Play a Resurgent Europe with These ETFs - ETF News And Commentary

September 23 2013 - 8:02AM

Zacks

For years, investors were down on European investments, choosing

instead to focus on the domestic market for exposure. You can’t

blame anyone for this approach either, as the continent was

struggling with major issues regarding debt and even the very

health of the common currency.

Lately, however, Europe has been coming back and it has actually

seen some inflows as well. Investors are apparently embracing the

more positive trends in Europe and are willing to bet on the region

once more (also read 4 Outperforming ETFs Leading Europe

Higher).

After all, manufacturing sentiment and investor confidence are

rising, while stock prices have also been firm. The euro has also

seen good trading against the dollar, while the debt of the PIIGS

nations has seen their spreads collapse against safer nations,

signaling that investors aren’t as worried about risks in these

countries anymore.

How to Play

In this type of environment, a look to European ETFs may be an

intriguing idea. These have seen solid trading lately, and given

the tailwinds, could remain decent picks in the months ahead as

well. For investors intrigued by this idea, we have highlighted

some of our favorites in this space below:

First Trust Europe AlphaDEX Fund (FEP) –This ETF

is a broad choice for European exposure, using the AlphaDEX system

to select only the best stocks for inclusion. The portfolio is

quite spread out as well, as no single firm makes up more than

1.25% of the total assets (see all the European Equity ETFs).

WisdomTree Europe Small Cap Dividend ETF (DFE) –

If you are looking for a play that targets companies which are most

impacted by European events, consider this small cap product. The

fund also has a 3% 30-Day SEC yield and it is dividend weighted, so

income will definitely be a big part of this fund’s risk return

profile.

iShares MSCI United Kingdom Index Fund (EWU) – For

a single country play, investors may want to take a look at the UK

and EWU for exposure. The country is seeing growth—unlike some in

Europe—while its focus on financials, consumer staples, and energy

could be a winning strategy in today’s market environment (read Can

UK ETFs Continue to Rise?).

More Information

For more on Europe ETFs and the positive trends in the space, watch

our short video on the subject below:

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-EU SC D (DFE): ETF Research Reports

ISHARS-UTD KING (EWU): ETF Research Reports

ISHARS-EMU IDX (EZU): ETF Research Reports

FT-EUROPE AD (FEP): ETF Research Reports

VANGD-FTSE EUR (VGK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

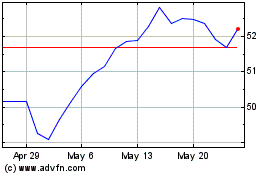

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From May 2024 to Jun 2024

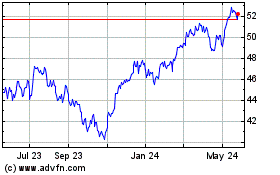

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Jun 2023 to Jun 2024