UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ |

Definitive Proxy Statement |

☒ |

Definitive Additional Materials |

☐ |

Soliciting Material Under §240.14a-12 |

Bolt Biotherapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

BOLT BIOTHERAPEUTICS, INC.

SUPPLEMENT TO NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND

DEFINITIVE PROXY STATEMENT FOR THE ANNUAL MEETING

OF STOCKHOLDERS TO BE HELD ON JUNE 12, 2024 AT 11:00 A.M. PACIFIC TIME

May 20, 2024

Bolt Biotherapeutics, Inc. (the “Company”) is filing this supplement (the “Supplement”) to update information contained in the Company’s Definitive Proxy Statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 26, 2024 (the “Proxy Statement”), and made available to the Company’s stockholders in connection with the solicitation of proxies on behalf of the Company’s board of directors (the “Board”) for its Annual Meeting of Stockholders to be held on June 12, 2024 (the “2024 Annual Meeting”).

Subsequent to the filing of the Proxy Statement, the Company filed a Current Report on Form 8-K on May 14, 2024, in which the Company disclosed a strategic pipeline prioritization and restructuring which included changes to the composition of the Board and the Company’s executive officers.

Except as specifically set forth in this Supplement, all information set forth in the Proxy Statement continues to apply and should be considered when voting your shares using one of the methods described in the Proxy Statement.

The Proxy Statement contains important additional information, and this Supplement should be read in conjunction with the Proxy Statement.

Departure of Director

On May 13, 2024, Edgar G. Engleman, M.D. notified the Company of his resignation as a member of Board and from all committees of the Board on which he served, effective as of May 15, 2024. Dr. Engleman's resignation is not the result of any disagreement with the Company relating to the Company's operations, policies or practices. Upon his departure as a member of the Board, Dr. Engleman joined the Company's Scientific Advisory Board to continue to provide his support to the Company with his extensive expertise and experience in the biopharmaceutical industry.

Departure of Chief Executive Officer and Director

Effective as of May 15 2024, Randall C. Schatzman, Ph.D. stepped down as the Company’s Chief Executive Officer and resigned as a member of the Board. Dr. Schatzman's resignation is not the result of any disagreement with the Company relating to the Company's operations, policies or practices. Dr. Schatzman will continue to be an employee of the Company through July 15, 2024, at which time he will become an advisor to the Company pursuant to a consulting agreement entered into on May 13, 2024 (the “Schatzman Consulting Agreement”). Pursuant to the Schatzman Consulting Agreement, the Company and Dr. Schatzman mutually agreed that commencing July 15, 2024 until the earlier of (i) nine months following July 15, 2024 or (ii) a termination in accordance with the terms of the Schatzman Consulting Agreement, Dr. Schatzman will provide certain advisory services to support the Company with the orderly transition of his duties. Dr. Schatzman’s provision of services under the Schatzman Consulting Agreement will be deemed “continuous service” (as defined in the Company’s 2021 Equity Incentive Plan and 2015 Equity Incentive Plan). Pursuant to the Schatzman Consulting Agreement, a total of 1,248,571 stock options previously granted to Dr. Schatzman were canceled. Dr. Schatzman will be entitled to severance payments pursuant to the Company’s Amended and Restated Severance and Change in Control Plan (the “Severance Plan”) as described in the Proxy Statement.

Departure of Chief Medical Officer

Effective as of May 15, 2024, Edith A. Perez, M.D. stepped down as the Company’s Chief Medical Officer, as the Company eliminated the position of Chief Medical Officer. Dr. Perez will continue to be an employee of the Company through July 15, 2024, at which time she will become an advisor to the Company pursuant to a consulting agreement entered into on May 13, 2024 (the “Perez Consulting Agreement”). Pursuant to the Perez Consulting Agreement, the Company and Dr. Perez mutually agreed that commencing July 15, 2024 until the earlier of (i) 12 months following July 15, 2024 or (ii) a termination in accordance with the terms of the Perez Consulting Agreement, Dr. Perez will provide certain advisory services to support the Company’s clinical development. Dr. Perez’s provision of services under the Perez Consulting Agreement will be deemed “continuous service” (as

defined in the Company’s 2021 Equity Incentive Plan and 2015 Equity Incentive Plan). Pursuant to the Perez Consulting Agreement, a total of 367,142 stock options previously granted to Dr. Perez were canceled. Dr. Perez will be entitled to severance payments pursuant to the Severance Plan as described in the Proxy Statement.

Appointment of President and Chief Executive Officer and Director

Effective May 15, 2024, William P. Quinn, the Company's Chief Financial Officer since 2020, also became the Company's President and Chief Executive Officer, and was appointed a member of the Board as a Class II director. Mr. Quinn will continue to serve as the Company’s Chief Financial Officer. Mr. Quinn’s annual base salary will be $450,000, and he will be eligible for an annual target bonus of 55% of his annual base salary.

In connection with his appointment as President and Chief Executive Officer, Mr. Quinn will sign a new participation agreement to the Severance Plan, providing for, among other things, the continued payment of his base salary for 12 months following either an involuntary termination without cause or a resignation for good reason (as each such term is defined in the Severance Plan) and a lump sum payment of 18 months of his base salary and his annual target bonus amount in the event of an involuntary termination without cause or a resignation for good reason that occurs in the period commencing three months prior to and ending 12 months following a change in control.

Appointment of Chief Operating Officer

Effective May 15, 2024, Grant Yonehiro, the Company's Chief Business Officer since 2016, became the Company's Chief Operating Officer. Mr. Yonehiro's annual base salary will be $450,000, and he will be eligible for an annual target bonus of 40% of his annual base salary.

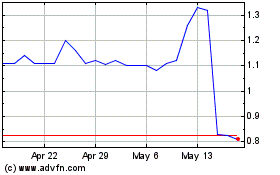

Bolt Biotherapeutics (NASDAQ:BOLT)

Historical Stock Chart

From May 2024 to Jun 2024

Bolt Biotherapeutics (NASDAQ:BOLT)

Historical Stock Chart

From Jun 2023 to Jun 2024