false

0001494582

0001494582

2024-05-20

2024-05-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2024 (May 20, 2024)

|

BOSTON OMAHA CORPORATION

|

|

(Exact name of registrant as specified in its Charter)

|

| |

|

Delaware

|

001-38113

|

27-0788438

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

| |

| |

|

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(Address and telephone number of principal executive offices, including zip code)

|

|

(857) 256-0079

(Registrant's telephone number, including area code)

|

|

Not Applicable

(Former name or address, if changed since last report)

|

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Class

|

Trading Symbol

|

Name of Exchange on Which Registered

|

|

Class A common stock,

$0.001 par value per share

|

BOC

|

The New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On May 20, 2024, Boston Omaha Corporation issued its 2023 Annual Letter on its website. The full text of the 2023 Annual Letter is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information in this Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements And Exhibits

|

|

(d)

|

Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Exhibit Title

|

| 99.1 |

|

2023 Annual Letter |

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BOSTON OMAHA CORPORATION

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Joshua P. Weisenburger

|

|

| |

|

Joshua P. Weisenburger,

|

|

| |

|

Chief Financial Officer

|

|

Date: May 20, 2024

Exhibit 99.1

B O S T O N

O M A H A

CORPORATION

2023 Annual Letter

To the Shareholders of Boston Omaha Corporation:

I could not be more excited to lead Boston Omaha forward on behalf of shareholders.

Over the past nine years, Boston Omaha has grown from a single piece of real estate in Houston, TX to where we stand today with over $500mm in capital raised and deployed in well over 75 acquisitions and investments. These moves allowed us to achieve scale in our three main operating businesses, secure capital for growth, and make opportunistic investments, at times in complex structures, where we’ve been able to recycle capital back into our main operating businesses. I firmly believe that having Co-CEOs was advantageous throughout these early years at the Company.

As recently announced, my Partner in building Boston Omaha since its inception, Alex Rozek, is departing to pursue a variety of interests which results in the end of the Co-CEO structure at the Company. Given where Boston Omaha is today versus where it began, it makes sense to now move forward with a single CEO for a host of operational reasons and it also saves the Company on the long-term costs of dual CEO’s.

Our focus in the near term will be less on new investments; instead, our team will concentrate on cost savings and efficiencies in our current businesses while continuing to scale them through internal investment or tuck-in acquisitions. Our internal reinvestment opportunities are both large and attractive while at the same time our balance sheet has limits, making it difficult for any new idea of scale to compete.

I am thankful for the nine years Alex and I spent together building Boston Omaha to what it is today and wish him the best in his future endeavors. Alex deserves a lot of credit for the strong foundation we have that allows us to continue building shareholder value. Going forward, our annual letters will certainly have less humor in them (one of Alex’s many talents), but I look forward to updating you on our progress in 2023 and for many more years to come.

Now, let me update you on the foundation built to date and the changes at Boston Omaha over the past year. To not bury the lead, I believe Boston Omaha’s business value grew in 2023 and our opportunity set for capital deployment within our current businesses expanded. However, we also made a few mistakes along the way that are worth reporting. Thankfully on the latter, our progress over the long term has outpaced our mistakes.

************

Since early 2015, the market value of a share of Boston Omaha stock has grown from $10.00 to $15.73, as of December 31, 2023, a compounded annual increase of only 5.5%. At year-end 2022, this figure stood at approximately 14%. What a difference a calendar year can make in public markets.

Your management believes our stock price performance is likely to mirror changes in underlying business value in the long term, but in the short term there will always be periods when the two are not at all reflective of each other, both on the upside and downside. At present, we do not believe our stock price has kept up with the business value created at Boston Omaha.

The team at Boston Omaha headquarters focuses on building business value, and on this front we believe 2023 was a good year in our three wholly owned businesses.

Our billboard business grew revenue organically by approximately 4%, free cash flows (operating cash flow less our judgment of maintenance capital expenditures) by double digits, and again lowered land costs. Our broadband business grew to 43K subscribers (9.6K fiber subscribers) and now owns over 26K fiber passings. Finally, our surety insurance business generated record profits while growing premium and further set the stage operationally for scalable growth.

Within our other business interests and investments, often minority interests, the news in 2023 is also mostly good.

| |

●

|

Sky Harbour Group Corporation (“Sky Harbour”) added several new land leases to support new hangar locations, and raised important equity capital to continue their impressive growth in what we believe is a high return durable asset.

|

| |

●

|

Our investments and general partner (“GP”) ownership in real estate funds obtained a range from decent to great returns on capital for its investment partners in 2023, increasing the value of both our own limited partnership interest as well as the value of our GP interest.

|

| |

●

|

At Crescent Bank & Trust (“CB&T”), the news is more mixed, the bank has obtained more scale as it grew but mistakes were also made in underwriting during the post COVID credit environment that are now apparent. Nonetheless, CB&T is working hard to minimize the losses caused by these credit decisions. Looking forward, the business plan is more moderate growth, which will lead to less efficiency gains in the near term, but we believe has the potential to generate higher returns on assets and equity for owners.

|

We believe our present revenue and cash flow run-rate in our three wholly owned businesses will grow organically and, as importantly, will do so without the demand for large capital investments. At the same time, we believe we have several opportunities to lower our costs looking forward whether it is the announced wind down of the asset management business or efficiency gains in broadband.

As management, we then have the responsibility to employ cash flows generated and our cash and investments already held, into new assets whether that be additional billboard faces, fiber passings, surplus additions, or new opportunities. Organic growth within existing assets coupled with disciplined capital allocation in adding to our asset base, is the growth algorithm that will power Boston Omaha forward.

With that, let’s dive into greater detail on the businesses we own and their 2023 performance.

Operating Businesses at Boston Omaha Corporation

Below is a breakout of the net1 assets of our operating businesses. This table includes everything except the investments at BOAM, which we break out separately.

|

($ in millions)

|

2023

|

2022

|

2021

|

2020

|

2019

|

|

Cash2

|

$30.5

|

$52.5

|

$152.4

|

$69.5

|

$84.5

|

|

Billboards3

|

176.4

|

176.5

|

165.9

|

139.2

|

147.3

|

|

Insurance4

|

36.0

|

32.9

|

36.1

|

34.0

|

29.5

|

|

Broadband4

|

166.7

|

121.4

|

51.3

|

43.5

|

-

|

|

Total

|

$409.6

|

$383.3

|

$405.7

|

$286.2

|

$261.3

|

1 Assets (excl. cash balances mentioned below in note 2) less liabilities.

2 Includes short-term U.S. Treasury securities but excludes cash balances held within UCS, our wholly owned underwriting business, and at Yellowstone, a SPAC sponsored by a subsidiary of Boston Omaha.

3 Excludes cash balances held within billboard and broadband operations as they are captured in “Cash” as shown above.

4 Includes cash balances held within UCS, our wholly owned underwriting business.

In terms of debt obligations, there are still none at the parent company and a modest amount at our billboard business, which is non-recourse to Boston Omaha. As our broadband business continues to grow fiber customers, we may consider a similar arrangement.

We keep the majority of our businesses’ excess cash at headquarters, almost always in the form of rolling short-term Treasury securities ready to be deployed. Lastly, 2023 saw a substantial investment in broadband, which we’ll discuss later in the letter.

Billboard Operations at Link Media Holdings

In calendar 2023, Link grew revenue organically just over 4% and lowered land costs to 18.6% of revenue. The result was another year of record performance by Scott LaFoy and his superb team.

Below we provide our annual chart of Link’s progress.

|

($ in millions)

|

2023

|

2022

|

2021

|

|

Revenue

|

$42.9

|

$39.2

|

$31.5

|

|

Land Cost %5

|

18.6%

|

19.7%

|

20.5%

|

|

Overhead %6

|

6.7%

|

6.6%

|

8.5%

|

|

EBITDA7

|

$16.0

|

$14.0

|

$10.1

|

|

Net Working Capital8

|

$2.6

|

$1.0

|

$1.2

|

|

Tangible PP&E, Net

|

$46.9

|

$49.4

|

$45.4

|

5 Land lease expense on billboards where we do not own the land as a percentage of revenue.

6 Overhead is Link Media expenses related to corporate employees, office and software as a percentage of revenue.

7 EBITDA is defined as net income before income tax expense (benefit), noncontrolling interest in subsidiary income (loss), interest expense (income), depreciation, amortization, accretion and gain or loss on disposition of assets.

8 Adjusted for current portion of lease liabilities related to ASC 842 implementation and assumes a certain maximum level of cash in business for operational purposes.

The value of Link over the years to Boston Omaha has been quite material. Sometimes this fact can be lost in accounting, so it is an important topic for shareholders to understand. In our view, the value of a business such as Link, which does not require much capital at all to produce organic growth, has two components.

First, is the business’s capital value, which one could refer to as its intrinsic value or private business value to an acquirer. This bucket is affected by some factors outside of our control such as interest rates and inflation. However, this aggregate value of Link, all else the same, grows at something close to the organic rate of growth of its free cash flow. As an example, if Link can organically grow at 5%, without much need at all to reinvest cash to obtain that growth, the capital value is also growing at approximately the same rate. As a result, this value creation for Boston Omaha continues upward over time, something GAAP accounting at present does not capture.

The second bucket of value to Boston Omaha in particular, is the free cash flow Link produces that is not needed for the above-mentioned growth that can be sent to Boston Omaha for reinvestment. This cash flow that we can freely use is mutually exclusive from Link’s capital value, if it remains true that the business can grow organically at a reasonable rate without needing to retain much of its earnings, all while keeping its engrained competitive position. Most businesses require substantial portions of earnings to be retained to grow over time or even to tread water, because they either require more physical capital to expand (i.e. working capital and property plant & equipment) or they require an acquisition or other investment to remain competitive. Link requires little of either, as a static billboard structure has a long useful life with little maintenance required and in the billboard business generally, it is exceedingly difficult to increase the roadside supply of advertising faces.

As a result of this second bucket, the free cash flow coupled with conservative debt levels, Link has funded other investments at Boston Omaha to the tune of approximately $45mm to date. The remaining cash flow Link has produced has been directly invested right back into growing our billboard business through tuck-in acquisitions and digital conversions, which adds additional growth beyond reported organic growth at Link.

One last attribute of Link is we have utilized approximately $54mm in depreciation and amortization expense that we believe is far above any economic value loss of our assets. These “expenses” over time, as reported in our income statement, have generated cash benefits to Boston Omaha, as we have used them to offset material taxable gains on successful investments made over the years.

During 2023, we were able to deploy some capital into Link, mostly in the form of purchasing perpetual easements to eliminate land costs and also in converting some static billboards to digital.

Insurance Operations at General Indemnity Group

General Indemnity Group (“GIG”) is our insurance subsidiary that writes one line of business, surety bonds, coast to coast. We are attracted to surety insurance due to its generally low loss ratios, short loss exposure durations, and opportunity to grow market share through technology, automation, and providing agents and customers a seamless way to book small transactional commercial bonds (which in turn feeds the larger contract bonds and vice versa).

Here is GIG’s track record of premium, revenue and operating performance.

|

($ in millions)

|

2023

|

2022

|

2021

|

|

Gross Written Premium

|

$18.8

|

$13.8

|

$9.3

|

|

Revenue

|

$17.7

|

$13.4

|

$10.2

|

|

EBITDA

|

$1.8

|

$1.4

|

($0.6)

|

|

Operating Income

|

$1.5

|

$1.1

|

($0.8)

|

|

Net Income (Loss)

|

$2.1

|

($2.5)

|

$1.9

|

In the past, we focused on controlled premium as we built scale at the company. We are now achieving scale so, going forward, we will focus less on controlled premium and more on revenue growth while maintaining positive operating income.

Calendar 2023 was a record year for GIG in terms of revenue, gross written premium and operating income, due to the efforts of Dave Herman, Bob Thomas, and their team. This was accomplished with no additional capital from Boston Omaha. The growth has come from a lot of hard work, great customer service and expanding relationships. It has also come from market demand by insurance agents for our SuretyBonds.Market portal, which allows agents to more easily arrange surety insurance for their customers. The growth through traditional methods combined with the growth in our technology offerings is making GIG an exciting entity to watch each year.

The amount of investment and progress GIG has made in both business development channels and systems has enabled us to have a scalable business looking forward. Dave estimates that we can now effectively double written premium over time without a commensurate increase to our cost structure given our investment and efforts over the last few years.

9 EBITDA is defined as net income before income tax expense (benefit), noncontrolling interest in subsidiary income (loss), interest expense (income), depreciation, amortization, accretion and gain or loss on disposition of assets.

Of course, doubling premium generally is of little value in insurance, anyone can do that if they underwrite poorly. Our goal is to always grow thoughtfully and profitably. We look forward to seeing what GIG produces in 2024 and have plans to invest incremental capital into the business.

Broadband Operations at Boston Omaha Broadband

Boston Omaha Broadband (“BOB”) is the parent company of four now wholly owned broadband businesses: Utah Broadband, AireBeam, Fiber Fast Homes (“FFH”), and InfoWest.

Though each business retains its own management teams, brands, and operational autonomy in its markets, internally BOB companies increasingly work as a cohesive enterprise, benefitting from shared resources, procurement, planning, increasing build opportunities and critically, capital.

Recently, we took another important step in forming this cohesive enterprise by purchasing the remaining minority ownership stakes in Utah Broadband and InfoWest, through the issuance of Boston Omaha stock to the minority members of each company. With these purchases, we now own 100% of all of our broadband businesses, and are thrilled to have Steve McGhie, Randy Cosby and Kelly Nyberg as Boston Omaha shareholders fully aligned with growing our broadband business in a way that will benefit all shareholders for years to come.

Before we get into the results, a quick reminder as to what we observed in the broadband business that triggered Boston Omaha to enter it and why we like the asset.

Historically, overbuilding fiber to the premises had mixed results. If anything, the average experience was quite poor for investors. Not all that many years ago, after following the major cable companies’ operations over the years, we started to observe some changes in the landscape of broadband usage by the consumer. Although there are plenty of variables to observe, two factors stood out the most.

| |

●

|

Broadband usage continued to increase and compound at high rates, yet the in-place last mile networks supporting that usage in many geographies, were not adequate for this compounding to continue.

|

| |

●

|

Content viewing options developed to where a consumer could directly purchase what they desired, as opposed to relying on the cable provider to aggregate content for them.

|

Many other factors exist both positive and negative, but we believe these two developments were important to think about in terms of the future economics of the broadband business. In other words, some facts changed, and when the future may look different than the past, opportunity could be knocking.

Outside of the changing landscape and the insatiable demand for better broadband, even if one is correct on that outcome, the underlying asset must be financially attractive and competitively advantaged to earn above average rates of return. Here are some of the attributes we like about the asset itself.

| |

●

|

Fiber is expensive upfront to build out, but enjoys a long economic life coupled with often materially lower maintenance costs than competing non fiber networks.

|

| |

●

|

A fiber build can be an advantaged asset relative to competitors depending on a host of variables that must be judged on a project-by-project basis. Some considerations could be that the project is contractual (such as an HOA deal), the costs to operate the asset after deployment are materially lower than the competition due to the reliability of fiber compared to traditional copper delivery, and/or there are competitive, geographic or structural constraints for others to come in and overbuild our fiber.

|

Below is a BOB level report on our recent progress.

|

($ in millions)

|

2023

|

2022

|

2021

|

|

Revenue

|

$35.3

|

$28.6

|

$15.2

|

|

EBITDA

|

$2.9

|

$4.4

|

$3.2

|

|

Net Income (Loss)

|

$(7.0)

|

$(2.7)

|

$0.0

|

|

Total Subscribers

|

42.9k

|

39.6k

|

18.2k

|

|

Fiber Subscribers

|

9.6k

|

4.9k

|

1.8k

|

|

Fiber Passings

|

26.6k

|

14.9k

|

5.5k

|

10 EBITDA is defined as net income before income tax expense (benefit), noncontrolling interest in subsidiary income (loss), interest expense (income), depreciation, amortization, accretion and gain or loss on disposition of assets.

Here EBITDA is used as a rough figure for cash flow before the very real expense of maintenance capital expenditure, and just as last year, the reported figure above includes our losses at FFH, which were $4.3mm in 2023. Similar to our billboard business, depreciation and amortization under GAAP are generally higher than the true maintenance capital expenditures to maintain the fiber portion of our broadband business at a steady state.

Important to understand is although we have increased fiber subscribers to 9.6K in 2023, our fiber passings that are not yet customers have also grown significantly. When thinking about our passings, shareholders should understand that capital invested is not yet producing revenue or cash flow but has the prospect of doing so in the future. How many and the timing of those potential new customers depends on where these builds are and the type of fiber projects they are. Project types can vary from a greenfield HOA deal where we expect an exceedingly high penetration rate once homes are finished and sold, to brownfield projects where we believe ending take rate will be attractive, but not 90%+.

Now to some possible mistakes made by your management team. We invested capital in an attempt to improve our fixed wireless business in order to keep current customers longer and to add new customers, and it is now less clear to us if that was a good use of capital relative to investing that same capital into more fiber.

In addition, within our FFH segment, we have invested capital in a small number of projects where we have good contracts, but it is not as clear when we could achieve scale in those specific geographies. It simply takes a significant period of time at FFH to build scale, as we are subject to the pace of homebuilding per geography. Time could be working against us in terms of obtaining the returns we expected given we have to carry the operational cash burn as we wait for customers. We will report back as our hand plays out in these instances, when we can give you a more definitive answer. In the meantime, we are looking at every way we can lower our burn rate at FFH in an intelligent manner, and for that matter, reviewing all possible efficiencies within our entire broadband operation.

The good news is, in the aggregate, we have plenty of great projects we are funding, and we believe they should overcome the mistakes we inevitably make along the way. When we underwrite projects, we are typically looking to earn an unleveraged double digit return on our capital after achieving targeted penetration rates, with possible upside depending on your view of what the ending intrinsic value is of a fiber customer relative to its cost basis. We will not always hit our return goals as cost overruns and delays will inevitably occur during construction. However, that is our goal when we consider whether to take on a new project.

In our judgment, broadband is a compelling opportunity to deploy larger sums of capital within Boston Omaha and shareholders can clearly see in our cash flow statements these capital expenditures being made. The broadband opportunity will be finite, and if we see returns either not meeting our expectations or declining as new projects are evaluated over time, we will alter our capital allocation course. As always, the job of your management is to compare our opportunities and deploy our collective capital to the best risk versus return that we observe at that time.

Investment Operations at Boston Omaha Asset Management

Boston Omaha Asset Management (“BOAM”) has historically been our catch-all for investments we have made over time that we do not control, as well as our asset management business. Below is a breakdown of those two segments with the first section showing our aggregate asset base according to GAAP and the second section outlining the asset management business specifically.

Boston Omaha Asset Management Investments

GAAP asset values as of December 31, 2023:

|

($ in millions)

|

2023

|

|

Sky Harbour11

|

$99.3

|

|

Boston Omaha Build for Rent12

|

$15.0

|

|

CB&T Holding Corporation

|

$19.1

|

|

24th Street Asset Management12

MyBundle TV

|

$21.6

$3.0

|

|

Logic Commercial Real Estate

|

$0.5

|

|

Breezeway

|

$0.3

|

|

Total BOAM Assets

|

$158.8

|

As mentioned in past letters, we generally won’t be providing specific commentary on the passive minority holdings in BOAM unless there is something new or material of note to report to Boston Omaha shareholders.

In regard to our ownership of Sky Harbour, we thought it would be helpful to provide a refresher on how we account for our investment and why we currently do not “mark-to-market” our shares of Sky Harbour’s Class A common stock. Our ownership of Sky Harbour is one of our primary businesses at Boston Omaha. In fact, it is our third largest, making Boston Omaha’s primary businesses by capital allocated: billboards, broadband, aviation hangar real estate, and surety insurance.

11 Includes 13,118,474 shares of Sky Harbour Class A common stock and 7,719,779 warrants. If our investment in Sky Harbour was accounted for at fair value based on its quoted market price as of December 31, 2023 it would be valued at approximately $132mm.

12 Includes only BOAM’s invested capital and GP interest.

As of December 31, 2023, we held 13,118,474 shares of Sky Harbour Class A common stock and 7,719,779 warrants to purchase future shares of Class A common stock. Sky Harbour’s Class A common stock and warrants ended 2023 at a price of $9.66/share and $0.75/warrant, respectively. That equates to a market value of our investment of approximately $132mm, a meaningful difference from the $99mm carrying value on our balance sheet as of December 31, 2023. We currently account for our investment in Sky Harbour Class A common stock under the equity method, given that we are deemed from an accounting perspective to have “significant influence” due to our large ownership percentage and our right to elect one of the seven members of Sky Harbour’s Board of Directors. Through equity method accounting, we pick up our share of Sky Harbour’s income or loss, which increases or decreases our GAAP carrying value, on a quarterly basis.

We believe that the overall intrinsic value of the investments listed above is higher than our current carrying value. However, we have little control on the timing of any future realization events in most cases, especially within the privately held interests.

For the investments that are publicly traded, we have more flexibility and can compare the underlying business prospects to our alternatives within Boston Omaha.

Boston Omaha Asset Management Funds Managed

Within asset management, we own the general partner plus have an investment in the underlying funds of both 24th Street and Boston Omaha Build for Rent (“BOBFR”). The two BORE special purpose entities own commercial real estate, and we are the general partner of both but do not have a capital investment.

In our recent 10-K, we announced that we will be winding down this segment over time. Keep in mind this will have no effect on our investment in Sky Harbour, CB&T, or any of the smaller investments listed above. Below is a table listing Boston Omaha’s investment in the underlying funds within asset management, total assets managed, and performance to date.

|

($ in millions)

|

BOAM Invested Capital

|

Total Fund Assets13

|

Fund IRR (net)14

|

|

24th Street Fund I

|

$3.0

|

$33.5

|

~20%

|

|

24th Street Fund II

|

$3.0

|

$43.6

|

~20%

|

|

BOBFR

|

$15.0

|

$30.5

|

|

|

BORE Hirsch

|

-

|

$15.9

|

|

|

BORE Fourth

|

-

|

$3.6

|

|

|

Total Assets Under Management

|

|

$127.1

|

|

The decision to wind down the asset management side of BOAM is directly attributable to our inability to launch a broadband fund on acceptable terms, lack of investment opportunity for our cash within the BOBFR fund, and the costs to carry the business that would remain. The remaining business of commercial real estate funds simply does not require three managing partners and a team to support it.

When we entered the asset management business we were solely a manager of real estate funds. We were both investors in these funds and we brought in partners who wanted to invest alongside us. Investing in real estate is something Brendan Keating and I have done together for many years, including prior to the founding of Boston Omaha. However, this was not the business plan that would work for the team. We believed together we could raise a much larger fund outside of real estate that would focus on the broadband sector, where we saw and continue to see opportunities that far exceed our own capital base. A large broadband fund had the potential to bring us scale in asset management and make it a material line of business for Boston Omaha.

13 As of December 31, 2023.

14 Past performance is not indicative of future results. Returns are net of expenses, asset management fees, and carried interest and are audited through 2023. Performance reflects the return since inception and is based on the actual management fees and expenses paid by fund investors as a whole. Performance for individual investors will vary (in some cases materially) from the performance stated herein as a result of the management fees or other fees paid or not paid by certain investors; the timing of their investment; their individual participation in investments and/or carry rates.

Unfortunately, after a huge amount of effort and time from a dedicated team, we were simply unable to raise a broadband fund or broadband capital at terms that we found acceptable when combined with the value of our own broadband assets and in a structure that would net add value for Boston Omaha shareholders.

************

To pour more salt on the wound, BOBFR, which started in 2021, was unable to find enough opportunities in residential real estate to invest its aggregate capital at returns we found acceptable for the risk incurred. Roughly half of our capital base in BOBFR was invested in real estate assets we found attractive, but the other half remained idle in cash.

We bid on a large number of assets over the past few years at prices that we believed would lead to good to great returns for partners. Unfortunately, time after time, another buyer was willing to underwrite purchases in a more aggressive manner than we were, and we were not successful in deploying all of the fund’s capital. Rather than holding investors' capital for an even longer period, in the hopes that a good opportunity would materialize, we decided to return the cash held in the fund to partners and are now working on maximizing the value of the real estate assets we were able to buy.

************

Lastly, continuing to manage commercial real estate funds alone at historic fund size levels would demand significant time and attention from Boston Omaha’s management and, in our view, is unlikely to contribute substantially to the Company’s overall value net of all costs. We also knew Boston Omaha had the opportunity to use the cash savings from winding down asset management to invest in our more scaled businesses.

Combining all of the above factors, we had to make the difficult decision to either continue to incur the meaningful costs associated with the asset management business or thoughtfully wind down the operation while maximizing returns for partners.

It is extremely disappointing that your management was not able to make a larger success out of the asset management business at BOAM both for shareholders and the team that worked so hard to try to build it. Shareholders should know it was not due to a lack of effort.

Now to the good news.

We still expect a good return on Boston Omaha’s capital from both our investment in our real estate funds and our general partnership interests, the caveat being any changes in real estate markets from today. Our combined basis in both amounts to around $26mm.

Inception to year-end 2023, we have received approximately $2.6mm in distributions and received approximately $10.5mm more in April 2024. During calendar 2024, we expect additional material proceeds as assets are sold from both our investments and our profit split as GP of the funds. These cash flows will be free and clear to be sent to Boston Omaha for reinvestment.

We will report figures to date in next year’s letter as they come to fruition so shareholders can easily see what we paid and what we received in the end. I continue to believe the ending return on our investment is likely to be somewhere between reasonable and attractive.

Executive Compensation

The current management incentive plan at Boston Omaha started in 2018 and I think there remains a good deal of confusion on this topic.

For the first several years after Boston Omaha’s founding, minimum wage was the sole compensation for our executive officers: Alex and I. We used the cash which would have gone to our salaries to grow the Company.

In 2018, the original management incentive plan was adopted and it provided that for the first 15 years a bonus would be paid to management based on a formula tied to financial performance, but importantly, the total amount that could be paid out was capped in dollars for that time period. I believe the thought process was that the performance bonus would be earned in incremental amounts over many years until the cap was reached. For instance, if the capped performance bonus was earned evenly over the 15 years, it would have amounted to $1mm per year or $0.5mm for each of Alex and I. Of course, the unexpected sometimes occurs, as we ended up realizing over $100mm in gains on various investments which caused the entire 15-year performance bonus to be earned in a single year. I do not believe anyone expected that to occur, but it did.

Looking forward, under the current plan, the initial bonus cap having been met in 2022 means that the bonus paid in 2022 is not a recurring annual cost as I think some may incorrectly believe. In addition, any future potential performance bonuses will likely be half of what they would have been now that we have just one CEO.

Annual Meeting and Closing Remarks

With recent announcements, we believe it is important to reverse course on a virtual only annual meeting and instead have it in person. We thoroughly enjoy the chance to meet shareholders in person and it is a great reason for our managers to get together with the entire Boston Omaha team. We plan to select a date and venue in Omaha in the near term and will announce the meeting details once we have everything finalized.

Looking forward, we are working on supplying shareholders with more supplemental information on a quarterly basis in addition to our normal quarterly reports. We are in the midst of working on this but expect it to be a few slides showing a basic update of our three operating businesses and any update on our investments. Stay tuned.

Between the employees of Boston Omaha, longtime investment partners, family, both old and new friends, and the board of directors; I would estimate this extended group owns a substantial percentage of Boston Omaha shares. I could not be more excited to lead this Company.

The Boston Omaha team thanks you for your continued belief in us.

| May 2024 |

Adam K. Peterson

Chairman of the Board

Omaha, NE

|

Safe Harbor Statement:

This Annual Letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and 21E of the Securities Exchange Act of 1934 regarding the future financial performance, business prospects and growth of Boston Omaha Corporation. These statements are only predictions based on current assumptions and expectations. Any statements in this press release about the Company’s future expectations, plans and prospects, including statements about our financing strategy, future operations, future financial position and results, market growth, total revenue, as well as other statements containing the words "anticipate," "believe," "continue," “goal,” “seek, ” "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "project," "should," "target," "will," or "would" and similar expressions, constitute forward-looking statements within the meaning of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. The Company may not actually achieve the plans, intentions or expectations disclosed in the Company’s forward-looking statements, and you should not place undue reliance on the Company’s forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements the Company make as a result of a variety of risks and uncertainties, including risks related to the Company’s estimates regarding the potential market opportunity for the Company’s current and future products and services, the competitive nature of the industries in which we conduct our business, general business and economic conditions, our ability to acquire suitable businesses, our ability to successfully integrate acquired businesses, the effect of a loss of, or financial distress of, any reinsurance company which reinsures the Company’s insurance operations, the risks associated with our investments in both publicly traded securities and privately held businesses, our history of losses and ability to maintain profitability in the future, the Company’s expectations regarding the Company’s sales, expenses, gross margins and other results of operations, and the other risks and uncertainties described in the "Risk Factors" sections of the Company’s public filings with the Securities and Exchange Commission (the "SEC") on Form 10-K for the year ended December 31, 2023, as amended, as well as other risks and uncertainties which may be described in any subsequent quarterly report on Form 10-Q filed by the Company and the other reports the Company files with the SEC. Copies of our SEC filings are available on our website at www.bostonomaha.com.

In addition, the forward-looking statements included in this press release represent the Company’s views as of the date hereof. The Company anticipates that general economic conditions and subsequent events and developments may cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

Use of Non-GAAP Financial Measures:

Key business metrics and the use of EBITDA, a non-GAAP financial measure, are presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with U.S. GAAP, and may be different from similarly titled metrics or measures presented by other companies. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures.

Our non-GAAP financial measure consists of EBITDA, which is defined in the text of this letter. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures. EBITDA has limitations as a financial measure, should be considered as supplemental in nature, and is not meant as a substitute for the related financial information prepared in accordance with U.S. GAAP. Because of these limitations, you should consider EBITDA alongside other financial performance measures, including net income and our other U.S. GAAP results. We use this non-GAAP financial measure as it enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. EBITDA is also used by management to make operating decisions such as evaluating performance, performing strategic planning, and budgeting.

Disclosure:

Boston Omaha Asset Management (“BOAM”) is the business/trade name for certain asset managers that are owned and controlled by Boston Omaha Asset Management, LLC, a wholly owned subsidiary of Boston Omaha Corporation. These managers currently include 24th Street Asset Management, LLC ("24th Street") and BOAM FUND ONE: IM LLC. BOAM FUND ONE: IM LLC manages Fund One: Boston Omaha Build for Rent (“BOBFR”). The information contained herein is not an offer to sell, or a solicitation of an offer to purchase any fund managed by these entities. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request.

The opinions expressed herein regarding BOAM and its investments are based on the views and research of BOAM as of the date of this letter and are subject to change. BOAM reserves the right to modify its current investment strategies and techniques based on changing market dynamics. It should not be assumed that any of the transactions or real estate assets discussed will prove to be profitable, or that the decisions we make in the future will be profitable or will equal the investment performance of the funds discussed herein. All fund returns, unless otherwise notated, are net of expenses, asset management fees, and carried interest. Inherent in any investment is the potential for a total loss of the investment. There can be no assurance that any fund investor will receive return of their capital.

v3.24.1.1.u2

Document And Entity Information

|

May 20, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BOSTON OMAHA CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 20, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38113

|

| Entity, Tax Identification Number |

27-0788438

|

| Entity, Address, Address Line One |

1601 Dodge Street, Suite 3300

|

| Entity, Address, City or Town |

Omaha

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68102

|

| City Area Code |

857

|

| Local Phone Number |

256-0079

|

| Title of 12(b) Security |

Class A common stock

|

| Trading Symbol |

BOC

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001494582

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

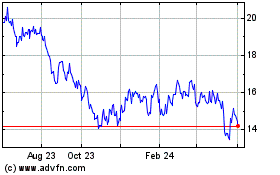

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From May 2024 to Jun 2024

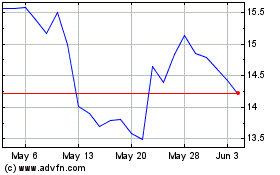

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Jun 2023 to Jun 2024