IBC Advanced Alloys Corp. (“

IBC” or the

“

Company”) (

TSX-V: IB; OTCQB:

IAALF) announces its financial results for the quarter

ended March 31, 2020.

In the quarter, the Company recorded comprehensive income of

$171,000, or $0.00 per share, which was driven by higher sales

across the Copper Alloys and Engineered Materials operating

divisions. Consolidated sales in the quarter of $5.9 million were

12.5% higher than the prior-year period, and year-to-date (“YTD”)

sales of $16.2 million were higher by 17.3% as compared to first

nine months of fiscal 2019.

|

SELECTED RESULTS: Consolidated |

|

|

Quarter Ended 3-31-2020 |

|

Quarter Ended 3-31-2019 |

|

|

Sales |

$5,851,977 |

|

$5,201,848 |

|

|

Operating Income (Loss) |

$133,909 |

|

$(381,885 |

) |

|

Net Income (Loss) |

$171,279 |

|

$(639,301 |

) |

|

Adjusted EBITDA |

$825,097 |

|

$(164,091 |

) |

The Copper Alloys division posted sales of $4.0 million, a 10%

increase over the prior-year period, and YTD sales of $11.4 million

were 16.4% higher than the comparable period of fiscal

2019.

The Engineered Materials division posted sales of $1.9 million

in the quarter, an increase of 18% over the prior-year

period. Year-to-date sales of $4.0 million were 19.8% higher

than in comparable prior-year period.

Consolidated gross margin also improved in the quarter to 20.4%,

from 11.9% in the prior-year period, and rose to 15.9%

year-to-date, from 10.1% in the nine months ended March 31,

2019.

Adjusted earnings before interest, taxes, depreciation, and

amortization (“Adjusted EBITDA”) for the quarter totaled $825,000,

which reversed an Adjusted EBITDA loss of $167,000 for the

prior-year period. Year-to-date Adjusted EBITDA totaled

$891,000, as compared to ($891,000) in the prior-year period.

Both operating divisions posted positive Adjusted EBITDA for the

quarter and on a year-to-date basis.

“The Board and I are very pleased with the strong sales

performance and gross margin improvements in the quarter across

both our Engineered Materials and Copper Alloys divisions,” said

Mark A. Smith, IBC Board Chairman. “We were especially

pleased to see the strong performance and profitable operations of

our Engineered Materials division, which specializes in

high-performance beryllium-aluminum alloys for both defense and

commercial applications.”

“The IBC team’s ability to achieve profitability in the midst of

challenging and volatile market conditions highlights the potential

of this team to continue improving operational efficiencies,

increasing gross margins, expanding sales, and delivering improved

shareholder value,” Mr. Smith added.

EMC Division Highlights

|

SELECTED RESULTS: Engineered Materials

Division |

|

|

Quarter Ended 3-31-2020 |

|

Quarter Ended 3-31-2019 |

|

|

Sales |

$1,872,695 |

|

$1,584,706 |

|

|

Operating Income (Loss) |

$272,352 |

|

$(90,265 |

) |

|

Net Income (Loss) |

$265,225 |

|

$(95,761 |

) |

|

Adjusted EBITDA |

$501,077 |

|

$17,836 |

|

The Engineered Materials division posted comprehensive income of

$265,000 in the quarter, which reversed a comprehensive loss of

$96,000 in the prior-year period.

Engineered Materials sales in the quarter of $1.9 million were

18% higher than sales of $1.6 million in the prior-year

period. Year to date, Engineered Materials sales grew to $4.8

million, a 20% increase over sales of $4.0 million in the prior

year-to-date period. This change was largely driven by

increased demand for beryllium-aluminum (“BeAl”) products sold to

semiconductor equipment manufacturers.

Adjusted EBITDA for the division was $501,000 in the quarter,

which compared favorably to Adjusted EBITDA of $15,000 in the

prior-year period. Year to date, Adjusted EBITDA for the

division was $791,000, which compared to Adjusted EBITDA of

($206,000) in the prior year-to-date period.

Demand for BeAl products used in defense applications remained

steady in fiscal year 2020 but is expected to strengthen as rates

of production for F-35 Lightning II aircraft begin to accelerate

beyond Low Rates of Initial Production (“LRIP”). For example,

according to data released publicly by our customer

Lockheed-Martin, the annual rate of production of the F-35 aircraft

is expected to nearly double by 2022 from 2018 production

levels. IBC is continuing to pursue additional contracts for

high-performance BeAl products in other defense-sector

platforms.

Copper Alloys Division Highlights

|

SELECTED RESULTS: Copper Alloys

Division |

|

|

Quarter Ended 3-31-2020 |

|

Quarter Ended 3-31-2019 |

|

|

Sales |

$3,979,282 |

|

$3,617,142 |

|

|

Operating Income (Loss) |

$173,350 |

|

$1,061 |

|

|

Adjusted EBITDA |

$321,256 |

|

$90,728 |

|

|

Net Income (Loss) |

$97,705 |

|

$(96,487 |

) |

The Copper Alloys division posted a net income of $98,000 in the

quarter, which reversed a net loss of $96,000 in the prior-year

period. Sales of $4.0 million in the quarter were 10% higher

than sales of $3.6 million in fiscal Q3 of 2019. Year-to-date

Copper Alloys sales were $11.4 million, a 16% increase over sales

of $9.8 million in the prior year-to-date period.

Average gross margin of 14.9% in the quarter compared to 14.1%

in the prior-year period, largely as a result of fixed costs being

spread over a larger production volume.

Adjusted EBITDA for the division was $322,000 in the quarter,

which compared favorably to Adjusted EBITDA of $91,000 in the

prior-year period. Year to date, Adjusted EBITDA was

$502,000, which compared to Adjusted EBITDA of ($80,000) in the

prior year-to-date period.

Higher demand for copper alloy products has been driven

primarily by strong demand in electronics, marine defense and power

generation markets. Growth has also accelerated due in part

to the division’s ability to produce more value-added products as a

result of several strategic capital equipment upgrades made in

fiscal year 2019.

FISCAL Q2 2020 SEGMENT AND CONSOLIDATED OPERATIONS

RESULTS

Following is a summary of the Company’s results of operations to

Adjusted EBITDA for the third fiscal quarter of 2020, on a

consolidated and segment-by-segment basis:

|

|

Three Months Ended |

|

|

Three Months Ended |

| |

March 31, 2020 |

|

|

March 31, 2019 |

|

|

Copper |

|

Eng. |

|

Corp. |

|

Consol- |

|

|

Copper |

|

Eng. |

|

Corp. |

|

Consol- |

|

| |

Alloys |

|

Mat. |

|

|

|

idated |

|

|

Alloys |

|

Mat. |

|

|

|

idated |

|

| |

($000s) |

|

($000s) |

|

($000s) |

|

($000s) |

|

|

($000s) |

|

($000s) |

|

($000s) |

|

($000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

3,979 |

|

1,873 |

|

- |

|

5,852 |

|

|

3,617 |

|

1,585 |

|

- |

|

5,202 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Materials |

2,149 |

|

418 |

|

- |

|

2,567 |

|

|

1,869 |

|

393 |

|

- |

|

2,262 |

|

|

Labor |

561 |

|

350 |

|

- |

|

911 |

|

|

553 |

|

402 |

|

- |

|

955 |

|

|

Subcontract |

84 |

|

45 |

|

- |

|

129 |

|

|

109 |

|

77 |

|

- |

|

186 |

|

|

Overhead |

497 |

|

252 |

|

- |

|

749 |

|

|

470 |

|

421 |

|

- |

|

891 |

|

|

Depreciation |

141 |

|

198 |

|

- |

|

339 |

|

|

99 |

|

99 |

|

- |

|

198 |

|

|

Change in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

finished goods |

(45 |

) |

9 |

|

- |

|

(36 |

) |

|

(2 |

) |

93 |

|

- |

|

91 |

|

| |

3,387 |

|

1,272 |

|

- |

|

4,659 |

|

|

3,098 |

|

1,485 |

|

- |

|

4,583 |

|

| Gross profit |

592 |

|

601 |

|

- |

|

1,193 |

|

|

519 |

|

100 |

|

- |

|

619 |

|

| Gross

margin |

14.9% |

|

32.1% |

|

|

|

20.4% |

|

|

14.3% |

|

6.3% |

|

|

|

11.9% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SG&A expenses |

419 |

|

328 |

|

312 |

|

1,059 |

|

|

518 |

|

190 |

|

293 |

|

1,001 |

|

| Income

(loss) before other items |

173 |

|

273 |

|

(312 |

) |

134 |

|

|

1 |

|

(90 |

) |

(293 |

) |

(382 |

) |

| Other income (expense) |

(75 |

) |

(8 |

) |

120 |

|

37 |

|

|

(97 |

) |

(6 |

) |

(154 |

) |

(257 |

) |

|

Total comprehensive income (loss) |

98 |

|

265 |

|

(192 |

) |

171 |

|

|

(96 |

) |

(96 |

) |

(447 |

) |

(639 |

) |

| Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax expense |

- |

|

- |

|

- |

|

- |

|

|

- |

|

(2 |

) |

(1 |

) |

(3 |

) |

|

Interest expense |

71 |

|

12 |

|

168 |

|

251 |

|

|

77 |

|

8 |

|

125 |

|

210 |

|

|

Depreciation, amortization, & impairment |

149 |

|

221 |

|

- |

|

370 |

|

|

101 |

|

98 |

|

- |

|

199 |

|

|

Stock-based compensation expense (non-cash) |

4 |

|

3 |

|

26 |

|

33 |

|

|

9 |

|

7 |

|

50 |

|

66 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

322 |

|

501 |

|

2 |

|

825 |

|

|

91 |

|

15 |

|

(273 |

) |

(167 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-IFRS MEASURES

To supplement its consolidated financial statements, which are

prepared and presented in accordance with IFRS, IBC uses “operating

income (loss)” and “Adjusted EBITDA”, which are non-IFRS financial

measures. IBC believes that operating income (loss) helps identify

underlying trends in the business that could otherwise be distorted

by the effect of certain income or expenses that the Company

includes in loss for the period, and provides useful information

about core operating results, enhances the overall understanding of

past performance and future prospects, and allows for greater

visibility with respect to key metrics used by management in

financial and operational decision-making.

The Company believes that Adjusted EBITDA is a useful indicator

for cash flow generated by the business that is independent of

IBC’s capital structure.

Operating income (loss) and Adjusted EBITDA should not be

considered in isolation or construed as an alternative to loss for

the period or any other measure of performance or as an indicator

of our operating performance. Operating income (loss) and Adjusted

EBITDA presented here may not be comparable to similarly titled

measures presented by other companies. Other companies may

calculate similarly titled measures differently, limiting their

usefulness as comparative measures to IBC’s data.

Operating Income (Loss)

Operating income (loss) represents loss for the period,

excluding foreign exchange loss, interest expense, interest income,

other income (expense) and income taxes that the Company does not

believe are reflective of its core operating performance during the

periods presented. A reconciliation of the third quarter income and

the nine-month period ended March 31, 2020 loss to operating income

follows:

|

Quarter ended March 31 |

2020 |

|

|

2019 |

|

|

|

($000s) |

|

|

($000s) |

|

|

Income (loss) for the period |

171 |

|

|

(639 |

) |

|

Foreign exchange (gain) loss |

(288 |

) |

|

30 |

|

|

Interest expense |

251 |

|

|

210 |

|

| Loss on disposal of

assets |

5 |

|

|

20 |

|

|

Interest income |

- |

|

|

- |

|

|

Other income |

(5 |

) |

|

(5 |

) |

| Arbitration award

liability |

- |

|

|

- |

|

|

Income taxes |

- |

|

|

2 |

|

|

Operating income (loss) |

134 |

|

|

(382 |

) |

|

Nine months ended March 31 |

2020 |

|

|

2019 |

|

|

|

($000s) |

|

|

($000s) |

|

|

Loss for the period |

(1,149 |

) |

|

(2,494 |

) |

|

Foreign exchange (gain) loss |

(288 |

) |

|

(1 |

) |

|

Interest expense |

805 |

|

|

708 |

|

| Loss on disposal of

assets |

5 |

|

|

20 |

|

|

Interest income |

- |

|

|

(6 |

) |

|

Other income |

(17 |

) |

|

(18 |

) |

| Arbitration award

liability |

- |

|

|

- |

|

|

Income taxes |

7 |

|

|

5 |

|

|

Operating loss |

(637 |

) |

|

(1,786 |

) |

Adjusted EBITDA

Adjusted EBITDA represents income (loss) for the period before

interest, income taxes, depreciation, amortization and share-based

compensation. A reconciliation of the Company’s third quarter

income to Adjusted EBITDA follows:

|

Quarter ended March 31 |

2020 |

|

|

2019 |

|

|

|

($000s) |

|

|

($000s) |

|

| |

|

|

|

|

|

|

Income (loss) for the period |

171 |

|

|

(639 |

) |

|

|

|

|

|

|

|

| Tax expense |

- |

|

|

(3 |

) |

| Interest expense |

251 |

|

|

210 |

|

| Depreciation, &

amortization, |

370 |

|

|

199 |

|

| Stock-based compensation

expense (non-cash) |

33 |

|

|

66 |

|

| |

|

|

|

|

|

|

Adjusted EBITDA |

825 |

|

|

(167 |

) |

|

Nine months ended March 31 |

2020 |

|

|

2019 |

|

|

|

($000s) |

|

|

($000s) |

|

| |

|

|

|

|

|

|

Loss for the period |

(1,149 |

) |

|

(2,494 |

) |

|

|

|

|

|

|

|

| Tax expense |

(7 |

) |

|

(5 |

) |

| Interest expense |

805 |

|

|

708 |

|

| Depreciation, &

amortization, |

1,135 |

|

|

582 |

|

| Stock-based compensation

expense (non-cash) |

107 |

|

|

318 |

|

| |

|

|

|

|

|

|

Adjusted EBITDA |

891 |

|

|

(891 |

) |

For more information on IBC and its innovative alloy products,

go here.

On Behalf of the Board of Directors:

"Mark A. Smith”

Mark A. Smith, Chairman of the Board

CONTACTS: Mark A. Smith, Chairman of the Board

Jim Sims, Investor and Public Relations IBC Advanced Alloys Corp.

+1 (303) 503-6203 Email: jim.sims@ibcadvancedalloys.com Website:

www.ibcadvancedalloys.com @IBCAdvanced $IB $IAALF

ABOUT IBC ADVANCED ALLOYS CORP.

IBC is a leading beryllium and copper advanced alloys company

serving a variety of industries such as defense, aerospace,

automotive, telecommunications, precision manufacturing, and

others. IBC's Copper Alloys Division manufactures and distributes a

variety of copper alloys as castings and forgings, including

beryllium copper, chrome copper, and aluminum bronze. IBC's

Engineered Materials Division makes the Beralcast® family of

alloys, which can be precision cast and are used in an increasing

number of defense, aerospace, and other systems, including the F-35

Joint Strike Fighter. IBC's has production facilities in Indiana,

Massachusetts, Pennsylvania, and Missouri. The Company's common

shares are traded on the TSX Venture Exchange under the symbol "IB"

and the OTCQB under the symbol "IAALF".

CAUTIONARY STATEMENTS

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. This disclosure contains a

forward-looking statements. Forward-looking statements

normally contain words like ‘believe’, ‘expect’, ‘anticipate’,

‘plan’, ‘intend’, ‘continue’, ‘estimate’, ‘may’, ‘will’, ‘should’,

‘ongoing’ and similar expressions, and within this news release

include any statements (express or implied) respecting anticipated

sales trends in fiscal 2020, expected demand for the Company’s

products and expectations as to additional quantities to be sold

under the Lockheed Martin contract. Although IBC believes that the

expectations reflected in these forward-looking statement are

reasonable, forward-looking statements, by their very nature, are

subject to inherent risks and uncertainties and are based on

assumptions, both general and specific, which give rise to the

possibility that actual results or events could differ materially

from our expectations expressed in or implied by such

forward-looking statement. The forward looking statements

made by the Company in this press release are based on its

experience, perception of historical trends, current conditions,

expected future developments and other factors it believes are

appropriate in the circumstances. As a result, we cannot

guarantee that any forward-looking statement will materialize and

we caution you against relying on any of these forward-looking

statements. IBC makes no commitment to revise or update any

forward-looking statements in order to reflect events or

circumstances after the date any such statement is made, except as

required by applicable law. Additional information identifying

risks and uncertainties is contained in IBC’s filings, including

its Annual Information Form for the fiscal year ended June 30,

2019, available at www.sedar.com.

1 We report non-IFRS measures such as "Adjusted EBITDA" and

“Operating Income.” Please see information on this and other

non-IFRS measures in the "Non-IFRS Measures" section of the

Company’s MD&A and in this news release.

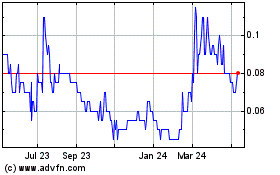

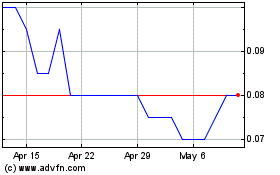

IBC Advanced Alloys (TSXV:IB)

Historical Stock Chart

From Apr 2024 to May 2024

IBC Advanced Alloys (TSXV:IB)

Historical Stock Chart

From May 2023 to May 2024