA, and that "there

was an unacceptably high risk that customers may not have been

treated fairly due to a number of failings within the banks'

approach to routine complaint handling."

The fine comes as RBS, which became 84%-owned by taxpayers after

a huge government bailout, is coming under heavy scrutiny over

reported plans to award Chief Executive Stephen Hester with a

GBP2.5 million bonus for 2010 and to give a separate GBP950 million

in bonuses to senior staff.

Margaret Cole, the FSA's managing director of enforcement and

financial crime, said: "The failure of these two high-street banks

to deal adequately with complaints put consumers at unacceptable

risk and the fine of GBP2.8 million reflects this."

"The poor complaints procedure of RBS and NatWest came to light

during our review of complaint handling in major banks. The review

showed that banks need to make major changes to handle consumer

complaints fairly and the FSA will continue to take appropriate

action to ensure these changes are put in place," Cole said.

Brian Hartzer, CEO of RBS' U.K. retail operations said: "We

acknowledge the findings of the FSA investigation. It confirmed

short comings in our routine complaint-handling that we assessed in

our own internal review and which we are committed to putting

right."

"We recognize the importance of complaint-handling for our

customers and are focussed on addressing the root causes of

complaints," Hartzer said.

The FSA said that the fine against RBS and NatWest was due in

part to delays in responding to customers, poor-quality

investigations into complaints, failing to fully address all of the

concerns raised by customers and failing to explain why complaints

had been upheld or rejected.

Of the complaint files reviewed by the FSA, 53% showed deficient

complaint-handling, 62% showed a failure to comply with FSA

requirements on timeliness and the disclosure of Ombudsman referral

rights, and 31% failed to show fair outcomes for consumers. The FSA

didn't give the total number of complaints.

The FSA said RBS and NatWest also didn't give complaint-handling

staff adequate training and guidance on how to properly investigate

a complaint.

At 1051 GMT GMT, RBS shares were up 1.2% at 40 pence while the

FTSE 100 index was up 1%.

-By Vladimir Guevarra, Dow Jones Newswires. Tel. +44 (0)

2078429486, vladimir.guevarra@dowjones.com

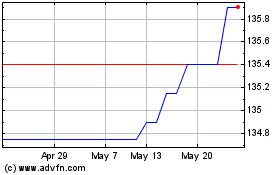

Nat.west 9%pf (LSE:NWBD)

Historical Stock Chart

From Apr 2024 to May 2024

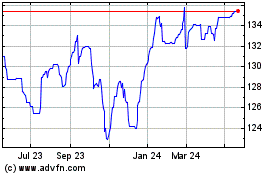

Nat.west 9%pf (LSE:NWBD)

Historical Stock Chart

From May 2023 to May 2024