P&G shifts pitch to appeal to millennials who 'don't know

what the product is for'

By Sharon Terlep

Procter & Gamble Co. has a fabric-softener problem.

Sales of the product -- an often sweetly scented liquid designed

to make clothes feel better after a wash -- have been declining for

more than a decade, hurt by improvements in modern washing machines

and laundry detergents, as well as heartier fabrics able to

withstand more washings without additives.

The Cincinnati consumer-products giant, which commands more than

half the $1.3 billion U.S. market for liquid softener with Downy

and Gain, says a new generation of shoppers, the coveted

millennials, have accelerated the decline. Shailesh Jejurikar,

P&G's head of global fabric care, told analysts recently that

most millennials "don't know what the product is for."

Fabric softener was popularized in the U.S. in the 1960s to

solve a common complaint that laundry emerged from washing machines

feeling rough and scratchy. But those complaints have been less

common following changes in detergents and washing machines that

have reduced the harshness of washing.

At the same time, popular athletic gear often comes with

instructions to avoid using softener because it can reduce the

ability of fabric to lift and trap moisture.

The result: U.S. liquid softener sales fell 15% between 2007 and

2015, with sales of P&G's market-leading Downy brand down 26%

in that period to $598 million, according to Euromonitor.

For P&G, the problem weighs on in its largest division,

fabric care, at a time when the company has been struggling to

offset slowing growth of its popular laundry pods. After years of

deep cost-cutting and scant growth, P&G is under pressure to

deliver sales gains.

P&G's organic sales -- a closely watched metric that strips

out currency moves, acquisitions and divestments -- have been

growing 1% to 3% annually for the last several years. In the years

leading up to the recession P&G's organic sales growth ranged

from 5% to double-digit gains.

Millennials and "eco-conscious" consumers are looking to limit

the amount of chemicals they use in their homes, dealing softeners

another blow, said Bibie Wu, vice president of fabric conditioning

for Germany's Henkel AG, which acquired Sun Products Corp., maker

of Snuggle fabric softener.

Some consumer and environmental advocates contend softener is

one of many household products that contains potentially unhealthy

chemicals. P&G and Sun maintain their products are safe. Downy

offers a softener free of dyes and perfumes, and Sun said scent-

and color-free products are a growing part of its portfolio.

Karen Repeckyj Vecchione, a 44-year-old mother of three from

Doylestown, Pa., stopped using liquid softeners and many other

household products after becoming pregnant with her first daughter

seven years ago. "I changed a lot of my cleaning substances then,"

she said. "I wanted her to have a good, toxin-free start to

life."

P&G views millennials as a prime target for increasing

softener sales because consumers in that age group are just

beginning to form their laundry habits, either because they are

living on their own for the first time, buying a first washing

machine or having children, said Nate Lawton, associate brand

director for P&G's North America fabric-care unit.

To that end, P&G changed the wording on its packaging last

year. It now refers to the product as "fabric conditioner," hoping

to draw a parallel to hair-conditioner as an integral part of many

hair-washing regimens. The company says liquid softener improves

longevity of clothes by protecting them in the wash, and makes

laundry look and smell better.

"Conditioning is the most intuitive and familiar way to talk

about this benefit for consumers," said Mr. Lawton.

P&G and its laundry-aisle rivals also are trying to fight

the downward slide with explanatory ad campaigns touting the

benefits of softener, which costs about $3 to $4 for a 50-ounce

bottle.

One recent Downy spot features footage from a GoPro video camera

inside a washing machine. A man's foreboding voice describes how

doing laundry "wreaks havoc" on clothes, "crushing them with 60

times the G-force of a rocket launch and baking them in a dryer

that can get hot enough to cook ribs."

It is a commercial designed for consumers like Nicholas Stephan,

a 26-year-old from Fort Wayne, Ind., who grew up using only

detergent. Frustrated that his clothes were getting worn out faster

than he could afford to replace them, Mr. Stephan recently went to

the store in search of a product that would help. After trying

dryer sheets and other items he realized he was buying the wrong

products. "It turns out I really needed fabric softener," Mr.

Stephan said.

Both P&G and Henkel said softener sales are responding to

the marketing push and have improved in recent months. That also is

because of new offerings such as so-called scent boosters -- small

beads that consumers put in washing machines to keep clothes

smelling clean longer. U.S. softener sales across all brands were

up 5% for the 12 months ended Oct. 1 compared with a year earlier,

according to Nielsen ratings.

To significantly boost sales, consumer-products companies should

focus on wooing more traditional customers, a feat that likely

would require profit-eroding discounts that P&G and rivals have

tried to move away from, said Kurt Jetta, CEO of TABS Analytics, a

retail- and consumer-analytics firm.

Still, Mr. Jetta says it will be hard to convince American

families to spend more on laundry. "Even if you are affluent or

have above-average income, it's an area where people are looking to

save money," he said.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

December 17, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

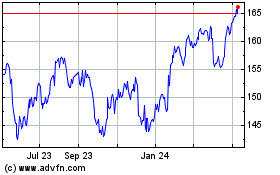

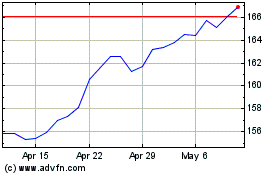

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Sep 2023 to Sep 2024