Gap Earnings Beat, Falls Y/Y, Hikes Div - Analyst Blog

February 28 2014 - 10:50AM

Zacks

The Gap Inc. (GPS)

posted fourth-quarter and fiscal 2013 results, wherein its

quarterly earnings of 68 cents a share tanked 6.9% year over year.

However, it came ahead of the Zacks Consensus Estimate of 66 cents

per share. Results were negatively impacted by the loss of a week

owing to calendar shift.

This calendar shift also affected nets sales, which slipped 3.2% to

$4.58 billion during the fourth quarter, almost meeting the Zacks

Consensus Estimate of $4.59 billion. However, with continued focus

on developing its omnichannel network, Gap’s quarterly online sales

came in at $698.0 million, up 15.9% from the prior-year

quarter.

The company reported a 10.3% fall in its quarterly gross profit to

$1,593 million with the gross margin contracting 280 basis points

(bps) to 34.8%. Operating income during the quarter dipped 13.3% to

$522 million, leading the operating margin to shrivel 130 bps to

11.4%. Gap’s operating expenses dropped by 8.8% to $1.07 billion,

backed by the company’s tough cost management.

Fiscal 2013 Highlights

For fiscal 2013, Gap’s earnings soared 17.6% to $2.74 per share,

marginally beating the Zacks Consensus Estimate of $2.73. Net sales

for the year after adjusting for foreign currency translation,

climbed 5%. Reported sales came in at $16.15 billion, compared to

$15.65 billion in fiscal 2012, roughly coming in line with the

Zacks Consensus Estimate of $16.16 billion.

Sales were driven by comparable store sales, which inched up 2%

during the year. Brand wise, Gap and Old Navy delivered positive

comps of 3% and 2% respectively, partially offset by a negative 1%

delivered by Banana Republic. Further, the company’s online sales

for the year grew 21% to $2.26 billion, supported by Gap’s

omnichannel capacities.

Financials

This apparel and shoe retailer ended the year with cash and cash

equivalents of $1,510 million, long-term debt at $1,369 million and

total shareholders equity of $3,062 million. Moreover, the company

generated a free cash flow of $1.04 billion and incurred $670

million as capital expenditure in 2013. Gap expects to spend $750

million as capital expenditures in 2014, highlighting the company’s

focus on investing in its strategic plans.

Dividend & Share Repurchase

During the fourth quarter, Gap paid its shareholders a cash

dividend of 20 cents a share and bought back shares worth $134

million. Also, from the company’s $1 billion share repurchase

program authorized in Nov 2013, shares worth $966 were still

remaining at the end of fiscal 2013.

Additionally, with the earnings release, the company announced a

10% hike in its annual dividend for fiscal 2014, to 88 cents a

share from 80 cents currently. Also, for first-quarter fiscal 2014,

it declared a dividend of 22 cents per share to be paid to

shareholders of record as on Apr 9, 2014, payable on or post Apr

30, 2014.

This fifth consecutive year of the annual dividend hike and Gap’s

share buy back program reflect its loyalty towards boosting

shareholder value and returning them excess cash.

Store Update

In 2013, the company opened 34 new Gap outlets in Mainland China,

bringing the store count in the region to 81 and 17 new Old Navy

stores in Japan. Its Athleta brand’s store count was 65 at the end

of fiscal 2013, reflecting the company’s emphasis on promoting

fashion cum fitness. Also, Gap was consistently enhancing its

franchise business all through 2013, as it introduced 70 new

stores, covering 40 international markets.

This brings the company’s total store count to 3,539 across 48

countries with 3,164 company-operated and 375 franchise outlets,

increasing its company operated floor space by 1% year over

year.

Going forward in fiscal 2014, Gap intends to open 185

company-operated outlets, barring relocations, with primary focus

on China, Athleta, Old Navy Japan and global outlet stores. It also

plans to shut down 70 company-operated outlets, net of relocations.

Following this, the company expects net square footage to increase

by 2.5% next year.

In 2014, the company plans to open 30 Gap outlets in China and 25

Old Navy stores in Japan. Gap also intends to introduce Old Navy in

the Chinese market by opening 5 new outlets there, apart from

opening the brand’s franchises globally, beginning with Philippines

next month. Also, the company anticipates its franchise partners to

add 75 new outlets, covering all brands including Banana Republic,

Old Navy and Gap.

Outlook

Looking ahead, Gap envisions earnings per share to lie in a band of

$2.90–$2.95 for fiscal 2014. The current Zacks Consensus Estimate

for 2014 stands at $3.05 per share, which is likely to undergo a

downward revision.

Also, on excluding the expected negative effect of foreign

currency, Gap anticipates operating margin to expand in fiscal

2014. Further, it forecasts inventories to advance by 7% at the end

of the first quarter of fiscal 2014.

Other Stocks to Consider

Gap currently holds a Zacks Rank #3 (Hold). Other better-ranked

stocks in the retail sector include Christopher & Banks

Corporation (CBK) with a Zacks Rank #1 (Strong Buy), along

with Finish Line Inc. (FINL) and H & M

Hennes & Mauritz AB (publ) (HNNMY) carrying a Zacks

Rank #2 (Buy).

CHRISTOPHER&BNK (CBK): Free Stock Analysis Report

FINISH LINE-CLA (FINL): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

HENNES&MAURIT (HNNMY): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

Hennes and Mauritz AB (PK) (USOTC:HNNMY)

Historical Stock Chart

From Apr 2024 to May 2024

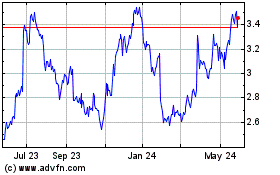

Hennes and Mauritz AB (PK) (USOTC:HNNMY)

Historical Stock Chart

From May 2023 to May 2024