- Amended Statement of Ownership: Solicitation (SC 14D9/A)

February 15 2011 - 5:20PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT UNDER

SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. 8)

MATRIXX INITIATIVES, INC.

(Name of Subject Company)

MATRIXX INITIATIVES, INC.

(Name of Person(s) Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

57685L105

(CUSIP Number of Class of Securities)

Samuel C. Cowley

Executive Vice President, General Counsel and Secretary

Matrixx Initiatives, Inc.

8515 E. Anderson Drive

Scottsdale, Arizona 85255

(602) 385-8888

(Name, Address and Telephone Number of Person Authorized to Receive Notices

and Communications on Behalf of the Person(s) Filing Statement)

With copies to:

|

|

|

|

|

Matthew P. Feeney

|

|

Stephen M. Kotran

|

|

Snell & Wilmer L.L.P

|

|

Sullivan & Cromwell LLP

|

|

One Arizona Center

|

|

125 Broad Street

|

|

400 E. Van Buren Street

|

|

New York, New York 10004-2498

|

|

Phoenix, Arizona 85004-2202

|

|

(212) 558-4000

|

|

(602) 382-6000

|

|

|

|

o

|

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer

|

TABLE OF CONTENTS

Introduction

This Amendment No. 8 (this “

Amendment

”) amends and supplements the

Solicitation/Recommendation Statement on Schedule 14D-9 (which, together with any amendments and

supplements thereto, collectively constitute the “

Schedule

”) originally filed with the U.S.

Securities and Exchange Commission (the “

SEC

”) by Matrixx Initiatives, Inc., a Delaware

corporation (the “

Company

”), on December 22, 2010. The Schedule relates to the tender

offer by Wonder Holdings, Inc., a Delaware corporation (“

Purchaser

”) and a wholly-owned

subsidiary of Wonder Holdings Acquisition Corp., a Delaware corporation (“

Parent

”), to

purchase all of the outstanding shares of common stock, par value $0.001 per share, of the Company,

including the associated rights issued pursuant to the Rights Agreement, dated as of July 22, 2002,

as amended on December 14, 2010 and further amended on January 11, 2011, between the Company and

Registrar and Transfer Company (the shares of the common stock of the Company, together with the

associated rights, collectively referred to as the “

Shares

”), at a price of $8.75 per Share

net to the seller in cash without interest and less any required withholding taxes, if any, upon

the terms and conditions set forth in the offer to purchase, dated December 22, 2010, as amended,

and in the related letter of transmittal, dated December 22, 2010, copies of which are attached to

the Tender Offer Statement on Schedule TO filed by Parent and certain of its affiliates, including

Purchaser, with the SEC on December 22, 2010, as amended.

Except as otherwise set forth below, the information set forth in the Schedule remains unchanged

and is incorporated herein by reference as relevant to the items in this Amendment. Capitalized

terms used but not defined herein have the meanings ascribed to them in the Schedule.

ITEM 8. ADDITIONAL INFORMATION

Item 8, “

Additional Information

” is hereby amended and supplemented by amending and restating

the section titled “

Other Legal Proceedings

,” which was inserted on page 40 of the Schedule

immediately following the section titled “

Product Liability Matters

” pursuant to Amendment No. 2 of

the Schedule, as follows:

“

Other Legal Proceedings

On January 7, 2011, Floyd Schneider filed a complaint (the “

Schneider Action

”)

on behalf of himself and as a putative class action on behalf of the Company’s public

stockholders (the “

Class

”) against all members of the Company Board (the

“

Individual Defendants

”), the Company, Parent and Purchaser in the Superior Court of

the State of Arizona for the County of Maricopa. The complaint alleges, among other things,

that the Individual Defendants breached their fiduciary duties in connection with the Offer

and the Merger by failing to engage in an honest and fair sale process and by providing

materially inadequate disclosure and material disclosure omissions regarding the Offer and

the Merger and that the Company, Parent and Purchaser have aided and abetted the breach of

fiduciary duties. The complaint seeks, among other things, a declaration that the action

brought by the complaint is a class action and that plaintiff be certified as the class

representative, an order enjoining the transactions contemplated by the Merger Agreement,

rescissory damages in the event the transaction is consummated prior to the entry of a final

judgment, an accounting of all damages caused by the defendants and all profits and special

benefits obtained, and an award to the plaintiff of all costs, including attorneys’ and

experts’ fees and expenses. The foregoing summary of the Schneider Action does not purport

to be complete and is qualified in its entirety by reference to the complaint, which is

furnished herewith as

Exhibit (a)(13)

.

In order to avoid the costs, disruption and distraction of further litigation, and

without admitting the validity of any allegations made in the Schneider Action, on February

14, 2011, counsel for each of the defendants entered into a memorandum of understanding with

plaintiff’s counsel (the “

MOU

”), which sets forth an agreement in principle to

settle the Schneider Action on the terms and conditions set forth in the MOU (the

“

Settlement

”). The MOU provides, among other things, that the parties to the

Schneider Action will use their best efforts to agree upon, execute and present to the

Superior Court, within 30 days of the MOU, a formal stipulation of settlement (the

“

Stipulation

”), which shall include, among other things, the following provisions:

(i) a conditional certification of the Schneider Action as a consolidated class

action pursuant to Arizona law;

(ii) a complete discharge, dismissal with prejudice, settlement and release of, and

an injunction barring, all claims of any kind or nature whatsoever that have been,

could have been, or in the future can or might be asserted against the defendants

(including certain affiliates and representatives thereof) in the Schneider Action

or in any other matter by or on behalf of any member of the Class, except the right

of the plaintiff or any other member of the Class to enforce the terms of the

Stipulation;

(iii) a release by the defendants of the plaintiff, members of the Class and

plaintiff’s counsel from all claims arising out of the institution, prosecution,

settlement or resolution of the Schneider Action, except the right to enforce the

terms of the Stipulation or the MOU;

(iv) that the defendants have denied and continue to deny that any of them have

committed or have threatened to commit or have aided or abetted the alleged

commission of any violations of law or breaches of duty to the plaintiff, the Class

or anyone else; and

(v) an acknowledgement that plaintiff’s counsel has a claim for attorneys’ fees and

reimbursement of expenses in connection with the Schneider Action and an agreement

by the defendants not to oppose plaintiff’s application for fees and expenses up to

and not exceeding $150,000.

In addition, the MOU provides that all proceedings in the Schneider Action, except for

those relating to the Settlement, shall be suspended pending the negotiation and execution

of the Stipulation. Except for the fees and expenses of plaintiff’s counsel, the defendants

shall bear no other expenses, costs, damages or fees alleged or incurred by the plaintiff,

by any member of the Class, or by any of their attorneys, experts or other representatives.

The MOU shall be null and void and of no further force and effect, unless otherwise

agreed to by the parties, if (i) the Settlement does not obtain final approval by the

Superior Court; (ii) plaintiff concludes, after obtaining certain confirmatory discovery

that the Company is obligated to provide pursuant to the MOU, that the Settlement is not

fair, adequate, and in the best interests of the Class, or (iii) the Offer is not concluded

for any reason. The effective date of the Settlement shall be the date on which the order

of the Superior Court approving the Settlement becomes final and no longer subject to

further appeal or review.”

Item 8, “

Additional Information

” is hereby amended and supplemented by adding the following

immediately before the section titled “

Forward-Looking Statements

”:

“

Expiration of the Offer and Announcement of Subsequent Offering Period

The Offer expired at 11:59 p.m., New York City time, on Monday, February 14, 2011 (the

“

Expiration Time

”). Based on information from the depositary, as of the Expiration

Time, a total of 6,525,546 Shares had been validly tendered and not withdrawn pursuant to

the Offer, including 211,814 Shares subject to guaranteed delivery procedures. Purchaser

accepted for payment all of such Shares in accordance with the terms of the Offer. As a

result of these transactions, Purchaser owns approximately 69.1% of the Shares.

In accordance with the Merger Agreement, Purchaser has commenced a subsequent offering

period to acquire all remaining untendered Shares (the “

Subsequent Offering

Period

”). The Subsequent Offering Period will expire at 11:59 p.m., New York City time,

on Thursday, February 17, 2011. During the Subsequent Offering Period, Purchaser will

immediately accept for payment and promptly pay for properly tendered Shares as such Shares

are tendered. Stockholders who properly tender during the Subsequent Offering Period will

receive the same $8.75 per Share cash consideration that is payable to stockholders who

tendered during the initial offering period. Procedures for tendering Shares during the

Subsequent Offering Period are the same as during the initial offering period with two

exceptions: (i)

Shares cannot be delivered by the guaranteed delivery procedure and (ii) pursuant to Rule

14d-7(a)(2) under the Exchange Act, Shares tendered during the Subsequent Offering Period

may not be withdrawn.

Following the Subsequent Offering Period, Purchaser may exercise its “top-up option” to

purchase Shares from the Company at a price of $8.75 per Share in accordance with the terms

of the Merger Agreement. These Shares, when added to the number of Shares owned by Purchaser

as a result of the initial offer period and the Subsequent Offer Period, may result in

Purchaser owning more than 90% of the Shares then outstanding. If Purchaser owns at least

90% of the Shares after the Subsequent Offering Period and, if necessary, after Purchaser’s

exercise of the “top-up option” under the terms of the Merger Agreement, Purchaser intends

to merge with and into the Company in accordance with the short-form merger provisions of

the DGCL, without prior notice to, or any action by, any other of the Company’s

stockholders.

If Purchaser is not able to consummate a short-form merger, it intends to seek approval

of the merger by a vote of the Company’s stockholders at a duly held meeting, where, as a

result of Purchaser’s purchase of Shares in the Offer, it will be able to approve the Merger

without the affirmative vote of any other stockholder. Upon consummation of a short-form or

other merger, the Company will become a wholly-owned subsidiary of Parent, and each Share

will be cancelled and (except for Shares held by Purchaser, Parent, the Company or their

respective subsidiaries or Shares held by the Company’s stockholders who have and validly

exercise appraisal rights under Delaware law) will be converted into the right to receive

the same consideration, without interest and less any applicable withholding taxes, received

by holders who tendered Shares in the Offer and the Subsequent Offering Period.

On February 15, 2011, the Company and H.I.G. issued a joint press release announcing

the preliminary results of the Offer and the commencement of the Subsequent Offering Period.

The full text of the press release is attached hereto as

Exhibit (a)(18)

and is

incorporated herein by reference.”

ITEM 9. EXHIBITS

Item 9, “

Exhibits

,” is hereby amended and supplemented by inserting the following

exhibit therein:

|

|

“(a)(18)

|

|

Joint Press Release issued by H.I.G. Capital, LLC and Matrixx Initiatives,

Inc. on February 15, 2011.”

|

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the

information set forth in this statement is true, complete and correct.

Dated: February 15, 2011

|

|

|

|

|

|

|

|

MATRIXX INITIATIVES, INC

|

|

|

|

/s/ William Hemelt

|

|

|

|

William Hemelt

|

|

|

|

President and Chief Executive Officer

|

|

|

|

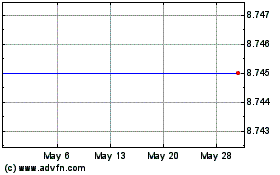

Matrixx Initiatives Inc. (MM) (NASDAQ:MTXX)

Historical Stock Chart

From May 2024 to Jun 2024

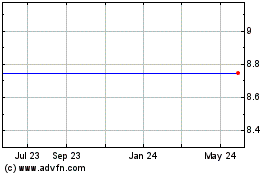

Matrixx Initiatives Inc. (MM) (NASDAQ:MTXX)

Historical Stock Chart

From Jun 2023 to Jun 2024