false

0000811641

0000811641

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 14, 2024

| ImmuCell Corporation |

| (Exact name of registrant as specified in its charter) |

| DE |

|

001-12934 |

|

01-0382980 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 56 Evergreen Drive Portland, Maine |

|

04103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code 207-878-2770

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.10 par value per share |

|

ICCC |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On May 14, 2024 ImmuCell Corporation (the “Company”) issued

a press release announcing its unaudited financial results for the quarter ended March 31, 2024. The full text of the press release issued

in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to liabilities of

that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except

as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit relating to Item 2.02 shall be deemed to be furnished,

and not filed:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IMMUCELL CORPORATION |

| |

|

| Date: May 14, 2024 |

By: |

/s/ Michael F. Brigham |

| |

|

Michael F. Brigham |

| |

|

President, Chief Executive Officer and Principal Financial Officer |

Exhibit Index

3

Exhibit 99.1

ImmuCell

ImmuCell Announces Unaudited Financial Results

for

the Quarter Ended March 31, 2024

For Immediate Release

PORTLAND, Maine – May 14, 2024 – ImmuCell

Corporation (Nasdaq: ICCC) (“ImmuCell” or the “Company”), a growing animal health company that develops,

manufactures and markets scientifically proven and practical products that improve the health and productivity of dairy and beef cattle,

today announced its unaudited financial results for the quarter ended March 31, 2024.

Management’s Discussion:

“Our preliminary, unaudited product sales for the first quarter

of 2024 were first reported on April 9, 2024,” commented Michael F. Brigham, President and CEO of ImmuCell. “We have no changes

to those figures.”

Total sales during the three-month period ended March 31, 2024 were

111% above the comparable period ended March 31, 2023. Total sales during the trailing twelve-month period ended March 31, 2024 were 33%

above the comparable period ended March 31, 2023. The $7.3 million in sales recorded during the first quarter of 2024 represents an all-time

quarterly sales record for the Company. The next highest quarter was $6 million recorded during the first quarter of 2022.

After a slowdown during 2023 that was necessary to remediate certain

production contamination events, finished goods produced increased steadily from approximately $3.3 million to $4 million during the first

and second quarters of 2023, respectively, and then further to the average of $5.2 million per quarter during the six-month period ended

December 31, 2023. The Company’s objective is to produce finished goods with an approximate sales value of $6 million or more per

quarter, which would annualize to about 80% or more of its estimated full production capacity of approximately $30 million. The actual

value of the Company’s production capacity varies based on biological and process yields, product format mix, selling price and

other factors.

“By implementing and optimizing a multi-year investment to increase

our production capacity, we achieved $7.2 million of production during the first quarter of 2024, which annualizes to $28.7 million, or

about 96% of our $30 million full capacity estimate,” continued Mr. Brigham.

As the work to increase production output to meet demand continues,

the backlog of orders was worth approximately $9.1 million as of March 31, 2024, which is a small decrease from approximately $9.4 million

as of December 31, 2023 but still a large increase from approximately $2.5 million as of December 31, 2022.

Certain Financial Results:

| ● | Product

sales increased by 111%, or $3.8 million, to $7.3 million during the three-month period ended

March 31, 2024 compared to $3.4 million during the three-month period ended March 31, 2023. |

| | | |

| ● | Product

sales increased by 33%, or $5.3 million, to $21.3 million during the trailing twelve-month

period ended March 31, 2024 compared to $16 million during the trailing twelve-month period

ended March 31, 2023. |

| | | |

| ● | Gross

margin earned was 32% and 9% of product sales during the three-month periods ended March

31, 2024 and 2023, respectively. The lower gross margin during the three-month period ended

March 31, 2023 was largely the result of product contamination events in the production processes

that resulted in a slowdown in output and write-offs of scrapped inventory. Remediation measures

have been implemented that are anticipated to mitigate the risk of future contamination events. |

| | | |

| ● | Net

loss was $438,000, or $0.06 per basic share, during the three-month period ended March 31,

2024 in comparison to a net loss of $2.3 million, or $0.30 per basic share, during the three-month

period ended March 31, 2023. |

| | | |

| ● | EBITDA

(a non-GAAP financial measure described on page 5 of this press release) improved to approximately

$377,000 during the three-month period ended March 31, 2024 in contrast to ($1.6) million

during the three-month period ended March 31, 2023. |

Balance

Sheet Data as of March 31, 2024:

| ● | Cash

and cash equivalents decreased to $960,000 as of March 31, 2024 from $979,000 as of December

31, 2023, with no draw outstanding on the available $1 million line of credit as of these

dates. |

| | | |

| ● | Net

working capital decreased to approximately $7.2 million as of March 31, 2024 from $7.3 million

as of December 31, 2023. |

| | | |

| ● | Stockholders’

equity decreased to $24.6 million as of March 31, 2024 from $25 million as of December 31,

2023. |

Update

on Re-Tain® Product Development Initiative:

The

FDA recently issued a CMC Technical Section Incomplete Letter (Incomplete Letter) to the Company in response to its third CMC

Technical Section submission for Re-Tain®. Pursuant to the Incomplete Letter, the FDA has provided some minor questions

about the Company’s submission requiring a re-submission of the CMC Technical Section, which is typically subject to a six-month

review. However, the FDA has indicated that this re-submission potentially could be handled through a shortened review period because

the open items are not complex. More critical to the timeline, however, is that the FDA has also required that the Company not re-submit

the CMC Technical Section until inspectional observations at the facilities of its Drug Product (DP) contract manufacturer are resolved.

Given the unique facts and circumstances, the Company is working with the FDA and its DP contract manufacturer to obtain an expedited

review.

“We will remain focused on the commercial opportunity we have

with First Defense®, and we intend to persist through yet another regulatory delay in our effort to bring Re-Tain®

to market,” Mr. Brigham concluded.

Cautionary Note Regarding Forward-Looking Statements (Safe Harbor

Statement):

This Press Release and the statements to be made

in the related conference call referenced herein contain “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended. Forward-looking statements can be identified by the fact that they do not relate strictly to

historical or current facts, and will often include words such as “expects”, “may”, “anticipates”,

“aims”, “intends”, “would”, “could”, “should”, “will”, “plans”,

“believes”, “estimates”, “targets”, “projects”, “forecasts”, “seeks”

and similar words and expressions. Such statements include, but are not limited to, any forward-looking statements relating to: our plans

and strategies for our business; projections of future financial or operational performance; the timing and outcome of pending or anticipated

applications for regulatory approvals; future demand for our products; the scope and timing of ongoing and future product development

work and commercialization of our products; future costs of product development efforts; the expected efficacy or impact of new products;

estimates about the market size for our products; future market share of and revenue generated by current products and products still

in development; our ability to increase production output and reduce costs of goods sold per unit; the adequacy of our own manufacturing

facilities or those of third parties with which we have contractual relationships to meet demand for our products on a timely basis; the

efficacy or timeline to complete our contamination remediation efforts; the likelihood, severity or impact of future contamination events;

the robustness of our manufacturing processes and related technical issues; estimates about our production capacity, efficiency and yield;

future regulatory requirements relating to our products; future expense ratios and margins; the effectiveness of our investments in our

business; anticipated changes in our manufacturing capabilities and efficiencies; our effectiveness in competing against competitors within

both our existing and our anticipated product markets; and any other statements that are not historical facts. These statements are intended

to provide management’s current expectation of future events as of the date of this Press Release, are based on management’s estimates,

projections, beliefs and assumptions as of the date hereof; and are not guarantees of future performance. Such statements involve known

and unknown risks and uncertainties that may cause the Company’s actual results, financial or operational performance or achievements

to be materially different from those expressed or implied by these forward-looking statements, including, but not limited to, those risks

and uncertainties relating to: difficulties or delays in development, testing, regulatory approval, production and marketing of our products

(including the First Defense® product line and Re-Tain®), competition within our anticipated

product markets, customer acceptance of our new and existing products, product performance, alignment between our manufacturing resources

and product demand (including the consequences of backlogs), uncertainty associated with the timing and volume of customer orders as we

come out of a prolonged backlog, adverse impacts of supply chain disruptions on our operations and customer and supplier relationships,

commercial and operational risks relating to our current and planned expansion of production capacity, and other risks and uncertainties

detailed from time to time in filings we make with the Securities and Exchange Commission (SEC), including our Quarterly Reports on Form

10-Q, our Annual Reports on Form 10-K and our Current Reports on Form 8-K. Such statements involve risks and uncertainties and are based

on our current expectations, but actual results may differ materially due to various factors. In addition, there can be no assurance that

future risks, uncertainties or developments affecting us will be those that we anticipate. We undertake no obligation to update any forward-looking

statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or

otherwise.

Condensed Statements of Operations (Unaudited)

| | |

During the Three-Month Periods Ended

March 31, | |

| (In thousands, except per share amounts) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Product sales | |

$ | 7,258 | | |

$ | 3,447 | |

| Costs of goods sold | |

| 4,963 | | |

| 3,146 | |

| Gross margin | |

| 2,295 | | |

| 301 | |

| | |

| | | |

| | |

| Product development expenses | |

| 1,263 | | |

| 1,110 | |

| Sales, marketing and administrative expenses | |

| 1,332 | | |

| 1,447 | |

| Operating expenses | |

| 2,595 | | |

| 2,557 | |

| | |

| | | |

| | |

| NET OPERATING LOSS | |

| (300 | ) | |

| (2,256 | ) |

| | |

| | | |

| | |

| Other expenses, net | |

| 137 | | |

| 57 | |

| | |

| | | |

| | |

| LOSS BEFORE INCOME TAXES | |

| (437 | ) | |

| (2,313 | ) |

| | |

| | | |

| | |

| Income tax expense | |

| 1 | | |

| 2 | |

| | |

| | | |

| | |

| NET LOSS | |

$ | (438 | ) | |

$ | (2,315 | ) |

| | |

| | | |

| | |

| Basic weighted average common shares outstanding | |

| 7,751 | | |

| 7,747 | |

| Basic net loss per share | |

$ | (0.06 | ) | |

$ | (0.30 | ) |

| | |

| | | |

| | |

| Diluted weighted average common shares outstanding | |

| 7,751 | | |

| 7,747 | |

| Diluted net loss per share | |

$ | (0.06 | ) | |

$ | (0.30 | ) |

Selected Balance Sheet Data (In thousands)

(Unaudited)

| |

|

As of

March 31,

2024 |

|

|

As of

December 31,

2023 |

|

| Cash and cash equivalents |

|

$ |

960 |

|

|

$ |

979 |

|

| Net working capital |

|

|

7,164 |

|

|

|

7,272 |

|

| Total assets |

|

|

43,051 |

|

|

|

43,808 |

|

| Stockholders’ equity |

|

$ |

24,636 |

|

|

$ |

24,993 |

|

Non-GAAP Financial Measures:

Generally, a non-GAAP financial measure is a numerical measure of a

company’s performance, financial position or cash flow that either excludes or includes amounts that are not normally excluded or

included in the most directly comparable measure calculated and presented in accordance with GAAP. The non-GAAP measures included in this

press release should be considered in addition to, and not as a substitute for or superior to, the comparable measure prepared in accordance

with GAAP. We believe that considering the non-GAAP measure of Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)

assists management and investors by looking at our performance across reporting periods on a consistent basis excluding these certain

charges that are not uses of cash from our reported loss before income taxes. We calculate EBITDA as described in the following table:

| | |

During the Three-Month Periods Ended March 31, | |

| (In thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Loss before income taxes | |

$ | (437 | ) | |

$ | (2,313 | ) |

| Interest expense (excluding debt issuance and debt discount costs) | |

| 136 | | |

| 88 | |

| Depreciation | |

| 663 | | |

| 652 | |

| Amortization | |

| 15 | | |

| 7 | |

| EBITDA | |

$ | 377 | | |

$ | (1,566 | ) |

EBITDA included stock-based compensation expense of approximately $81,000

and $96,000 during the three-month periods ended March 31, 2024 and 2023, respectively, which is a non-cash expense that management adds

back to EBITDA when assessing its cash flows. Cash payments to satisfy debt repayment obligations or to make capital expenditure investments

are other uses of cash that are not included in the calculation of EBITDA, which management considers when assessing its cash flows.

Conference Call:

The Company is planning to host a conference call on Wednesday, May 15, 2024 at 9:00 AM ET to discuss the unaudited financial results

for the quarter ended March 31, 2024. Interested parties can access the conference call by dialing (844) 855-9502 (toll free) or (412)

317-5499 (international). A teleconference replay of the call will be available until May 22, 2024 at (877) 344-7529 (toll free) or (412)

317-0088 (international), utilizing replay access code #2581533. Investors are encouraged to review the Company’s updated Corporate

Presentation slide deck that provides an overview of the Company’s business and is available under the “Investors” tab

of the Company’s website at www.immucell.com, or by request to the Company. An updated version of the slide deck will be made available

under the “Investors” tab of the Company’s website after the market closes on Tuesday, May 14, 2024.

About ImmuCell:

ImmuCell Corporation’s (Nasdaq: ICCC) purpose is to create scientifically

proven and practical products that improve the health and productivity of dairy and beef cattle. ImmuCell manufactures and markets

First Defense®, providing Immediate Immunity™ to newborn dairy and beef calves, and is in the late

stages of developing Re-Tain®, a novel treatment for subclinical mastitis in dairy cows without FDA-required milk

discard or meat withhold claims that provides an alternative to traditional antibiotics. Press releases and other information about the

Company are available at: http://www.immucell.com.

| Contacts: |

Michael F. Brigham, President and CEO |

| |

ImmuCell Corporation |

| |

(207) 878-2770 |

| |

|

| |

Joe Diaz, Robert Blum and Joe Dorame |

| |

Lytham Partners, LLC |

| |

(602) 889-9700 |

| |

iccc@lythampartners.com |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

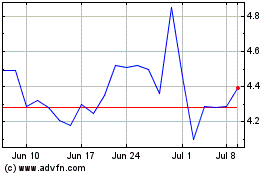

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From May 2024 to May 2024

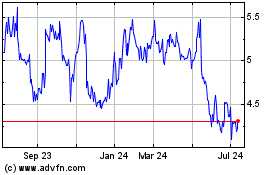

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From May 2023 to May 2024