Cybex Announces Q1 Results; EPS $.04 vs $.01

April 25 2006 - 8:30AM

Business Wire

Cybex International, Inc. (AMEX: CYB), a leading exercise equipment

manufacturer, today reported results for the first quarter ended

April 1, 2006. Net sales for the first quarter 2006 were

$28,912,000, compared to $24,759,000 for the corresponding 2005

period, an increase of 17%. Net income for the quarter ended April

1, 2006 was $667,000, or $0.04 per diluted share, compared to net

income for the first quarter of 2005 of $119,000, or $0.01 per

diluted share. John Aglialoro, Chairman and CEO, stated, "Our first

quarter results are evidence of our progress and we are confident

that the continued sales growth of our existing products and a

solid pipeline of new products in 2006 and beyond will continue our

positive momentum. We were pleased with the reception of the new

VR3 and updated Eagle strength lines as well as our new light

commercial treadmill at the IHRSA trade show in March." Cybex

International, Inc. is a leading manufacturer of premium exercise

equipment for commercial and consumer use. The CYBEX product line

includes a full range of both strength training and cardio training

machines sold worldwide under the CYBEX brand. Products and

programs are designed and engineered to reflect the natural

movement of the human body, assisting each unique user - from the

professional athlete to the first-time exerciser - to improve daily

human performance. For more information on CYBEX and its product

line, please visit the Company's website at

www.cybexinternational.com. This news release may contain

forward-looking statements. There are a number of risks and

uncertainties that could cause actual results to differ materially

from those anticipated by the statements made above. These include,

but are not limited to, competitive factors, technological and

product developments, market demand, economic conditions, the

resolution of litigation involving the Company, completion of the

planned stock offering, and the ability of the Company to comply

with the terms of its credit facilities. Further information on

these and other factors which could affect the Company's financial

results can be found in the Company's previously filed Report on

Form 10-K, its Reports on Form 10-Q, its Current Reports on Form

8-K, and its proxy statement dated April 4, 2006. Financial Tables

to Follow -0- *T CYBEX INTERNATIONAL, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands, except per share data)

(unaudited) Three Months Ended -------------------------------

April 1, March 26, 2006 2005 ------------- -------------- Net sales

$ 28,912 $ 24,759 Cost of sales 18,361 15,904 --------------

--------------- Gross profit 10,551 8,855 As a percentage of sales

36.5% 35.8% Selling, general and administrative expenses 9,187

8,026 Bad debt expense 75 57 -------------- ---------------

Operating income 1,289 772 Interest expense, net 559 596

-------------- --------------- Income before income taxes 730 176

Income taxes 63 57 -------------- --------------- Net income $ 667

$ 119 ============== =============== Basic and diluted net income

per share $ 0.04 $ .01 ============== =============== Shares used

in computing basic net income per share 15,158 15,105

============== =============== Shares used in computing diluted net

income per share 15,847 15,724 ============== =============== CYBEX

INTERNATIONAL, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In

thousands) (unaudited) April 1, December 31, 2006 2005

------------- ------------- ASSETS Current assets: Cash $ 1,785 $

807 Accounts receivable, net 14,523 18,320 Inventories 9,477 9,258

Prepaid expenses and other 3,504 2,707 --------------

-------------- Total current assets 29,289 31,092 Property and

equipment, net 11,544 12,124 Goodwill 11,247 11,247 Other assets

1,026 1,209 -------------- -------------- $ 53,106 $ 55,672

============== ============== LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Current maturities of long-term debt $ 2,684 $

3,929 Current portion of capital leases 433 481 Accounts payable

5,500 5,918 Accrued expenses 15,659 16,286 --------------

-------------- Total current liabilities 24,276 26,614 Long-term

debt 9,059 9,730 Capital leases 252 332 Other liabilities 2,589

2,808 -------------- -------------- Total liabilities 36,176 39,484

Stockholders' equity 16,930 16,188 -------------- -------------- $

53,106 $ 55,672 ============== ============== *T

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Apr 2024 to May 2024

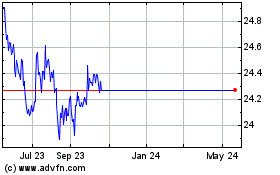

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From May 2023 to May 2024