TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Companies

A Cease Trade Order has been issued by the British Columbia Securities

Commission on November 9, 2009, against the following Company for

failing to file the documents indicated within the required time

period:

Period

Symbol Company Failure to File Ending (Y/M/D)

("GJB.P") Gold Jubilee interim financial

Capital Corp. statements 09/08/31

management's discussion

& analysis 09/08/31

("LBK") Lifebank Corp. interim financial

statements 09/08/31

management's discussion

& analysis 09/08/31

Upon revocation of the Cease Trade Order, the Company's shares will

remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of

the company during the period of the suspension or until further

notice.

TSX-X

-----------------------------------------------------------------------

ANTIOQUIA GOLD INC. ("AGD")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining

to a purchase agreement (the "Agreement") dated April 9, 2009, between

Antioquia Gold Inc. (the "Company") and Bullet Holding Corp. (the

"Vendor"). Pursuant to the Agreement, the Company shall acquire a 90%

interest in two mining concessions (the "Property") in the Cisneros

area of Antioquia, Colombia.

As consideration, the Company will issue the Vendor an aggregate of

1,062,500 shares and 531,250 warrants within an eighteen month period.

Each warrant is exercisable into one common share at a price of $0.40

for a two year period. The Company must also incur an aggregate of

US$2,000,000 in exploration expenditures by October 9, 2010.

On or before December 31, 2011, the Vendor has the option to continue

to hold its 10% in the Property by provide 10% of the funds going

forward or to convert the 10% interest into a 1% net smelter return

royalty.

For further information, please refer to the Company's press releases

dated April 17, 2009 and November 4, 2009.

TSX-X

-----------------------------------------------------------------------

AURION RESOURCES LTD. ("AU")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated November 6, 2009,

the Exchange has accepted an amendment with respect to a Non-Brokered

Private Placement announced September 16, 2009 and October 9, 2009.

The following insiders and pro-group members participated in the

private placement but were not disclosed on the original bulletin:

Insider=Y /

Name ProGroup=P / # of Shares

George M. Smith III Y 350,000

Brad Mercer Y 70,000

Narinder Nagra Y 50,000

K. Peter Miller Y 25,000

Sandra Lee Y 20,000

Rob Klassen P 250,000

Richard Cohen P 250,000

Olav Langelaar P 100,000

Tracy Dabbs P 250,000

Inderjit Shoker P 50,000

Robert Sali P 600,000

TSX-X

-----------------------------------------------------------------------

CHAIRMAN CAPITAL CORP. ("CMN.P")

BULLETIN TYPE: Suspend

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated October 9, 2009,

effective at the opening Wednesday, November 11, 2009, trading in the

shares of the Company will be suspended, the Company having failed to

complete a Qualifying Transaction within the prescribed time.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

-----------------------------------------------------------------------

COLONIA ENERGY CORP. ("CLA")

BULLETIN TYPE: Halt

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

Effective at the opening, November 10, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

-----------------------------------------------------------------------

ENTERPRISE ENERGY RESOURCES LTD. ("EER")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an acquisition agreement

(the "Agreement"), dated October 30, 2009, between Enterprise Energy

Resources Ltd. (the "Company") and Savant Alaska, LLC ("Savant")

pursuant to which Savant will acquire all of the issued and outstanding

shares of the Company's wholly owned subsidiary Bordeaux Alaska

Holdings, Inc. ("BAH").

The aggregate compensation payable by Savant to the Company is

US$700,000 cash.

Insider / Pro Group Participation: N/A

For further details, please refer to the Company's press release dated

November 2, 2009.

TSX-X

-----------------------------------------------------------------------

GENOIL INC. ("GNO")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: November 10, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 719,302 shares at a deemed price of US$0.13 per share and 178,571

shares at a deemed price of US$0.14 per share to settle outstanding

debt in the amount of US$118,509.21.

Number of Creditors: 2 Creditors

The Company shall issue a news release when the shares are issued and

the debt extinguished.

TSX-X

-----------------------------------------------------------------------

GOLD HAWK RESOURCES INC. ("CGK")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a share purchase agreement

(the "Agreement"), dated September 30, 2009, between Gold Hawk

Resources Inc. (the "Company") and Nyrstar ("Nyrstar"; NYSE Euronext

Brussels: NYR), pursuant to which Nyrstar will acquire an 85 per cent

interest in the Company's Peruvian operating subsidiary (Compania

Minera San Juan (Peru) S.A. (CMSJ)) for US$15 million.

As part of the transaction, Nyrstar will also assume the Company's

guarantee in respect of CMSJ's existing US$13 million senior debt

facility, which is payable in February 2010.

Nyrstar has also agreed to loan up to US$20 million to CMSJ to fund re-

start and expansion costs for the Coricancha Mine.

Insider / Pro Group Participation: N/A

For further details, please refer to the Company's press releases dated

October 1, 2009 and November 9, 2009.

TSX-X

-----------------------------------------------------------------------

GOLD STAR RESOURCES CORP. ("GXX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 23, 2009:

Number of Shares: 2,135,000 shares

Purchase Price: $0.10 per share

Warrants: 2,135,000 share purchase warrants to

purchase 2,135,000 shares

Warrant Exercise Price: $0.20 for a two year period

Number of Placees: 28 placees

Finder's Fee: $14,760 payable to 314 Financial Corp. (T.

Baras).

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

INTERNATIONAL GOLD MINING LIMITED ("IGL")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated October 28, 2009,

the Exchange has accepted an amendment with respect to a Non-Brokered

Private Placement announced September 14, 2009. The finder's fee

payable to Canaccord Capital Corporation has increased to 830,136

finder warrants and $4,150.68

TSX-X

-----------------------------------------------------------------------

JASPER MINING CORPORATION ("JSP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 9, 2009:

Number of Shares: 250,000 flow-through shares

Purchase Price: $0.20 per unit

Warrants: 25,000 share purchase warrants to purchase

25,000 shares

Warrant Exercise Price: $0.75 per share for a period of eighteen

months

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

M. Blake Willard Y 250,000

Finder's Fee: First Merchants Capital Inc. - $3,000 cash

and 10,000 finder's options. Each finder's

option is exercisable at a price of $0.75

per share for a period of eighteen months.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

JNR RESOURCES INC. ("JNN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 22, 2009:

Number of Shares: 7,400,000 flow-through shares

Purchase Price: $0.25 per share

Number of Placees: 20 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Richard Kusmirski Y 100,000

Dave Billard Y 60,000

Finder's Fee: $96,000 payable to Toll Cross Securities

Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

JYW CAPITAL CORP. ("JYW.H")

(formerly JYW Capital Corp. ("JYW.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

In accordance with TSX Venture Exchange Policy 2.4, Capital Pool

Companies, the Company has not completed a qualifying transaction

within the prescribed time frame. Therefore, effective Wednesday,

November 11, 2009, the Company's listing will transfer to NEX, the

Company's Tier classification will change from Tier 2 to NEX, and the

Filing and Service Office will change from Vancouver to NEX.

As of November 11, 2009, the Company is subject to restrictions on

share issuances and certain types of payments as set out in the NEX

policies.

The trading symbol for the Company will change from JYW.P to JYW.H.

There is no change in the Company's name, no change in its CUSIP number

and no consolidation of capital. The symbol extension differentiates

NEX symbols from Tier 1 or Tier 2 symbols within the TSX Venture

Exchange.

Further to the TSX Venture Exchange Bulletin dated August 7, 2009,

trading in the Company's securities will remain suspended.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

-----------------------------------------------------------------------

KODIAK ENERGY INC. ("KDK")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to

a Purchase and Sale Agreement dated October 1, 2009. (the "Agreement").

Pursuant to the terms of the Agreement, Cougar Energy, Inc., a majority

controlled subsidiary of Kodiak Energy Inc., has acquired wells,

facilities and production from a private company located in Alberta.

In consideration, Cougar will pay $100,000 cash and issue 155,000

shares.

TSX-X

-----------------------------------------------------------------------

LUCARA DIAMOND CORP. ("LUC")

BULLETIN TYPE: Halt

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

Effective at 10:55 a.m. PST, November 10, 2009, trading in the shares

of the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

-----------------------------------------------------------------------

MICROPLANET TECHNOLOGY CORP. ("MP")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible

Debenture/s, Amendment

BULLETIN DATE: November 10, 2009

TSX Venture Tier 1 Company

AMENDMENT:

Further to the TSX Venture Exchange Bulletin dated November 5, 2009,

the Exchange has accepted an amendment with respect to a Non-Brokered

Private Placement announced October 16, 2009:

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / Principal Amount

Brett Ironside Y $175,000

Myron Tetrault Y $113,000

All other aspects of the original bulletin remain the same.

TSX-X

-----------------------------------------------------------------------

MOUNTAIN LAKE RESOURCES INC. ("MOA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 2, 2009:

Number of Shares: 1,500,000 flow-through shares

Purchase Price: $0.30 per share

Warrants: 750,000 share purchase warrants to

purchase 750,000 shares

Warrant Exercise Price: $0.45 for a two year period. If the

shares close at a price above $0.90 for 20

consecutive days, the company may, upon

notice to warrant holders, shorten the

exercise period to 30 days.

Number of Placees: 2 placees

Finder's Fee: $4,500 cash, 60,000 finder's non flow-

through shares and 120,000 finder's

options to purchase units (comprised of

one non-flow through share and one warrant

exercisable at $0.30 for two years and

subject to the same accelerated exercise

provision as warrants issued pursuant to

the private placement) payable to Limited

Market Dealer.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

-----------------------------------------------------------------------

MPAC INDUSTRIES CORPORATION ("MPN.H")

(formerly MPAC Industries Corporation ("MPN"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.5, the Company has not

maintained the requirements for a TSX Venture Tier 2 company.

Therefore, effective the opening Wednesday, November 11, 2009, the

Company's listing will transfer to NEX, the Company's Tier

classification will change from Tier 2 to NEX, and the Filing and

Service Office will change from Vancouver to NEX.

As of November 11, 2009, the Company is subject to restrictions on

share issuances and certain types of payments as set out in the NEX

policies.

The trading symbol for the Company will change from MPN to MPN.H.

There is no change in the Company's name, no change in its CUSIP number

and no consolidation of capital. The symbol extension differentiates

NEX symbols from Tier 1 or Tier 2 symbols within the TSX Venture

market.

Further to the Exchange Bulletin dated May 27, 2009, trading in the

shares of the Company will remain suspended.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

-----------------------------------------------------------------------

NEXSTAR ENERGY LTD. ("NXE.A")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 10, June 26, and

July 14, 2009:

Number of Shares: 8,220,300 shares

Purchase Price: $0.075 per share

Number of Placees: 6 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Qwest Energy Canadian

Resource Class Y 2,008,800

CDR 2007 Private Flow-Through LP Y 3,334,900

Mellum Capital Corp.

(Brian J. Mellum) Y 400,000

Flagstone Capital Corp.

(Brian J. Mellum) Y 200,000

Formation Capital Management

(Brian J. Mellum) Y 400,000

Norrep Performance 2006

Flow-Through LP Y 1,876,600

No Finder's Fee.

TSX-X

-----------------------------------------------------------------------

NORDIC OIL AND GAS LTD. ("NOG")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: November 10, 2009

TSX Venture Tier 1 Company

This is a first tranche closing

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 24, 2009:

Convertible Debenture: $497,000

Conversion Price: Convertible into Class A Common Shares at

a price of $0.15 per share.

Maturity date: Three years from the date of issuance

Interest rate: 10% per annum

Number of Placees: 18 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / Principal Amount

Roy Fullerton P $10,000

Finder's Fee: Union Securities Inc. - $1,500 cash

Jory Capital Inc. - $26,600 cash

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly. (

TSX-X

-----------------------------------------------------------------------

NORTHERN STAR MINING CORP. ("NSM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 27, 2009:

Number of Shares: 1,100,000 shares

Purchase Price: $0.58 per share

Number of Placees: 2 placees

Finder's Fee: $44,660 cash and 77,000 Agent's warrants

exercisable at $0.58 for three years

payable to Casimir Capital L.P.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

NULOCH RESOURCES INC. ("NLR.A")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced September 15, 2009. Each

Unit consists of 118 Class A Common Shares and 882 Subscription

Receipts:

Number of Shares: 3,157,444 common shares + 23,600,556

subscription receipts

10,100,000 flow-through shares

Purchase Price: $700.00 per unit (common shares and

subscription receipts)

$0.80 per flow-through share

Expiry Date: November 30, 2009 (subscription receipts)

Number of Placees: 102 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of U/FT

Glenn Dawson Y 143 U

Eva Jelec and Paul Jelec P 725 U

Eva Jelec P 626 U

Paul Jelec P 256 U

Chris MacDougall P 70 U

James Harris P 70 U

Tony Loria P 72 U

John Perraton Y 62,500 FT

Glenn Dawson Y 131,250 FT

Elaine Knotek-Holmes P 35,750 FT

Gregg Blaha P 20,500 FT

Agent's Fee: Genuity Capital Markets - $1,575,669 cash

and 1,105,740 Agent's Options. Each option

is exercisable at a price of $0.70 per

share for a period of six months.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s).

TSX-X

-----------------------------------------------------------------------

PLATINUM COMMUNICATIONS CORPORATION ("PCS")

BULLETIN TYPE: Shares for Bonuses, Correction

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

CORRECTION:

Further to the TSX Venture Exchange Bulletin dated November 4, 2009,

the Bulletin should have read as follows:

The deemed price of the shares is $0.065 per share.

All other aspects of the original bulletin remain the same.

TSX-X

-----------------------------------------------------------------------

PUREPOINT URANIUM GROUP INC. ("PTU")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced November 5, 2009:

Number of Shares: 5,000,000 flow-through shares

Purchase Price: $0.20 per share

Warrants: 2,500,000 share purchase warrants to

purchase 2,500,000 shares

Warrant Exercise Price: $0.25 for a one year period

$0.30 in the second year

Number of Placees: 4 placees

Agent: First Canadian Securities, Toronto, ON

Agents' Fee: 250,000 broker warrants. Each broker

warrant entitles the holder to acquire one

unit at $0.20 for a two year period.

Commission: $50,000 payable in cash

For further details, please refer to the Company's new release dated

November 6, 2009.

TSX-X

-----------------------------------------------------------------------

RARE ELEMENT RESOURCES LTD. ("RES")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing a purchase and sale

agreement dated October 30, 2009 between Rare Element Resources Ltd.

(the 'Company') and VMS Ventures Inc. (a TSX Venture listed company),

whereby the Company will acquire a 100% interest in the Eden Lake

claims located in Manitoba.

Total consideration consists of 300,000 shares of the Company to be

issued over an eighteen month period.

In addition, there is a 3% net smelter return in favour of the

underlying property owner (Strider Resources Limited) relating to the

acquisition. The Company may at any time purchase 1.5% of the net

smelter return for $1,500,000 in order to reduce the total net smelter

return to 1.5%.

A finder's fee of 10,000 shares will be paid Marin Katusa and a

finder's fee of 10,000 shares will be paid to Clint Cox.

TSX-X

-----------------------------------------------------------------------

SHOREHAM RESOURCES LTD. ("SMH")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining

to an option agreement dated March 5, 2009 and a subsequent definitive

letter agreement (the "Agreement") dated August 15, 2009, between

Shoreham Resources Ltd. (the "Company") and Guiana Shield Resources

Inc. (the "Optionor"). Pursuant to the Agreement, the Company shall

have the right to earn a 100% interest in four project packages (the

"Packages"), consisting of an aggregate of 13 prospecting licenses and

12 prospecting permits in Guyana, currently owned by the Optionor.

As consideration, the Company must pay the Optionor an aggregate of

US$700,000 and issue 5,000,000 shares over a six year period. Upon

receipt of one or more mining licenses within a Package, the Company

will issue the Optionor an additional 1,000,000 shares per Package (a

total potential issuance of an additional 4,000,000 shares for all

Packages) and additional cash payment of US$1.00 for each ounce of gold

contained in the combined categories of resources as set out in the

feasibility study.

The Optionor holds the right to receive a royalty of 3% of the Net

Smelter Returns ("NSR") from all future production from these lands.

The Company has the option to purchase 1/3 of the NSR (reducing the NSR

to 2%) for a payment of US$1,000,000, an additional payment of

US$2,000,000 to reduce the NSR to 1%, and an additional payment of

US$3,000,000 to further reduce the NSR to zero. In the event that the

Company sells or assigns part of its interest in the Packages to a

third party, the Company will pay the Optionor 10% of any compensation

that the third party pays for the Packages, which is payable in cash or

shares at the option of the Company and will be subject to further

Exchange approval should shares be issued.

For further information, please refer to the Company's press release

dated April 6, 2009 and May 28, 2009.

TSX-X

-----------------------------------------------------------------------

STAR NAVIGATION SYSTEMS GROUP LTD. ("SNA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 4, 2009:

Number of Shares: 10,776,666 shares

Purchase Price: $0.06 per share

Warrants: 10,776,666 share purchase warrants to

purchase 10,776,666 shares

Warrant Exercise Price: $0.20 for a two year period

Number of Placees: 20 placees

Finder's Fee: An aggregate of 1,045,999 finder's shares

issuable to Skyhawk Aviation Inc., Derek

Maharaj, and Karim Kanji.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). Note

that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

TSX-X

-----------------------------------------------------------------------

SUPREME RESOURCES LTD. ("SPR")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced September 18, 2009 and

amended on October 16, 2009:

Number of Shares: 4,792,000 flow-through shares

Purchase Price: $0.10 per share

Warrants: 2,396,000 share purchase warrants to

purchase 2,396,000 shares

Warrant Exercise Price: $0.20 for a one year period

Number of Placees: 15 placees

Agent's Fee: $23,960 and 239,600 shares payable to

Raymond James Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly. (Note that in certain circumstances the Exchange

may later extend the expiry date of the warrants, if they are less than

the maximum permitted term.)

TSX-X

-----------------------------------------------------------------------

TAKARA RESOURCES INC. ("TKK")

BULLETIN TYPE: Halt

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

Effective at 11:05 a.m. PST, November 10, 2009, trading in the shares

of the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

-----------------------------------------------------------------------

TITAN TRADING ANALYTICS INC. ("TTA")

BULLETIN TYPE: Property-Asset or Share Purchase Amending Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an amendment to the

Amended and Restated Software Transfer Agreements dated July 10, 2006

described in the TSXV bulletin dated September 29, 2006 and in the TSXV

amending bulletins dated October 29, 2007 and October 2, 2008. The

amended terms are summarized as follows:

1. The total number of common shares and the amount of the cumulative

gross revenue milestones will not change however, the common shares

will only be issued upon the Company achieving the milestones by May

31, 2010 and any common shares not earned by May 31, 2010 will not be

eligible for issuance.

2. The total number of performance warrants and the amount of the gross

revenue milestones will not change however, the performance warrants

will be exercisable upon the Company achieving the gross revenue

milestones for the one year period ended May 31, 2010. The exercise

prices will remain the same however the exercise period for the first

and second tranche will be the six month period commencing June 1,

2010.

The Exchange will not accept any further extension requests.

TSX-X

-----------------------------------------------------------------------

TRAFINA ENERGY LTD. ("TFA.A")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to

the Offer to Purchase (the "Agreement") between Trafina Energy Ltd.

(the "Company") and a Canadian Bank (the "Seller") dated October 28,

2009 wherein the Company will purchase all of the outstanding

indebtedness and liabilities owing to the Seller by a private Alberta

oil and gas corporation (the "Debtor") and security documents granted

by the Debtor to the Seller. The Debtor's assets include a 100%

working interest in more than 41 sections of land in southwest

Saskatchewan. In consideration the Company will pay an aggregate of

$620,000.

No Insider / Pro Group Participation.

This transaction was announced in the Company's press releases dated

October 29, 2009.

TSX-X

-----------------------------------------------------------------------

WHITE BEAR RESOURCES INC. ("WBR")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: November 10, 2009

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated August

31, 2009, has been filed with and accepted by TSX Venture Exchange, and

filed with and receipted by the British Columbia Securities Commission

on September 1, 2009, pursuant to the provisions of the British

Columbia Securities Act.

The gross proceeds received by the Company for the Offering were

$1,000,000 (10,000,000 common shares at $0.10 per share). The Company

is classified as a 'mineral exploration and development' company.

Commence Date: At the opening Wednesday, November 11,

2009, the Common shares will commence

trading on TSX Venture Exchange.

Corporate Jurisdiction: Business Corporations Act (British

Columbia)

Capitalization: Unlimited common shares with no par value

of which 20,700,001 common shares are

issued and outstanding

Escrowed Shares: 2,980,001 common shares

Transfer Agent: Computershare Investor Services Inc.

(Vancouver)

Trading Symbol: WBR

CUSIP Number: 96349P 10 2

Sponsoring Member: Blackmont Capital Inc. (Calgary)

Agent: Blackmont Capital Inc. (Calgary)

Agent's Option: 1,000,000 non-transferable agent's

options. One option to purchase one share

at $0.10 per share up to 24 months.

For further information, please refer to the Company's Prospectus dated

August 31, 2009.

Company Contact: Byron Coulthard, President, CEO,

Secretary, & Director

Company Address: Suite 1320 - 885 West Georgia Street

Vancouver, BC V6C 3E8

Company Phone Number: (604) 687-3067

Company Fax Number: (604) 682-4309

Company Email Address: slewis@shawcable.com

TSX-X

-----------------------------------------------------------------------

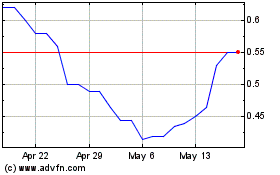

Kodiak Copper (TSXV:KDK)

Historical Stock Chart

From Apr 2024 to May 2024

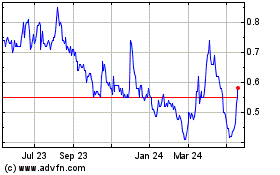

Kodiak Copper (TSXV:KDK)

Historical Stock Chart

From May 2023 to May 2024