AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $10,884,000 for the year ended 2012, a 10% increase over

the $9,886,000 earned in 2011. Earnings per share (basic) for 2012

increased to $2.46 versus $2.24 in 2011. Shares outstanding at the

end of the year totaled 4,432,331.

“It’s a tribute to our staff that they, once again, provided our

shareholders a double digit return on equity in a single digit

market,” said Robert Schack, Chairman.

“American Business Bank has had another great year by putting

our customers first and by acting as a financial advisor to

contribute to their success,” said Don Johnson, Chief Executive

Officer.

“The Bank managed to hit all of its goals for the year 2012 and

is looking forward to continuing to build on the Bank’s success in

2013,” said Leon Blankstein, President. “The quality of our people,

the culture of the Bank and the execution of our business model

continue to serve our shareholders well.”

Total assets increased 11% or $131 million to $1.305 billion at

December 31, 2012 as compared to $1.174 billion at December 31,

2011. The loan portfolio (net) increased 20% or $85 million to $494

million at December 31, 2012 as compared to $409 million at

December 31, 2011, while investments and federal funds sold

increased $35 million. Deposits increased 4% or $38 million to

$1.067 billion at December 31, 2012 as compared to $1.029 billion

at the end of 2011.

During 2012, Net Interest Income increased $1,706,000 or 4.9% to

$36,621,000 from $34,915,000 in 2011.

Non-Interest income during 2012 increased $715,000 or 16.6% to

$5,024,000 from $4,309,000 in 2011.

Non-Interest expense for 2012 increased $512,000 or 2.2% to

$23,788,000 from $23,276,000 during 2011.

Asset quality at quarter-end remains excellent, with $1,144,000

non-performing loans or 0.2% of total loans; and, no OREO. At the

end of December 2012, the allowance for loan losses stood at

$10,537,000 or 2.09% of loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

American Business Bank Figures in $000, except per share

amounts

CONSOLIDATED BALANCE SHEET (unaudited) For

the period ended: December December

Change 2012 2011 %

Assets:

Cash & Equivalents $ 31,852 $ 27,059 17.7 % Fed Funds Sold

5,000 0

N/A

Interest Bearing Balances 28 1,034 -97.3 %

Investment

Securities:

US Agencies 408,803 385,826 6.0 % Mortgage Backed Securities

178,855 193,637 -7.6 % State & Municipals 145,460 123,349 17.9

% Other 132

138 -4.3 % Total Investment Securities 733,250

702,950 4.3 %

Gross

Loans:

Commercial Real Estate 267,406 225,965 18.3 % Commercial &

Industrial 194,645 156,167 24.6 % Other Real Estate 36,903 30,238

22.0 % Other 5,320

5,918 -10.1 % Total Gross Loans 504,274

418,288 20.6 % Allowance for Loan &

Lease Losses (10,537 ) (8,934 ) 17.9 %

Net Loans 493,737 409,354 20.6 % Premises & Equipment 720 1,087

-33.8 % Other Assets 39,916

32,078 24.4 %

Total Assets $ 1,304,503

$ 1,173,562 11.2 %

Liabilities:

Demand Deposits $ 522,001 $ 459,317 13.6 % Money Market 464,348

483,481 -4.0 % Time Deposits and Savings

80,251 85,760 -6.4 %

Total Deposits 1,066,600 1,028,558 3.7 % FHLB Advances / Other

Borrowings 117,600 48,000 145.0 % Other Liabilities

16,568 10,512

57.6 %

Total Liabilities

$ 1,200,768 $

1,087,070 10.5 %

Shareholders'

Equity:

Common Stock & Retained Earnings $ 90,605 $ 78,613 15.3 %

Accumulated Other Comprehensive Income 13,130

7,879 66.6 %

Total

Shareholders' Equity $ 103,735

$ 86,492 19.9 %

Total Liabilities & Shareholders' Equity $

1,304,503 $ 1,173,562

11.2 %

Capital

Adequacy:

Tangible Common Equity / Tangible Assets 7.95 % 7.37 % -- Tier 1

Leverage Ratio 7.19 % 6.72 % -- Tier 1 Capital Ratio / Risk

Weighted Assets 16.29 % 16.58 % -- Total Risk-Based Ratio 17.55 %

17.84 % --

Per Share

Information:

Common Shares Outstanding 4,432,331 4,427,862 -- Book Value Per

Share $ 23.40 $ 19.53 19.8 % Tangible Book Value Per Share $ 23.40

$ 19.53 19.8 %

American Business Bank Figures in

$000, except per share amounts

CONSOLIDATED INCOME STATEMENT (unaudited)

For the 12-month period: December

December Change 2012 2011

%

Interest

Income:

Loans & Leases $ 22,544 $ 22,122 1.9 % Investment

Securities 16,824

16,339 3.0 % Total Interest Income 39,368 38,461 2.4 %

Interest

Expense:

Money Market, NOW Accounts & Savings 1,905 2,453 -22.3 % Time

Deposits 542 778 -30.3 % Repurchase Agreements / Other

Borrowings 300 315 -4.8 %

Total Interest Expense 2,747 3,546 -22.5 % Net

Interest Income 36,621 34,915 4.9 % Provision for Loan

Losses (1,624 ) (1,977 )

-17.9 % Net Interest Income After Provision 34,997 32,938 6.3 %

Non-Interest

Income:

Deposit Fees 1,073 1,012 6.0 % Realized Securities Gains / (Losses)

3,702 2,663 39.0 % Other

249 634 -60.7 % Total

Non-Interest Income 5,024 4,309 16.6 %

Non-Interest

Expense:

Compensation & Benefits 14,270 13,169 8.4 % Occupancy &

Equipment 1,568 1,612 -2.7 % Other

7,950 8,495

-6.4 % Total Non-Interest Expense 23,788 23,276 2.2 %

Pre-Tax Income 16,233 13,971 16.2 % Provision for Income Tax

(5,349 ) (4,085 ) 30.9 %

Net Income $

10,884 $ 9,886 10.1 %

Per Share

Information:

Average Shares Outstanding (for the year) 4,430,503 4,413,946 --

Earnings Per Share - Basic $ 2.46 $ 2.24 9.7 %

American

Business Bank Figures in $000, except per share amounts

December December Change 2012

2011 %

Performance

Ratios

Return on Average Assets (ROAA) 0.88 % 0.90 % -- Return on Average

Equity (ROAE) 11.36 % 13.19 % --

Asset Quality

Overview

Non-Performing Loans $ 924 $ 2,239 -58.7 % Loans 90+Days

Past Due 220 0

N/A

Total Non-Performing Loans $ 1,144 $ 2,239 -48.9 %

Restructured Loans (TDR's) $ 6,423 $ 134 4693.3 % Other Real

Estate Owned 0 0 -- ALLL / Gross Loans 2.09 % 2.14 % -- ALLL

/ Non-Performing Loans * 921.07 % 399.02 % -- Non-Performing Loans

/ Total Loans * 0.23 % 0.54 % -- Non-Performing Assets / Total

Assets * 0.09 % 0.19 % -- Net Charge-Offs $ - $ - -- Net

Charge-Offs / Average Gross Loans 0.00 % 0.00 % -- *

Excludes Restructured Loans

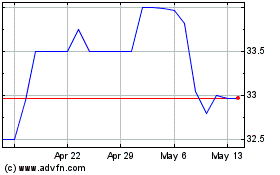

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Apr 2024 to May 2024

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From May 2023 to May 2024