Current Report Filing (8-k)

July 02 2021 - 4:11PM

Edgar (US Regulatory)

0001819796FALSE00018197962021-05-132021-05-1300018197962021-01-012021-06-300001819796us-gaap:CommonStockMember2021-05-132021-05-130001819796us-gaap:WarrantMember2021-05-132021-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 2, 2021

GCM Grosvenor Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-39716

|

|

85-2226287

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

900 North Michigan Avenue

Suite 1100

Chicago, Illinois

|

|

60611

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(312) 506-6500

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

GCMG

|

|

The Nasdaq Stock Market LLC

|

|

Warrants to purchase one share of Class A common stock

|

|

GCMGW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously reported by GCM Grosvenor Inc. (together with its consolidated subsidiaries, the “Company”), in a transaction effective January 1, 2020, Grosvenor Capital Management Holdings, LLLP, a subsidiary of the Company (“GCMH”) and its affiliates transferred certain indirect partnership interests related to historical investment funds managed by GCMH and its affiliates to Mosaic Acquisitions 2020, L.P. (“Mosaic”) in a transaction referred to as the “Mosaic Transaction.” The limited partner of Mosaic is a third-party investor affiliated with the Canada Pension Plan Investment Board (the “third-party investor”). Mosaic holds limited partnership interests representing financial assets of the Company including a right to certain carried interest generated by funds raised prior to December 31, 2019 and certain funded general partner interests and to-be-funded general partner interests.

On July 2, 2021, GCMH exercised its option to purchase the interest in Mosaic held by the third-party investor for a net purchase price of approximately $163 million, adjusted for true-up distributions and expenses through the closing date, and inclusive of a $13 million negotiated discount. GCMH’s purchase will result in the interest held by the third-party investor no longer being accounted for as a redeemable noncontrolling interest of the Company.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Current Report on Form 8-K, including without limitation, the historical performance of GCM Grosvenor's funds may not be indicative of GCM Grosvenor's future results; risks related to redemptions and termination of engagements; effect of the COVID-19 pandemic on GCM Grosvenor's business; the variable nature of GCM Grosvenor's revenues; competition in GCM Grosvenor's industry; effects of government regulation or compliance failures; market, geopolitical and economic conditions; identification and availability of suitable investment opportunities; risks relating to our internal control over financial reporting; and risks related to the performance of GCM Grosvenor's investments. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sections of the Annual Report on Form 10-K/A filed by GCM Grosvenor Inc. on May 10, 2021 and its other filings with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking statements, and GCM Grosvenor assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GCM Grosvenor Inc.

|

|

Date: July 2, 2021

|

|

By:

|

/s/ Michael J. Sacks

|

|

|

|

Name:

|

Michael J. Sacks

|

|

|

|

Title:

|

Chief Executive Officer

|

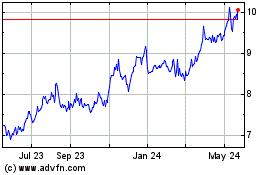

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Apr 2024 to May 2024

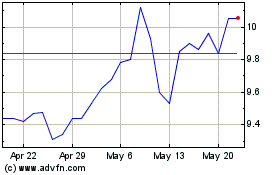

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From May 2023 to May 2024