Sama Resources Closes First Tranche of Equity Financing

May 16 2014 - 6:35PM

Marketwired Canada

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO THE UNITED STATES NEWSWIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES

Sama Resources Inc./Ressources Sama Inc. (TSX VENTURE:SME) ("Sama" or the

"Company") is pleased to announce the closing of the first tranche of its

previously announced non-brokered private placement (the "Private Placement") by

issuing 3,888,899 units (the "Units) at a price of CAN$0.18 per Unit, for gross

proceeds of $700.001.82.

Each Unit is comprised of one common share of the Company (a "Share") and

one-half of one share purchase warrant (a "Warrant"). Each whole Warrant will

entitle the holder thereto to purchase for a period of twenty-four (24) months

one additional Share (a "Warrant Share") at an exercise price per Warrant Share

of CAN$0.20.

The Company may pay finders' fees in cash and issue finder's warrants. All

securities issued under the Private Placement will be subject to a hold period

of four months and one day from the closing date. The Private Placement and

finders' fees are subject to final regulatory approval.

Net proceeds from the Private Placement will be used for the advancement of the

Company's exploration and development programs and for general working capital

purposes related thereto.

Sama is a Canadian-based mineral exploration and development company with

projects in West Africa. For more information about Sama, please visit Sama's

website at www.samaresources.com.

Neither the TSXV nor its Regulation Services Provider (as that term is defined

in the policies of the TSXV) accepts responsibility for the adequacy or accuracy

of this release.

Forward Looking Statements

This release contains forward looking statements. More particularly, this

release contains statements concerning the anticipated Private Placement.

Although Sama believes that the expectations reflected in these forward looking

statements are reasonable, undue reliance should not be placed on them because

Sama can give no assurance that they will prove to be correct. Since forward

looking statements address future events and conditions, by their very nature

they involve inherent risks and uncertainties. The closing of the Private

Placement could be delayed if Sama is not able to obtain the necessary

regulatory and stock exchange approvals on the timelines it has planned. The

Private Placement will not be completed at all if these approvals are not

obtained or some other condition to the closing is not satisfied. Accordingly,

there is a risk that the Private Placement will not be completely sold,

completed within the anticipated time or at all. Additional information on these

and other factors that could affect Sama's operations and financial results are

included in reports on file with Canadian securities regulatory authorities and

may be accessed through the SEDAR website (www.sedar.com).

FOR FURTHER INFORMATION PLEASE CONTACT:

Sama Resources Inc.

Dr. Marc-Antoine Audet, President and CEO

(514) 726-4158

ceo@samaresources.com

Sama Resources Inc.

Mr. Matt Johnston

(604) 443-3835 or Toll Free: 1 (877) 792-6688, Ext. 4

info@samaresources.com

www.samaresources.com

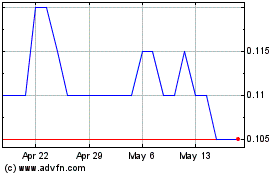

Sama Resources (TSXV:SME)

Historical Stock Chart

From May 2024 to Jun 2024

Sama Resources (TSXV:SME)

Historical Stock Chart

From Jun 2023 to Jun 2024