3 European ETFs Leading the Recovery - ETF News And Commentary

October 30 2013 - 10:00AM

Zacks

Unlike the fall of 2012, 2013 has seen a definite turnaround in the

European economy. The latest economic indicators for the region

signal that the economy is slowly picking up.

European consumer and business confidence are rising, indicating a

new era of growth for the continent. In fact, the confidence

indicator in September managed to maintain its upward trend, with a

two-year high set in August (Read: Play a Resurgent Europe with

These ETFs).

The economy is experiencing rising GDP forecasts for 2013 and 2014

as well. The economic outlook for France, Germany, Greece,

Portugal and Spain are improving. The re-election of Chancellor

Angela Merkel of Germany has also helped to restore political

stability in the region considering that Germany is the largest

economy in the EU.

The bailout packages by the International Monetary Fund (IMF) and

EU have saved the Grecian economy from deteriorating further. The

economy is approaching the close end of stabilization and 2014 is

expected to mark the first year of growth since 2007.

The government expects its economy to grow about 0.6% in 2014,

bringing the six-year darkness of recession to a gradual end (Read:

3 Cyclical ETFs for an Improving Economy).

Moreover, based on preliminary figures from the Bank of Spain, the

Spanish economy grew 0.1% during the third quarter. The positive

figure suggests a surprising end to the two-year recession, marking

the first quarterly growth in over two years.

Top Performers

Given these improving trends, there is a “feel-good factor “about

the European region. And this is further corroborated by the fact

that some of the worst performing markets have led the upswing this

past one month.

The surge in these markets is expected to continue at least for the

rest of the year and could be worth a look for investors keen to

bet on European investments heading into the end of 2013 (See all

the European Equity ETFs).

Below, we have highlighted the top three country ETFs from the

continent, which have been the star performers in the last four

weeks. Interestingly, these European ETFs have delivered

double-digit returns over the last one month, beating out the

S&P 500, as well as the broad European ETFs like

Vanguard FTSE Europe ETF (VGK) and

iShares

MSCI EMU ETF (EZU).

The Global X FTSE Greece 20 ETF

(GREK)

Surprisingly, the best performer among the European ETFs comes from

Greece. Investors can consider betting on the economy with

The Global X FTSE Greece 20 ETF (GREK). The fund

has gained around 22% over the last 4 weeks, suggesting that a

strong positive shift in Greece is at hand. (Read: Greece ETF on

the Rise, Can It Continue?).

The product tracks the FTSE/ATHEX Custom Capped Index and manages a

small asset base of $84.3 million. The ETF has heavy exposure to

the top three firms – Coca Cola HBC AG, Hellenic Telecom and Opap

S.A. – that collectively make up 30% of total assets. The fund

charges a fee of 65 basis points on an annual basis.

The product is also focused from a sector perspective, with

Consumer Defensive (20.44%), Consumer Cyclical (18.54%) and

Financial Services (15.15%) taking the three biggest spots. The

fund charges a fee of 69 basis points on an annual basis.

iShares MSCI Spain Capped ETF

(

EWP)

Spain can be played with EWP, an ETF that primarily invests in

large and mid-cap Spanish stocks. The fund has enriched investors’

portfolio with over 12% returns in the last one month, while adding

around 40% in the last one year.

This noteworthy performance has been driven by its holdings

breakdown, which is heavily skewed towards Financial Securities.

Two of its top three financial holdings – Banco Santander and BBVA

–account for 33% of its total assets.

The fund provides ample liquidity with an average volume of

approximately 0.6 million shares per day and charges investors a

decent fee of 52 basis points a year (see Why PIIGS ETFs Are

Outperforming)

.

iShares MSCI Italy Capped ETF

(EWI)

To target the market of Italy, investors can choose this ETF which

holds over two dozen Italian stocks and charges investors 52 basis

points annually.

The product is highly concentrated in its top ten holdings which

together make up around 64% of the fund assets, while its top pick

alone takes up 17.8% of the fund.

The fund is heavy on Financials (31.69%) and Energy (22.41%), while

sectors such as Utilities, Industrial and Consumer Discretionary

also have double-digit exposure in the fund.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-ITALY (EWI): ETF Research Reports

ISHARS-SPAIN (EWP): ETF Research Reports

ISHARS-EMU IDX (EZU): ETF Research Reports

GLBL-X/F GREC20 (GREK): ETF Research Reports

VANGD-FTSE EUR (VGK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

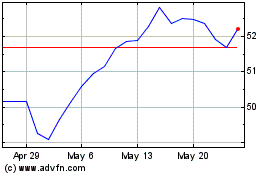

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From May 2024 to Jun 2024

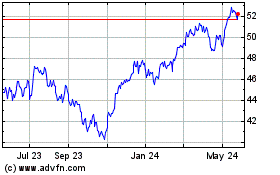

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Jun 2023 to Jun 2024