Additional Proxy Soliciting Materials (definitive) (defa14a)

May 05 2023 - 6:07AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☒ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under §240.14a-12 |

| EVERGREEN

CORPORATION |

| (Name

of Registrant as Specified In Its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

EXPLANATORY

NOTE

On

May 2, 2023, Evergreen Corporation, a Cayman Islands exempted company (the “Company”), filed its definitive proxy

statement, dated May 2, 2023 (the “Proxy Statement”), for the Extraordinary General Meeting with the Securities and

Exchange Commission (the “SEC”). On May 3, 2023, the Company filed an amended Proxy Statement and the related proxy card

(the “Amended Proxy Statement”) with the SEC, which replaced the Proxy Statement in its entirety. On May 4, 2023,

the Company filed with the SEC Supplement No.1, dated May 4, 2023, to the Amended Proxy Statement (“Supplement No. 1”

and together with the Amended Proxy Statement, the “Definitive Proxy Statement”). The Company is filing these definitive

additional proxy materials on May 4, 2023, to amend and supplement certain information in the Definitive Proxy Statement. No other information

in the Definitive Proxy Statement has been revised, supplemented, updated or amended.

SUPPLEMENT

NO. 2 DATED MAY 4, 2023

TO

DEFINITIVE

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS

OF EVERGREEN CORPORATION

TO

BE HELD ON MAY 9, 2023

EVERGREEN

CORPORATION

15-04,

The Pinnacle

Persiaran

Lagoon, Bandar Sunway

Petaling

Jaya, Selangor, Malaysia

The

following supplemental disclosure amends the Definitive Proxy Statement to add a new section entitled “Risk Factors,” which

shall read in its entirety as follows:

RISK

FACTORS

If

we were deemed to be an investment company for purposes of the Investment Company Act of 1940, as amended (the “Investment Company

Act”), we may be forced to abandon our efforts to complete an initial business combination and instead be required to liquidate

the Company. To avoid that result, we may determine, in our discretion, to liquidate the securities held in the trust account and instead

hold all funds in the trust account in an interest bearing bank demand deposit account, which may earn less interest than we otherwise

would have if the trust account had remained invested in U.S. government securities or money market funds.

There

is currently uncertainty concerning the applicability of the Investment Company Act to a special purpose acquisition company (“SPAC”)

and we may in the future be subject to a claim that we have been operating as an unregistered investment company. If we are deemed to

be an investment company for purposes of the Investment Company Act, we might be forced to abandon our efforts to complete an initial

business combination and instead be required to liquidate. If we are required to liquidate, our investors would not be able to realize

the benefits of owning stock in a successor operating business, including the potential appreciation in the value of our stock and warrants

following such a transaction, and our warrants would expire worthless.

The

funds in the trust account have, since our initial public offering, been held only in U.S. government securities within the meaning set

forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 180 days or less or in money market funds investing solely

in United States Treasuries and meeting certain conditions under Rule 2a-7 under the Investment Company Act. However, to mitigate the

risk of us being deemed to have been operating as an unregistered investment company (including under the subjective test of Section

3(a)(1)(A) of the Investment Company Act), we may, in our own discretion, instruct Continental Stock Transfer & Trust Company, the

trustee with respect to the trust account, to liquidate the U.S. government securities or money market funds held in the trust account

and thereafter, until the earlier of consummation of our initial business combination or liquidation, to hold all funds in the trust

account in an interest bearing bank demand deposit account, which may earn less interest than we otherwise would have if the trust account

had remained invested in U.S. government securities or money market funds. This may mean that the amount of funds available for redemption

would not increase, or would only minimally increase, thereby reducing the dollar amount our public shareholders would receive upon any

redemption or liquidation of the Company.

In

addition, the longer that the funds in the trust account are held in short-term U.S. government securities or in money market funds invested

exclusively in such securities, there is a greater risk that we may be considered an unregistered investment company, in which case we

may be required to liquidate. Accordingly, we may determine, in our discretion, to liquidate the securities held in the trust account

at any time and instead hold all funds in the trust account in an interest bearing bank demand deposit account, which may earn less interest

than we otherwise would have if the trust account had remained invested in U.S. government securities or money market funds.

Evergreen (NASDAQ:EVGRU)

Historical Stock Chart

From Apr 2024 to May 2024

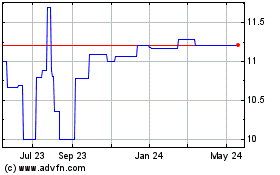

Evergreen (NASDAQ:EVGRU)

Historical Stock Chart

From May 2023 to May 2024