0001869824

false

0001869824

2023-07-24

2023-07-24

0001869824

SGII:UnitsMember

2023-07-24

2023-07-24

0001869824

us-gaap:CommonStockMember

2023-07-24

2023-07-24

0001869824

SGII:WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member

2023-07-24

2023-07-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section

13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): July 24, 2023

SEAPORT

GLOBAL ACQUISITION II CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41075 |

|

86-1326052 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

| 360

Madison Avenue, 23rd

Floor |

|

|

| New

York, NY |

|

10017 |

| (Address of principal executive offices) |

|

(Zip Code) |

(212)

616-7700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Units,

each consisting of one share of Class A common stock and one-half of one redeemable warrant |

|

SGIIU |

|

The Nasdaq Stock Market LLC |

| Class

A common stock, par value $0.0001 per share |

|

SGII |

|

The Nasdaq Stock Market LLC |

| Warrants,

each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

SGIIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

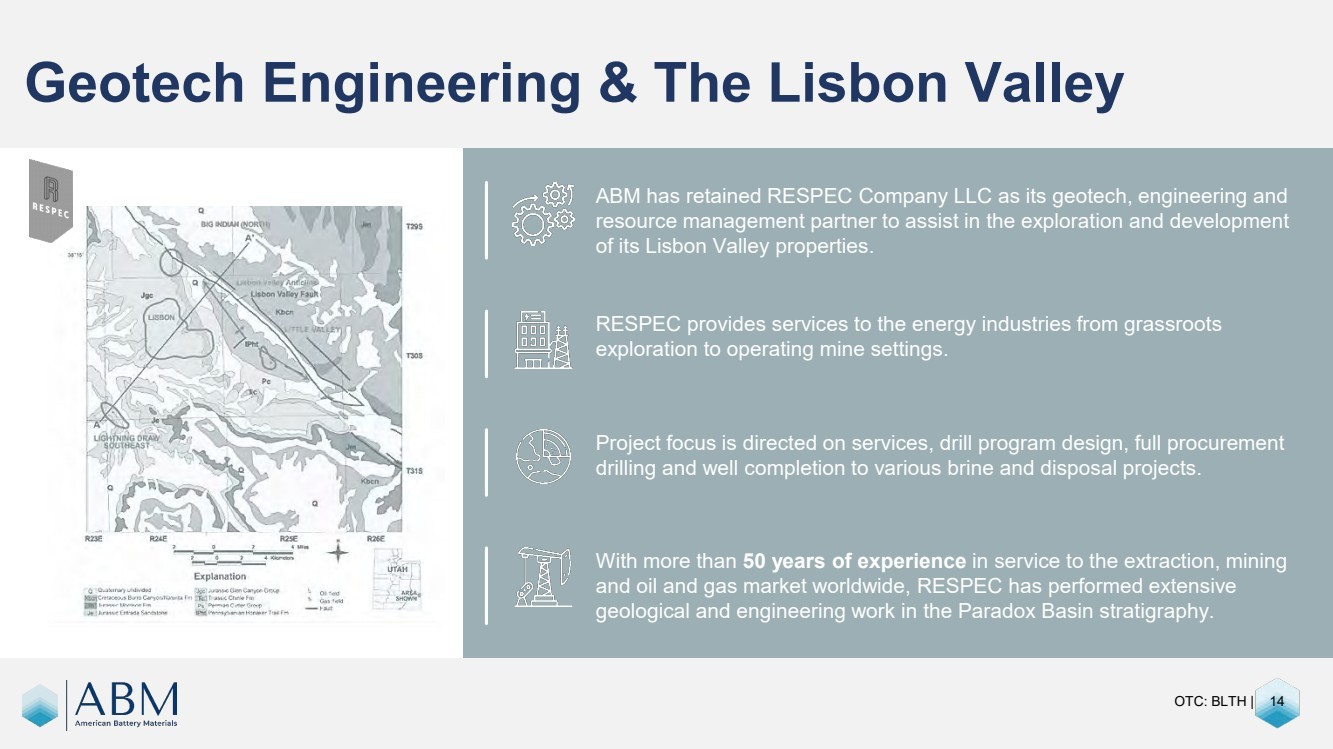

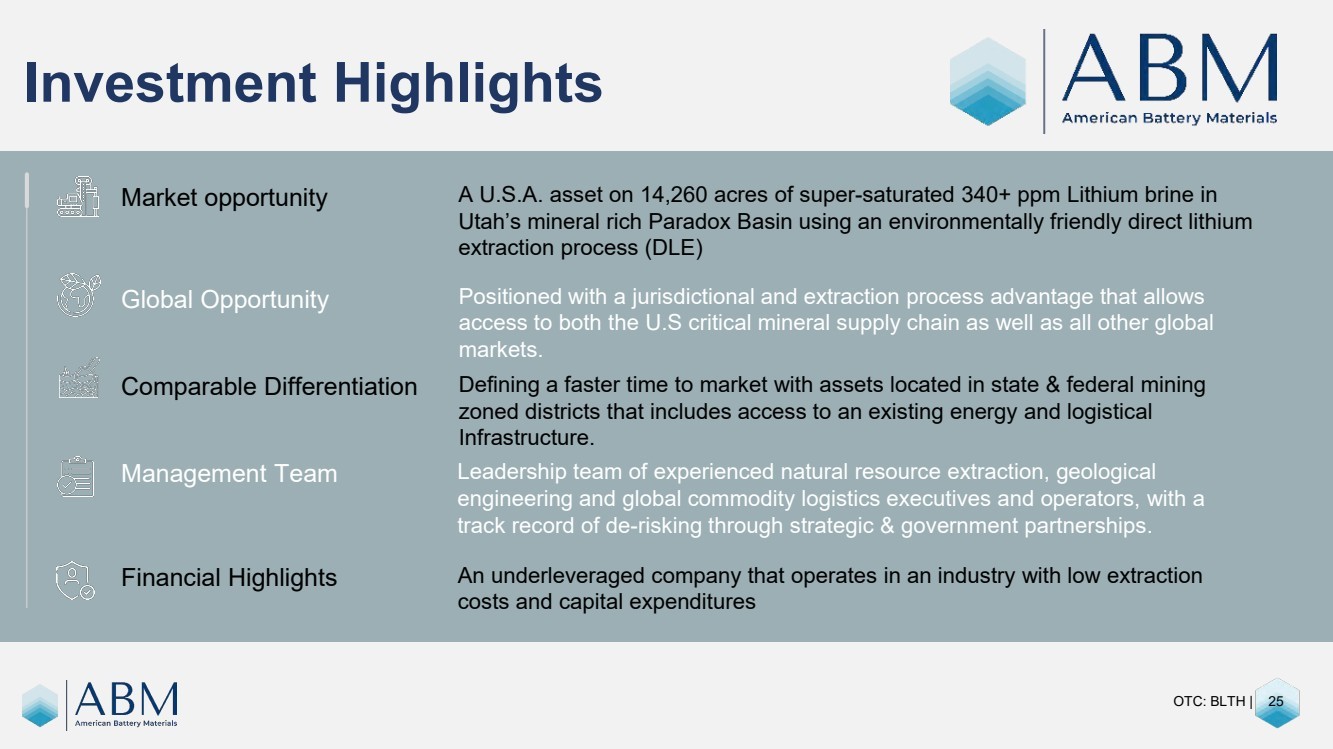

As previously announced, on June 1, 2023,

Seaport Global Acquisition II Corp., a Delaware corporation (“SGII”), entered into an Agreement and Plan of Merger,

as amended by Amendment No. 1 to Agreement and Plan of Merger dated as of July 14, 2023 (“Merger Agreement”),

by and among SGII, Lithium Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of SGII (“Merger Sub”),

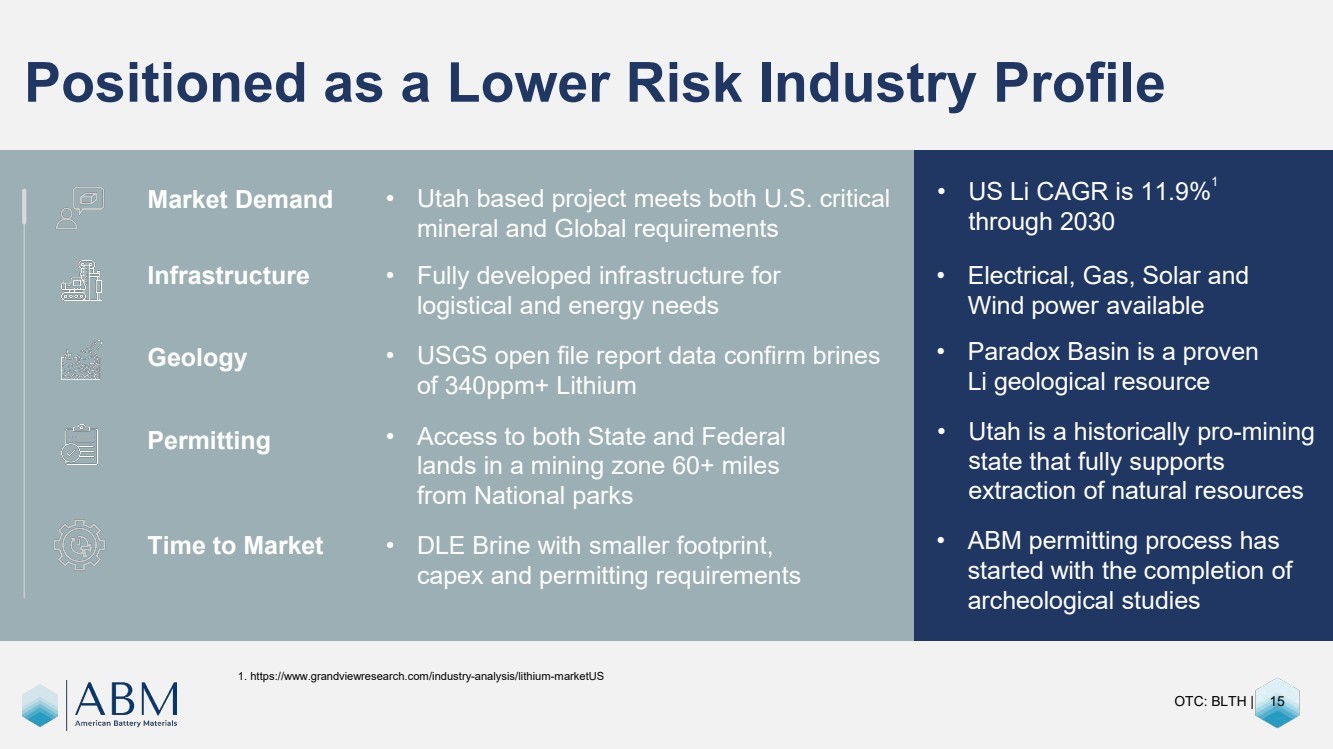

and American Battery Materials, Inc. (OTC Pink: BLTH), a Delaware corporation (“ABM”). ABM is an exploration stage

company focused on environmentally friendly direct lithium extraction and other minerals critical to the global energy transition. Pursuant

to the Merger Agreement, Merger Sub will merge with and into ABM, with ABM surviving the merger (the “Merger” and,

together with the other transactions contemplated by the Merger Agreement, the “Transactions”). As a result of the

Transactions, ABM will become a wholly-owned subsidiary of SGII, with the stockholders of ABM becoming stockholders of SGII.

On July 24, 2023, ABM issued a press release

announcing that it has acquired and staked additional lithium mining claims adjacent to its Lisbon Valley Project, located in San Juan

County, Utah. The newly acquired mining claims expand ABM’s strategic land position to approximately 14,300 acres, a seven-fold

increase from its current position of 2,000 acres.

In connection with the new acquisition, ABM released

a revised version of its Technical Report Summary focused on its Lisbon Valley Project and posted a revised version of its corporate presentation

(the “Corporate Presentation”).

A

copy of the Technical Report Summary, the press release and the Corporate Presentation are each furnished hereto as Exhibit 96.1,

Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference. The press release, the Technical Report

Summary and the Corporate Presentation are intended to be furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the

liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Important Information and Where to Find It

In

connection with the Transactions, SGII intends to file a preliminary and definitive proxy statement with the U.S. Securities and Exchange

Commission (“SEC”). SGII’s stockholders and other interested persons are advised to read, when available,

the registration statement on Form S-4, which will include a proxy statement/prospectus of SGII (the “S-4”), as

well as other documents filed with the SEC in connection with the Transactions, as these materials will contain important information

about ABM, SGII and the Transactions. This communication is not a substitute for the S-4 or any other document that SGII will

send to its stockholders in connection with the Transactions. When available, the S-4 will be mailed to stockholders of SGII as of a record

date to be established for voting on, among other things, the proposed Transactions. Stockholders will also be able to obtain copies of

the S-4 and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the

SEC's website at www.sec.gov. The information contained on, or that may be accessed through, the websites referenced in this

communication is not incorporated by reference into, and is not a part of, this communication.

Participants in the Solicitation

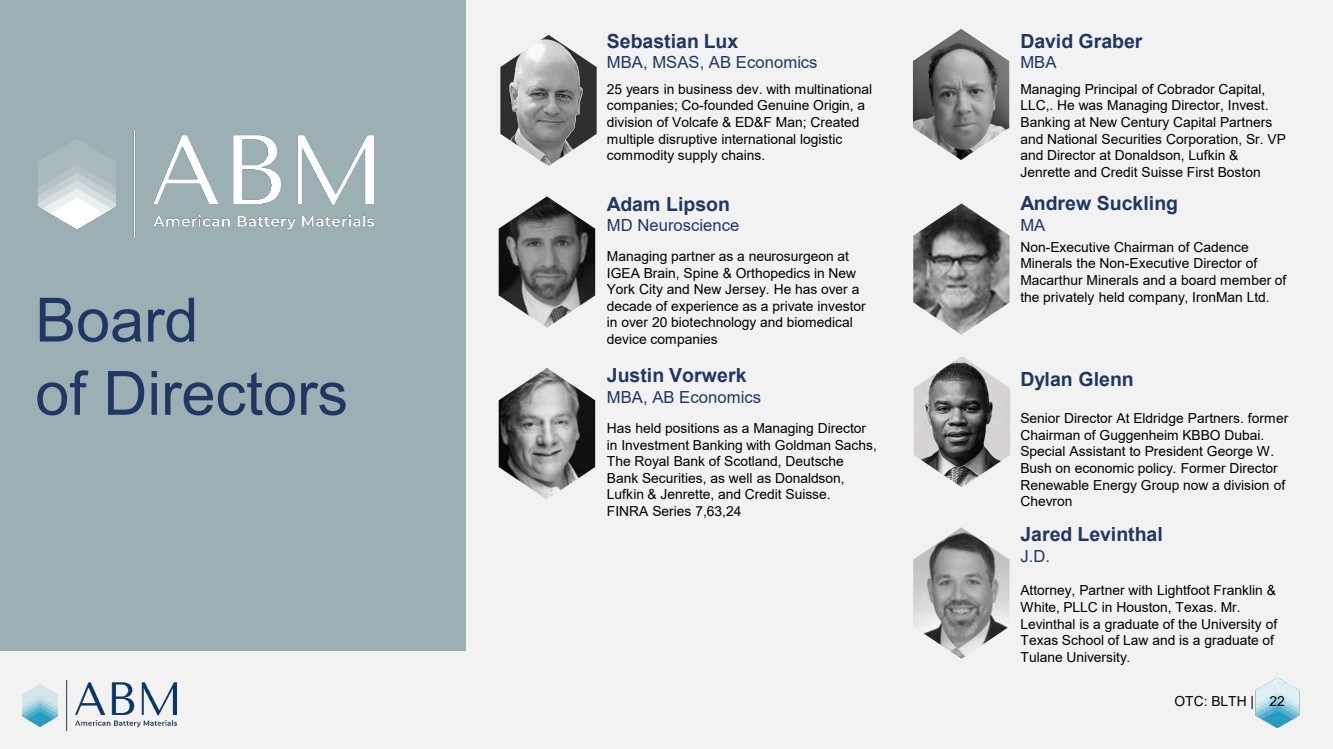

SGII and its respective directors and executive

officers may be deemed participants in the solicitation of proxies from SGII’s and ABM’s stockholders in connection with the

proposed Transactions. SGII’s and ABM’s stockholders and other interested persons may obtain, without charge, more detailed

information regarding the directors and officers of SGII and ABM in SGII's Annual Report on Form 10-K filed with the SEC on April 4,

2023 and ABM’s Annual Report on Form 10-K filed with the SEC on April 21, 2023. Information regarding the persons who

may, under SEC rules, be deemed participants in the solicitation of proxies to SGII stockholders in connection with the proposed Transactions

will be set forth in the proxy statement for the proposed Transactions when available. Additional information regarding the interests

of participants in the solicitation of proxies in connection with the proposed Transactions will be included in the Form S-4 that

SGII intends to file with the SEC.

No Offer or Solicitation

This communication is for informational purposes

only and shall neither constitute an offer to sell or the solicitation of an offer to buy any securities or to vote in any jurisdiction

pursuant to the Transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which

the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Forward Looking Statements

This Current Report on Form 8-K includes

certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as

"believe," "may," "will," "estimate," "continue," "anticipate," "intend,"

"expect," "should," "would," "plan," "predict," "potential," "seem,"

"seek," "future," "outlook," and similar expressions that predict or indicate future events or trends or

that are not statements of historical matters. All statements, other than statements of present or historical fact included in this communication,

regarding SGII’s proposed Transactions with ABM, SGII's ability to consummate the transaction, the benefits of the transaction and

the combined company’s future financial performance, as well as the combined company’s strategy, future operations, estimated

financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management, and the target grades

and tonnages information are forward-looking statements. These statements are based on various assumptions, whether or not identified

in this communication, and on the current expectations of the respective management of SGII and ABM and are not predictions of actual

performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not

be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of

SGII or ABM. Potential risks and uncertainties that could cause the actual results to differ materially from those expressed or implied

by forward-looking statements include, but are not limited to, changes in domestic and foreign business, market, financial, political

and legal conditions; the inability of the parties to successfully or timely consummate the business combination, including the risk that

any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined

company or the expected benefits of the business combination or that the approval of the stockholders of SGII or ABM is not obtained;

failure to realize the anticipated benefits of business combination; risk relating to the uncertainty of the projected financial information

with respect to ABM; the amount of redemption requests made by SGII's stockholders; the overall level of consumer demand for lithium;

general economic conditions and other factors affecting; disruption and volatility in the global currency, capital, and credit markets;

ABM's ability to implement its business and growth strategy; changes in governmental regulation, ABM's exposure to litigation claims and

other loss contingencies; disruptions and other impacts to ABM’s business, as a result of the COVID-19 pandemic and government actions

and restrictive measures implemented in response, and as a result of the proposed transaction; ABM's ability to comply with environmental

regulations; competitive pressures from many sources, including those, having more experience and better financing; changes in technology

that adversely affect demand for lithium compounds; the impact that global climate change trends may have on ABM and its potential mining

operations; any breaches of, or interruptions in, SGII's or ABM’s information systems; fluctuations in the price, availability and

quality of electricity and other raw materials and contracted products as well as foreign currency fluctuations; changes in tax laws and

liabilities, tariffs, legal, regulatory, political and economic risks.

More information on potential factors that could

affect SGII’s or ABM's financial results is included from time to time in SGII's and ABM’s public reports filed with the

SEC, including their Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K as well

as the S-4 that SGII plans to file with the SEC in connection with SGII’s solicitation of proxies for the meeting of stockholders

to be held to approve, among other things, the proposed Transactions. If any of these risks materialize or SGII's or ABM's assumptions

prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional

risks that neither SGII nor ABM presently know, or that SGII and ABM currently believe are immaterial, that could also cause actual results

to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect SGII's and ABM's expectations,

plans or forecasts of future events and views as of the date of this communication. SGII and ABM anticipate that subsequent events and

developments will cause their assessments to change. However, while SGII and ABM may elect to update these forward-looking statements

at some point in the future, SGII and ABM specifically disclaim any obligation to do so, except as required by law. These forward-looking

statements should not be relied upon as representing SGII's or ABM's assessments as of any date subsequent to the date of this communication.

Accordingly, undue reliance should not be placed upon the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: July 24, 2023

| |

SEAPORT GLOBAL ACQUISITION II CORP. |

| |

|

| |

|

|

| |

By: |

/s/ Stephen Smith |

| |

Name: |

Stephen Smith |

| |

Title: |

Chief Executive Officer |

Exhibit 96.1

| TECHNICAL REPORT SUMMARY

ABM LISBON VALLEY LITHIUM PROJECT

SAN JUAN COUNTY, UTAH, USA

Effective Date: July 6, 2023

Prepared for:

American Battery Materials, Inc.

By:

Bradley C. Peek, MSc., CPG

Peek Consulting, Inc.

V.07.2023.02 |

| American Battery Materials Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page ii

Lisbon Valley Lithium Project Prepared for

TABLE OF CONTENTS

1. SUMMARY............................................................................................................................. 1

1.1 Introduction .......................................................................................................................... 1

1.2 Property Description and Location ...................................................................................... 1

1.3 Accessibility, Climate, Local Resources, Infrastructure and Physiography ........................ 2

1.4 History.................................................................................................................................. 2

1.5 Geologic Setting and Mineralization ................................................................................... 3

1.6 Deposit Types ...................................................................................................................... 4

1.7 Exploration ........................................................................................................................... 5

1.8 Drilling ................................................................................................................................. 6

1.9 Mineral Processing and Metallurgical Testing .................................................................... 6

1.10 Adjacent Properties .............................................................................................................. 6

1.11 Interpretation and Conclusions ............................................................................................ 7

1.12 Recommendations ................................................................................................................ 7

2. INTRODUCTION ................................................................................................................... 8

3. RELIANCE ON OTHER SPECIALISTS ............................................................................. 10

4. PROPERTY DESCRIPTION AND LOCATION ................................................................. 11

5. ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND

PHYSIOGRAPHY ........................................................................................................................ 16

6. HISTORY .............................................................................................................................. 19

7. GEOLOGIC SETTING AND MINERALIZATION ............................................................ 22

7.1 Stratigraphy ........................................................................................................................ 23

7.2 Structure ............................................................................................................................. 28 |

| American Battery Materials Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page iii

Lisbon Valley Lithium Project Prepared for

7.3 Geophysics ......................................................................................................................... 30

8. DEPOSIT TYPES.................................................................................................................. 33

8.1 Brines ................................................................................................................................. 34

8.2 Wells Located on the Subject Property .............................................................................. 48

9. EXPLORATION ................................................................................................................... 50

10. DRILLING ......................................................................................................................... 52

11. SAMPLE PREPARATION, ANALYSES AND SECURITY .......................................... 53

12. DATA VERIFICATION ................................................................................................... 54

13. MINERAL PROCESSING AND METALLURGICAL TESTING ................................. 55

14. ADJACENT PROPERTIES .............................................................................................. 58

15. OTHER RELEVANT DATA AND INFORMATION ..................................................... 61

16. INTERPRETATION AND CONCLUSIONS ................................................................... 62

17. RECOMMENDATIONS ................................................................................................... 64

18. REFERENCES .................................................................................................................. 65

19. CERTIFICATE OF THE AUTHOR .................................................................................. 68

20. CONSENT OF COMPETENT PERSON .......................................................................... 69 |

| American Battery Materials Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page iv

Lisbon Valley Lithium Project Prepared for

List of Figures

Figure 4.1 – Road map of Utah with project location. .................................................................. 12

Figure 4.2 - Overview of ABM’s Lisbon Lithium claims in San Juan County, Utah. ................. 14

Figure 4.3 – An example of one of the claim stakes found on the property May 7, 2023. ........... 15

Figure 5.1 – Topographic map underlying a plot of the ABM claim blocks. CI=40’. ................. 17

Figure 5.2 - Climate data for Moab, Utah. .................................................................................... 18

Figure 6.1 - Lisbon Valley Lithium claims in relation to the Superior Peterson Fed 88-21P well.

........................................................................................................................................................ 21

Figure 7.1 - Structural elements of the Paradox Basin and adjacent areas (from Nuccio and

Condon, 1996)............................................................................................................................... 23

Figure 7.2 - Generalized stratigraphic nomenclature within the greater Paradox Basin area. ...... 26

Figure 7.3 - Geologic map of the LVL claim area outlined in red. Modified after Doelling

(2002). ........................................................................................................................................... 27

Figure 7.4 – W-E Cross section through the Lisbon Oil field on the north flank of the Lisbon

Valley Anticline. ........................................................................................................................... 29

Figure 7.5a - Three-dimensional analysis of the Lisbon Valley gravity anomaly (Byerly and

Joesting, 1959). ............................................................................................................................. 31

Figure 7.5b – Two-dimensional analysis of the Lisbon Valley gravity anomaly (Byerly and

Joesting, 1959). ............................................................................................................................. 32

Figure 8.1 – Oil and gas wells occurring on the ABM claims. ..................................................... 49

Figure 9.1 – Stratigraphic column and type log for the units showing (Pennsylvanian) clastic and

salt section (Mayhew and Heylmann 1965).................................................................................. 51

Figure 13.1 - Process flow diagram of a typical lithium extraction process. ................................ 56

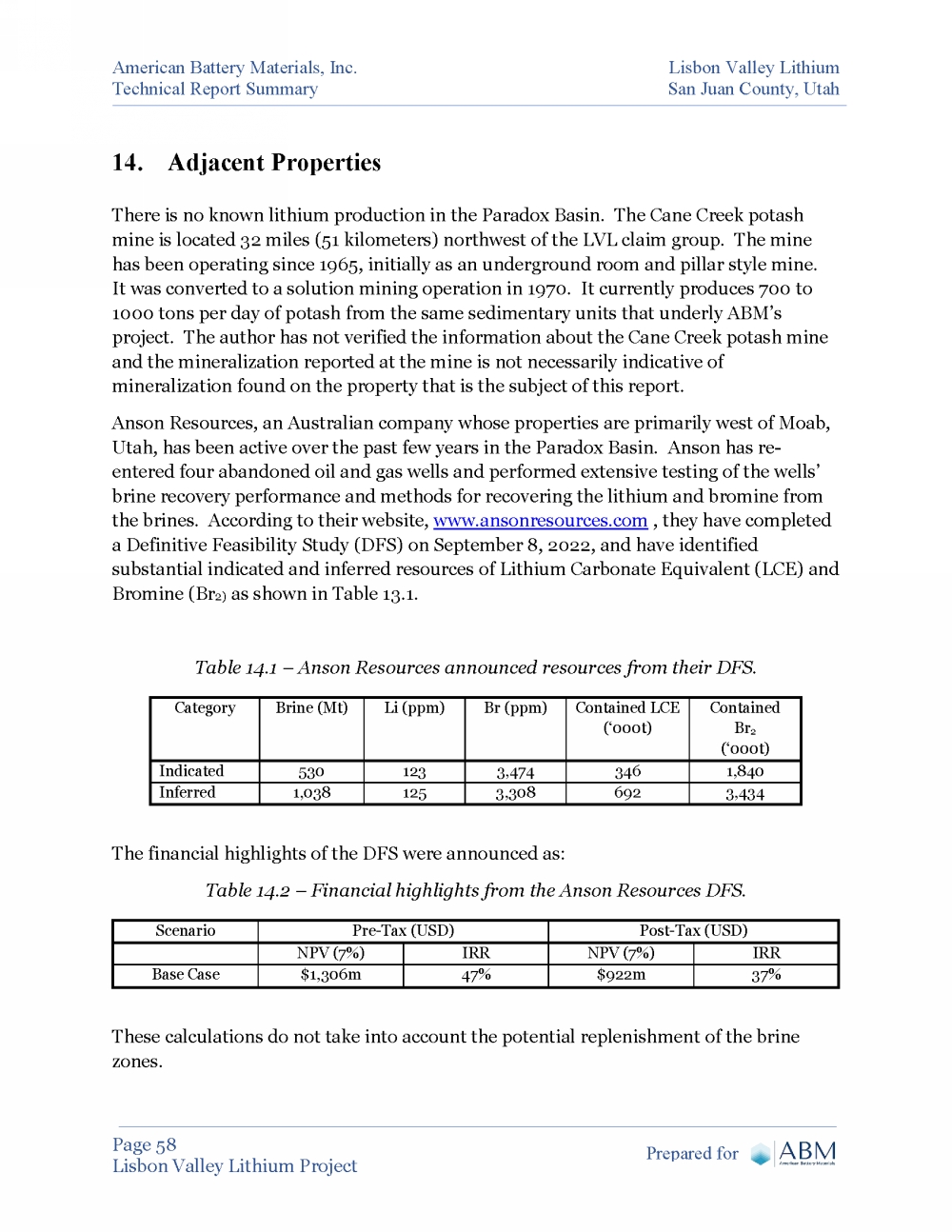

Figure 14.1 – The location of ABM’s Lisbon Lithium Project relative to Anson’s project and the

Cane Creek Potash Mine. .............................................................................................................. 60

List of Tables

Table 1.1 - Chemical analysis of brine from the Superior Fed 88-21P well from Hite

(1978). ............................................................................................................................................ 3

Table 1.2 - Anson Resources announced resources from their DFS. ............................................. 7

Table 2.1 - Abbreviations and Acronyms used in report. ............................................................... 9

Table 4.1 - Claims with BLM UT numbers. ................................................................................. 13

Table 6.1 - Chemical analysis of brine from the Superior Fed 88-21P well from Hite (1978). ... 20

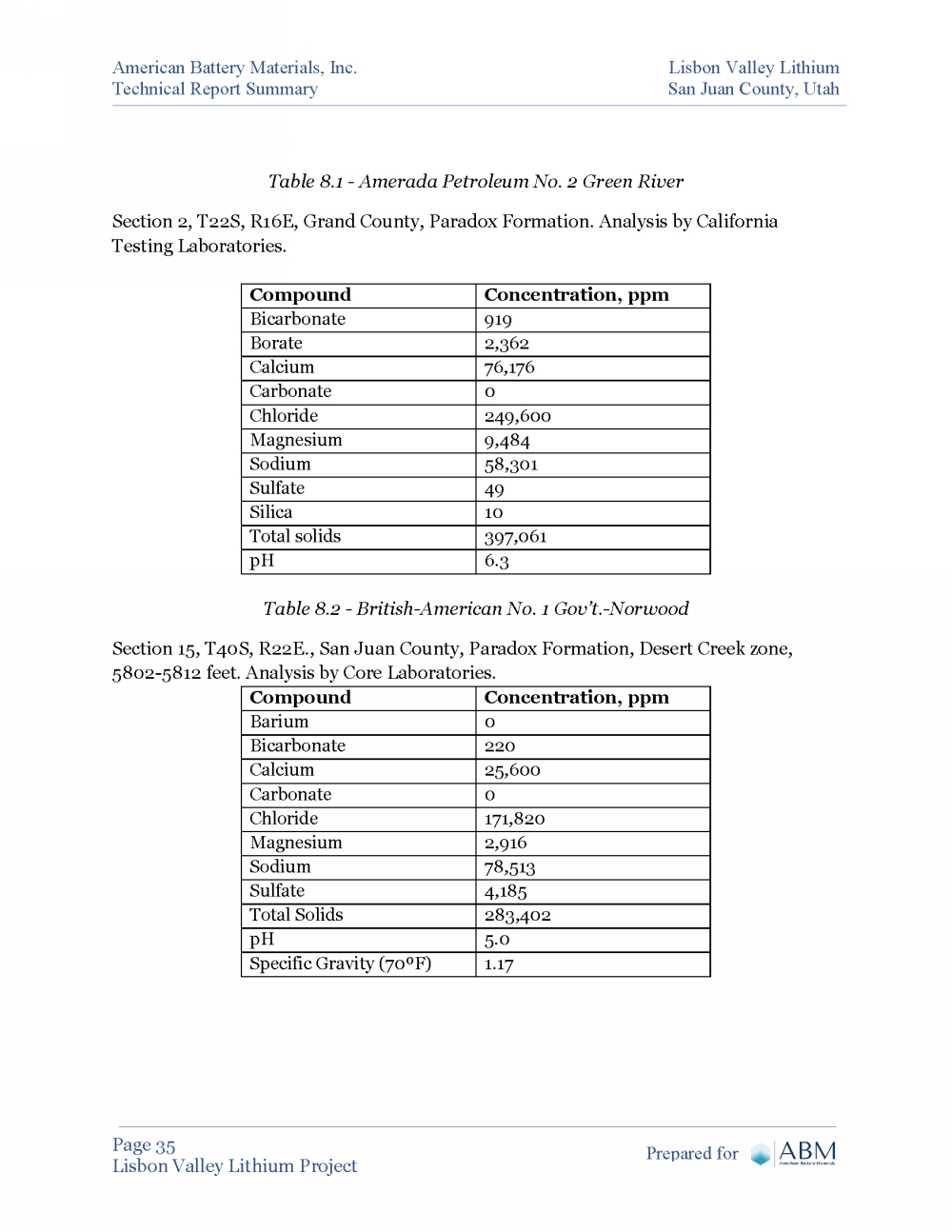

Table 8.1 - Amerada Petroleum No. 2 Green River ..................................................................... 35

Table 8.2 - British-American No. 1 Gov’t.-Norwood .................................................................. 35

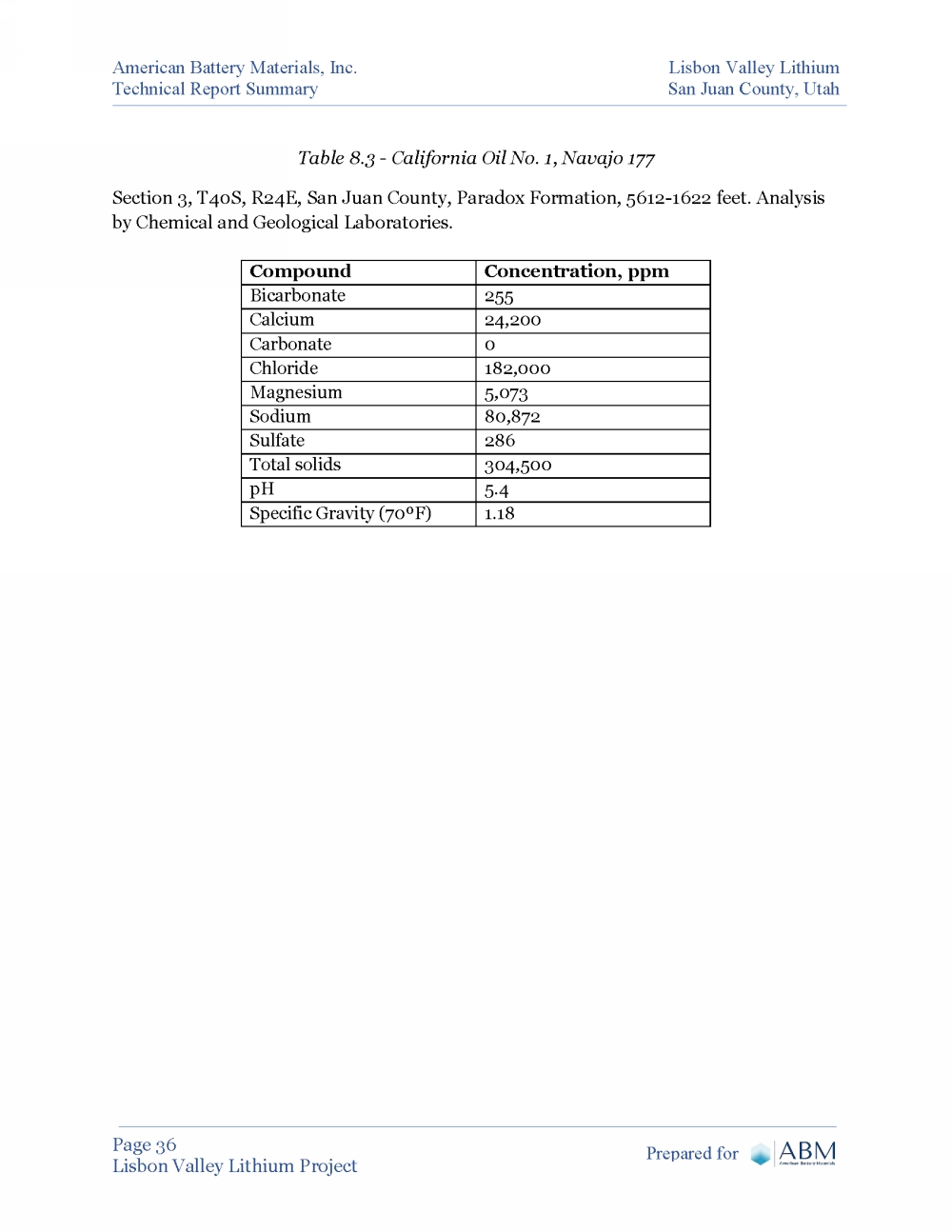

Table 8.3 - California Oil No. 1, Navajo 177 ............................................................................... 36

Table 8.4 - Delhi-Taylor No. 2, Seven Mile ................................................................................. 37

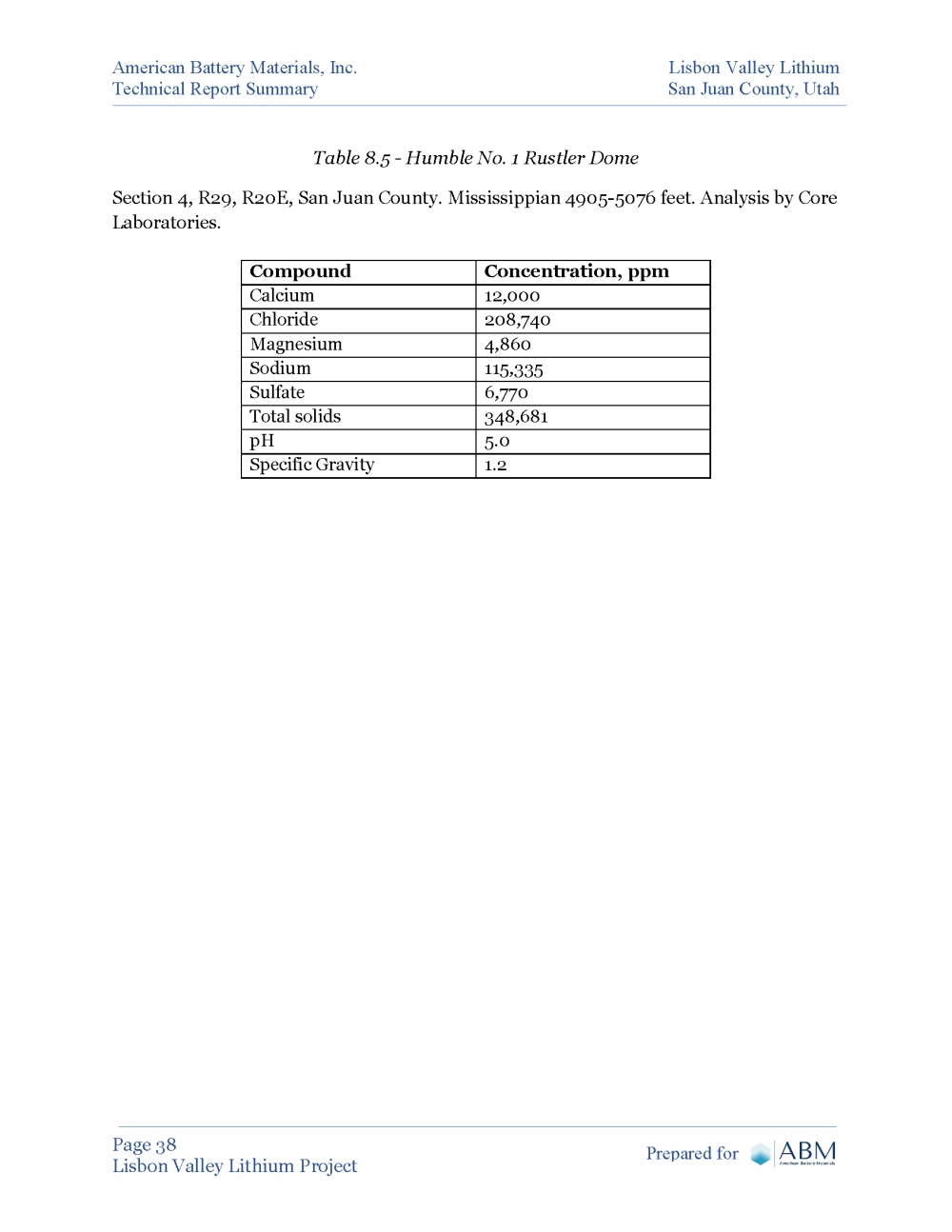

Table 8.5 - Humble No. 1 Rustler Dome ...................................................................................... 38

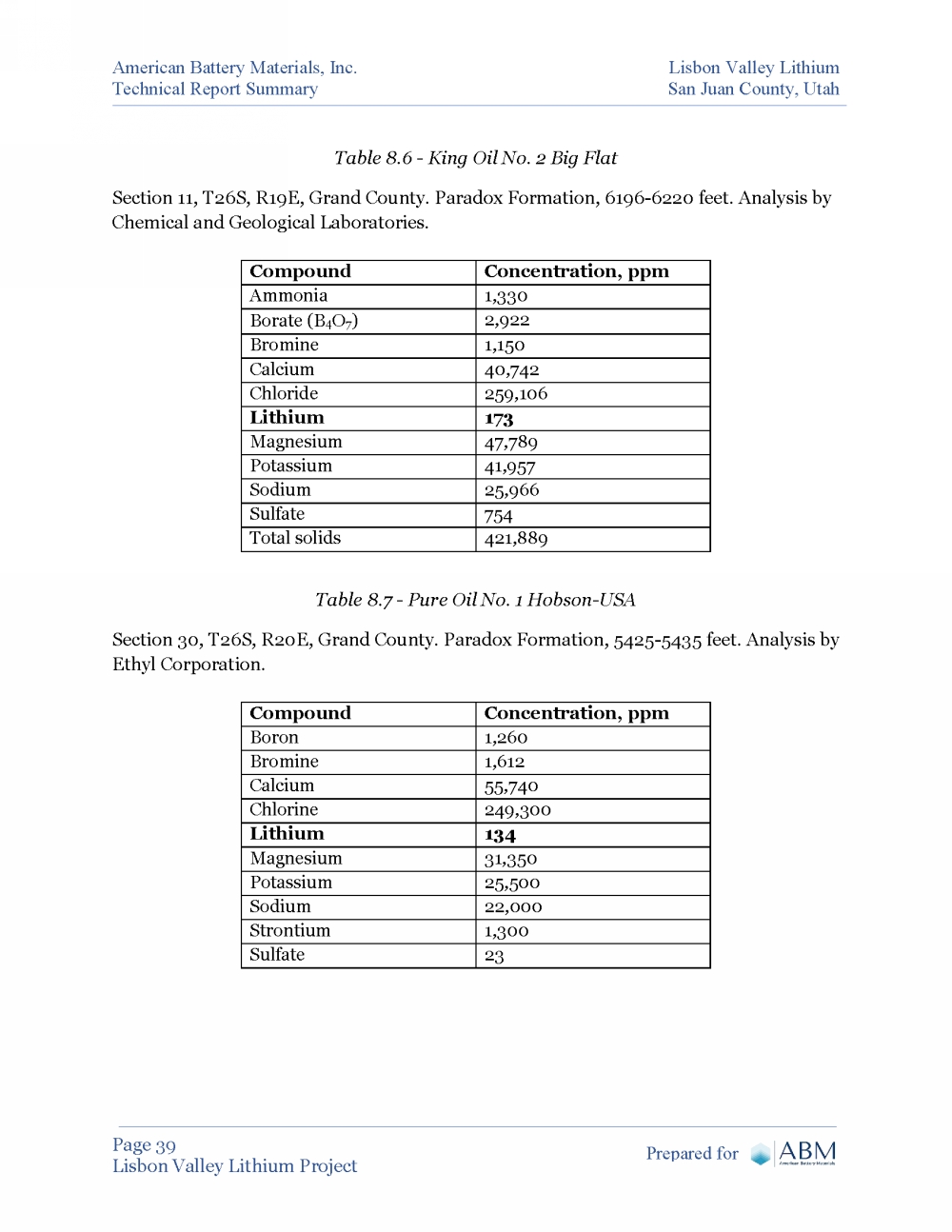

Table 8.6 - King Oil No. 2 Big Flat .............................................................................................. 39

Table 8.7 - Pure Oil No. 1 Hobson-USA ...................................................................................... 39 |

| American Battery Materials Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page v

Lisbon Valley Lithium Project Prepared for

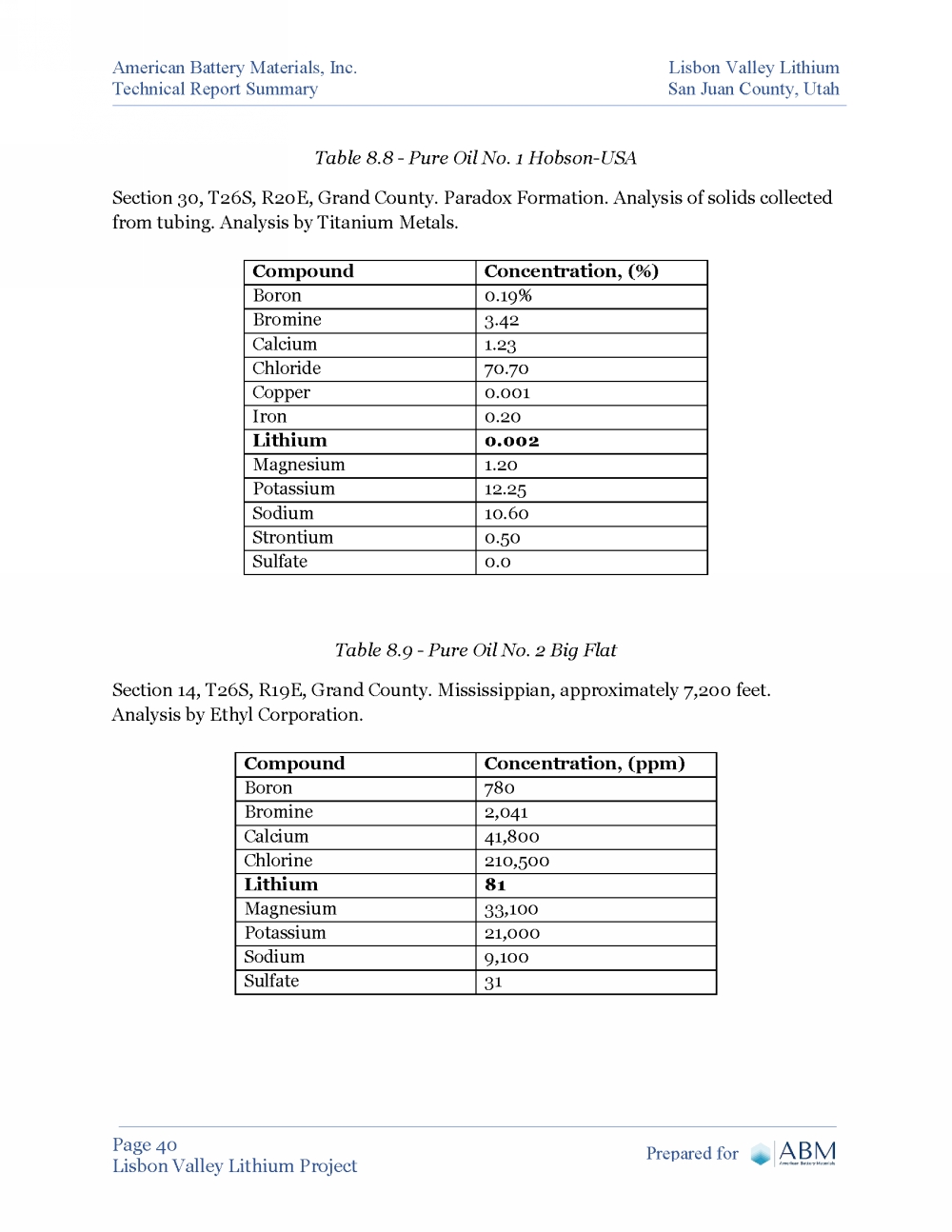

Table 8.8 - Pure Oil No. 1 Hobson-USA ...................................................................................... 40

Table 8.9 - Pure Oil No. 2 Big Flat ............................................................................................... 40

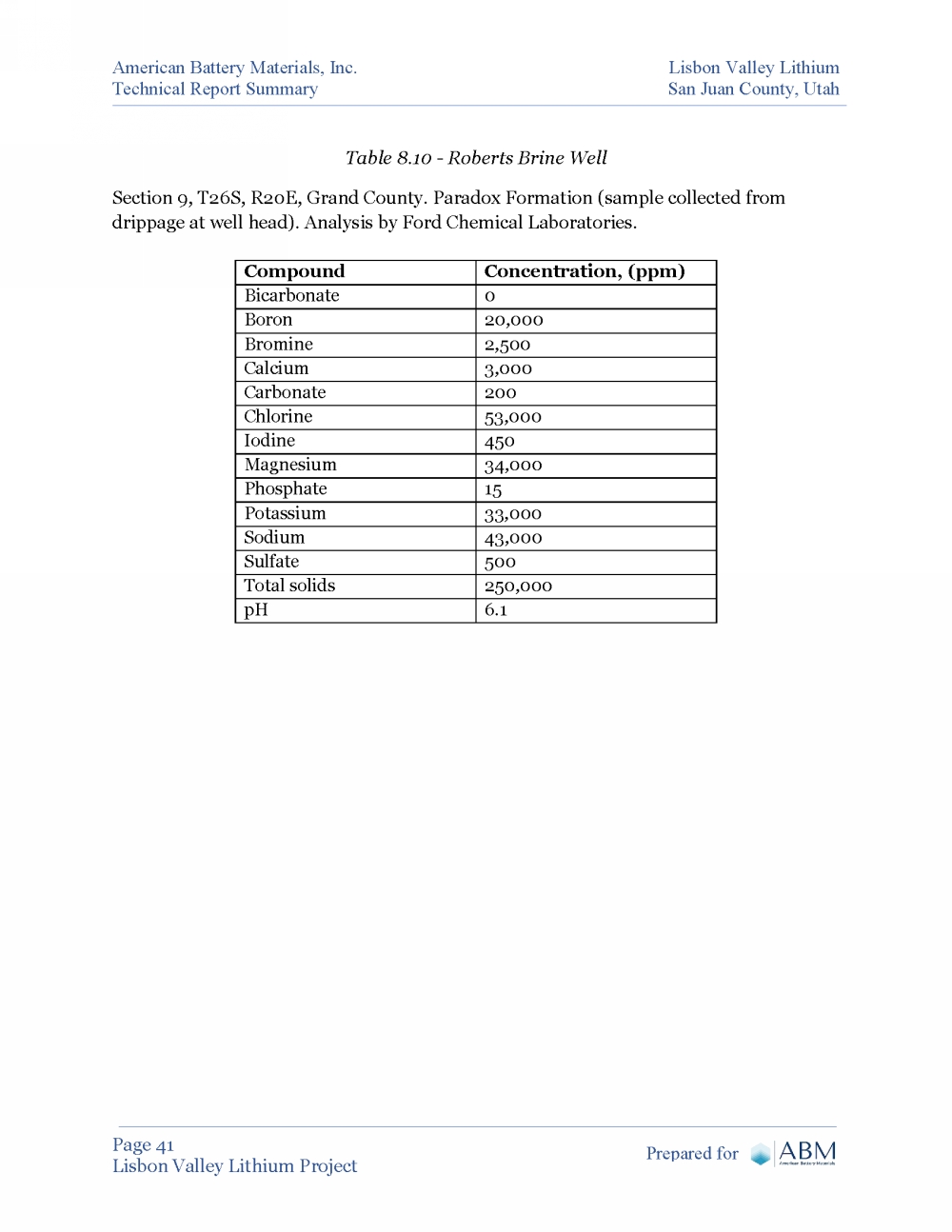

Table 8.10 - Roberts Brine Well ................................................................................................... 41

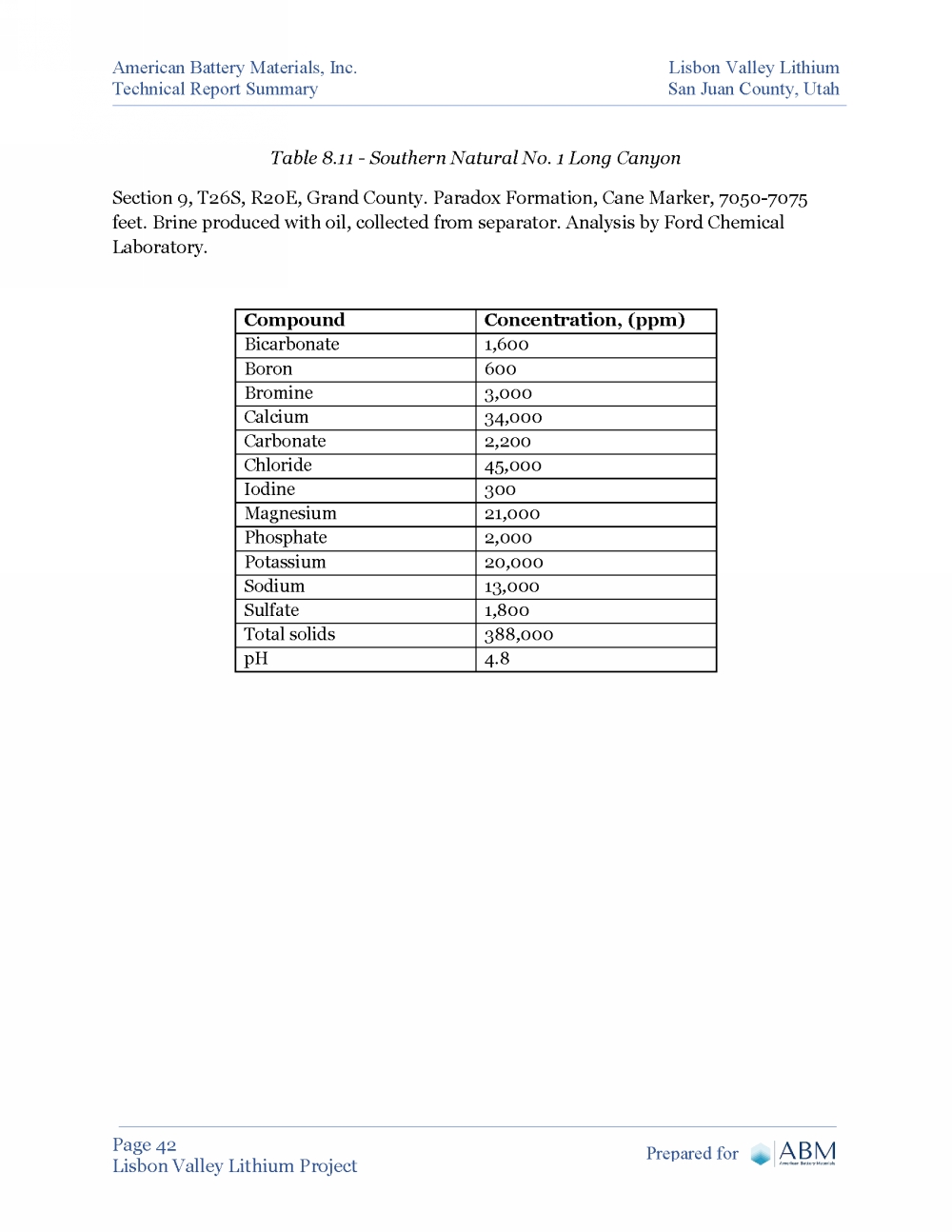

Table 8.11 - Southern Natural No. 1 Long Canyon ...................................................................... 42

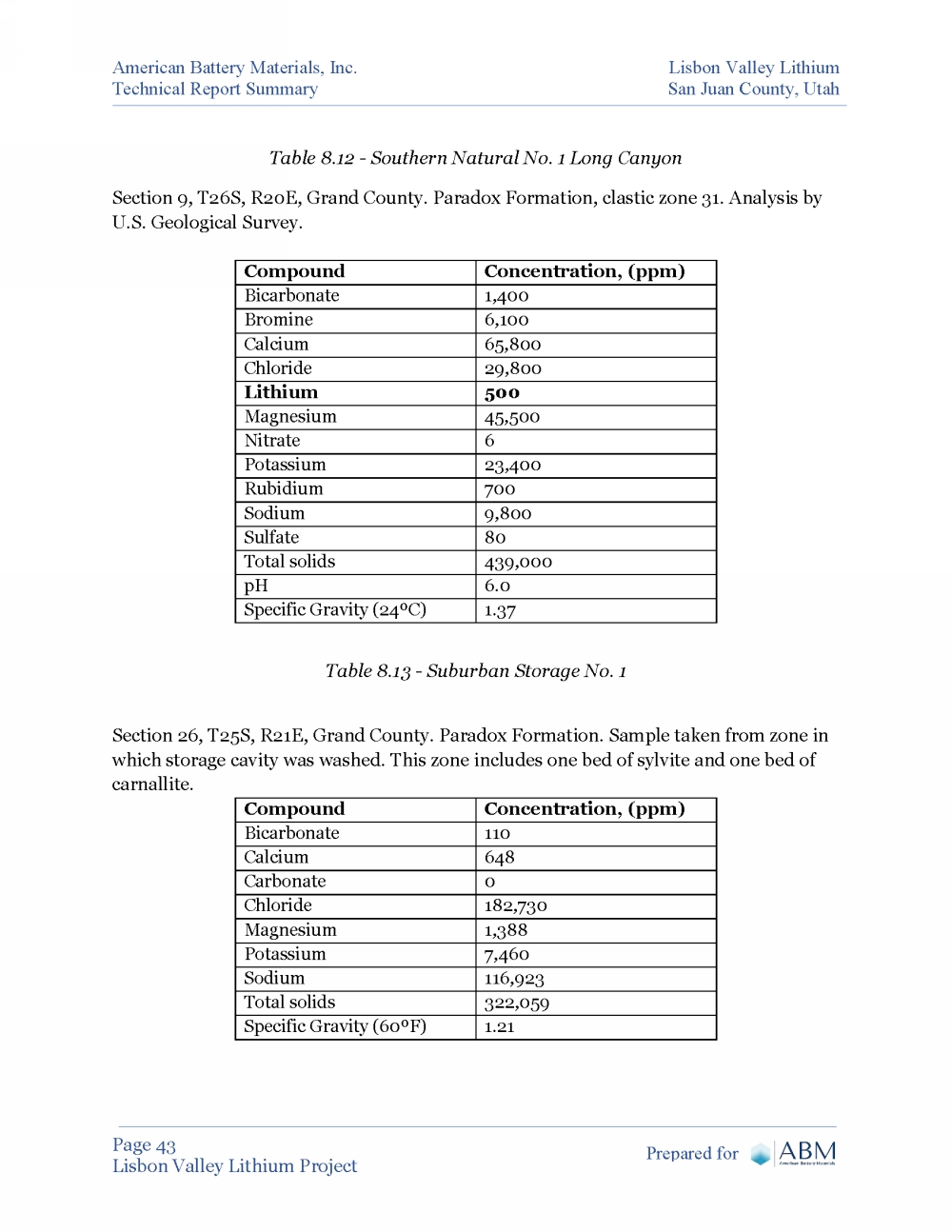

Table 8.12 - Southern Natural No. 1 Long Canyon ...................................................................... 43

Table 8.13 - Suburban Storage No. 1 ............................................................................................ 43

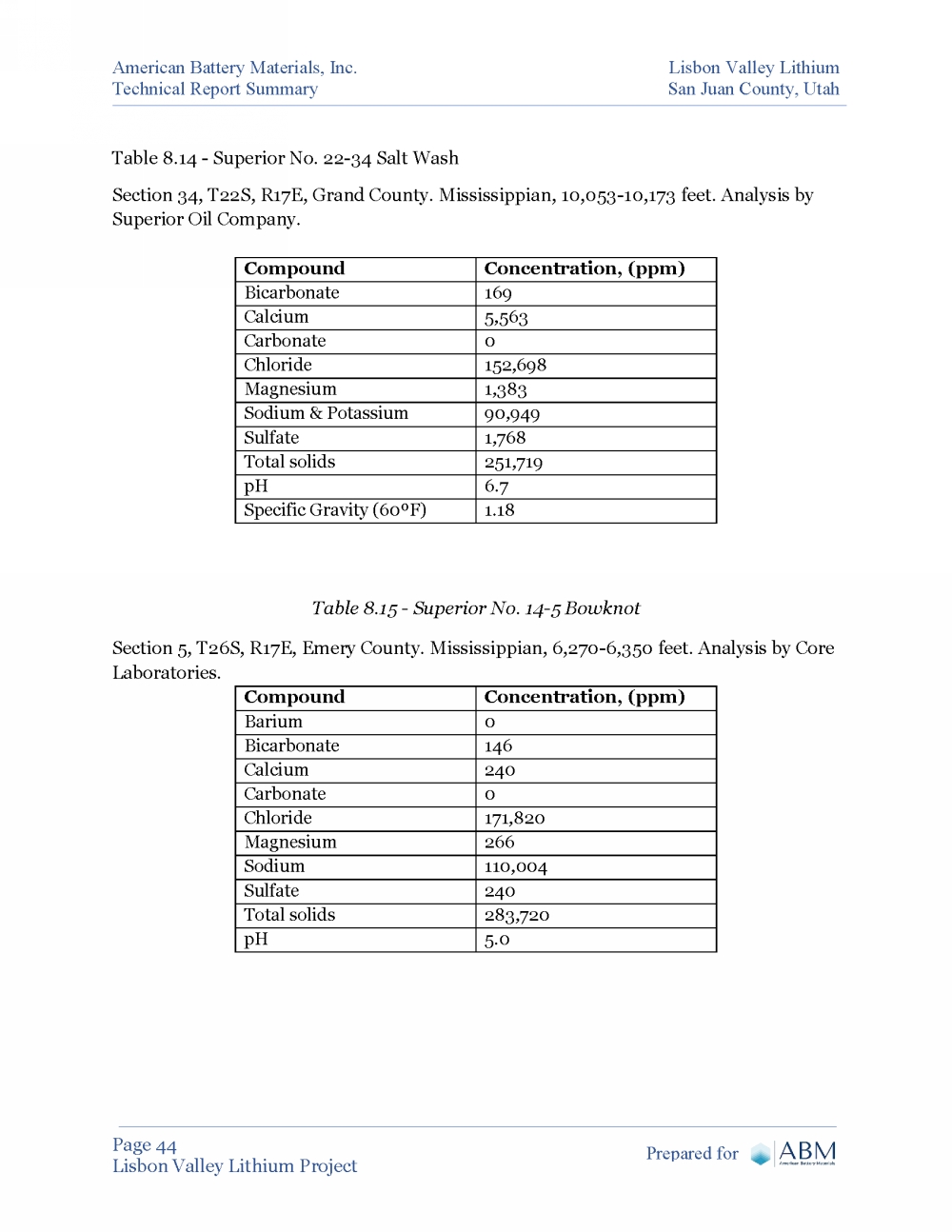

Table 8.14 - Superior No. 22-34 Salt Wash ............................................................................ 44

Table 8.15 - Superior No. 14-5 Bowknot ..................................................................................... 44

Table 8.16 - Texaco No. 2 Navajo AC ......................................................................................... 45

Table 8.17 - Texaco No. 1 Smoot (Salt Wash field) ..................................................................... 45

Table 8.18 - Tidewater No. 74-11 Big Flat ................................................................................... 46

Table 8.19 - Tidewater No. 74-11 Big Flat ................................................................................... 46

Table 8.20 - White Cloud #2 (aka. Roberts Brine Well) .............................................................. 47

Table 8.21 - Oil & gas wells drilled within the LVL claim block. ............................................... 48

Table 14.1 – Anson Resources announced resources from their DFS. ......................................... 58

Table 14.2 – Financial highlights from the Anson Resources DFS. ............................................. 58 |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 1

Lisbon Valley Lithium Project Prepared for

1. Summary

1.1 Introduction

American Battery Materials, Inc. (ABM)(formerly BoxScore Brands Inc.) acquired the

rights to the Lisbon Lithium Project from Plateau Ventures LLC. Peek Consulting was

engaged by ABM to write this report to document progress on the property and for

funding purposes.

The report has been written to conform to the U. S. Securities and Exchange

Commission’s (SEC’s) Subpart 1300 of Regulation S-K for a Technical Report Summary.

The subject property is an exploration stage property that currently has no mineral

resources or mineral reserves yet defined. No exploration has been conducted on the

property to date. This report is a summary of the data reviewed and the conclusions

drawn from that data.

This report is an update of a previous report entitled “ABM Lisbon Valley Lithium

Project, San Juan County, Utah, USA” with an effective date of May 15, 2023. The

current report includes a substantial increase in the land position of the project.

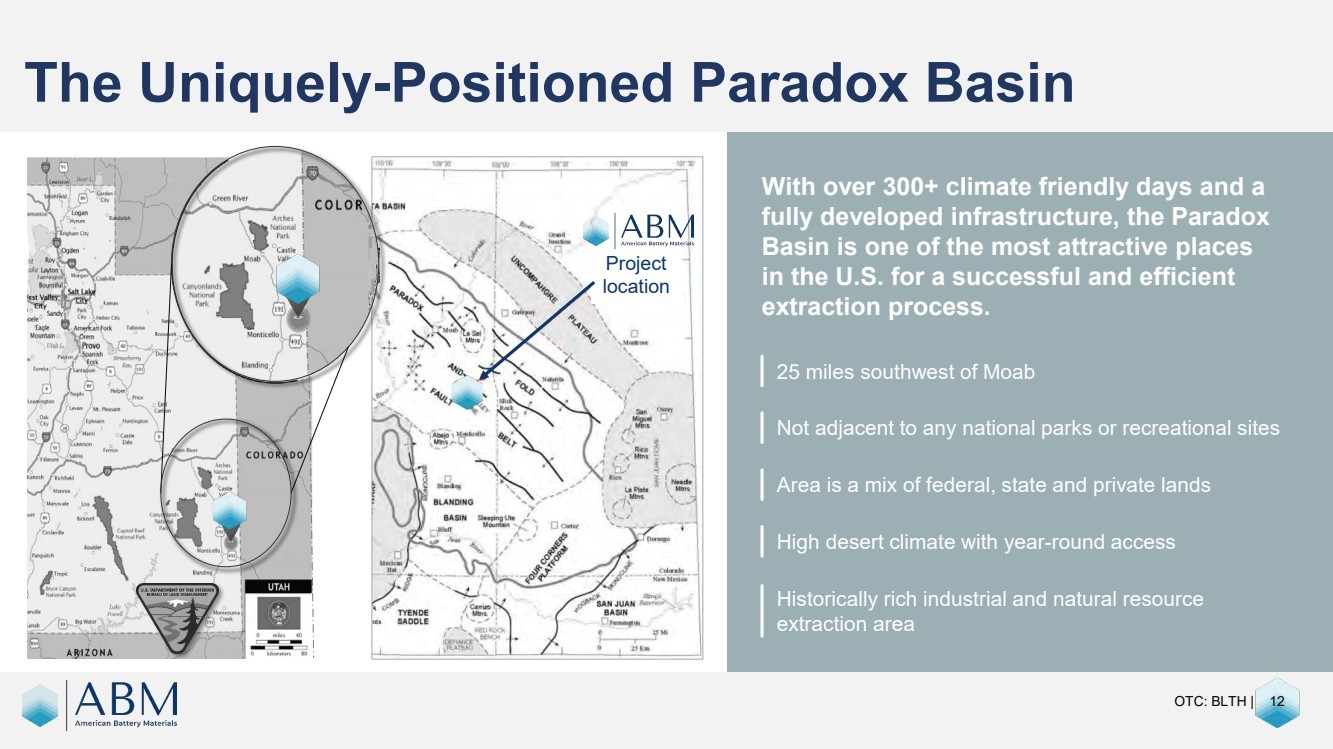

1.2 Property Description and Location

The property is located in San Juan County, Utah. The center of the claims lies

approximately 35 miles (58 kilometers) southeast of the city of Moab. The property

position consists of 743 placer mining claims staked on U. S. Government land

administered by the U. S. Bureau of Land Management (BLM).

The claims are a semi-contiguous group named the LVL group covering roughly 23

square miles. The original 102 claims were staked in portions of Sections 17-18, 20-22,

and 27-29, T30S, R25E, Salt Lake Baseline and Principal Meridian in 2017, with

additional claims staked in Q2, 2023 in Sections 22, 25-28, 33-35 in T30S, R25E;

Section 31, T30S, R26E; Sections 1, 3-4, 8-15, 17, T 31S, R25E; and Sections 5-8, 17-18,

T31S, R26E (Figure 4.2). The original 102 claims were located on September 8, 9 and

10, 2021. All original claim corners and location monuments were located using

handheld Garmin GPS units (Gavin Harrison, personal communication). Additional

claims were located and staked by a (confidential) mining consulting company between

May 3, 2023 and June, 12 2023.

It will be necessary for ABM to re-enter an oil and gas well or to drill a new well to

obtain brine samples for analysis and metallurgical testing. Permits for such |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 2

Lisbon Valley Lithium Project Prepared for

operations will be required from the BLM and the Utah Division of Oil, Gas and

Mining. These permits are currently in process.

1.3 Accessibility, Climate, Local Resources, Infrastructure and

Physiography

Moab, Utah, the nearest population center to the property, is a city of 5,336 persons

(2020 Census). It is located in a relatively remote portion of Utah but is easily accessed

by U. S. Highway 191. Highway 191 intersects with Interstate 70 about 30 miles (48

kilometers) north of Moab, at Crescent Junction. Moab is a tourist destination and has

numerous motels and restaurants. Moab would also be the nearest source of labor in

the region.

The region has a history of mining, primarily uranium and vanadium that dates back as

far as 1881. The Lisbon Valley Copper Mine is in the heart of the Lisbon Valley and is

currently producing copper cathode. An all-weather road and electric power supply the

mine.

All the ABM claims fall between elevations of 6200 and 6900 feet (1890 and 2100

meters) above sea level.

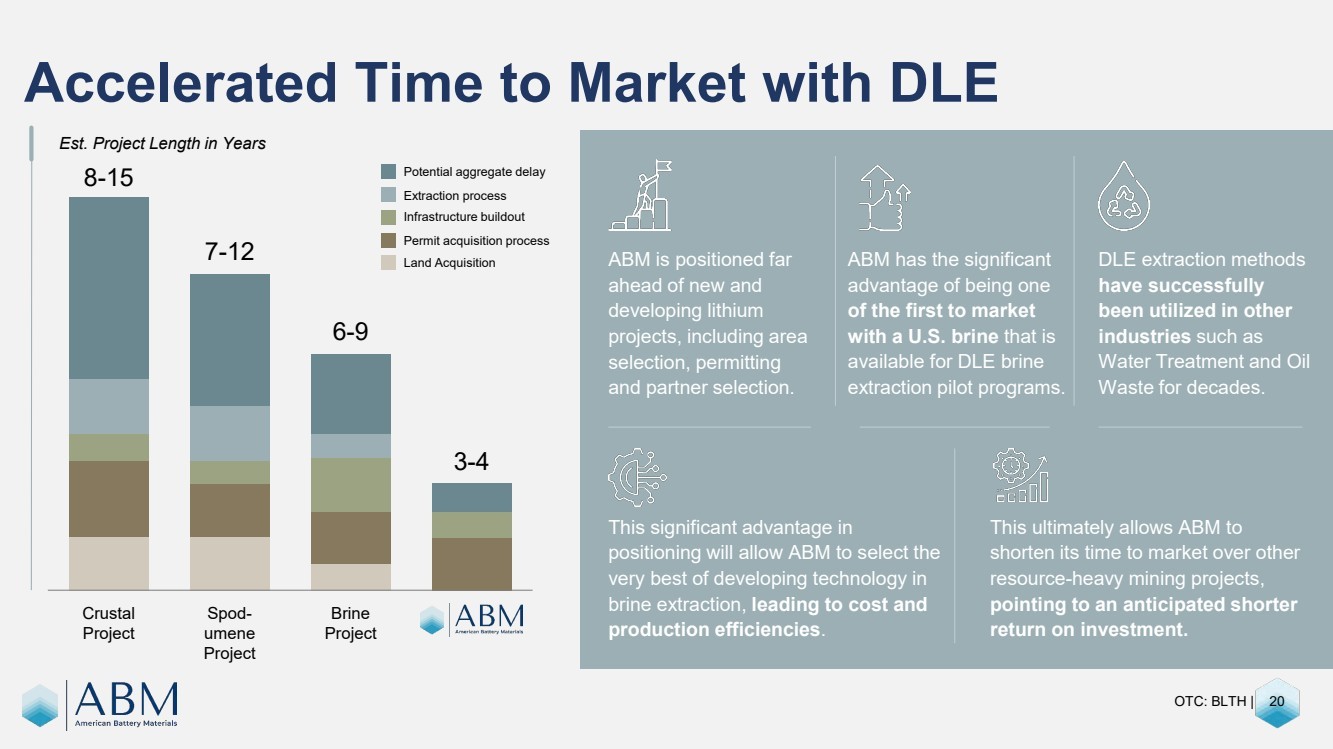

It is anticipated that ABM will use a Direct Lithium Extraction (DLE) method rather

than using evaporation ponds to recover the lithium and other potential mineral from

brines, should the project advance to the production stage. The project should therefore

have sufficient space on the ABM claims to construct processing facilities.

The climate is arid, also termed “high desert”. Moab has average annual precipitation of

9.02 inches (229 mm). The climatic conditions allow for fieldwork to continue

throughout the year.

1.4 History

The Paradox Basin initially attracted attention because of high lithium values reported

in the literature in brines recovered from oil and gas exploration wells. The Paradox

Basin has been explored for oil and gas for many years (Durgin, 2011). The earliest

discoveries of potash in the area were made in 1924 in oil and gas wells, but the

correlation of the beds and the extent and richness of the deposits were not recognized

until the 1950s. The Seven Mile, Salt Wash and White Cloud potash target areas, all west |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 3

Lisbon Valley Lithium Project Prepared for

of Moab, were quickly identified. Further exploration led to the development of the Cane

Creek potash mine adjacent to the Colorado River.

Brines were commonly encountered in these wells, but none of the wells was of

economic significance for brine until in 1962 when the Southern Natural Gas Company

drilled a well, Long Canyon Unit #1, which encountered a substantial flow of high-density brine at a depth of 6,013 feet (Durgin, 2011).

Several companies have reported high lithium values occurring in brines from oil & gas

and potash wells drilled into the Paradox Formation. Hite (1978) investigated the

potash potential of the Lisbon Valley area in a USGS Open File Report. The analytical

report has been the main impetus for the acquisition of the Lisbon Valley Lithium

property. In Hite’s report, he published the analytical results of a brine sample from the

Superior Oil Co. Well Fed 88-21P. Table 1.1 lists the analytical results from Hite’s

report.

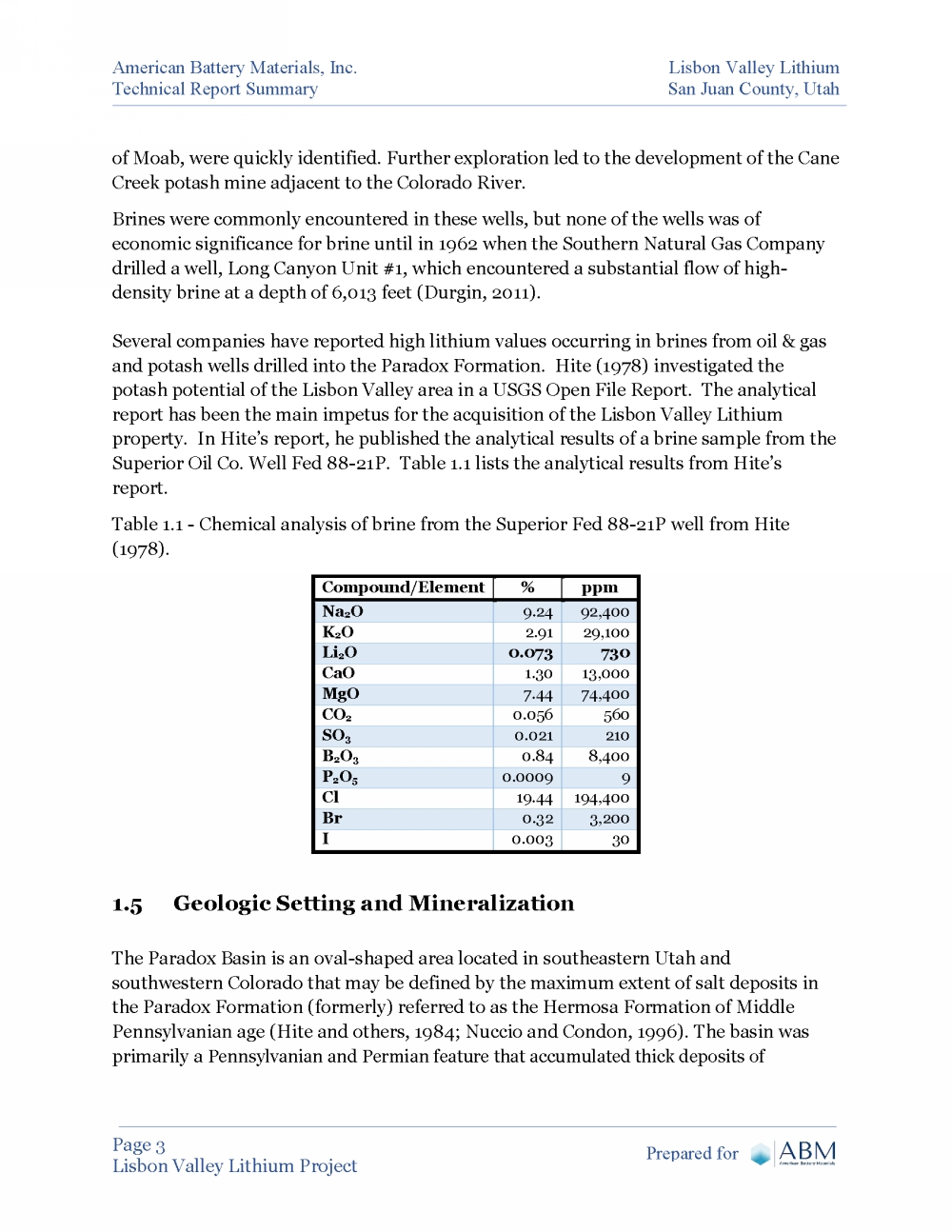

Table 1.1 - Chemical analysis of brine from the Superior Fed 88-21P well from Hite

(1978).

Compound/Element % ppm

Na2O 9.24 92,400

K2O 2.91 29,100

Li2O 0.073 730

CaO 1.30 13,000

MgO 7.44 74,400

CO2 0.056 560

SO3 0.021 210

B2O3 0.84 8,400

P2O5 0.0009 9

Cl 19.44 194,400

Br 0.32 3,200

I 0.003 30

1.5 Geologic Setting and Mineralization

The Paradox Basin is an oval-shaped area located in southeastern Utah and

southwestern Colorado that may be defined by the maximum extent of salt deposits in

the Paradox Formation (formerly) referred to as the Hermosa Formation of Middle

Pennsylvanian age (Hite and others, 1984; Nuccio and Condon, 1996). The basin was

primarily a Pennsylvanian and Permian feature that accumulated thick deposits of |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 4

Lisbon Valley Lithium Project Prepared for

carbonate, halite, and clastic rocks in response to downwarping and uplift along its

northeastern basin. The basin was later modified, largely due to the Laramide Orogeny 50 to

70 million years (Ma) ago. Today the basin has been eroded in places by uplift of the

Colorado Plateau and downcutting by the Colorado River and its tributaries (Nuccio and

Condon, 1996).

The Paradox Basin is composed of sedimentary rocks that overlie an Early Proterozoic

basement of metamorphic gneiss and schist that is locally intruded by granite (Nuccio

and Condon, 1996; Tweto,1987). Cambrian through Jurassic sedimentary rocks

unconformably overlie the basement rock in much of the basin. Cretaceous rocks are

also noted in the southeastern part of the basin.

The Paradox Formation, which is of primary interest to this study, contains dolomite,

black shale, anhydrite, halite, and other salts. The lithium-rich brines of the Paradox

Basin have all been derived from the Paradox Formation. Halite is the most abundant

rock type, occurring in beds tens of feet thick. The black, dolomitic shale is the source

rock of some of the oil and gas recovered in the basin. The Paradox was deposited in a

series of cycles that represent repeated desiccation and marine flooding of the basin

(Hite and Buchner, 1981). The black shales of the Paradox have been used as marker

beds to correlate depositional cycles throughout the basin. The cycles have been grouped

into larger zones, or “substages” (Barnes and others, 1967), or “production intervals”

(Hite and others, 1984).

The primary structure in the area of the ABM claims is the Lisbon Valley anticline. It is

bordered on its northeast side by the Lisbon Valley fault. The fault zone can be traced

on surface northwest and southeast for a distance of 41 miles (66 km). The fault and

anticline are the result of salt tectonics prevalent in the Paradox Basin (Hite, 1978).

1.6 Deposit Types

There is currently no known production of lithium from the Paradox Basin. The deposit

model and exploration target for the Lisbon Lithium Project is very similar to the model

defined by Anson Resources in the Paradox Basin to the northwest of ABM’s claim block

(See Section 13 – Adjacent Properties). Anson, an Australian company, operating in the

U. S. as A1 Lithium Incorporated, has defined a major lithium and bromine resource

and has completed a Definitive Feasibility Study. ABM’s target deposit model is similar

in all respects to that of Anson’s deposit.

In the Paradox Basin the lithium-rich brines occur in the “saline facies” of the Paradox

Member of the Hermosa Formation of Pennsylvanian age and are totally in the |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 5

Lisbon Valley Lithium Project Prepared for

subsurface. The “saline facies” of the Paradox Formation is composed of at least 29

evaporite cycles. Many of the cycles are potash-bearing and there is an active potash

mine in the basin.

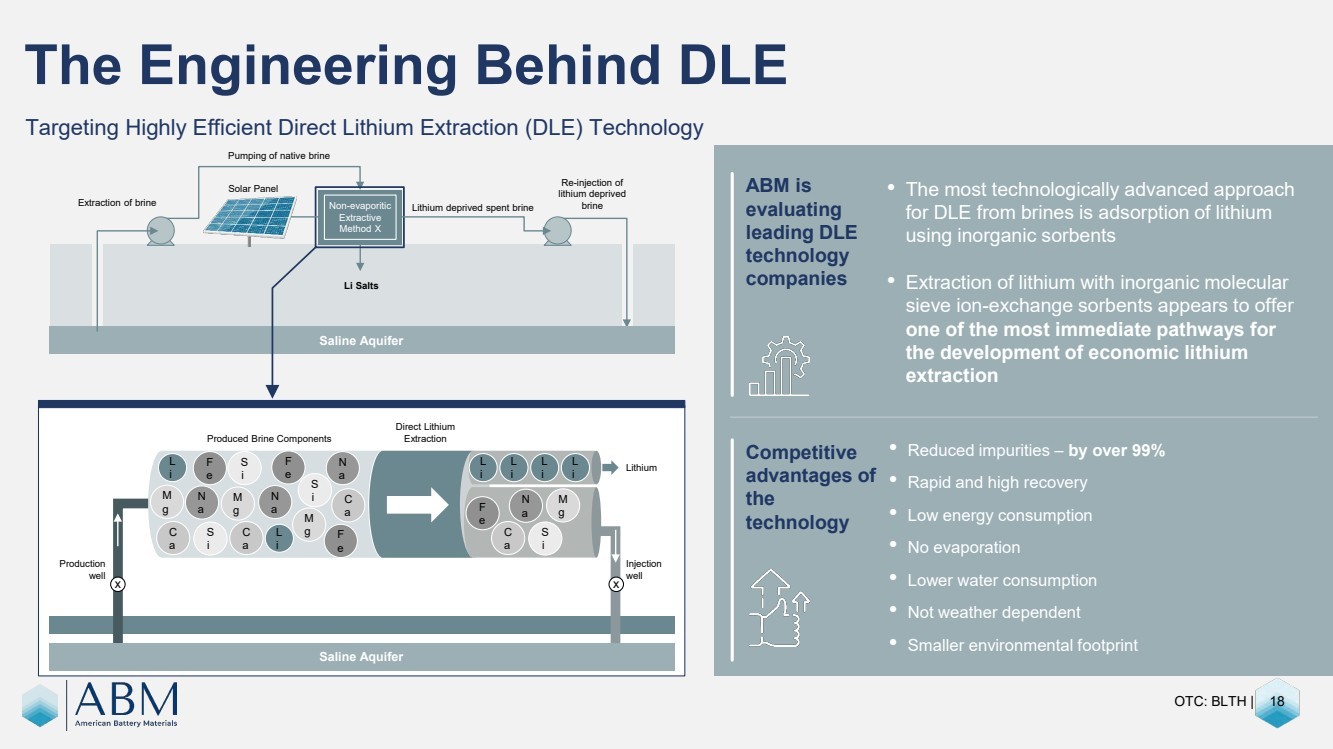

The method of extraction of the lithium from the brines is foreseen to be by Direct

Lithium Extraction (DLE) and reinjection of the processed brine back into the

subsurface. This method has been gaining favor in the lithium industry over the last

several years because it does not involve the use of evaporation ponds. DLE uses a

much smaller footprint than evaporation ponds and is therefore more acceptable from

an environmental standpoint. As yet, ABM has not done any testing for the possibility

of using DLE and will not be able to do any testing until samples of brine are acquired

from the target formations.

The brines were not considered important until 1962, when Southern Natural Gas

intersected the brine zone and a very substantial flow of brines under tremendous

pressure. A second well was drilled 500 feet (152 meters) northeast of the first well and

encountered flows estimated to be in excess of 50,000 barrels of brine per day. Many of

the wells had analyses showing lithium assays. These are partially enumerated in

Section 8.1 – Brines.

Seven oil and gas wells have been drilled on the property now held by ABM according to

records of the Utah Division of Oil, Gas and Mining. Unfortunately, no analyses of the

brines from these wells have been found in the literature. Six of the wells have been

plugged and abandoned. One well is being used as a water disposal well.

1.7 Exploration

There has been no exploration conducted on the property by ABM or its predecessors

other than the gathering and assimilation of data from all available sources.

A thorough review of 40 historic well files and corresponding well log data was

conducted in the fall and winter of 2022-2023. Formation tops were picked in 23 of the

available 40 wells that penetrated some or all of the Paradox salts/clastics and/or the

Leadville Limestone.

Structure contour maps of the zones have been generated but are currently proprietary.

The primary targets include Clastic Zones 17 and 31, as well as the Leadville Limestone.

These zones have been shown by historical records and recent production to have free

flowing brines with high lithium concentrations – in some cases above 200 ppm Li. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 6

Lisbon Valley Lithium Project Prepared for

Secondary targets are Clastic Zones 19, 29, 33, and 39. These zones have been recently

identified by Anson Resources’ drilling and testing (see Section 13 on Adjacent

Properties) to contain supersaturated brines with elevated lithium concentrations.

Though potential targets have been identified, ABM intends to test all clastic zones

encountered in future appraisal wells.

1.8 Drilling

No drilling has been conducted by ABM or its predecessors. Drilling has been

conducted by oil and gas and by potash interests on and in the area surrounding the

LVL claims, which has provided much of the information for this report.

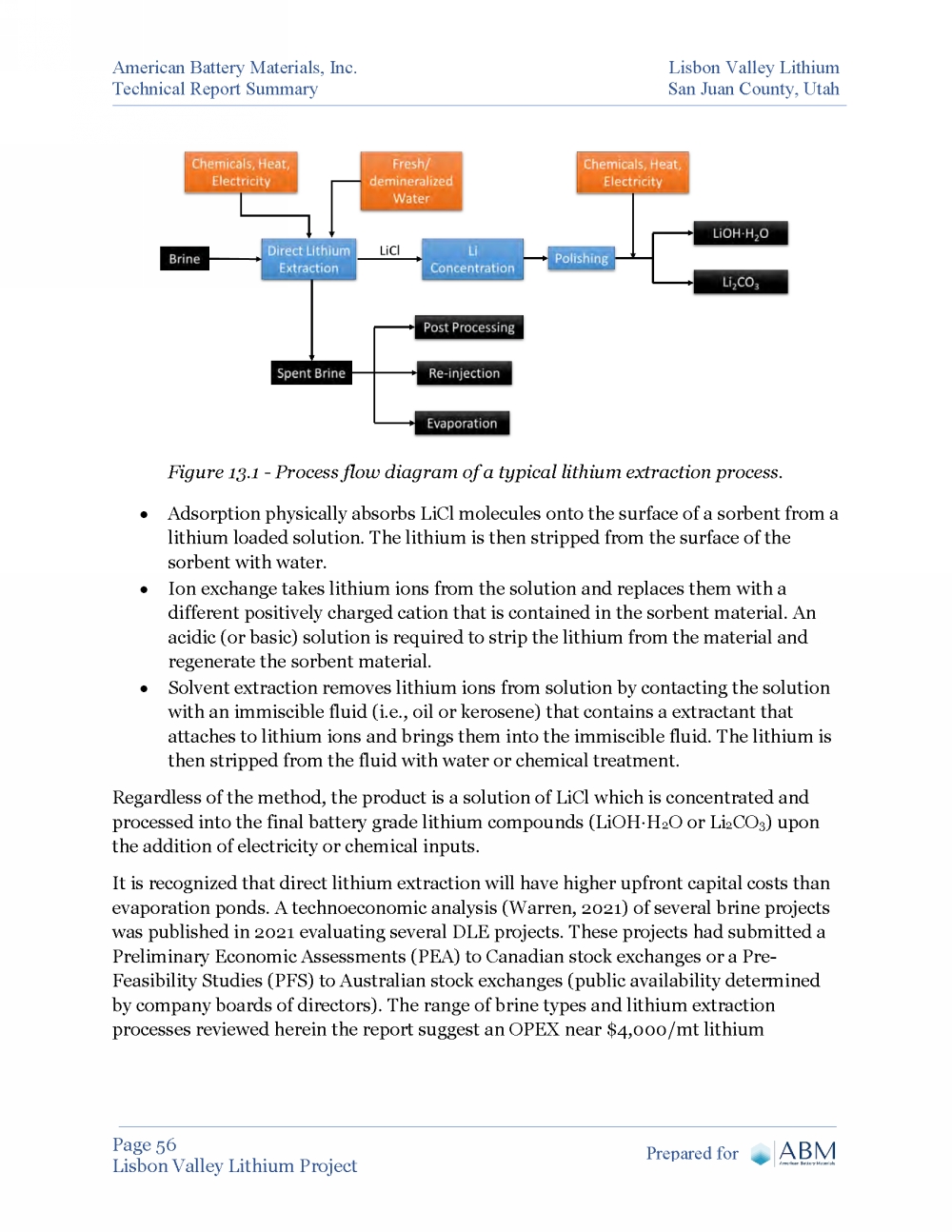

1.9 Mineral Processing and Metallurgical Testing

No metallurgical testing has been conducted by ABM and none can be conducted until

brine samples can be collected from wells drilled or re-entered on the subject property.

The anticipated type of processing envisioned by ABM for extraction of lithium and

possibly other commodities from the brines is summarized here.

The use of open ponds for evaporation and concentration of lithium brines is nominally

inexpensive, however, the evaporation process is time consuming, land intensive and

wasteful of water. The development of new brine resources from undeveloped lithium

brine deposits is likely to meet significant environmental and social barriers to

implementation, particularly in the US, and evaporation ponds are not considered

environmentally sustainable.

Over the past decade many direct lithium extraction (DLE) technologies have arisen due

to intense research and economic drive to separate lithium from other ions in a feed

solution. These processes can involve organic and inorganic sorption reagents based on

polymers, membranes, manganese, titanium, or aluminum oxides and form the

backbone of DLE extraction technologies.

1.10 Adjacent Properties

There is no known lithium production in the Paradox Basin. The Cane Creek potash

mine is located 32 miles (51 kilometers) northwest of the LVL claim group. The mine

has been operating since 1965, initially as an underground room and pillar style mine.

It was converted to a solution mining operation in 1970. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 7

Lisbon Valley Lithium Project Prepared for

Anson Resources, an Australian company whose properties are primarily west of Moab,

Utah, has been active over the past few years in the Paradox Basin. Anson has re-entered four abandoned oil and gas wells and performed extensive testing of the wells’

brine recovery performance and methods for recovering the lithium and bromine from

the brines. According to their website, www.ansonresources.com , they have completed

a Definitive Feasibility Study (DFS) on September 8, 2022, and have identified

substantial indicated and inferred resources of Lithium Carbonate Equivalent (LCE) and

Bromine (Br2) as shown in Table 1.2.

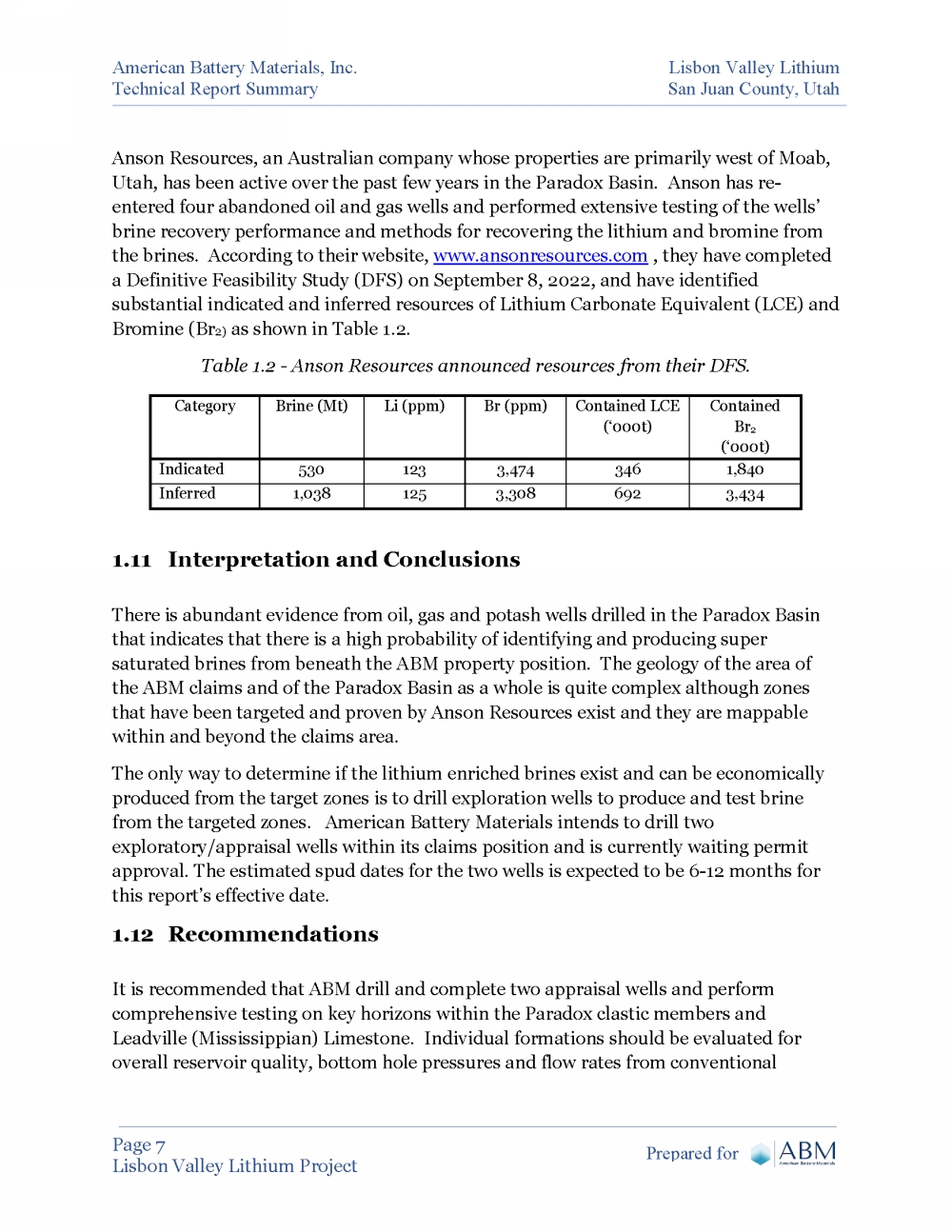

Table 1.2 - Anson Resources announced resources from their DFS.

Category Brine (Mt) Li (ppm) Br (ppm) Contained LCE

(‘000t)

Contained

Br2

(‘000t)

Indicated 530 123 3,474 346 1,840

Inferred 1,038 125 3,308 692 3,434

1.11 Interpretation and Conclusions

There is abundant evidence from oil, gas and potash wells drilled in the Paradox Basin

that indicates that there is a high probability of identifying and producing super

saturated brines from beneath the ABM property position. The geology of the area of

the ABM claims and of the Paradox Basin as a whole is quite complex although zones

that have been targeted and proven by Anson Resources exist and they are mappable

within and beyond the claims area.

The only way to determine if the lithium enriched brines exist and can be economically

produced from the target zones is to drill exploration wells to produce and test brine

from the targeted zones. American Battery Materials intends to drill two

exploratory/appraisal wells within its claims position and is currently waiting permit

approval. The estimated spud dates for the two wells is expected to be 6-12 months for

this report’s effective date.

1.12 Recommendations

It is recommended that ABM drill and complete two appraisal wells and perform

comprehensive testing on key horizons within the Paradox clastic members and

Leadville (Mississippian) Limestone. Individual formations should be evaluated for

overall reservoir quality, bottom hole pressures and flow rates from conventional |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 8

Lisbon Valley Lithium Project Prepared for

completions. Any extracted brines should be tested to determine lithium concentrations

and to prove economic viability of a pilot and permanent production program. The

company has identified an appraisal and development program that is proprietary. This

information will be disclosed in an advanced technical report after the appraisal wells

are drilled and individual zones are identified and fully evaluated.

2. Introduction

American Battery Materials, Inc. (ABM)(formerly BoxScore Brands Inc.) acquired the

rights to the Lisbon Lithium Project from Plateau Ventures LLC. Peek Consulting was

engaged by ABM to write this report to document progress on the property and for

funding purposes.

The report has been written to conform to the U. S. Securities and Exchange

Commission’s (SEC’s) Subpart 1300 of Regulation S-K for a Technical Report Summary.

The subject property is an exploration stage property that currently has no mineral

resources or mineral reserves yet defined. No exploration has been conducted on the

property to date. This report is a summary of the data reviewed and the conclusions

drawn from that data.

This report is an update of a previous report entitled “ABM Lisbon Valley Lithium

Project, San Juan County, Utah, USA” with an effective date of May 15, 2023. The

current report includes a substantial increase in the land position of the project.

Peek Consulting, Inc. and Bradley C. Peek, CPG were retained by ABM to prepare this

technical report summary. The author is an independent consultant and is not an

employee of ABM. The author is a Qualified Person as defined by Canada’s NI 43-101

and the SEC’s Regulation S-K 1300.

The majority of information contained in this report was gleaned from various sources

and, when possible, verified by the author. These other sources being:

• Published literature.

• Utah Geological Survey website.

• Oil, gas and potash well logs from various sources.

• Plateau Ventures LLC concerning the claim staking and ownership.

• A confidential claim staking company also concerning claim staking and

ownership. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 9

Lisbon Valley Lithium Project Prepared for

• The U. S. Bureau of Land Management (BLM) MLRS website for verification that

the mining claims are active.

• Sources are also referenced in the text of this document, where pertinent.

The author lived in Moab from 2006 until 2010, so is familiar with the general area of

the claims and the geology of the Paradox Basin. The author consulted for the Lisbon

Valley Mining Company at the Lisbon Valley Copper Mine in 2007. The mine is

adjacent to the placer claims that are the subject of this report, so the author is familiar

with the area’s geology and surface expression.

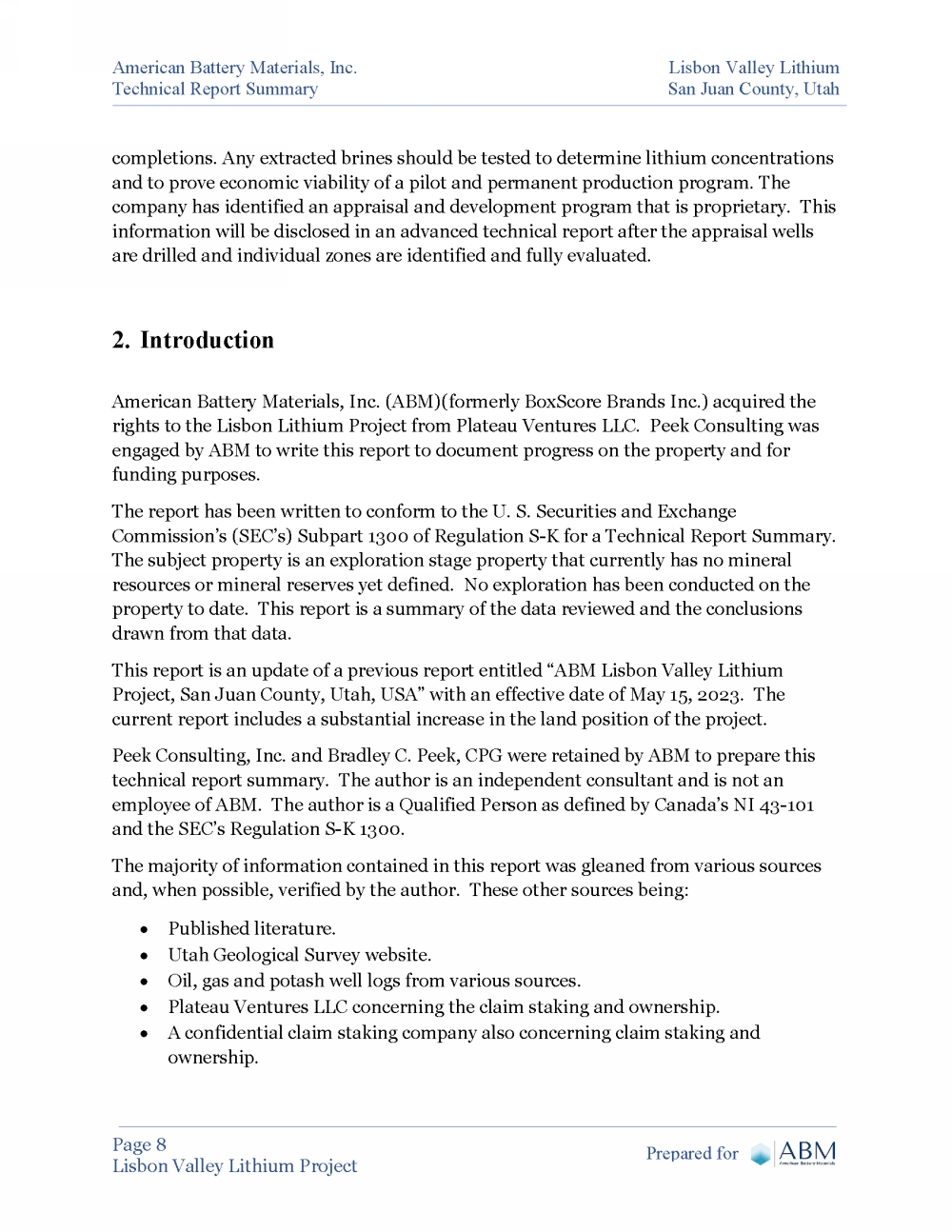

Table 2.1 - Abbreviations and Acronyms used in report.

BLM U. S. Bureau of Land Management

BSWPD Barrels Salt Water Per Day

LCE Lithium Carbonate Equivalent

Li Chemical symbol for lithium

Ma Million years before present

mD Millidarcy

Psi Pounds per square inch

PPM Parts per million

TDS Total Dissolved Solids

USGS U. S. Geological Survey

All dollar figures in this report are in U. S. dollars unless otherwise noted.  |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 10

Lisbon Valley Lithium Project Prepared for

3. Reliance on Other Specialists

Gavin Harrison of Plateau Ventures LLC, who is not a Qualified Person, supplied most

of the information regarding the staking and locations of the placer mining claims. Mr.

Harrison has more than 20 years of experience staking and recording claims on BLM

land in several states in the western U. S.

Kenneth C. “Scott” Avanzino, Jr., ABM’s current COO is an exploration and wellsite

geologist with 18 years of industry experience. Mr. Avanzino holds a B. S. in Geology

from Colgate University and M. S. in Geology from Tulane University. Mr. Avanzino

assisted the author with well log interpretation, subsurface mapping, and reviewed the

technical report summary. Subsurface mapping is currently proprietary and confidential

and will be included in later advanced technical reports.

The author takes full responsibility for the content of this report summary. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 11

Lisbon Valley Lithium Project Prepared for

4. Property Description and Location

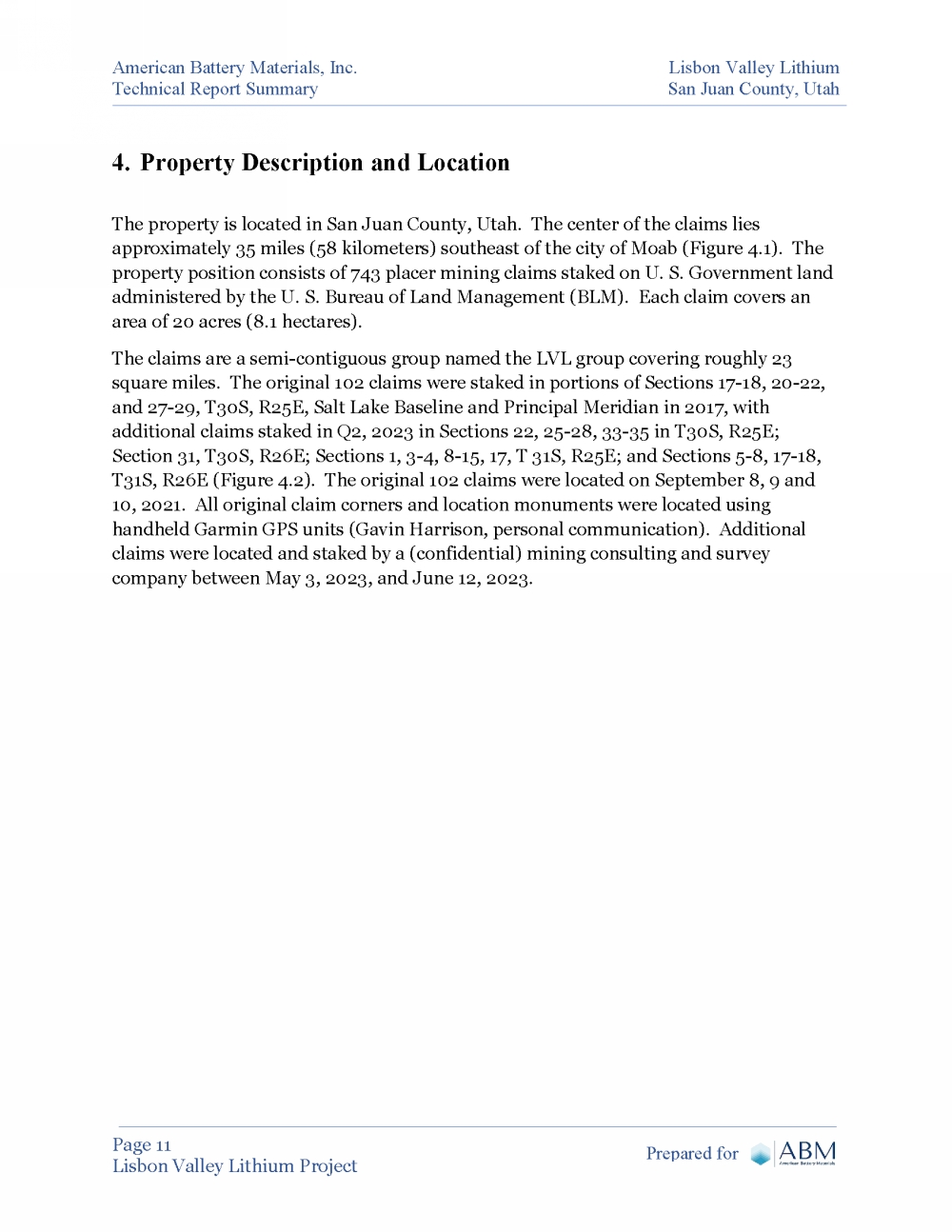

The property is located in San Juan County, Utah. The center of the claims lies

approximately 35 miles (58 kilometers) southeast of the city of Moab (Figure 4.1). The

property position consists of 743 placer mining claims staked on U. S. Government land

administered by the U. S. Bureau of Land Management (BLM). Each claim covers an

area of 20 acres (8.1 hectares).

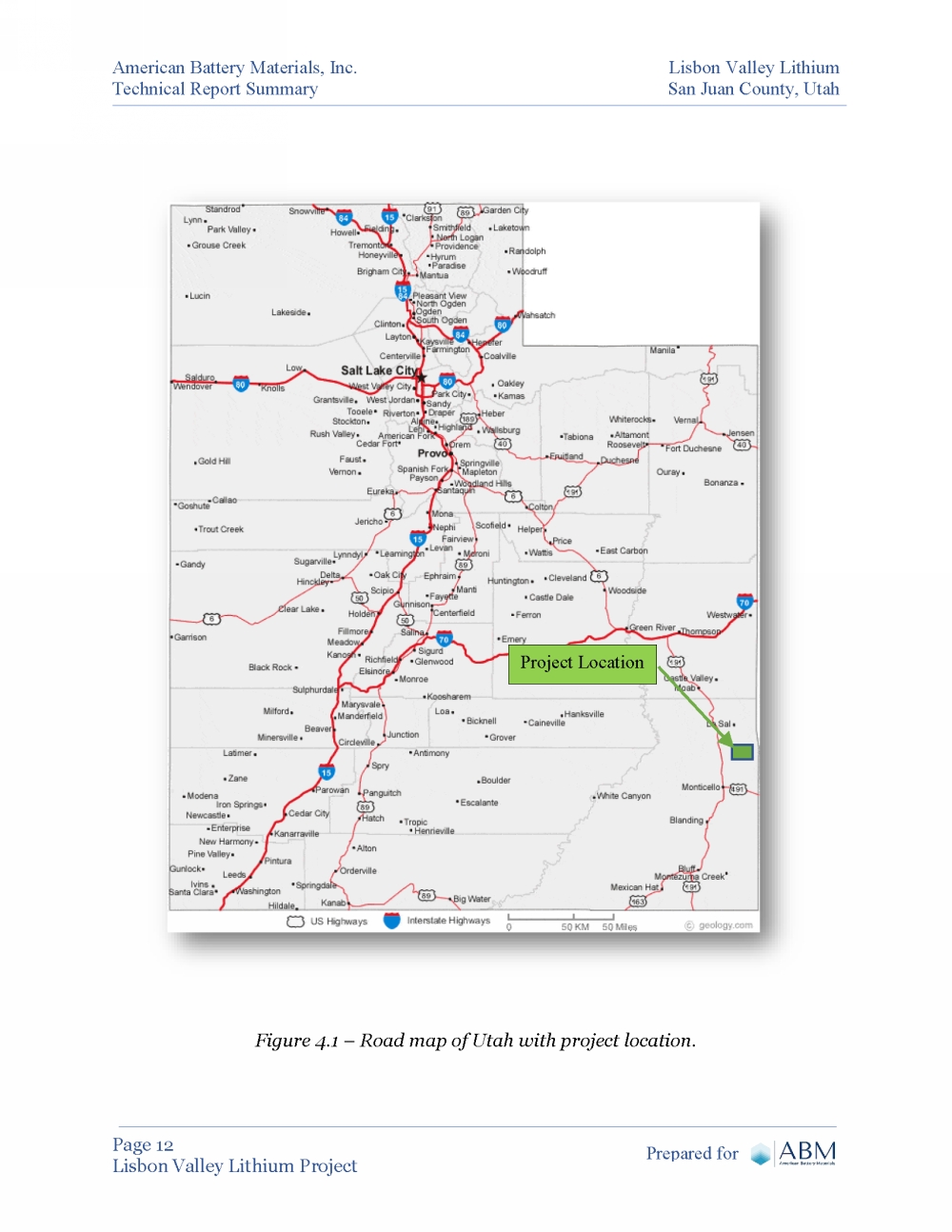

The claims are a semi-contiguous group named the LVL group covering roughly 23

square miles. The original 102 claims were staked in portions of Sections 17-18, 20-22,

and 27-29, T30S, R25E, Salt Lake Baseline and Principal Meridian in 2017, with

additional claims staked in Q2, 2023 in Sections 22, 25-28, 33-35 in T30S, R25E;

Section 31, T30S, R26E; Sections 1, 3-4, 8-15, 17, T 31S, R25E; and Sections 5-8, 17-18,

T31S, R26E (Figure 4.2). The original 102 claims were located on September 8, 9 and

10, 2021. All original claim corners and location monuments were located using

handheld Garmin GPS units (Gavin Harrison, personal communication). Additional

claims were located and staked by a (confidential) mining consulting and survey

company between May 3, 2023, and June 12, 2023. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 12

Lisbon Valley Lithium Project Prepared for

Figure 4.1 – Road map of Utah with project location.

Project Location |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 13

Lisbon Valley Lithium Project Prepared for

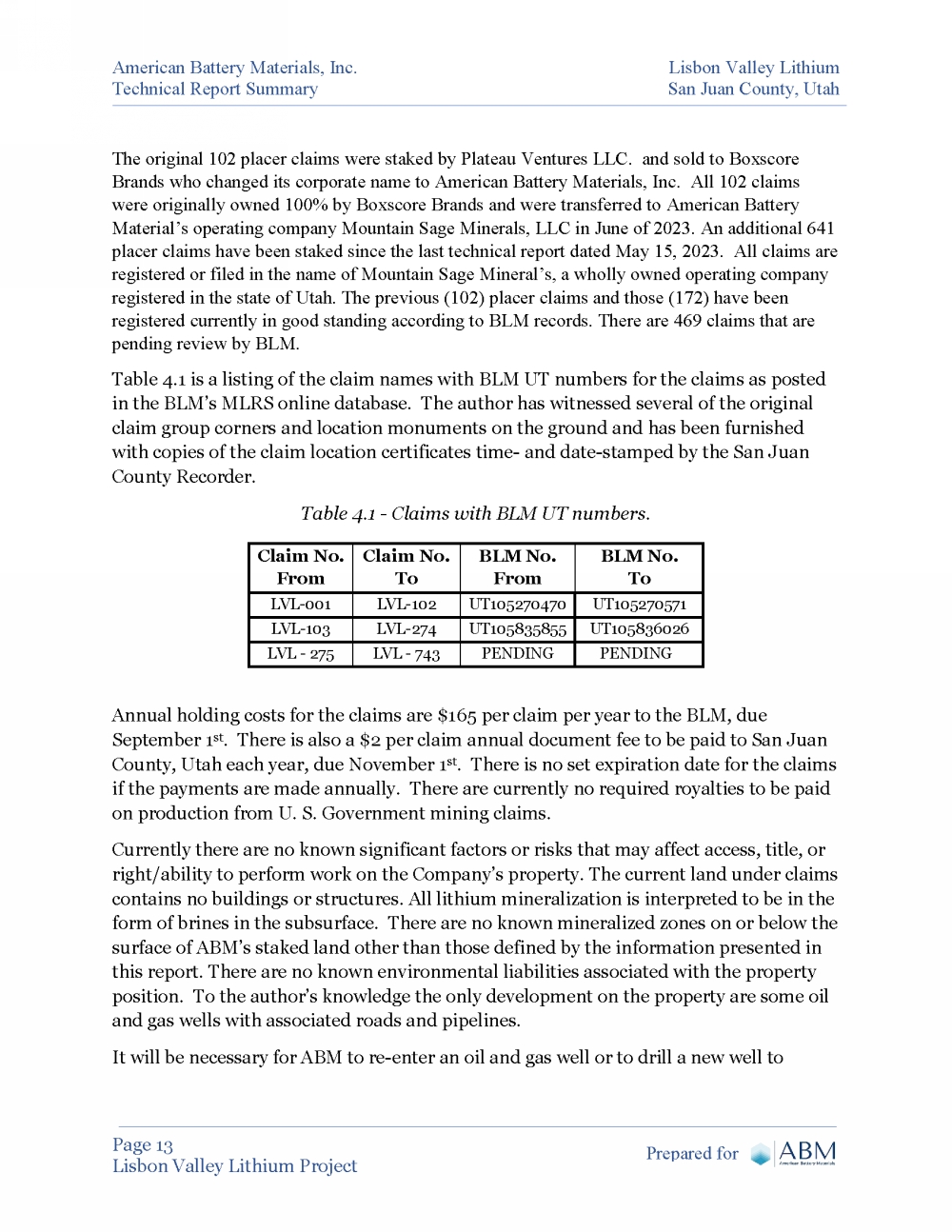

The original 102 placer claims were staked by Plateau Ventures LLC. and sold to Boxscore

Brands who changed its corporate name to American Battery Materials, Inc. All 102 claims

were originally owned 100% by Boxscore Brands and were transferred to American Battery

Material’s operating company Mountain Sage Minerals, LLC in June of 2023. An additional 641

placer claims have been staked since the last technical report dated May 15, 2023. All claims are

registered or filed in the name of Mountain Sage Mineral’s, a wholly owned operating company

registered in the state of Utah. The previous (102) placer claims and those (172) have been

registered currently in good standing according to BLM records. There are 469 claims that are

pending review by BLM.

Table 4.1 is a listing of the claim names with BLM UT numbers for the claims as posted

in the BLM’s MLRS online database. The author has witnessed several of the original

claim group corners and location monuments on the ground and has been furnished

with copies of the claim location certificates time- and date-stamped by the San Juan

County Recorder.

Table 4.1 - Claims with BLM UT numbers.

Claim No.

From

Claim No.

To

BLM No.

From

BLM No.

To

LVL-001 LVL-102 UT105270470 UT105270571

LVL-103 LVL-274 UT105835855 UT105836026

LVL - 275 LVL - 743 PENDING PENDING

Annual holding costs for the claims are $165 per claim per year to the BLM, due

September 1st. There is also a $2 per claim annual document fee to be paid to San Juan

County, Utah each year, due November 1st. There is no set expiration date for the claims

if the payments are made annually. There are currently no required royalties to be paid

on production from U. S. Government mining claims.

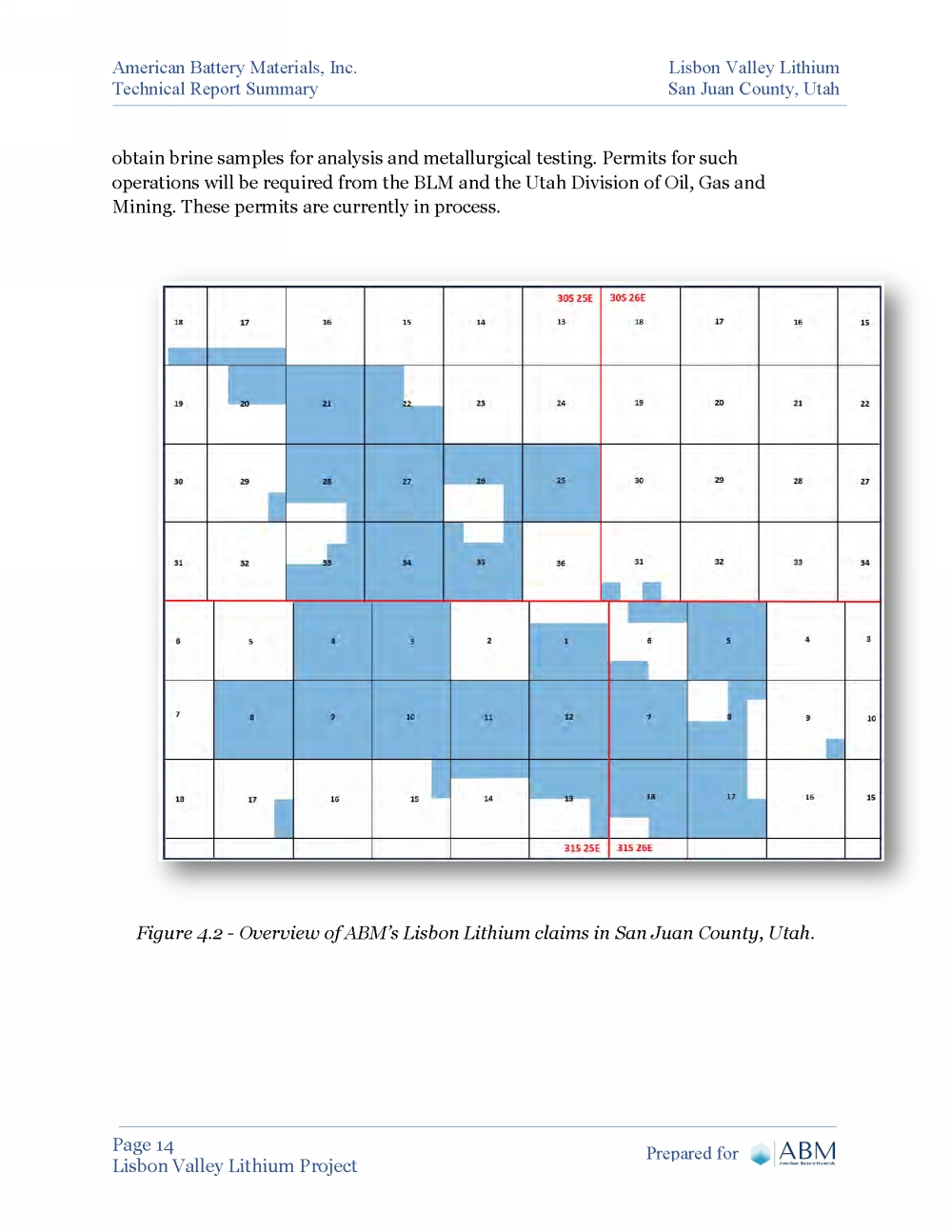

Currently there are no known significant factors or risks that may affect access, title, or

right/ability to perform work on the Company’s property. The current land under claims

contains no buildings or structures. All lithium mineralization is interpreted to be in the

form of brines in the subsurface. There are no known mineralized zones on or below the

surface of ABM’s staked land other than those defined by the information presented in

this report. There are no known environmental liabilities associated with the property

position. To the author’s knowledge the only development on the property are some oil

and gas wells with associated roads and pipelines.

It will be necessary for ABM to re-enter an oil and gas well or to drill a new well to |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 14

Lisbon Valley Lithium Project Prepared for

obtain brine samples for analysis and metallurgical testing. Permits for such

operations will be required from the BLM and the Utah Division of Oil, Gas and

Mining. These permits are currently in process.

Figure 4.2 - Overview of ABM’s Lisbon Lithium claims in San Juan County, Utah. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 15

Lisbon Valley Lithium Project Prepared for

Figure 4.3 below is an example of one of the claim stakes found on the property during

the author’s site visit on May 7, 2023. The stake is the location monument for claim

number LVL#5.

Figure 4.3 – An example of one of the claim stakes found on the property May 7, 2023. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 16

Lisbon Valley Lithium Project Prepared for

5. Accessibility, Climate, Local Resources, Infrastructure and

Physiography

Moab, Utah, the nearest population center to the property, is a city of 5,336 persons

(2020 Census). It is located in a relatively remote portion of Utah but is easily accessed

by U. S. Highway 191. Highway 191 intersects with Interstate 70 about 30 miles (48

kilometers) north of Moab, at Crescent Junction. Moab is a tourist destination and has

numerous motels and restaurants. Moab would also be the nearest source of labor in

the region.

The region has a history of mining, primarily uranium and vanadium that dates back as

far as 1881. The Lisbon Valley Copper Mine is in the heart of the Lisbon Valley and is

currently producing copper cathode. An all-weather road and electric power supply the

mine.

To access the property from Moab, travel south on Highway 191 for 25 miles (40

kilometers) to La Sal Junction. Turn east on State Highway 49. Travel 7 miles (11

kilometers) and turn south onto Highway 113. Go another 13 miles (21 kilometers) to

the northeast corner of the property. A few gravel roads cross the property. Oil and gas

drilling and production, along with ranching have made the area relatively accessible.

All the ABM claims fall between elevations of 6200 and 6900 feet (1890 and 2100

meters) above sea level.

It is anticipated that ABM will use a Direct Lithium Extraction (DLE) method rather

than using evaporation ponds to recover the lithium and other potential mineral from

brines, should the project advance to the production stage. The project should therefore

have sufficient space on the ABM claims to construct processing facilities.

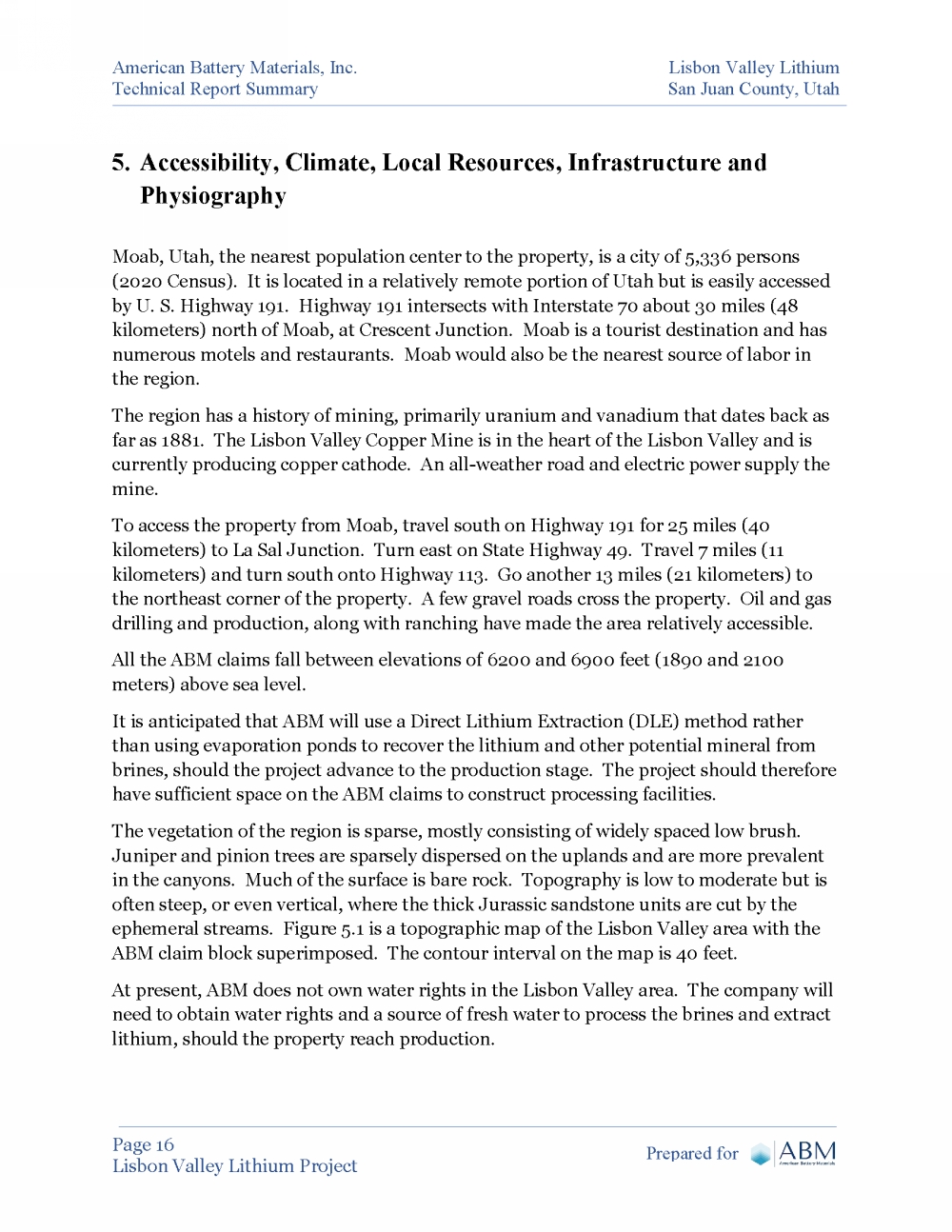

The vegetation of the region is sparse, mostly consisting of widely spaced low brush.

Juniper and pinion trees are sparsely dispersed on the uplands and are more prevalent

in the canyons. Much of the surface is bare rock. Topography is low to moderate but is

often steep, or even vertical, where the thick Jurassic sandstone units are cut by the

ephemeral streams. Figure 5.1 is a topographic map of the Lisbon Valley area with the

ABM claim block superimposed. The contour interval on the map is 40 feet.

At present, ABM does not own water rights in the Lisbon Valley area. The company will

need to obtain water rights and a source of fresh water to process the brines and extract

lithium, should the property reach production. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 17

Lisbon Valley Lithium Project Prepared for

Figure 5.1 – Topographic map underlying a plot of the ABM claim blocks. CI=40’.

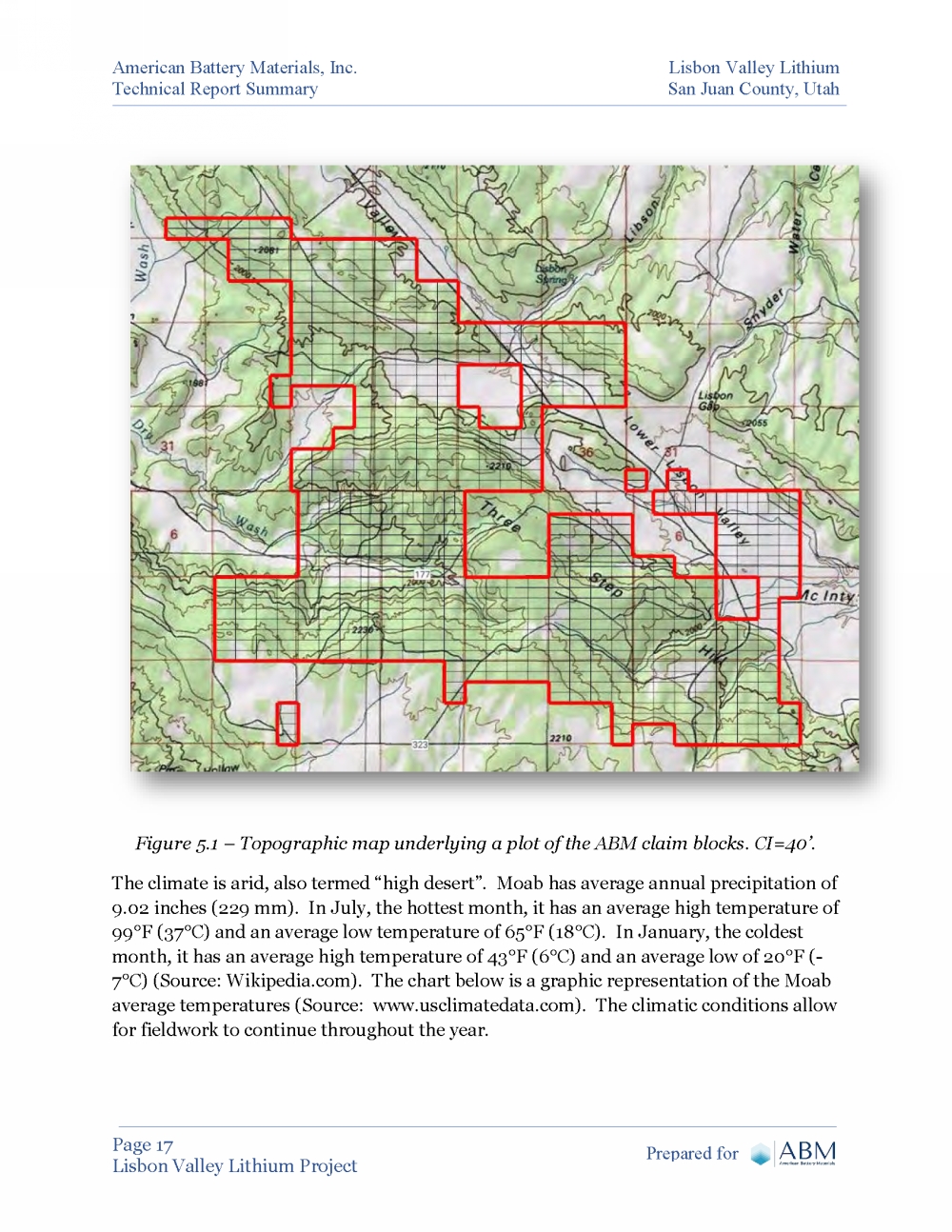

The climate is arid, also termed “high desert”. Moab has average annual precipitation of

9.02 inches (229 mm). In July, the hottest month, it has an average high temperature of

99°F (37°C) and an average low temperature of 65°F (18°C). In January, the coldest

month, it has an average high temperature of 43°F (6°C) and an average low of 20°F (-

7°C) (Source: Wikipedia.com). The chart below is a graphic representation of the Moab

average temperatures (Source: www.usclimatedata.com). The climatic conditions allow

for fieldwork to continue throughout the year. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 18

Lisbon Valley Lithium Project Prepared for

The Paradox Basin covers a large portion of the central part of the Colorado Plateau.

The landscape is dominated by thick sections of mostly red Jurassic sandstones cut by

streams and rivers into deep, steep-sided canyons. Mattox (1968) describes the Paradox

Basin in the following way:

“The Paradox Basin, here defined as being that area in southeastern Utah and

southwestern Colorado that is underlain by saline strata of Pennsylvanian age, has an

aerial extent of approximately 1,000 square miles. The climate is essentially arid over

much of the basin, the only exceptions being in the Abajo and La Sal Mountains. The

vegetation is sparse except in the mountains, where there are heavy stands of timber.

The Colorado River traverses the basin, and it and some of its tributaries are permanent

streams; in general, however, the streams of the area are ephemeral, and flash flooding

is a characteristic phenomenon of their flow.”

Figure 5.2 - Climate data for Moab, Utah. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 19

Lisbon Valley Lithium Project Prepared for

6. History

The Paradox Basin initially attracted attention because of high lithium values reported

in the literature in brines recovered from oil and gas exploration wells. The Paradox

Basin has been explored for oil and gas for many years (Durgin, 2011). The earliest

discoveries of potash in the area were made in 1924 in oil and gas wells, but the

correlation of the beds and the extent and richness of the deposits were not recognized

until the 1950s. The Seven Mile, Salt Wash and White Cloud potash target areas, all west

of Moab, were quickly identified. Further exploration led to the development of the Cane

Creek potash mine adjacent to the Colorado River.

Brines were commonly encountered in these wells, but none of the wells was of

economic significance for brine until in 1962 when the Southern Natural Gas Company

drilled a well, Long Canyon Unit #1, which encountered a substantial flow of high-density brine at a depth of 6,013 feet (Durgin, 2011).

In 1964 the White Cloud #2 well was drilled by J.E. Roberts, 500 feet northeast of the

Long Canyon #1 well, specifically for testing the “Brine Zone.” Brine was encountered at

6,013 feet and it was recorded that artesian brine flow was so strong that drilling had to

be suspended after penetrating only 6 feet of the 28 foot pay zone. The hole was

eventually deepened. Brine from the well was tested by a U. S. Geological Survey

laboratory and was reported to contain 1700 ppm lithium (Gwynn, 2008). See note in

table 8.20 relating to this reported value.

In 1953 Delhi Oil Corporation explored the Seven Mile area, seven miles NW of Moab,

drilling 10 holes on one-half mile centers and identifying a substantial potash resource.

In 1956 Delhi identified an excellent potash target at Cane Creek, nine miles south of the

Seven Mile area. They drilled 7 test holes there and decided that the Cane Creek target

was thicker and higher grade. In 1957 a wildcat oil hole 10 miles west of the Seven Mile

area intersected a 16-foot-thick high grade potash bed at the same stratigraphic horizon

as Cane Creek and Seven Mile.

In 1960 Texas Gulf Sulfur acquired the Delhi potash properties and was in full production

from an underground mine by early in 1965. They announced that the Cane Creek potash

bed was 11 feet thick and averaged 25 to 30% potash (Jackson, 1973). The Cane Creek

mine, now owned by Intrepid Potash switched to solution mining and solar evaporative

precipitation in 1971 and as of Intrepid’s 2020 annual report is still producing at a rate |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 20

Lisbon Valley Lithium Project Prepared for

between 75,000 and 120,000 tons of potash per year. Its expected mine life is +100 years

with proven and probable reserves at grades of 44.4% and 46.2% KCl, respectively.

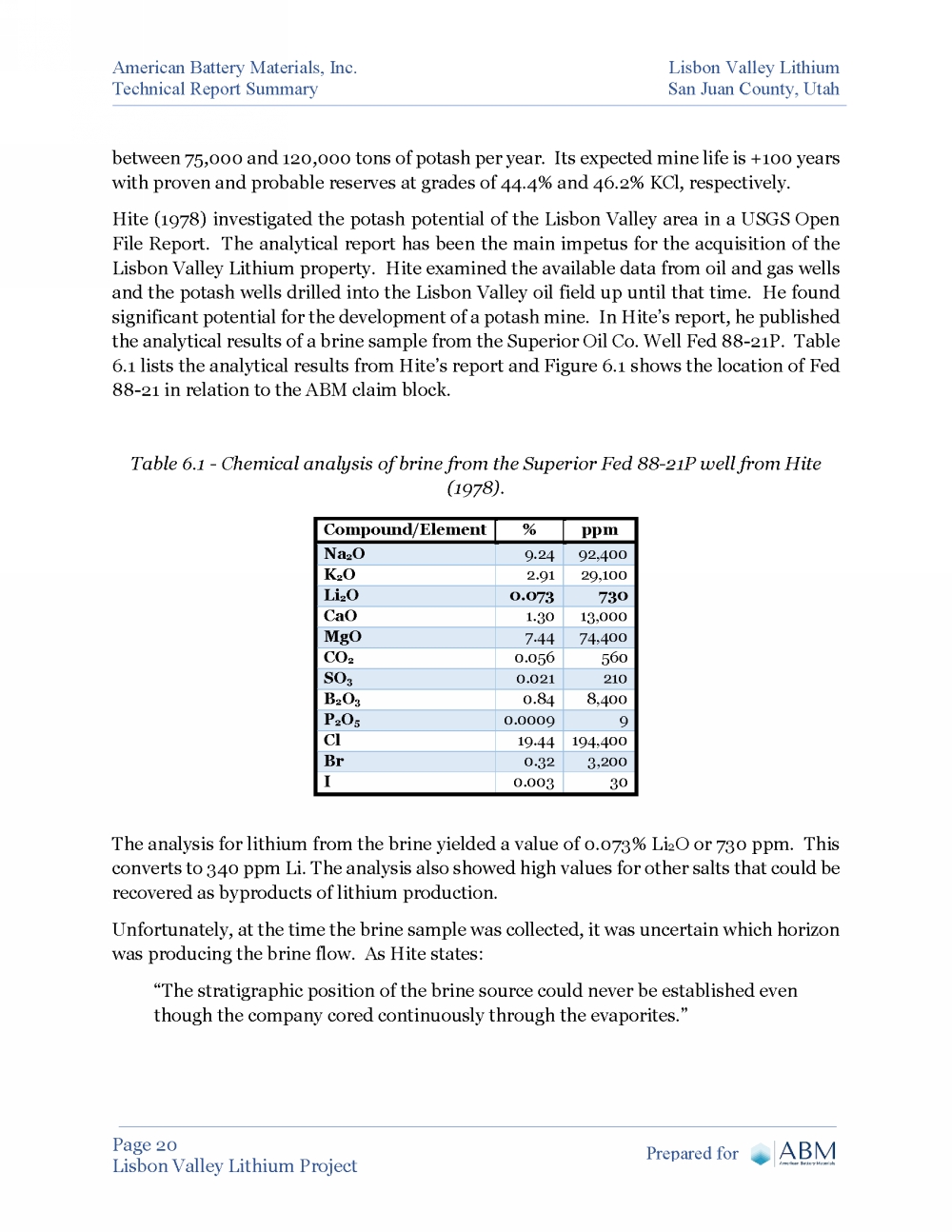

Hite (1978) investigated the potash potential of the Lisbon Valley area in a USGS Open

File Report. The analytical report has been the main impetus for the acquisition of the

Lisbon Valley Lithium property. Hite examined the available data from oil and gas wells

and the potash wells drilled into the Lisbon Valley oil field up until that time. He found

significant potential for the development of a potash mine. In Hite’s report, he published

the analytical results of a brine sample from the Superior Oil Co. Well Fed 88-21P. Table

6.1 lists the analytical results from Hite’s report and Figure 6.1 shows the location of Fed

88-21 in relation to the ABM claim block.

Table 6.1 - Chemical analysis of brine from the Superior Fed 88-21P well from Hite

(1978).

Compound/Element % ppm

Na2O 9.24 92,400

K2O 2.91 29,100

Li2O 0.073 730

CaO 1.30 13,000

MgO 7.44 74,400

CO2 0.056 560

SO3 0.021 210

B2O3 0.84 8,400

P2O5 0.0009 9

Cl 19.44 194,400

Br 0.32 3,200

I 0.003 30

The analysis for lithium from the brine yielded a value of 0.073% Li2O or 730 ppm. This

converts to 340 ppm Li. The analysis also showed high values for other salts that could be

recovered as byproducts of lithium production.

Unfortunately, at the time the brine sample was collected, it was uncertain which horizon

was producing the brine flow. As Hite states:

“The stratigraphic position of the brine source could never be established even

though the company cored continuously through the evaporites.” |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 21

Lisbon Valley Lithium Project Prepared for

If the well were to be re-entered, the different zones would need to be isolated and

tested to establish which stratigraphic horizons produce brines with the highest lithium

values. Based on the casing point and Superior 88-21 well’s total depth, the producing

horizon lies between 2400 to 3500 feet below the ground surface.

Anson Resources, an Australian company operating in the United States as A1 Lithium

Incorporated, has taken their project in the Paradox Basin to the Definitive Feasibility

stage (See Section 13 – Adjacent Properties). To date, no lithium production has

occurred in the Paradox Basin.

Figure 6.1 - Lisbon Valley Lithium claims in relation to the Superior Peterson Fed 88-

21P well. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 22

Lisbon Valley Lithium Project Prepared for

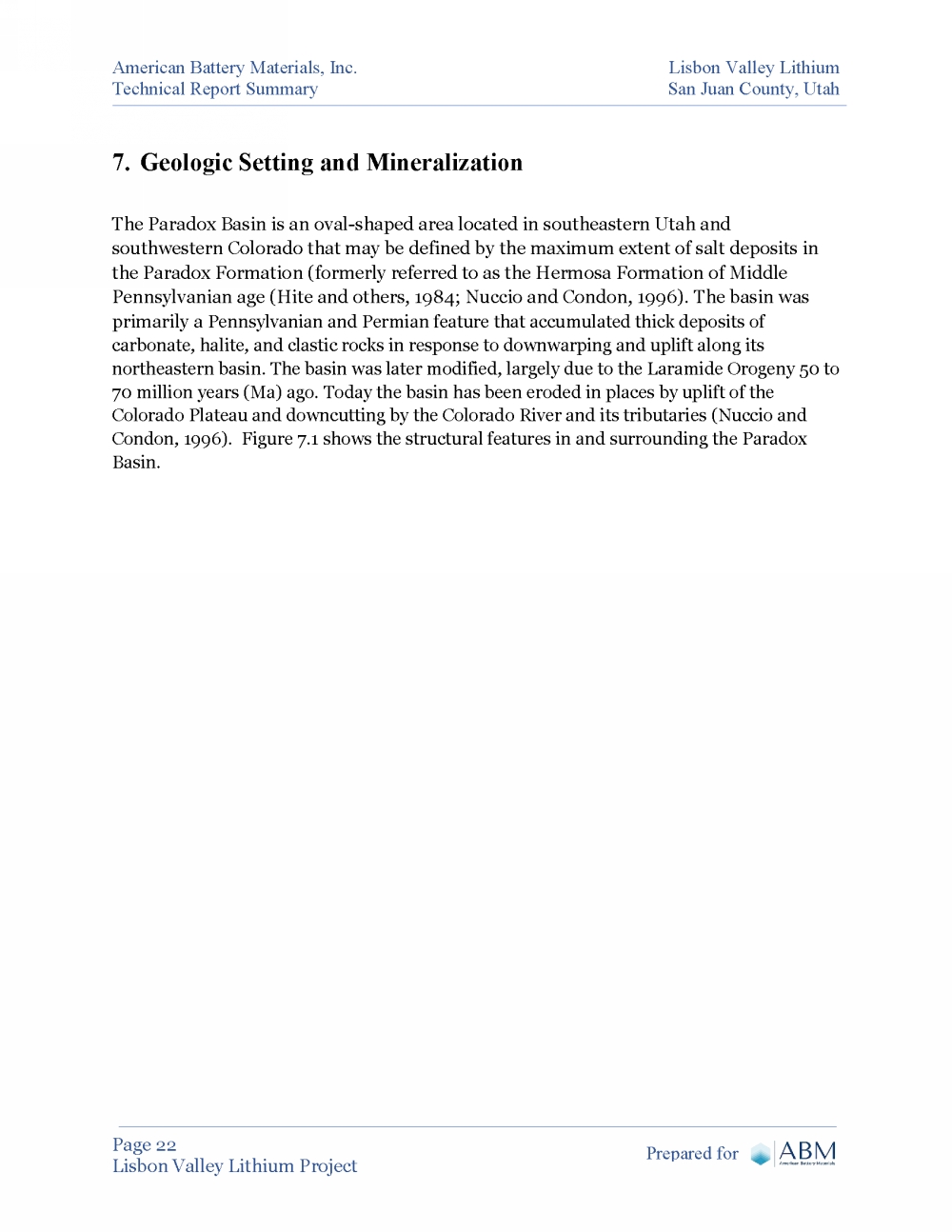

7. Geologic Setting and Mineralization

The Paradox Basin is an oval-shaped area located in southeastern Utah and

southwestern Colorado that may be defined by the maximum extent of salt deposits in

the Paradox Formation (formerly referred to as the Hermosa Formation of Middle

Pennsylvanian age (Hite and others, 1984; Nuccio and Condon, 1996). The basin was

primarily a Pennsylvanian and Permian feature that accumulated thick deposits of

carbonate, halite, and clastic rocks in response to downwarping and uplift along its

northeastern basin. The basin was later modified, largely due to the Laramide Orogeny 50 to

70 million years (Ma) ago. Today the basin has been eroded in places by uplift of the

Colorado Plateau and downcutting by the Colorado River and its tributaries (Nuccio and

Condon, 1996). Figure 7.1 shows the structural features in and surrounding the Paradox

Basin. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 23

Lisbon Valley Lithium Project Prepared for

Figure 7.1 - Structural elements of the Paradox Basin and adjacent areas (from Nuccio

and Condon, 1996).

7.1 Stratigraphy

The Paradox Basin is composed of sedimentary rocks that overlie an Early Proterozoic

basement of metamorphic gneiss and schist that is locally intruded by granite (Nuccio

and Condon, 1996; Tweto,1987). A stratigraphic column of the basin is presented in

Figure 7.2. Cambrian through Jurassic sedimentary rocks unconformably overlie the |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 24

Lisbon Valley Lithium Project Prepared for

basement rock in much of the basin. Cretaceous rocks are also noted in the southeastern

part of the basin.

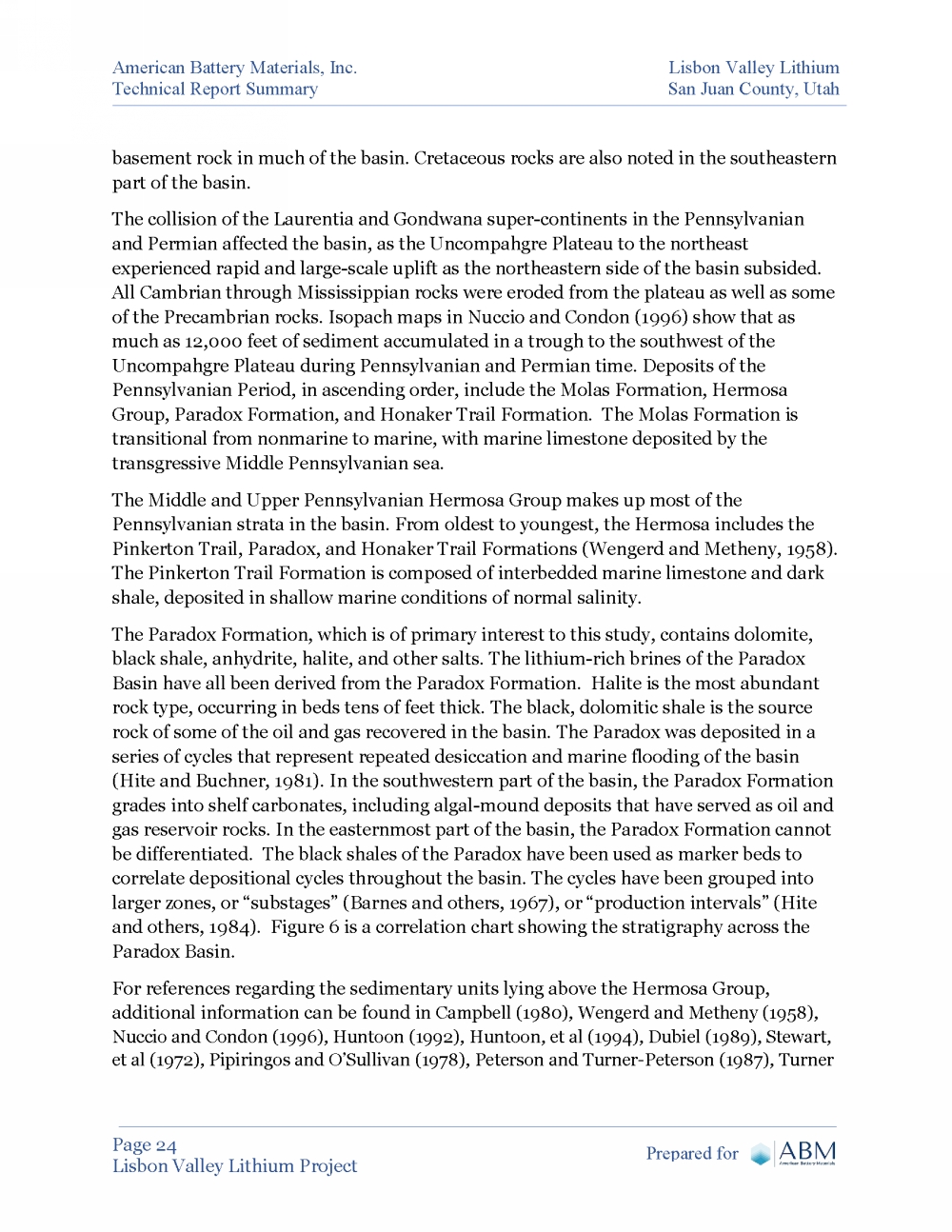

The collision of the Laurentia and Gondwana super-continents in the Pennsylvanian

and Permian affected the basin, as the Uncompahgre Plateau to the northeast

experienced rapid and large-scale uplift as the northeastern side of the basin subsided.

All Cambrian through Mississippian rocks were eroded from the plateau as well as some

of the Precambrian rocks. Isopach maps in Nuccio and Condon (1996) show that as

much as 12,000 feet of sediment accumulated in a trough to the southwest of the

Uncompahgre Plateau during Pennsylvanian and Permian time. Deposits of the

Pennsylvanian Period, in ascending order, include the Molas Formation, Hermosa

Group, Paradox Formation, and Honaker Trail Formation. The Molas Formation is

transitional from nonmarine to marine, with marine limestone deposited by the

transgressive Middle Pennsylvanian sea.

The Middle and Upper Pennsylvanian Hermosa Group makes up most of the

Pennsylvanian strata in the basin. From oldest to youngest, the Hermosa includes the

Pinkerton Trail, Paradox, and Honaker Trail Formations (Wengerd and Metheny, 1958).

The Pinkerton Trail Formation is composed of interbedded marine limestone and dark

shale, deposited in shallow marine conditions of normal salinity.

The Paradox Formation, which is of primary interest to this study, contains dolomite,

black shale, anhydrite, halite, and other salts. The lithium-rich brines of the Paradox

Basin have all been derived from the Paradox Formation. Halite is the most abundant

rock type, occurring in beds tens of feet thick. The black, dolomitic shale is the source

rock of some of the oil and gas recovered in the basin. The Paradox was deposited in a

series of cycles that represent repeated desiccation and marine flooding of the basin

(Hite and Buchner, 1981). In the southwestern part of the basin, the Paradox Formation

grades into shelf carbonates, including algal-mound deposits that have served as oil and

gas reservoir rocks. In the easternmost part of the basin, the Paradox Formation cannot

be differentiated. The black shales of the Paradox have been used as marker beds to

correlate depositional cycles throughout the basin. The cycles have been grouped into

larger zones, or “substages” (Barnes and others, 1967), or “production intervals” (Hite

and others, 1984). Figure 6 is a correlation chart showing the stratigraphy across the

Paradox Basin.

For references regarding the sedimentary units lying above the Hermosa Group,

additional information can be found in Campbell (1980), Wengerd and Metheny (1958),

Nuccio and Condon (1996), Huntoon (1992), Huntoon, et al (1994), Dubiel (1989), Stewart,

et al (1972), Pipiringos and O’Sullivan (1978), Peterson and Turner-Peterson (1987), Turner |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 25

Lisbon Valley Lithium Project Prepared for

and Fishman (1991), Molenaar (1981), Robinson (1972), McDonald (1972), Spieker (1949),

Fouch (1976), and Fouch et al (1983).

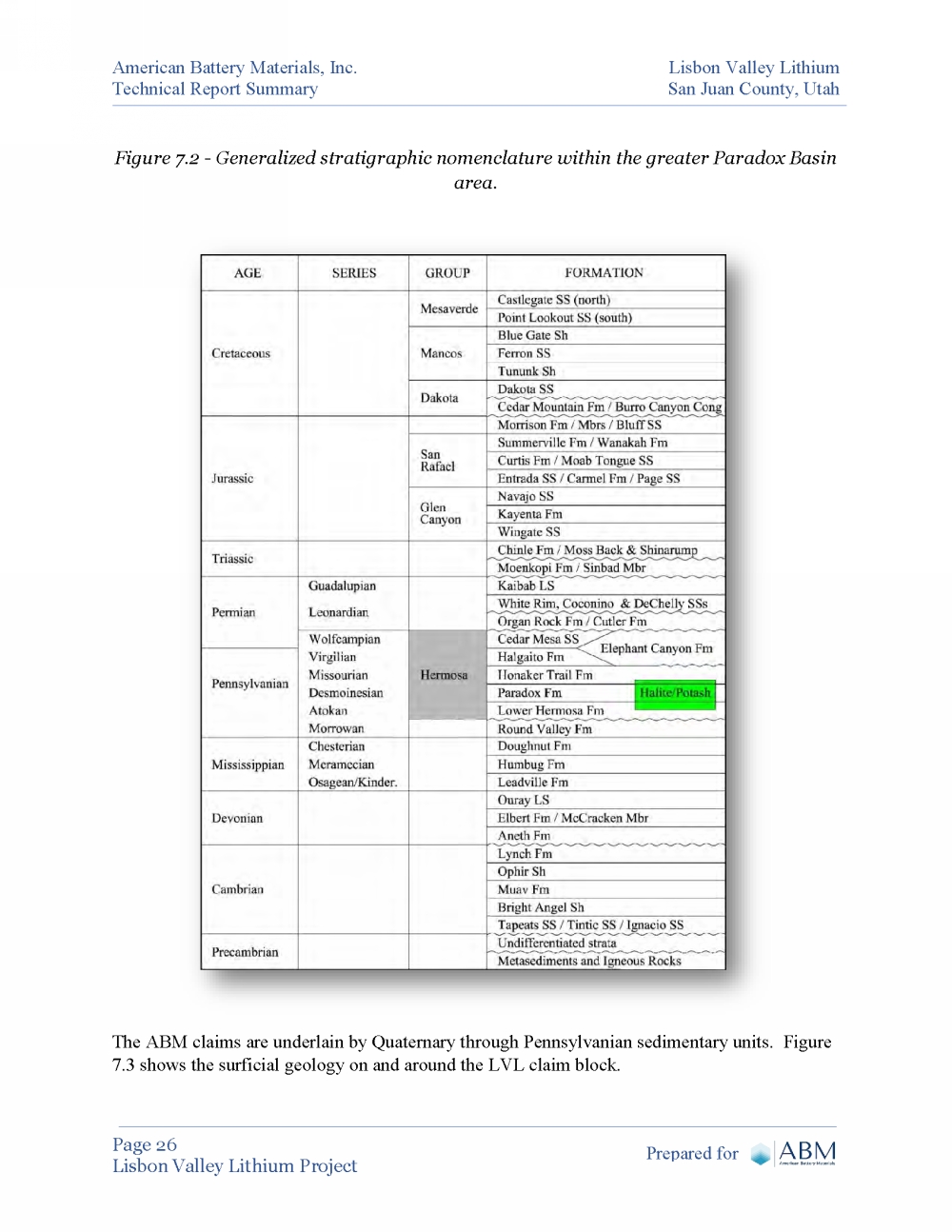

Figure 7.2 below is the generalized stratigraphic nomenclature within the greater

Paradox Basin area. North American series names have been added for the

Mississippian, Pennsylvanian and Permian; however, there is not an intended exact

respective match with the formations. Formations assigned to the Hermosa Group are

after Rasmussen, D.L. and L. Rasmussen (2009) and Rasmussen (2014). The halite-and potash-bearing interval is marked by green shading. Regional unconformities are

shown by the undulating line separating some formations and groups. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 26

Lisbon Valley Lithium Project Prepared for

Figure 7.2 - Generalized stratigraphic nomenclature within the greater Paradox Basin

area.

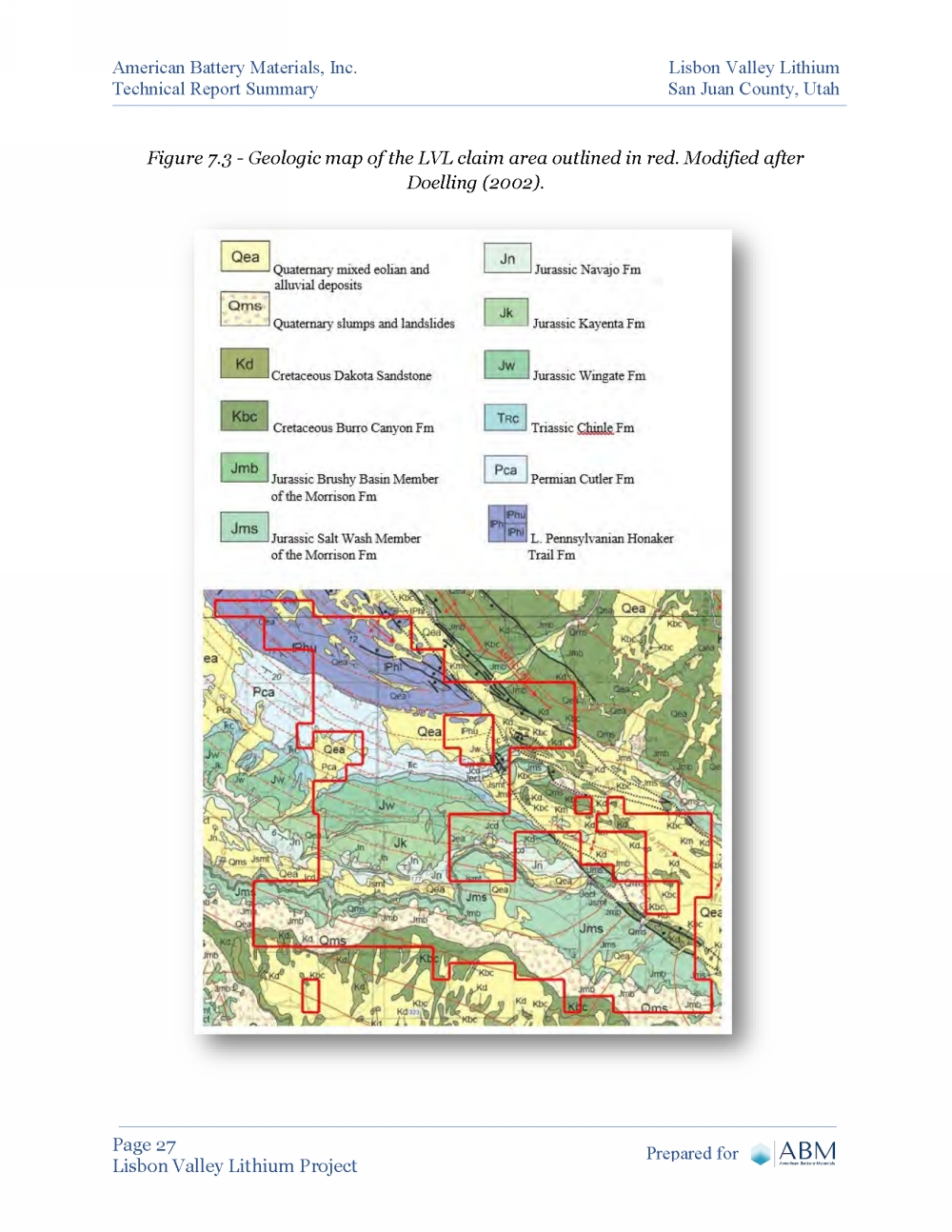

The ABM claims are underlain by Quaternary through Pennsylvanian sedimentary units. Figure

7.3 shows the surficial geology on and around the LVL claim block. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 27

Lisbon Valley Lithium Project Prepared for

Figure 7.3 - Geologic map of the LVL claim area outlined in red. Modified after

Doelling (2002). |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 28

Lisbon Valley Lithium Project Prepared for

7.2 Structure

The primary structure in the area of the ABM claims is the Lisbon Valley Anticline. The

Lisbon Valley Anticline was originally identified by gravity anomaly in 1959 (Figure

7.5a) and later supported by 2D seismic surveys and subsurface mapping using available

oil and gas well data. The structure is a 4-way anticlinal closure that is cut by a large

listric normal fault on its northeast side by the NW/SE trending, down to the northeast,

Lisbon Valley Fault (shown in Figure 7.3). The Lisbon Valley Fault zone can be traced

on the surface (northwest and southeast trend) for a distance of 41 miles (66 km). The

fault and anticline are the result of salt tectonics prevalent in the Paradox Basin (Hite,

1978). Bedding and dip of the Paradox and younger sedimentary rocks generally

conform to the structure map presented in Figure 7.5a, showing the top of salt. On the

crest of the anticline, salt dissolution has occurred in the upper salt members and

salt/clastics zones are highly folded and, in some cases, faulted with increasing depth.

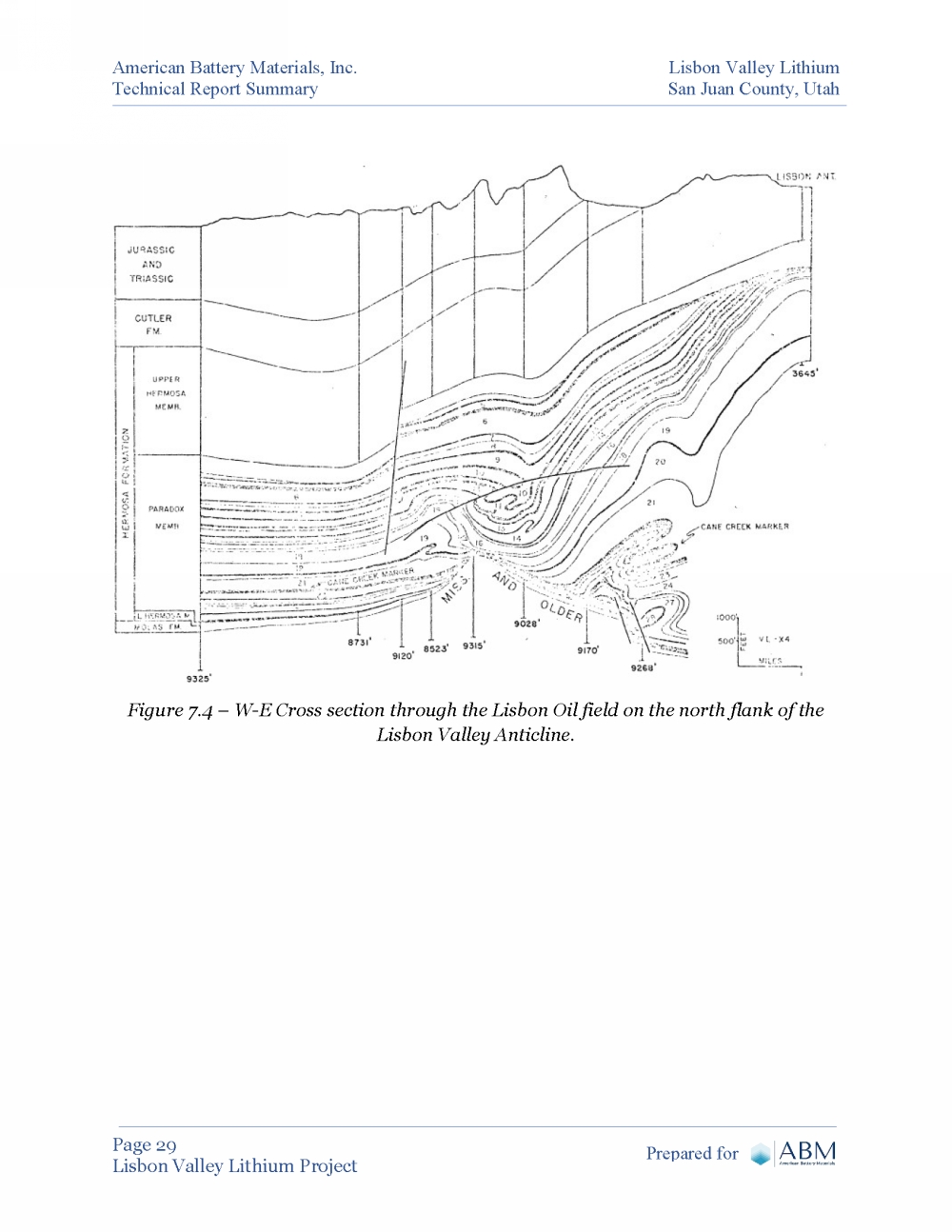

Figure 7.4 is a cross section across the NW flank of the Lisbon Valley Anticline showing

Robert Hite’s interpretation of the intense structural deformation caused by salt flowage

(from Hite 1978). It is important to note that the ABM claims sit on the southeast flank

of the Lisbon Valley Anticline where deformation is less prevalent, and individual beds

are mappable. Salt is typically encountered between 2200 and 2500 feet below ground

level and is generally 6500' thick in vicinity of the ABM claims area. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 29

Lisbon Valley Lithium Project Prepared for

Figure 7.4 – W-E Cross section through the Lisbon Oil field on the north flank of the

Lisbon Valley Anticline. |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 30

Lisbon Valley Lithium Project Prepared for

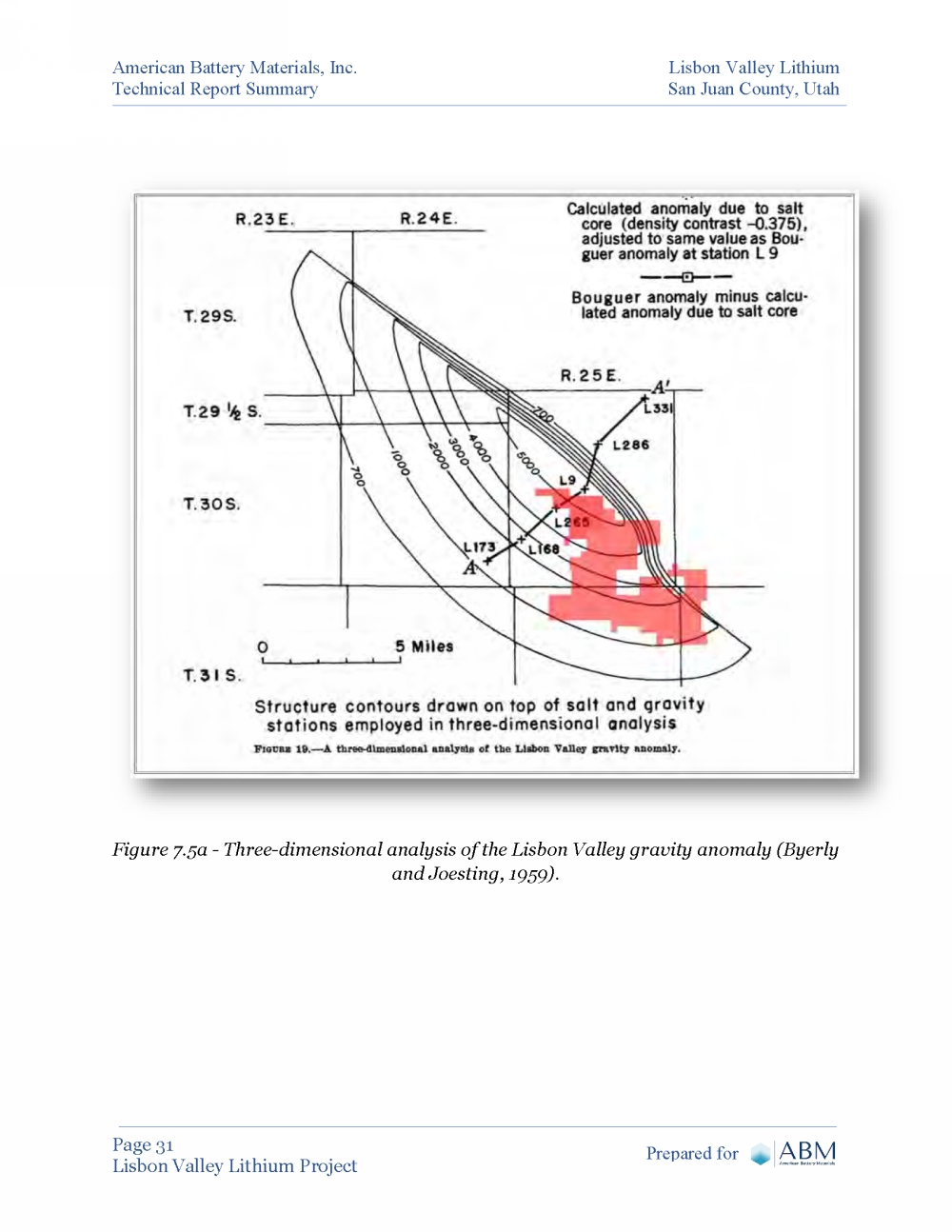

7.3 Geophysics

No geophysical surveys have been conducted by ABM on the property. There are

numerous 2D seismic lines and a single 3D seismic survey in the vicinity of the ABM

claims that may be purchased, but these have not been pursued at this point in time.

A published study (Byerly and Joesting, 1959) included a gravity survey across Lisbon

Valley. The three and two-dimensional survey results are shown in Figures 7.5a and

7.5b. The gravity anomalies are caused by density contrasts and changes in thickness of

the evaporites in the Paradox Formation relative to the other intrabasement rocks. In

general, these early geophysical results match up very well to standard subsurface

mapping using formation tops identified in the later oil and gas well logs. (Section 9 –

Exploration). |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 31

Lisbon Valley Lithium Project Prepared for

Figure 7.5a - Three-dimensional analysis of the Lisbon Valley gravity anomaly (Byerly

and Joesting, 1959). |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 32

Lisbon Valley Lithium Project Prepared for

Figure 7.6b – Two-dimensional analysis of the Lisbon Valley gravity anomaly (Byerly

and Joesting, 1959). |

| American Battery Materials, Inc. Lisbon Valley Lithium

Technical Report Summary San Juan County, Utah

Page 33

Lisbon Valley Lithium Project Prepared for

8. Deposit Types

There is currently no known production of lithium from the Paradox Basin. The deposit

model and exploration target for the Lisbon Lithium Project is very similar to the model

defined by Anson Resources in the Paradox Basin to the northwest of ABM’s claim block

(See Section 13 – Adjacent Properties). Anson, an Australian company, operating in the

U. S. as A1 Lithium Incorporated, has defined a major lithium and bromine resource

and has completed a Definitive Feasibility Study. ABM’s target deposit model is similar

in all respects to that of Anson’s deposit.

In the Paradox Basin the lithium-rich brines occur in the “saline facies” of the Paradox

Member of the Hermosa Formation of Pennsylvanian age and are totally in the

subsurface. The “saline facies” of the Paradox Formation is composed of at least 29

evaporite cycles. Many of the cycles are potash-bearing and there is an active potash

mine in the basin. Each cycle, if complete, consists of, in ascending order, (1) limestone,

(2) dolomite, (3) anhydrite, and (4) halite with or without potash salts. The sequence is

then repeated in a reverse order of (3) anhydrite, (2) dolomite, and (1) limestone to

complete the cycle. Units 1, 2 and 3 of each cycle include some clastic material that is

commonly euxinic black shale, mudstone, and siltstone. A complete vertical succession

in any one cycle is not everywhere present because of a lateral gradation from a

hypersaline or saline facies in the basin deep to a limestone facies on the basin shelf.

Thus, in the basin deep, only units 3 and 4 may be present, while at some point

intermediate between the basin deep and basin shelf all units may be present, and the

vertical succession is complete (Hite, 1961).

Halite (NaCl), anhydrite (CaSO4), carnallite (KMgCl3·6H2O), and sylvite (KCl) are the

most common evaporite minerals in the Paradox Formation. Halite is the most common

salt, totaling over ten thousand feet of thickness in some wells (Mayhew and Heylman,

1966). Anhydrite is also common in dolomite and black shale in the clastic breaks that

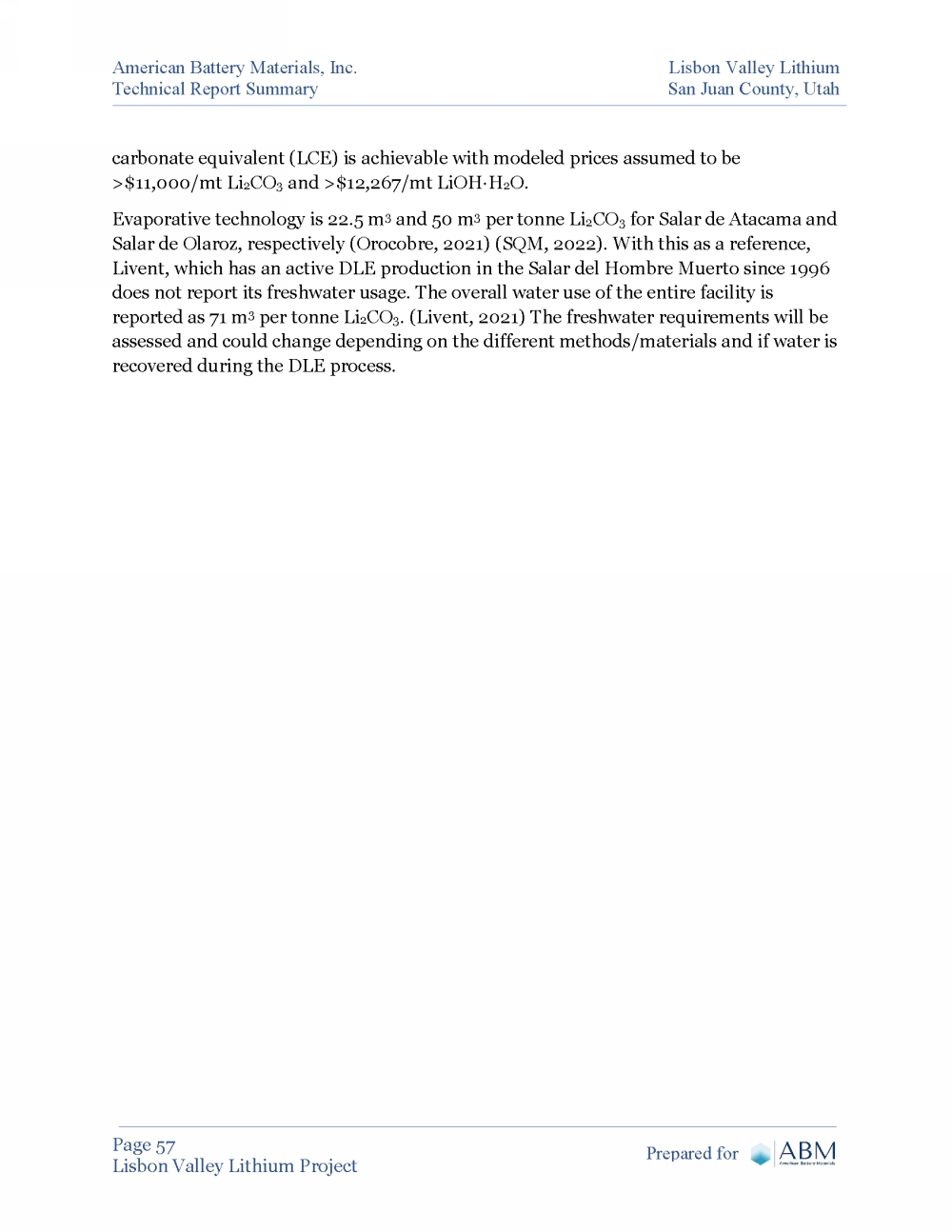

separate the salt beds.