atai Life Sciences (NASDAQ: ATAI) (“atai” or “Company”), a

clinical-stage biopharmaceutical company aiming to transform the

treatment of mental health disorders, today announced first quarter

2024 financial results, provided corporate updates and announced a

transition in its leadership.

Florian Brand (“Mr. Brand”), Co-Founder and

current CEO, will step down as CEO by the end of this year.

Co-Founder Srinivas Rao, M.D., Ph.D. (“Dr. Rao”), currently the

Chief Scientific Officer, will be promoted to Co-CEO effective June

1, 2024 and intends to assume the role of CEO by the end of the

year subject to appointment as required by local law.

“I co-founded atai in 2018 with the bold mission

to transform mental health care, and I am immensely proud of our

accomplishments and continuous progress made across our R&D

programs over the last six years. To that end, looking at the

recent months, we have achieved many clinical milestones, with

dosing in our VLS-01 Phase 1b program well underway and encouraging

Phase 2 data readouts from both BPL-003 and COMP360,” said Mr.

Brand.

“As I prepare to turn my focus to new

entrepreneurial ventures in other areas of significant unmet

medical needs, I am confident in passing the torch to my Co-Founder

Srini by year-end. His exceptional leadership and deep expertise in

neuropsychiatric drug development have been pivotal to our success,

and I am delighted that he will be leading atai into its next

phase, where his experience in late stage clinical development will

be especially relevant and impactful.”

Dr. Rao brings over 24 years of knowledge and

experience from diverse biotechnology and pharmaceutical roles,

having held the titles of Chief Scientific, Medical, or Executive

Officer at companies ranging from venture-backed startups to

vertically integrated, publicly traded pharmaceutical

companies.

“It is an honor to follow in the footsteps of my dear friend and

Co-Founder, Florian. I am deeply grateful for the opportunity to

continue to work with him as Co-CEOs until the end of the year and

build upon our shared vision, ensuring atai’s continued success in

addressing challenging mental health conditions,” said Dr. Rao. “In

the near-term this year, I look forward to several data milestones,

including the Phase 2b readout of BPL-003 in TRD, Phase 3 data of

COMP360 in TRD and the VLS-01 Phase 1b readout.”

Founder and Chairman Christian Angermayer

commented: "Since its inception in 2018, atai has been at the

forefront of mental health innovation, driven by a commitment to

deliver ground-breaking therapies to those in need, with a special

focus on psychedelic substances.

Florian successfully led the company from its

early days through numerous R&D, business development and

financing milestones, including an IPO in 2021. Florian's

leadership and execution focus have been foundational to the

success of atai. We look forward to seeing the new heights he will

achieve.

As Florian transitions, we are deeply grateful

for the enduring impact he made on our company, and while he will

leave as CEO at the end of this year, he will always be part of the

atai family and our success story. With his extensive experience in

late stage drug development, Srini has the right profile and

skillset to lead atai into its next evolutionary phase.”

Corporate Updates

- Florian Brand,

Co-Founder and current CEO of atai, will assume the role of Co-CEO

effective June 1, 2024 and will step down as CEO by the end of this

year.

- Co-Founder

Srinivas Rao, currently the Chief Scientific Officer of atai, will

be promoted to Co-CEO effective June 1, 2024, and intends to assume

the role of CEO by the end of the year subject to appointment as

required by local law.

Clinical Highlights

VLS-01: N,N-dimethyltryptamine (DMT) for

Treatment-Resistant Depression (TRD)

- VLS-01 is an

oral transmucosal film (OTF) formulation of DMT designed to fit

within the two-hour in-clinic treatment paradigm successfully

established by Spravato®

- In March 2024, we announced the

initiation of dosing in a Phase 1b study that is designed to

evaluate the relative safety, tolerability, pharmacokinetics (PK)

and pharmacodynamics (PD) of an optimized OTF formulation of

VLS-01, compared to intravenous (IV) DMT.

- Results of the Phase 1b study are

anticipated in 2H 2024.

- The Company

plans to initiate a randomized, placebo-controlled Phase 2 trial of

VLS-01 in TRD patients around YE’24.

BPL-003: 5-MeO-DMT for TRD as primary indication

- Beckley

Psytech’s BPL-003 is an intranasal formulation of

5-methoxy-N,N-dimethyltryptamine (5-MeO-DMT) designed to fit within

an approximately two hour in-clinic treatment paradigm.

- In March 2024, Part 1 of a Phase 2a

open-label (OL) study showed that a single administration of

BPL-003 resulted in rapid and durable antidepressant effects, with

45% of patients in remission three months after dosing. Acute

effects resolved on average in less than two hours, and BPL-003 was

found to be well-tolerated, with no serious adverse events

reported.

- In April 2024,

Part 2 of the Phase 2a OL study initiated to investigate BPL-003 as

an adjunctive therapy to Selective Serotonin Reuptake Inhibitors in

TRD patients.

- A randomized,

controlled Phase 2b study of BPL-003 in TRD patients is underway

with topline data expected in 2H 2024.

COMP360: Psilocybin Therapy for TRD as primary indication

- Compass Pathways’ COMP360 is an oral

formulation of synthetic psilocybin that is currently being

evaluated in multiple clinical studies.

- In May 2024, results from an OL

Phase 2 study in 22 patients with PTSD showed that COMP360 met its

primary safety endpoint and was well tolerated, with no serious

adverse events. COMP360 demonstrated a rapid and durable

improvement in PTSD symptoms.

- Week 4 and 12 reductions in the

CAPS-5 total score of 29.9 and 29.5, respectively, were

observed.

- The response rate, as defined by

patients experiencing a ≥ 15-point improvement on CAPS-5 score, was

81.8% at week 4 and 77.3% at week 12.

- The remission rate, as defined by

CAPS-5 total score of ≤ 20, was 63.6% at week 4 and 54.5% at week

12.

- The Phase 3 program of COMP360 in

TRD patients is composed of two pivotal trials, each with a

long-term follow-up component. Pivotal Trial 1 (COMP005) topline

data is expected in the fourth quarter of 2024 and Pivotal Trial 2

(COMP006) topline data is anticipated mid-2025.

Upcoming R&D Catalysts

- 1H’24

- ELE-101 MDD

Phase 1/2a initial data

- 2H’24

- VLS-01 Phase 1b

topline data

- BPL-003 AUD

Phase 2a OL data (mid’24)

- COMP360 TRD

Phase 3 Pivotal Trial 1 topline data

- BPL-003 TRD

Phase 2b data

- IBX-210 OUD

Phase 1/2a initiation

- VLS-01 TRD Phase

2 initiation (around YE’24)

- 2025

- RL-007 CIAS

Phase 2b topline data (mid’25)

- COMP360 TRD

Phase 3 Pivotal Trial 2 topline data (mid’25)

Consolidated Financial

Results

Cash, cash equivalents, and short-term

investments: As of March 31, 2024, the Company had cash, cash

equivalents, restricted cash and short-term investments of $121.3

million compared to $154.2 million as of December 31, 2023. The

decrease of $32.9 million was primarily driven by $22.6 million net

cash used in operating activities and $10 million for the Beckley

Psytech investment. The Company expects its cash, marketable

securities and committed term loan facility with Hercules Capital,

Inc. to be sufficient to fund operations into 2026.

Research and development (R&D) expenses:

R&D expenses were $11.5 million for the three months ended

March 31, 2024, as compared to $19.3 million for the same

prior year period. The year-over-year decrease of $7.8 million was

primarily attributable to a decrease of $5.1 million in

program-specific expenses and $2.6 million in R&D personnel.

Within program-specific expenses, the decrease was primarily driven

by more clinical trials, discovery expenses and manufacturing costs

in prior year. During the quarter, the Company allocated capital

resources to invest in the R&D activities of its Beckley

Psytech strategic investment. The Company is anticipating R&D

spend to increase as its R&D programs progress into later stage

clinical trials.

General and administrative (G&A)

expenses: G&A expenses for the three months ended

March 31, 2024 were $12.6 million as compared to

$14.0 million in the same prior year period. The

year-over-year decrease of $1.4 million was primarily attributable

to $2.6 million decrease in personnel related expenses, $0.7

million net decrease of professional services and other

administrative expenses, partially offset by a $1.9 million

increase related to a prior year non-income tax refund. The Company

is actively controlling G&A spend. The Company expects the

reduction in G&A spend over prior years to continue.

Net loss: Net loss attributable to stockholders

for the three months ended March 31, 2024, was

$26.7 million as compared to $33.1 million for the three

months ended March 31, 2023.

atai Life Sciences

atai is a clinical-stage biopharmaceutical

company aiming to transform the treatment of mental health

disorders and was founded as a response to the significant unmet

need and lack of innovation in the mental health treatment

landscape. atai is dedicated to efficiently developing innovative

therapeutics to treat depression, anxiety, addiction, and other

mental health disorders. By pooling resources and best practices,

atai aims to responsibly accelerate the development of new

medicines to achieve clinically meaningful and sustained behavioral

change in mental health patients. atai's vision is to heal mental

health disorders so that everyone, everywhere can live a more

fulfilled life. For more information, please

visit www.atai.life.

Forward-looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended. We intend such forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements contained in Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). The words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “anticipate,”

“initiate,” “could,” “would,” “project,” “plan,” “potentially,”

“preliminary,” “likely,” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these words. Forward-looking

statements include express or implied statements relating to, among

other things: our business strategy and plans; transition plans for

our CEO and Co-CEO; the potential, success, cost and timing of

development of our product candidates, including the progress of

preclinical and clinical trials and related milestones;

expectations regarding our strategic investment in Beckley Psytech;

expectations regarding our cash runway; and the plans and

objectives of management for future operations, research and

development and capital expenditures.

Forward-looking statements are neither promises

nor guarantees, but involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those projected, including, without limitation, the important

factors described in the section titled “Risk Factors” in our most

recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (“SEC”), as such factors may be updated from

time to time in atai's other filings with the SEC. atai disclaims

any obligation or undertaking to update or revise any

forward-looking statements contained in this press release, other

than to the extent required by applicable law.

Contact Information

Investor Contact:IR@atai.life

Media Contact:PR@atai.life

| ATAI LIFE

SCIENCES N.V. |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Amounts in

thousands, except share and per share amounts) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three Months

Ended |

| |

|

|

March 31, |

| |

|

|

2024 |

|

2023 |

| |

|

|

(unaudited) |

|

|

License revenue |

|

$ |

— |

|

|

$ |

37 |

|

| |

Operating

expenses: |

|

|

|

|

| |

Research and development |

|

|

11,530 |

|

|

|

19,281 |

|

| |

General and administrative |

|

|

12,555 |

|

|

|

13,970 |

|

| |

Total operating expenses |

|

|

24,085 |

|

|

|

33,251 |

|

| |

Loss from

operations |

|

|

(24,085 |

) |

|

|

(33,214 |

) |

| |

Other income

(expense), net |

|

|

(1,596 |

) |

|

|

58 |

|

| |

Loss before

income taxes |

|

|

(25,681 |

) |

|

|

(33,156 |

) |

| |

Benefit from (provision for) income taxes |

|

|

4 |

|

|

|

(165 |

) |

| |

Losses from

investments in equity method investees, net of tax |

|

|

(1,701 |

) |

|

|

(1,033 |

) |

| |

Net

loss |

|

|

(27,378 |

) |

|

|

(34,354 |

) |

| |

Net loss

attributable to noncontrolling interests |

|

|

(665 |

) |

|

|

(1,219 |

) |

| |

Net loss

attributable to ATAI Life Sciences N.V. stockholders |

|

$ |

(26,713 |

) |

|

$ |

(33,135 |

) |

| |

Net loss per

share attributable to ATAI Life Sciences N.V. stockholders — basic

and diluted |

|

$ |

(0.17 |

) |

|

$ |

(0.21 |

) |

| |

Weighted

average common shares outstanding attributable to ATAI Life

Sciences N.V. stockholders — basic and diluted |

|

|

158,891,067 |

|

|

|

155,792,490 |

|

| |

|

|

|

|

|

| ATAI LIFE

SCIENCES N.V. |

| CONDENSED

CONSOLIDATED BALANCE SHEET |

| (Amounts in

thousands) |

|

(unaudited) |

| |

|

|

|

|

| |

|

March

31, |

|

December

31, |

| |

|

2024 |

|

2023 |

|

Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

18,867 |

|

$ |

45,034 |

| Short term

restricted cash for other investments |

|

|

5,000 |

|

|

- |

| Securities

carried at fair value |

|

|

87,379 |

|

|

109,223 |

| Committed

Investment Funds |

|

|

- |

|

25,000 |

| Prepaid

expenses and other current assets |

|

|

5,732 |

|

|

5,830 |

| Short term

notes receivable - related party, net |

|

|

522 |

|

|

505 |

| Long term

restricted cash for other investments |

|

|

10,000 |

|

|

- |

| Property and

equipment, net |

|

|

920 |

|

|

981 |

| Operating

lease right-of-use asset, net |

|

|

1,115 |

|

|

1,223 |

| Other

investments held at fair value |

|

|

90,205 |

|

|

89,825 |

| Other

investments |

|

|

32,807 |

|

|

1,838 |

| Long term

notes receivable - related parties, net |

|

|

98 |

|

|

97 |

| Convertible

notes receivable - related party |

|

|

13,902 |

|

|

11,202 |

| Other

assets |

|

|

2,574 |

|

|

2,720 |

|

Total assets |

|

$ |

269,121 |

|

$ |

293,478 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

| Accounts

payable |

|

|

3,843 |

|

|

4,589 |

| Accrued

liabilities |

|

|

10,926 |

|

|

15,256 |

| Current

portion of lease liability |

|

|

244 |

|

|

275 |

| Contingent

consideration liability - related parties |

|

|

607 |

|

|

620 |

| Contingent

consideration liability |

|

|

1,406 |

|

|

1,637 |

| Noncurrent

portion of lease liability |

|

|

907 |

|

|

990 |

| Convertible

promissory notes - related parties |

|

|

417 |

|

|

164 |

| Convertible

promissory notes and derivative liability |

|

|

4,099 |

|

|

2,666 |

| Long term

debt, net |

|

|

15,140 |

|

|

15,047 |

| Other

liabilities |

|

|

8,275 |

|

|

7,918 |

| Total

stockholders' equity attributable to ATAI Life Sciences N.V.

stockholders |

|

|

222,544 |

|

|

242,962 |

|

Noncontrolling interests |

|

|

713 |

|

|

1,354 |

|

Total liabilities and stockholders' equity |

|

|

269,121 |

|

|

293,478 |

| |

|

|

|

|

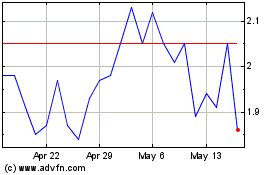

ATAI Life Sciences NV (NASDAQ:ATAI)

Historical Stock Chart

From Apr 2024 to May 2024

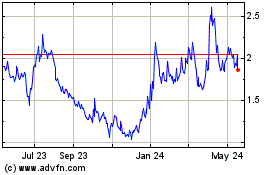

ATAI Life Sciences NV (NASDAQ:ATAI)

Historical Stock Chart

From May 2023 to May 2024