false

0000063330

0000063330

2024-05-13

2024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2024

MAUI LAND & PINEAPPLE COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-06510

|

99-0107542

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

|

500 Office Road, Lahaina, Maui, Hawaii 96761

(Address of principal executive offices) (Zip Code)

|

(808) 877-3351

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

MLP

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On May 13, 2024, the Company issued a press release, which sets forth the results of its operations for the three months ended March 31, 2024. A copy of the press release is filed herewith as Exhibit 99.1 and incorporated herein by reference.

Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

Exhibit

Number

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MAUI LAND & PINEAPPLE COMPANY, INC.

|

| |

|

|

|

Date: May 13, 2024

|

By:

|

/s/ WADE K. KODAMA

|

| |

|

Wade K. Kodama

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

Maui Land & Pineapple Company Reports Fiscal 2024 First Quarter Results

Annual Meeting and Shareholder Presentation to be held virtually on May 15, 2024 at 10:00 a.m. HST

KAPALUA, Hawai‘i / May 13, 2024 (BusinessWire) – Maui Land & Pineapple Company, Inc. (NYSE: MLP) today reported financial results covering the three month period ended March 31, 2024. The company’s annual meeting and shareholder presentation will be held virtually on May 15, 2024 at 10:00 a.m. Hawaii Standard Time, via meeting link posted on mauiland.com/investors.

“Maui Land & Pineapple Company’s renewed mission to maximize the productive use of our diverse portfolio of land and commercial properties is starting to yield tangible results,” said CEO Race Randle. “Despite the challenges following the 2023 Maui wildfires, concerted efforts to reposition and increase occupancy at the Kapalua Village and Hali‘imaile Town Centers contributed to an 8% year-over-year growth in revenue. Our strategic investments to enhance the Company’s commercial properties and prepare unimproved landholdings for new projects will help position us to meet the needs of current and prospective tenants, improve Maui’s housing supply, and create added value for shareholders.”

First Quarter 2024 Highlights

“During the first quarter of the year, we have focused on new strategic investments in market research, planning, and engineering while also evaluating future land sale strategies” said Randle. “We believe these investments will enhance the value and productivity of unimproved land through planning and building necessary infrastructure for improved lots. Concurrently, we plan on establishing new partnerships to accelerate the utilization of entitled parcels and have begun listing non-strategic assets for sale.”

| |

●

|

Operating Revenues – Operating revenues totaled $2,483,000 for the three months ended March 31, 2024, an increase of $185,000 compared to the three months ended March 31, 2023. Leasing revenues of $2,216,000 for the three months ended March 31, 2024, as compared to $2,077,000 for the three months ended March 31, 2023, increased $139,000 due to a $110,000 increase in percentage rents and a $29,000 increase in base rents. The increase in percentage rents is an indication that economic activity is steadily improving post-wildfires and the rise in base rents is a result of Maui Land & Pineapple Company’s initial work to fill vacancies and renew leases at market rates.

|

| |

●

|

Costs and expenses – Operating costs and expenses totaled $3,882,000 for the three months ended March 31, 2024, an increase of $214,000 compared to the three months ended March 31, 2023. The increase in operating costs were driven by $183,000 in land planning and improvement costs as the Company activates landholdings for projects and $198,000 increase in leasing costs for tenant-related improvements on commercial properties. Cost increases were offset by a $113,000 cost reduction in the management and operations of the Kapalua Club, a non-equity membership club providing amenities to resort residents.

|

| |

●

|

Net loss – Net loss was $1,375,000, or $0.07 per common share, in the three months ended March 31, 2024, compared to net loss of $1,364,000 or $0.07 per common share, in the three months ended March 31, 2023. The net loss in the three months ended March 31, 2024 was primarily driven by non-cash, GAAP expenses related to depreciation, share-based compensation and post-retirement expenses amounting to $1,209,000. In addition, severance payments in the amount of $108,000 to the former CEO was incurred and will extend through March 31, 2025.

|

| |

●

|

Adjusted EBITDA (Non-GAAP) – For the three months ended March 31, 2024, after adjusting for non-cash income and expenses of $1,178,000, Adjusted EBITDA was ($197,000). Of the negative Adjusted EBITDA, ($108,000) was attributed to the former CEO severance.

|

| |

●

|

Cash and Investments Convertible to Cash (Non-GAAP) – Cash and investments convertible to cash totaled $8,553,000 on March 31, 2024, a decrease of ($282,000) compared to December 31, 2023. The decrease reflects the additional cash spent towards reinvestment into the commercial assets and preparing for new projects but was offset by collection of leasing receivables.

|

Appointment of Vice President of Real Estate

Maui Land & Pineapple Company appointed Jonathan Grobe as Vice President of Real Estate effective April 1, 2024, marking the latest addition to the Company’s executive leadership team. Born and raised in Hawai‘i, Grobe most recently served as a Vice President at Lendlease, leading efforts in Google’s large scale master-planned community in Mountain View, CA. Prior roles included management of retail, hospitality, multifamily, residential, and mixed-use projects in Hawaii and California.

“Jonathan brings valuable experience paired with local values that will significantly contribute to our efforts to activate our real estate assets,” said Randle. “As we make strategic investments to advance our long-range vision and execution of projects at Maui Land & Pineapple Company, a strong leadership team with a deep understanding of the local landscape is critical to our success.”

Non-GAAP Financial Measures

Certain non-GAAP financial measures are presented in this press release, including Adjusted EBITDA and Cash and Investments Convertible to Cash, to provide information that may assist investors in understanding the Company's financial results and financial condition and assessing its prospects for future performance. We believe that Adjusted EBITDA is an important indicator of our operating performance because it excludes items that are unrelated to, and may not be indicative of, our core operating results. We believe cash and investments convertible to cash are important indicators of liquidity because it includes items that are convertible into cash in the short term. These non-GAAP financial measures are not intended to represent and should not be considered more meaningful measures than, or alternatives to, measures of operating performance or liquidity as determined in accordance with GAAP. To the extent we utilize such non-GAAP financial measures in the future, we expect to calculate them using a consistent method from period to period.

EBITDA is a non-GAAP financial measure defined as net income (loss) excluding interest, taxes, depreciation, and amortization. Adjusted EBITDA is further adjusted for non-cash stock-based compensation expense and pension and post-retirement expenses. Adjusted EBITDA is a key measure used by the Company to evaluate operating performance, generate future operating plans, and make strategic decisions for the allocation of capital. The Company presents Adjusted EBITDA to provide information that may assist investors in understanding its financial results. However, Adjusted EBITDA is not intended to be a substitute for net income (loss). A reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure is provided further below.

Cash and investments convertible to cash is a non-GAAP financial measure defined as cash and cash equivalents plus restricted cash and investments. Cash and cash investments convertible to cash is a key measure used by the Company to evaluate internal liquidity. The inclusion of the convertible investments to cash better describes the overall liquidity of the company as convertible investments convert to cash within forty eight hours of authorization to liquidate the investment portfolio.

Additional Information

More information about Maui Land & Pineapple Company’s fiscal year 2023 operating results are available in the Form 10-K filed with the Securities and Exchange Commission on March 28, 2024 and posted at mauiland.com.

About Maui Land & Pineapple Company

Maui Land & Pineapple Company, Inc. (NYSE: MLP) is dedicated to the thoughtful stewardship of their portfolio including over 22,300 acres of land and 266,000 square feet of commercial real estate. The Company envisions a future where Maui residents thrive in more resilient communities with sufficient housing supply, economic stability, food and water security, and renewed connections between people and place. For over a century, the Company has built a legacy of authentic innovation through conservation, agriculture, community building and land management. The Company continues this legacy today with a mission to carefully maximize the use of its assets in a way that honors the past, meets current critical needs, and provides security for future generations.

The Company’s assets include land for future residential communities within the world-renowned Kapalua Resort, home to luxury hotels, such as The Ritz-Carlton Maui and Montage Kapalua Bay, two championship golf courses, pristine beaches, a network of walking and hiking trails, and the Pu‘u Kukui Watershed, the largest private nature preserve in Hawai‘i.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include but are not limited to statements regarding the Company’s ability to repurpose its land for productive use, increase Maui’s housing supply and improve tenanting of the village centers, and fill the vacancies in our commercial properties. These forward-looking statements are based on the current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties, and contingencies, many of which are beyond the control of the Company. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Company's reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC's Internet site (http://www.sec.gov). We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether because of new information, future developments or otherwise.

# # #

CONTACT

|

Investors:

|

Wade Kodama | Chief Financial Officer | Maui Land & Pineapple Company

|

| |

e: wade@mauiland.com

|

|

Media:

|

Ashley Takitani Leahey | Vice President | Maui Land & Pineapple Company

e: ashley@mauiland.com

Dylan Beesley | Senior Vice President | Bennet Group Strategic Communications

e: dylan@bennetgroup.com

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(in thousands except per share amounts)

|

|

|

OPERATING REVENUES

|

|

|

|

|

|

|

|

|

|

Land development and sales

|

|

$ |

- |

|

|

$ |

- |

|

|

Leasing

|

|

|

2,216 |

|

|

|

2,077 |

|

|

Resort amenities and other

|

|

|

267 |

|

|

|

221 |

|

|

Total operating revenues

|

|

|

2,483 |

|

|

|

2,298 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING COSTS AND EXPENSES

|

|

|

|

|

|

|

|

|

|

Land development and sales

|

|

|

266 |

|

|

|

83 |

|

|

Leasing

|

|

|

992 |

|

|

|

794 |

|

|

Resort amenities and other

|

|

|

436 |

|

|

|

549 |

|

|

General and administrative

|

|

|

1,057 |

|

|

|

1,025 |

|

|

Share-based compensation

|

|

|

959 |

|

|

|

964 |

|

|

Depreciation

|

|

|

172 |

|

|

|

253 |

|

|

Total operating costs and expenses

|

|

|

3,882 |

|

|

|

3,668 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING LOSS

|

|

|

(1,399 |

) |

|

|

(1,370 |

) |

| |

|

|

|

|

|

|

|

|

|

Other income

|

|

|

104 |

|

|

|

129 |

|

|

Pension and other post-retirement expenses

|

|

|

(78 |

) |

|

|

(121 |

) |

|

Interest expense

|

|

|

(2 |

) |

|

|

(2 |

) |

| |

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$ |

(1,375 |

) |

|

$ |

(1,364 |

) |

|

Other comprehensive income - pension, net

|

|

|

68 |

|

|

|

82 |

|

|

TOTAL COMPREHENSIVE LOSS

|

|

$ |

(1,307 |

) |

|

$ |

(1,282 |

) |

| |

|

|

|

|

|

|

|

|

|

NET LOSS PER COMMON SHARE-BASIC AND DILUTED

|

|

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

March 31, 2024

|

|

|

December 31, 2023

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands except share data)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

5,377 |

|

|

$ |

5,700 |

|

|

Accounts receivable, net

|

|

|

1,253 |

|

|

|

1,166 |

|

|

Investment in debt securities , current portion

|

|

|

2,589 |

|

|

|

2,671 |

|

|

Prepaid expenses and other assets

|

|

|

347 |

|

|

|

467 |

|

|

Total current assets

|

|

|

9,566 |

|

|

|

10,004 |

|

| |

|

|

|

|

|

|

|

|

|

PROPERTY & EQUIPMENT, NET

|

|

|

16,027 |

|

|

|

16,059 |

|

| |

|

|

|

|

|

|

|

|

|

OTHER ASSETS

|

|

|

|

|

|

|

|

|

|

Investment in debt securities, net of current portion

|

|

|

587 |

|

|

|

464 |

|

|

Investment in joint venture

|

|

|

1,627 |

|

|

|

1,608 |

|

|

Deferred development costs

|

|

|

12,860 |

|

|

|

12,815 |

|

|

Other noncurrent assets

|

|

|

1,388 |

|

|

|

1,273 |

|

|

Total other assets

|

|

|

16,462 |

|

|

|

16,160 |

|

|

TOTAL ASSETS

|

|

$ |

42,055 |

|

|

$ |

42,223 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,408 |

|

|

$ |

1,154 |

|

|

Payroll and employee benefits

|

|

|

217 |

|

|

|

502 |

|

|

Accrued retirement benefits, current portion

|

|

|

142 |

|

|

|

142 |

|

|

Deferred revenue, current portion

|

|

|

308 |

|

|

|

217 |

|

|

Other current liabilities

|

|

|

475 |

|

|

|

465 |

|

|

Total current liabilities

|

|

|

2,550 |

|

|

|

2,480 |

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accrued retirement benefits, net of current portion

|

|

|

1,528 |

|

|

|

1,550 |

|

|

Deferred revenue, net of current portion

|

|

|

1,333 |

|

|

|

1,367 |

|

|

Deposits

|

|

|

2,078 |

|

|

|

2,108 |

|

|

Other noncurrent liabilities

|

|

|

12 |

|

|

|

14 |

|

|

Total long-term liabilities

|

|

|

4,951 |

|

|

|

5,039 |

|

|

TOTAL LIABILITIES

|

|

|

7,501 |

|

|

|

7,519 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Preferred stock--$0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock--$0.0001 par value; 43,000,000 shares authorized; 19,641,045 and 19,615,350 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively

|

|

|

85,201 |

|

|

|

84,680 |

|

|

Additional paid-in-capital

|

|

|

11,174 |

|

|

|

10,538 |

|

|

Accumulated deficit

|

|

|

(54,992 |

) |

|

|

(53,617 |

) |

|

Accumulated other comprehensive loss

|

|

|

(6,829 |

) |

|

|

(6,897 |

) |

|

Total stockholders' equity

|

|

|

34,554 |

|

|

|

34,704 |

|

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

|

|

$ |

42,055 |

|

|

$ |

42,223 |

|

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

|

|

SUPPLEMENTAL FINANCIAL INFORMATION

|

|

(NON-GAAP) UNAUDITED

|

| |

|

Three Months Ended

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(in thousands)

|

|

|

(in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS)

|

|

$ |

(1,375 |

) |

|

$ |

(1,364 |

) |

| |

|

|

|

|

|

|

|

|

|

Add: Non-cash expenses

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

2 |

|

|

|

2 |

|

|

Depreciation

|

|

|

172 |

|

|

|

253 |

|

|

Amortization of licensing fee revenue

|

|

|

(33 |

) |

|

|

(33 |

) |

|

Share-based compensation

|

|

|

|

|

|

|

|

|

|

Vesting of former CEO upon separation from the Company

|

|

|

- |

|

|

|

675 |

|

|

Vesting of Stock Options granted to Board Chair and Directors

|

|

|

439 |

|

|

|

- |

|

|

Vesting of Stock Compensation granted to Board Chair and Directors

|

|

|

144 |

|

|

|

174 |

|

|

Vesting of Stock Options granted to CEO

|

|

|

197 |

|

|

|

- |

|

|

Vesting of employee Incentive Stock

|

|

|

179 |

|

|

|

116 |

|

|

Pension and other post-retirement expenses

|

|

|

78 |

|

|

|

121 |

|

| |

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA (LOSS)

|

|

$ |

(197 |

) |

|

$ |

(56 |

) |

| |

|

March 31, 2024

|

|

|

December 31, 2023

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands)

|

|

|

(in thousands)

|

|

|

CASH AND INVESTMENTS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

5,377 |

|

|

$ |

5,700 |

|

|

Investments, current portion

|

|

|

2,589 |

|

|

|

2,671 |

|

|

Investments, net of current portion

|

|

|

587 |

|

|

|

464 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL CASH AND INVESTMENTS CONVERTIBLE TO CASH

|

|

$ |

8,553 |

|

|

$ |

8,835 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MAUI LAND & PINEAPPLE COMPANY, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-06510

|

| Entity, Tax Identification Number |

99-0107542

|

| Entity, Address, Address Line One |

500 Office Road

|

| Entity, Address, Address Line Two |

Lahaina

|

| Entity, Address, City or Town |

Maui

|

| Entity, Address, State or Province |

HI

|

| Entity, Address, Postal Zip Code |

96761

|

| City Area Code |

808

|

| Local Phone Number |

877-3351

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MLP

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000063330

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

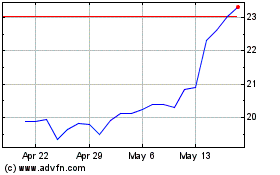

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

From Apr 2024 to May 2024

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

From May 2023 to May 2024