Current Report Filing (8-k)

June 07 2022 - 12:15PM

Edgar (US Regulatory)

0000720858falsetrue00007208582022-06-012022-06-010000720858us-gaap:CommonStockMember2022-06-012022-06-010000720858itic:RightsToPurchaseSeriesAJuniorParticipatingPreferredStockMember2022-06-012022-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | | | | | | | | | | |

| | June 1, 2022 | | |

| Date of Report (Date of earliest event reported) | |

| | | | | | | |

| | Investors Title Company | | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | |

| North Carolina | | 0-11774 | | 56-1110199 |

| (State or Other Jurisdiction of | | (Commission | | (I.R.S. Employer |

| Incorporation or Organization) | | File Number) | | Identification No.) |

121 North Columbia Street, Chapel Hill, North Carolina 27514

(Address of principal executive offices) (Zip Code)

(919) 968-2200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | ITIC | | The Nasdaq Stock Market LLC |

| Rights to Purchase Series A Junior Participating Preferred Stock | | | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.01. Changes in Registrant's Certifying Accounting

Investors Title Company (the "Company") was notified that Dixon Hughes Goodman LLP ("DHG"), the Company's independent registered public accounting firm, merged with BKD LLP ("BKD") on June 1, 2022, and combined practice now operates under the name FORVIS, LLP (“FORVIS”).

Investors Title Company (the “Company”) was notified that Dixon Hughes Goodman LLP (“DHG”), the Company’s independent registered public accounting firm, merged with BKD LLP (“BKD”) on June 1, 2022, and the combined practice now operates under the name FORVIS, LLP (“FORVIS”). On June 7, 2022, the Audit Committee of the Company’s Board of Directors approved the engagement of FORVIS as DHG’s successor to continue as the Company’s independent registered public accountant for the fiscal year ending December 31, 2022.

The reports of DHG on the financial statements of the Company for the fiscal years ended December 31, 2021 and 2020 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

During the Company’s fiscal years ended December 31, 2021 and 2020 and the subsequent interim period preceding the engagement of FORVIS, there were no disagreements between the Company and DHG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of DHG, would have caused DHG to make reference to any subject matter of the disagreements in connection with its audit reports on the Company’s financial statements. During the Company’s past fiscal years ended December 31, 2021 and 2020 and the interim period through the engagement of FORVIS, DHG did not advise the Company of any matters specified in Item 304(a)(1)(v) of Regulation S-K.

The Company has requested that FORVIS, as successor to DHG, review the disclosures contained in this report and has asked FORVIS to furnish it with a currently dated letter addressed to the Securities and Exchange Commission containing any new information, clarification of the Company’s expression of its views or the respects in which it does not agree with the statements made by the Company in response to Item 304(a) of Regulation S-K. A copy of such letter is filed as exhibit 16.1 to this report.

During the Company’s two most recently completed fiscal years and through the date of engagement of FORVIS, neither the Company nor anyone on behalf of the Company consulted with BKD regarding (a) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements as to which the Company received a written report or oral advice that was an important factor in reaching a decision on any accounting, auditing or financial reporting issue; or (b) any matter that was the subject of a disagreement or a reportable event as defined in Items 304(a)(1)(iv) and (v), respectively, of Regulation S-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT INDEX

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | INVESTORS TITLE COMPANY |

| | | | |

| Date: | June 7, 2022 | By: | /s/ James A. Fine, Jr. |

| | | | James A. Fine, Jr. |

| | | | President, Principal Financial Officer and |

| | | | Principal Accounting Officer |

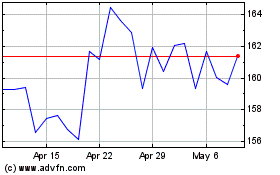

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From May 2024 to Jun 2024

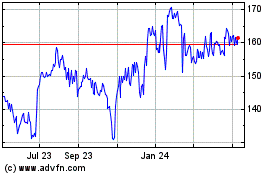

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2023 to Jun 2024