Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 11 2024 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission file number: 001-39477

GLOBAL BLUE GROUP HOLDING AG

(Translation of registrant’s name into English)

Zürichstrasse 38, 8306 Brüttisellen, Switzerland

+41 22 363 77 40

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On January 11, 2024, Global Blue Group Holding AG (the "Company") issued a press release, attached as exhibit 99.1 to this Form 6-K, providing a business update on the Tax Free Shopping ("TFS") sustained recovery in Continental Europe, and the steady TFS recovery in Asia Pacific.

INCORPORATION BY REFERENCE

This Report on Form 6-K and the exhibits hereto shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Nos. 333-259200, 333-267850, and 333-274233) and Form S-8 (No. 333-260108) of the Company and the prospectuses incorporated therein, and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

| | | | | |

| Exhibit number | Description |

| 99.1 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 11, 2024

GLOBAL BLUE GROUP HOLDING AG

By: /s/ Jacques Stern

Name: Jacques Stern

Title: Chief Executive Officer

1 GLOBAL BLUE RELEASES THE MONTHLY TAX FREE SHOPPING BUSINESS UPDATE FOR DECEMBER 2023 Signy, Switzerland, January 11, 2024 Fresh data from Global Blue reveals that the global dynamic recovery for Tax Free Shopping has remained solid across Continental Europe and Asia Pacific compared to previous months. Globally, issued Sales in Store like-for-like recovery reached 130%1 in December versus 125%1 in October/November and 123%1 in Q3 ’23. A sustained recovery in Continental Europe In Continental Europe, the recovery remains solid reaching 121%1 in December vs. 117%1 in October/November and 119%1 in Q3 ’23, despite the events in Palestine. Excluding Mainland Chinese and Russian shoppers, (who represented 25% and 8% of Sales in Store in the region in 2019), the recovery would have reached 154%1 in December vs. 153%1 in October/November and 157%1 in Q3 ‘23. In terms of origin markets, US shoppers have sustained a strong level of recovery, reaching 246%1 in December, consistent with October/November at 249%1 and Q3 ’23 at 258%1. GCC shopper recovery also remains solid at 230%1 in December, vs. 248%1 in October/November and 200%1 in Q3 ‘23. Regarding destination markets, December has maintained a stable recovery across most destinations with Greece at 165%1, France at 145%1, Spain at 143%1, Switzerland at 133%1, and Italy at 119%1. A steady recovery in Asia Pacific In Asia Pacific, the recovery rate remains solid, reaching 151%1 in December vs. 149%1 in October/November and 134%1 in Q3 ‘23 with Japan driving the acceleration in this region. When excluding Mainland Chinese shoppers (who represented 55% of Sales in Store in the region in 2019), the recovery would have reached 198%1 in December vs. 196%1 in October/November and 169%1 in Q3 ‘23. Regarding origin markets, residents from Hong Kong and Taiwan and North East Asia continue to drive the strong recovery in Asia Pacific. Notably, travelers from Hong Kong and Taiwan sustained a significantly high recovery, reaching 512%1 in December vs. 555%1 in 1 Recovery rate is equal to 2023 Issued Sales in Store divided by 2019 Issued Sales in Store, like-for-like (i.e.: at constant merchant scope and exchange rates).

2 October/November and 448%1 in Q3 ‘23. Following behind are North East Asia travelers, with a recovery rate of 336%1 in December vs. 306%1 in October/November and 203%1 in Q3 ‘23. When examining destination markets, Japan continues to propel in Asia Pacific due to the attraction of the weakened Japanese Yen, reaching 231%1 in December, followed by South Korea at 106%1. Worldwide recovery of Mainland Chinese shoppers In December, the worldwide Sales in Store like-for-like recovery of Mainland China shoppers reached 82%1 vs. 77%1 in October/November and 70%1 in Q3’23. Within Continental Europe, the Sales in Store like-for-like recovery among Mainland China shoppers has remained in line with previous months, bearing in mind that constraints such as the lead time required for visa issuance and limited group travel were still present in December. The recovery reached 58%1 in December vs. 57%1 in October/November and 45%1 in Q3 ’23. In Asia Pacific, the pace of the recovery has remained solid, reaching 104%1 in December in line with October/November at 105%1 and Q3 ’23 at 105%1. APPENDIX YTD Data Issued SIS L/L recovery1 (in % of 2019) December 2023 November 2023 October 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Continental Europe 121% 118% 115% 119% 121% 109% 104% 101% Asia Pacific 151% 152% 147% 134% 111% 87% 80% 51% TOTAL 130% 127% 123% 123% 118% 101% 97% 89% Glossary - Gulf Cooperation Council countries include: Kuwait, Qatar, Saudi Arabia, United Arab Emirates, Bahrain, Oman - South East Asia includes: Indonesia, Thailand, Cambodia, Philippines, Vietnam, Malaysia, Singapore - North East Asia includes: Japan, South Korea MEDIA CONTACTS Virginie Alem – SVP Marketing & Communications Mail: valem@globalblue.com INVESTOR RELATIONS CONTACTS Frances Gibbons – Head of Investor Relations Mob: +44 (0)7815 034 212

3 Mail: fgibbons@globalblue.com ABOUT GLOBAL BLUE Globa l Blue pioneered the concept of Tax Free Shopping 40 years ago. Through continuous innovation, we have become the leading strategic technology and payments par tner, empowering retai lers to improve their per formance and shoppers to enhance their experience. Globa l Blue offers innovative solutions in three different fie lds: • Tax Free Shopping: Helping retai lers at over 300,000 points of sale to e ffic ient ly manage 35 mil l i on Tax Free Shopping transactions a year, thanks to i ts fu l ly in tegrated in -house technology plat form. Meanwhi le , i ts industry -leading digi tal Tax Free shopper so lutions create a better , more seamless customer experience . • Payment services: Providing a ful l suite of foreign exchange and Payment technology solutions that a l low acquirers, hote ls, and retai lers to offer value -added services and improve the cus tomer experience during 31 mi l l ion payment transactions a year at 130,000 points of interaction . • Complementary Reta ilTech: Offer ing new technology so lutions to retai lers, including digi tal receipts and eCommerce returns , that can be eas i ly integrated with their core systems and al low them to optimize and digita l ize their processes throughout the omni -channe l customer journey, both in -store and online. In addi t ion, our data and advisory serv ices offer a strategic advisory to help retai lers identify opportunit ies for growth, whi le our shopper exper ience and engagement solut ions provide data -dr i ven solutions to increase footfal l, convert footfa ll to revenue and enhance performance. For more in formation, vis i t https://www.globalblue.com/about -us/media Global Blue Monthly Speaker Notes Data, December 2023, Source: Global Blue

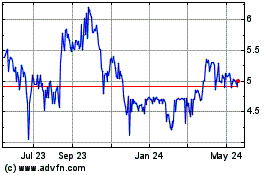

Global Blue (NYSE:GB)

Historical Stock Chart

From Apr 2024 to May 2024

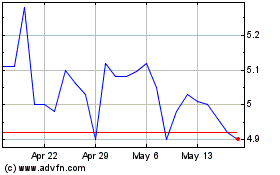

Global Blue (NYSE:GB)

Historical Stock Chart

From May 2023 to May 2024