Greene King 1,008 not out

01/15/2014

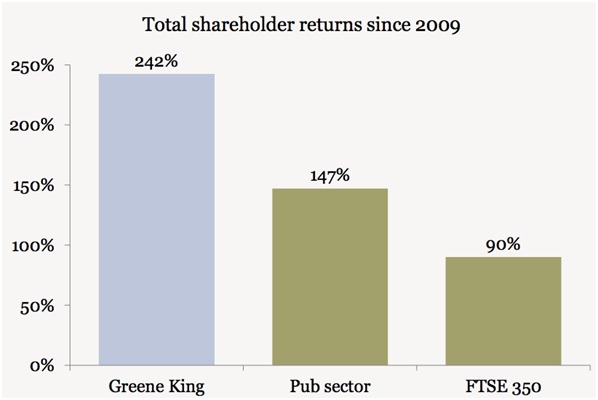

Greene King (LSE, GNK) is the biggest restaurant and pub group in the UK with a market capitalisation at £1.9bn. This is just ahead of Mitchells & Butlers (LSE, MAB) which has a market value of £1.68bn and a larger pub estate. Greene King has a higher price earnings ratio (P/E rating) than peers given a stronger operational performance and lower risk profile.

GNK’s results for the six months to 13th October showed stable margins and earnings per share (EPS) growth of 6.3% to 30.4p. A key factor in Greene King’s success is the company's fully owned, or retail, pubs and their focus. The number of retail pubs and restaurants is set to rise to 1,100, with the company in the fourth year of its five-year strategy.

Looking at the strategy progress so far and Greene King now has 1,008 retail pubs and restaurants which is close to the 1,100 target. In the first half of the financial year (13th October 2013) the average number of trading sites was 996.

This represents 3.3% growth on the 964 sites operating in the first half of the previous financial year. The target of 1,100 retail pubs reflects growth of 10% on the average number of retail pubs in the six months to September 2013.

First half financial results for Greene King saw revenue rise by 5.2% and operating profits rise by 3.7% as the operating margin fell slightly. However, profit before tax increased by 5.7% and earnings per share rose by 6.3%.

Profit before tax rose by more than operating profit as finance costs were flat on a year ago as net debt fell. Earnings per share rose at a faster rate than profits before tax as the tax rate in the UK was lower than last year.

Greene King showed its strength with like-for-like sales at retail pubs increasing by 3.5% in the first half. The group further states that “Christmas bookings are ahead of last year by 13%,” boding well for second half trading.

In the second half (six months to the end of April) the group is also targeting a further 20 new build pubs. The group notes that real incomes for UK consumers remain under pressure and as such “cautious.” However, the company also notes some positive signs to indicate the UK economy is picking up.

This report was produced by Senior Research Analyst, Andrew Latto.

|