Current Report Filing (8-k)

March 17 2023 - 8:16AM

Edgar (US Regulatory)

0001577445

false

0001577445

2023-03-16

2023-03-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 16, 2023

SCOUTCAM

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

333-188920 |

|

847-4257143 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

Suite

7A, Industrial Park

P.O.

Box 3030, Omer, Israel |

|

8496500 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

+972

73 370-4691

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Not

Applicable |

|

Not

Applicable |

|

Not

Applicable |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

March 16, 2023 (the “Closing Date”), ScoutCam Inc. (the “Company”) entered into and consummated Stock

Purchase Agreements (the “Purchase Agreements”) for a private placement (the “Private Placement”) with (i) Moshe

Arkin through his individual retirement account (“Arkin”) and (ii) The Phoenix Insurance Company Ltd. (“Phoenix Insurance”)

and Shotfut Menayot Israel – Phoenix Amitim (“Phoenix Amitim”), in connection with the sale and issuance of an aggregate

of 3,294,117 units (collectively, the “Units”), at a purchase price of US$4.25 per Unit, and for an aggregate purchase price

of approximately US$14,000,000. Each Unit consists of: (i) one share of the Company’s common stock par value US$0.001 per share

(the “Common Stock”) and (ii) one warrant to purchase one share of Common Stock with an exercise price of US$5.50 (the “Warrants”).

The shares of Common Stock and Warrants were issued in the Private Placement pursuant to Regulation S of the Securities Act of 1933,

as amended.

The

Warrants are immediately exercisable and will expire three (3) years from the date of issuance and will be subject to customary adjustments.

The closing of the Private Placement was subject to customary representations and warranties and closing conditions and took place on

March 16, 2023. No placement agent was retained, and no placement agent fees are payable in connection with the Private Placement.

The Company intends to use the proceeds from the Private Placement for working capital and general corporate purposes, including to further

advance its innovative products and technology in the fields of condition based maintenance and predictive maintenance.

In

connection with the execution of the Purchase Agreements, the Company undertook to file with the U.S. Securities and Exchange Commission,

within one hundred and twenty (120) days of the Closing Date, a registration statement on Form S-1 (or such other form of registration

that is then available to effect a registration) covering the resale of the shares of Common Stock issued pursuant to the Purchase Agreements,

the shares of Common Stock underlying the Warrants issued pursuant to the Purchase Agreements, any other shares of Common Stock and shares

of Common Stock underlying warrants to the extent previously issued to Arkin, Phoenix Insurance or Phoenix Amitim, and any other securities

issued or issuable with respect to or in exchange for the foregoing, and to use commercially reasonable efforts to have such registration

statement declared effective as soon as practicable. The Company will bear all expenses of such registration of the resale of the Common

Stock.

Arkin,

Phoenix Insurance and Phoenix Amitim are existing shareholders of the Company and Arkin is a member of the Company’s board of directors.

The

securities sold in the Private Placement have not been registered under the Securities Act of 1933, as amended, and may not be offered

or sold in the United States absent registration or an applicable exemption from registration requirements.

The

foregoing descriptions of the Purchase Agreements, the Warrants, and the Registration Rights Agreement are summaries of the material

terms of such agreements and documents, do not purport to be complete and are qualified in their entirety by reference to the Form of

Warrant to Purchase Shares of Common Stock filed as Exhibit 4.1, the Purchase Agreement with Arkin filed as Exhibit 10.1, the Purchase

Agreement with Phoenix Insurance and Phoenix Amitim filed as Exhibit 10.2, the Registration Rights Agreement with Arkin filed as Exhibit

10.3 and the Registration Rights Agreement with Phoenix Insurance and Phoenix Amitim filed as Exhibit 10.4 to this Current Report on

Form 8-K and incorporated by reference herein.

Neither

this Current Report on Form 8-K nor any exhibit attached hereto is an offer to sell or the solicitation of an offer to buy any securities

of the Company.

Item

3.02 Unregistered Sale of Equity Securities.

The

disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of the Company’s Common

Stock in connection with the transactions contemplated by the Purchase Agreements is incorporated by reference herein.

Item

8.01 Other Events.

On

March 17, 2023, the Company issued a press release announcing the consummation of the Purchase Agreements and related information,

a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Current Report on Form 8-K (including Exhibits 99.1 through 99.4 attached hereto) is intended to be furnished and

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Exchange Act, except as expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

Exhibit

No. |

|

Description

of Exhibits |

| |

|

|

| 4.1 |

|

Form of Warrant to Purchase Shares of Common Stock |

| |

|

|

| 10.1 |

|

Stock

Purchase Agreement, dated March 16, 2023, among ScoutCam Inc. and the Investor defined therein |

| |

|

|

| 10.2 |

|

Stock

Purchase Agreement, dated March 16, 2023, among ScoutCam Inc. and the Investors defined therein |

| |

|

|

| 10.3 |

|

Registration

Rights Agreement, dated March 16, 2023, among ScoutCam Inc. and the Investor defined therein |

| |

|

|

| 10.4 |

|

Registration

Rights Agreement, dated March 16, 2023, among ScoutCam Inc. and the Investors defined therein |

| |

|

|

| 99.1 |

|

Press

Release, dated March 17, 2023 |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SCOUTCAM INC. |

| |

|

|

| Date:

March 17, 2023 |

By: |

/s/ Tanya Yosef |

| |

Name: |

Tanya Yosef |

| |

Title: |

Chief Financial Officer |

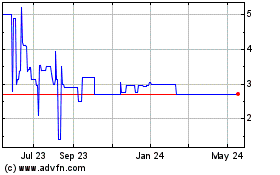

Scoutcam (QB) (USOTC:SCTC)

Historical Stock Chart

From Apr 2024 to May 2024

Scoutcam (QB) (USOTC:SCTC)

Historical Stock Chart

From May 2023 to May 2024