Portugal ETF Off to a Strong Start: Inside the Surge - ETF News And Commentary

December 09 2013 - 2:03PM

Zacks

Global X added another product to its lineup on November 13 with

its Portugal ETF. This debut was well received by the market as the

country is slowly exiting its bailout program. Further optimism is

being laid by the European economy, which is reviving on reduced

debt worries, strong growth in some key members and firmer

currency.

Investors should note that the PIIGS (Portugal, Ireland, Italy,

Greece and Spain) countries, often considered the weakest members

in the Euro zone, are showing an impressive turnaround and are

leading the broad European recovery (read: 3 European ETFs Leading

the Recovery).

Better Portugal Economy Trends

After struggling for more than two years, the economic situation is

improving in Portugal aided by two consecutive quarters of growth,

declining unemployment, lower trade deficit and rising consumer

confidence. The economy grew 0.2% in the third quarter followed by

1.1% in the second, while unemployment declined to 15.6% from 16.4%

in the third quarter.

Portugal has initiated a sovereign debt swap in order to fully exit

from the €78 billion European Union-International Monetary Fund

bailout rescue program in June next year. The country exchanged

€6.64 billion ($9 billion) in bonds maturing in 2014 and 2015 for

notes due in 2017 and 2018. This move will reduce the debt

repayment in the country and would spread an air of confidence over

the nation’s future.

In addition, rising tourism and growing exports are driving growth

in the country after years of bailout austerity. Given a bullish

outlook and strengthening fundamentals, the Portuguese government

now expects the economy to shrink 1.8% this year compared to the

previous outlook of a 2.3% decline, and it raised its 2014 growth

outlook from 0.6% to 0.8%.

This bout of optimism and bullish trend helped the new Portugal ETF

to enjoy the first mover advantage in the relatively small nation

of Portugal in this short span (read: Why PIIGS ETFs Are

Outperforming).

This is especially true given that the

Global X FTSE

Portugal 20 ETF (PGAL) added over 4% since its inception

and easily outpaced the broader American and European funds by wide

margins. This suggests the strong positive momentum in the outlook

of this debt-ridden country.

Portugal ETF in Focus

The fund has garnered a small amount of investor interest by

accumulating about $1.6 million in AUM in its first month; though

volume is light. The ETF charges little higher in fees per year of

60 bps (read: Global X Launches First Portugal ETF (PGAL)).

The product tracks the performance of the FTSE Portugal 20 Index,

holding 20 Portuguese stocks in its basket. The index focuses on

the biggest stocks in the nation (or those that primarily derive

their revenues from the country), screening by liquidity and

weighting by modified free-float market capitalization.

The fund is heavily concentrated on the top firm – EDP – at under

20% of total assets, closely followed by Jeronimo Martins and Galp

Energia at 13% each. From a sector perspective, utilities and

consumer services dominate the fund’s portfolio at nearly 26% and

23%, respectively, indicating that the ETF might not be volatile

due to higher allocations to defensive sectors (see: all the

European ETFs here).

Bottom Line

Given the bullish trends and improving confidence, the Portugal ETF

could make for an interesting investment for patient investors who

believe that the worst might be over for the European debt story

and expect good trading ahead (read: 3 Top Ranked Europe ETFs to

Buy Now).

Further, PGAL has room for further upside than the larger PIIGS

member such as Spain and Italy that always have better bailout

prospects anyway. However, growth might be difficult in the near

term as the country is still battling austerity measures, so make

sure to watch this fund closely if you decide to take on this

intriguing market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMU IDX (EZU): ETF Research Reports

GLBL-XF PORTG20 (PGAL): ETF Research Reports

VANGD-FTSE EUR (VGK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

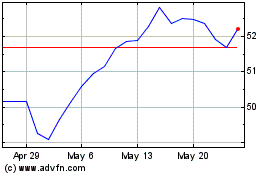

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From May 2024 to Jun 2024

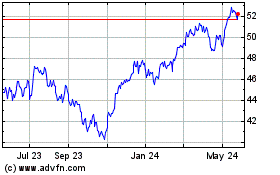

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Jun 2023 to Jun 2024