B.P. Marsh & Partners PLC Investee Company Update

August 25 2020 - 5:36AM

RNS Non-Regulatory

TIDMBPM

B.P. Marsh & Partners PLC

25 August 2020

Date: 25(th) August 2020

On behalf of: B.P. Marsh & Partners Plc

Immediate Release

B.P. Marsh & Partners Plc

("B.P. Marsh", "the Company" or "the Group")

Investee Company Update - Walsingham Motor Insurance Limited

B.P. Marsh & Partners Plc (AIM: BPM), the specialist

investor in early stage financial services businesses, is pleased

to present an update on one of its investments, Walsingham Motor

Insurance Limited ("Walsingham").

Walsingham is a London based Managing General Agency,

specialising in fleet insurance for public and private taxi fleets

and couriers in the UK. It is backed by The New India Assurance Co.

Ltd ("New India"), the Indian government owned insurance company

with GBP9bn of assets, who have been operating in the London market

since 1921. Walsingham have grown from a start-up to now writing

over GBP26,000,000 in Gross Written Premiums ("GWP").

B.P. Marsh invested in Walsingham in December 2013, and owns a

40.5% direct shareholding, together with an additional indirect

2.3% via Walsingham Holdings Limited. In total it has invested

GBP600,000 in equity and valued this combined holding at

GBP2,103,000 at 31(st) January 2020. In addition, B.P. Marsh also

provided GBP1,200,000 of loan funding to support expansion which

was repaid in full in July 2020.

Walsingham's business was impacted by Covid-19 and the lockdown

restrictions. They foresaw that their taxi portfolio, which

represents c.50% of their book, would be subject to mass

cancellations, and the courier portfolio would see increased

vehicles and drivers. Walsingham immediately recognised the need to

allow taxi policyholders flexibility in their work and allowed for

food and shopping deliveries as well as various NHS support work to

be undertaken without the need for policy extensions. This meant

the retention of taxi fleets on the portfolio, which are once again

already approaching full capacity.

Walsingham's team worked hard to keep up to date with requests

for vehicles to be added to courier fleets, while ensuring that

driver underwriting criteria was still being adhered to. This

effort not only helped their Brokers and Policyholders, but also

local communities reliant on drivers' incomes and distribution of

food and medicines.

Walsingham saw approximately 10% of their book reduce over a

four-week period as taxi drivers reacted to the lockdown. However,

due to Walsingham's initiative and flexibility, as those

restrictions eased GWP has increased significantly such that the

initial Covid-19 reductions have now reversed, and the business is

back on its original budget. At the same time, due to reduced

traffic on the road this has resulted in significantly reduced

claims frequencies over the last four months.

Garry Watson, Walsingham's CEO stated "At a time when many

businesses within our sector are struggling to come to terms with

the impact of Covid-19, Walsingham has not furloughed any staff and

has been able to repay our outstanding investor loan ahead of

schedule . The business has shown its trading strength during this

unique period and capitalised on its core strengths; namely

flexibility, organisation and planning, while utilising the

excellent relationships we have built with our trading

partners."

For further information:

B.P. Marsh & Partners Plc www.bpmarsh.co.uk

Brian Marsh OBE +44 (0)20 7233 3112

Nominated Adviser & Broker

Panmure Gordon

Atholl Tweedie / Charles Leigh-Pemberton

/ Ailsa MacMaster +44 (0)20 7886 2500

Financial PR & Investor Relations

Tavistock bpmarsh@tavistock.co.uk

Simon Hudson / Tim Pearson +44 (0)20 7920 3150

Notes to Editors:

B.P. Marsh's current portfolio contains eighteen companies. More

detailed descriptions of the portfolio can be found at

www.bpmarsh.co.uk .

Since formation over 25 years ago, the Company has assembled a

management team with considerable experience both in the financial

services sector and in managing private equity investments. Many of

the directors have worked with each other in previous roles, and

all have worked with each other for approaching ten years.

- Ends -

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Private

Policy.

END

NRAFIFVATFIEFII

(END) Dow Jones Newswires

August 25, 2020 05:36 ET (09:36 GMT)

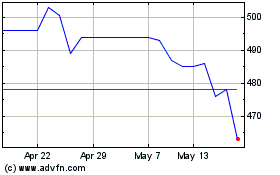

B.p. Marsh & Partners (LSE:BPM)

Historical Stock Chart

From Apr 2024 to May 2024

B.p. Marsh & Partners (LSE:BPM)

Historical Stock Chart

From May 2023 to May 2024