UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October

24, 2014

W&E Source Corp.

(Exact name of registrant as specified in its charter)

| Delaware |

000-52276 |

98-0471083 |

| (State or other jurisdiction of |

(Commission File Number) |

(IRS Employer Identification |

| incorporation) |

|

Number) |

| Delaware Intercorp, Inc., 113 Barksdale Professional

Center |

|

| Newark, Delaware |

19711 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s Telephone Number, including area code: (450)

443-1153

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| [ ] |

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

ITEM 10.1 Entry into a Material Definitive Agreement

On October 26, 2014, the Company entered into Loan Repayment

Agreements (the “Agreements”) with four individuals who have extended loans to

the Company with a total outstanding balance of $155,383 (the “Loan”). Pursuant

to the Agreements the Company agreed to issue a total of 15,538,300 shares of

its common stock, $0.0001 par value per share (the “Shares”) at the rate of

$0.01 per share as full payment for the Loan. Upon issuance and delivery of the

Shares, the Loan shall be fully paid and the Company shall no longer have any

obligations to the individuals under the Loan.

ITEM 3.02 Unregistered Sales of Equity Securities

As described in Item 1.01 of this Report on Form 8-K, the

Company will issue to the individual lenders a total of 15,538,300 shares of the

Company’s common stock, $0.0001 par value per share, pursuant to the Agreements.

These shares will not be registered under the Securities Act of 1933, as amended

(the “Securities Act”). The issuance of these shares was made pursuant to

Regulation S under the Securities Act.

ITEM 4.01 Changes in Registrant's Certifying Accountant

(a) Dismissal of Independent Certifying

Accountant

Effective October 24, 2014, WWC, P.C. was dismissed as the

Company’s independent registered public accounting firm. The dismissal of WWC,

P.C. as the independent registered public accounting firm was approved by the

Company’s Board of Directors.

The reports of WWC, P.C. regarding the Company’s financial

statements for the fiscal year ended June 30, 2014 did not contain any adverse

opinion or disclaimer of opinion and were not qualified or modified as to

uncertainty, audit scope or accounting principles, except that the audit report

of WWC, P.C. on the Company’s financial statements for fiscal year ended June

30, 2014 contained an explanatory paragraph which noted that there was

substantial doubt about the Company’s ability to continue as a going concern.

During the year ended June 30, 2014, and during the period from

June 30, 2014 to October 24, 2014, the date of dismissal, (i) there were no

disagreements with WWC, P.C. on any matter of accounting principles or

practices, financial statement disclosure or auditing scope or procedures, which

disagreements, if not resolved to the satisfaction of WWC, P.C. would have

caused it to make reference to such disagreement in its reports; and (ii) there

were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

The Company has provided WWC, P.C. with a copy of the foregoing

disclosures and requested that WWC, P.C. furnish the Company with a letter

addressed to the SEC stating whether or not it agrees with the above statements.

WWC, P.C. has not responded and if and when WWC, P.C. responses and furnishes

the Company with a letter addressed to the SEC stating whether or not it agrees

with the above statement, the Company will furnish such letter by amendment.

(b) Engagement of Independent Certifying

Accountant

Effective October 27, 2014, the Board of Directors of the

Company engaged CANUSWA Accounting & Tax Services Inc. (“CANUSWA”) as its

independent registered public accounting firm to audit the Company’s financial

statements for the fiscal year ending June 30, 2015.

During each of the Company’s two most recent fiscal years and

through the interim periods preceding the engagement of CANUSWA, the Company (a)

has not engaged CANUSWA as either the principal accountant to audit the

Company’s financial statements, or as an independent accountant to audit a

significant subsidiary of the Company and on whom the principal accountant is

expected to express reliance in its report; and (b) has not consulted with

CANUSWA regarding (i) the application of accounting principles to a specific

transaction, either completed or proposed, or the type of audit opinion that

might be rendered on the Company’s financial statements, and no written report

or oral advice was provided to the Company by CANUSWA concluding there was an

important factor to be considered by the Company in reaching a decision as to an accounting, auditing or financial

reporting issue; or (ii) any matter that was either the subject of a

disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K or

a reportable event, as that term is described in Item 304(a)(1)(v) of Regulation

S-K.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned duly authorized.

| W&E Source Corp. |

| |

|

| By: |

/s/

Hong Ba |

| |

Hong Ba, Chief Executive Officer

|

Date: October 30, 2014

Form of Loan Repayment Agreement

This Loan Repayment Agreement

(“Agreement”) is made as of October __, 2014 by and between W&E

Source Corp., a Delaware corporation (the “Company”), and ______________

(the “Lender”).

WITNESSETH

WHEREAS, Lender extended a series

of loans to the Company and as of the date of this Agreement, the outstanding

aggregate balance due is $1______________ (the “Loan”);

WHEREAS, the Company desire to

provide for the payment in full of the Loan as of the date hereof in common

stock of the company in lieu of cash; and

WHEREAS, the Lender is willing to

accept the Company’s common stock as payment for the Loan and release the

Company of all obligations under the Loan.

NOW, THEREFORE, the parties

hereto, in consideration of the confirmation of the foregoing recitals and the

mutual covenants contained herein and intending to be legally bound, hereby

agree as follows:

1. The

Lender and Company acknowledge that the Loan is the full amount of indebtedness

that the Company owes to the Lender as of the date of this Agreement.

2. The

Lender will accept as full payment of the Loan ________________ shares of the

Company’s common stock, par value $0.0001 per share, at rate of $0.01 per share

(the “Shares”).

3. The

Company has duly and validly reserved the Shares for issuance shall issued the

Shares to the Lender within 15 business days of the date of this Agreement and

the Shares

4. The

Lender upon receipt of the stock certificate representing the Shares, shall

accept the Shares as full payment of the Loan and forever release the Company

from any and all obligations and liabilities relating to the Loan.

5. The

Company is a corporation duly organized, validly existing, and in good standing

under the laws of the State of Delaware and has full corporate power and

authority to enter into and perform its obligations under this Agreement.

6. This

Agreement executed and delivered by the Company in connection with the

transactions contemplated by this Agreement, have been duly authorized, executed

and delivered by the Company and is each the valid and legally binding

obligation of the Company.

7. The

Shares that are being issued to Lender, when issued, and delivered in accordance

with the terms hereof for the consideration expressed herein, will be duly and

validly issued, fully paid and nonassessable and free of restrictions on

transfer, other than restrictions on transfer under this Agreement and under

applicable federal and state securities laws, and will be free of all other

liens and adverse claims.

8. The

execution, delivery and performance of this Agreement will not violate any law

or any order of any court or government agency applicable to the Company, as the

case may be, or the Articles of Incorporation or Bylaws of the Company.

9. The

Lender understands that the Shares have not been registered under the Securities

Act of 1933, as amended, and may not be transferred or resold except pursuant to

an effective registration statement or exemption from registration and each

certificate representing the Shares will be endorsed with the following legend:

“THE SECURITIES ARE BEING OFFERED TO INVESTORS WHO ARE NOT U.S.

PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT OF 1933, AS AMENDED

(“SECURITIES ACT”)) AND WITHOUT REGISTRATION WITH THE UNITED STATES SECURITIES

AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT IN RELIANCE UPON REGULATION S

PROMULGATED UNDER THE SECURITIES ACT.”

“TRANSFER OF THESE SECURITIES IS PROHIBITED, EXCEPT IN

ACCORDANCE WITH THE PROVISIONS OF REGULATION S, PURSUANT TO REGISTRATION UNDER

THE SECURITIES ACT, OR PURSUANT TO AVAILABLE EXEMPTION FROM REGISTRATION.

HEDGING TRANSACTIONS MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE

SECURITIES ACT.”

10. This

Agreement and the other documents delivered pursuant hereto constitute the full

and entire understanding and agreement among the parties with regard to the

subjects hereof and no party shall be liable or bound to any other party in any

manner by any representations, warranties, covenants, or agreements except as

specifically set forth herein or therein. Nothing in this Agreement, express or

implied, is intended to confer upon any party, other than the parties hereto and

their respective successors and assigns, any rights, remedies, obligations, or

liabilities under or by reason of this Agreement, except as expressly provided

herein.

11. This

Agreement may be executed in one or more counterparts. Delivery of an executed

counterpart of the Agreement by facsimile transmission shall be equally as

effective as delivery of an executed hard copy of the same.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS

WHEREOF, the parties have executed this Agreement as of the date first

set forth above.

| THE LENDER: |

| |

| |

| Name: |

| |

| THE COMPANY: |

| |

| W&E Source Corp. |

| |

| |

| By: |

|

| |

Hong Ba, CEO |

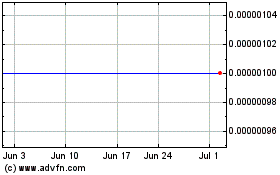

W and E Source (CE) (USOTC:WESC)

Historical Stock Chart

From May 2024 to Jun 2024

W and E Source (CE) (USOTC:WESC)

Historical Stock Chart

From Jun 2023 to Jun 2024