UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) January 28, 2016

_______________________

MERITAGE HOMES CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

| | | | | | |

|

| | | | | | |

Maryland | | 1-9977 | | 86-0611231 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 8800 E. Raintree Drive, Suite 300, Scottsdale, Arizona 85260 | |

| (Address of Principal Executive Offices) (Zip Code) | |

| | |

| (480) 515-8100 | |

| (Registrant’s telephone number, including area code) | |

| | |

| | |

| (Former Name or Former Address, if Changed Since Last Report) | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 28, 2016, we announced in a press release information concerning our results for the quarterly and annual period ended December 31, 2015. A copy of this press release, including information concerning forward-looking statements and factors that may affect our future results, is attached as Exhibit 99.1. This press release is being furnished, not filed, under Item 2.02 in this Report on Form 8-K.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

99.1 Press Release dated January 28, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 28, 2016

|

| |

MERITAGE HOMES CORPORATION |

| |

/s/ | Larry W. Seay |

By: | Larry W. Seay |

| Executive Vice President and Chief Financial Officer |

Exhibit 99.1

|

| | | | |

| | | | |

| | | Contacts: | Brent Anderson, VP Investor Relations |

| | | | (972) 580-6360 (office) |

| | | | investors@meritagehomes.com |

Meritage Homes reports fourth quarter 2015 results, including 23% order growth, 11% increase in home closing revenue and 6% increase in diluted EPS at $1.26

SCOTTSDALE, Ariz., January 28, 2016 - Meritage Homes Corporation (NYSE: MTH), a leading U.S. homebuilder, today announced fourth quarter and full year results for the periods ended December 31, 2015.

.

Summary Operating Results (unaudited)

(Dollars in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2015 | | 2014 | | %Chg | | 2015 | | 2014 | | %Chg |

Homes closed (units) | | 1,919 |

| | 1,863 |

| | 3 | % | | 6,522 |

| | 5,862 |

| | 11 | % |

Home closing revenue | | $ | 761,372 |

| | $ | 688,288 |

| | 11 | % | | $ | 2,531,556 |

| | $ | 2,142,391 |

| | 18 | % |

Average sales price - closings | | $ | 397 |

| | $ | 369 |

| | 8 | % | | $ | 388 |

| | $ | 365 |

| | 6 | % |

Home orders (units) | | 1,568 |

| | 1,272 |

| | 23 | % | | 7,100 |

| | 5,944 |

| | 19 | % |

Home order value | | $ | 634,181 |

| | $ | 490,999 |

| | 29 | % | | $ | 2,822,785 |

| | $ | 2,238,117 |

| | 26 | % |

Average sales price - orders | | $ | 404 |

| | $ | 386 |

| | 5 | % | | $ | 398 |

| | $ | 377 |

| | 6 | % |

Ending backlog (units) | | | | | | | | 2,692 |

| | 2,114 |

| | 27 | % |

Ending backlog value | | | | | | | | $ | 1,137,681 |

| | $ | 846,452 |

| | 34 | % |

Average sales price - backlog | |

|

| |

|

| |

| | $ | 423 |

| | $ | 400 |

| | 6 | % |

Net earnings | | $ | 52,897 |

| | $ | 49,208 |

| | 7 | % | | $ | 128,738 |

| | $ | 142,241 |

| | (9 | )% |

Diluted EPS | | $ | 1.26 |

| | $ | 1.19 |

| | 6 | % | | $ | 3.09 |

| | $ | 3.46 |

| | (11 | )% |

MANAGEMENT COMMENTS

“We finished the full year with double-digit growth over 2014 in closings, orders and backlog, with particularly strong performance in our east and west regions,” said Steven J. Hilton, chairman and chief executive officer of Meritage Homes. “Our full year orders benefited from significant growth in the fourth quarter -- including a 16% increase in Texas -- reflecting a higher absorption pace within most of our markets, in addition to more actively selling communities.

“We achieved a 15% increase over 2014 in our pretax earnings for the fourth quarter,” continued Mr. Hilton. “Our home closing revenue increased 11% as we closed more homes at higher average prices, which in turn provided greater overhead leverage and more than offset a lower gross margin on home closings. We also achieved a 100 basis point improvement in our percentage of selling, general and administrative expenses from cost controls, in addition to higher closing revenue.”

Mr. Hilton added, “With continued healthy market conditions as we’ve been experiencing in most of our divisions, we are confident in our prospects for 2016, especially considering that we entered the year with a backlog valued at over $1.1 billion -- 34% higher than it was a year ago.

“We currently anticipate closing between 7,000 and 7,500 homes in 2016 and growing our community count 5-10% by the end of the year,” concluded Mr. Hilton. “Furthermore, considering longer-term growth prospects for our industry, we believe our goal of delivering 10,000 homes in 2018 is achievable.”

FOURTH QUARTER RESULTS

| |

• | Net earnings increased 7% to $52.9 million ($1.26 per diluted share) for the fourth quarter of 2015, compared to prior year net earnings of $49.2 million ($1.19 per diluted share), primarily reflecting increased revenue and lower overhead expenses as a percentage of revenue, partially offset by lower home closing gross margin, higher interest expense and a higher effective tax rate. |

| |

• | Home closing revenue increased 11% due to a 3% increase in home closings, combined with an 8% increase in average price over the prior year period. The west region (California, Colorado and Arizona) grew home closing revenue by 27% over 2014, followed by the east region’s 18% increase (Florida, the Carolinas, Georgia and Tennessee), and a 14% decrease in the central region (Texas) due in part to the impact of lower oil prices on the Houston market. |

| |

• | Total value of homes ordered increased 29%, combining a 23% increase in orders with a 5% increase in average sales prices. Orders increased in every state but Colorado, where average community count was |

down 6%. Total order value was up across the board in the fourth quarter of 2015, including Texas, where orders and order value increased 16% and 29%, respectively, over the fourth quarter of 2014.

| |

• | Total active community count of 254 at year-end 2015 was 11% higher than 2014 year-end, with increases concentrated in the east and central regions, where the average actively selling communities were up 18% and 15% year-over-year in the fourth quarter, respectively. Average orders per community also increased 11% to 6.2 in the fourth quarter of 2015 from 5.6 in the fourth quarter of 2014. |

| |

• | Order cancellation rate decreased to 12% in the fourth quarter of 2015 from 17% in the fourth quarter of 2014, reflecting buyer confidence and rising home values. |

| |

• | Home closing gross profit increased 5% over the prior year due to higher home closing revenue, partially offset by a decline in home closing gross margin. Fourth quarter 2015 home closing margin was 19.3% compared to 20.3% in the fourth quarter of 2014, due to increases in land prices and overall construction costs exceeding home price appreciation during 2015. |

| |

• | Commissions and other sales costs decreased 20 basis points from the prior year to 7.0% of home closing revenue, benefitting from higher closing revenue and tighter cost controls in the fourth quarter of 2015, compared to 7.2% of home closing revenue in the fourth quarter of 2014. |

| |

• | General and administrative expenses decreased by 80 basis points to 3.4% of total closing revenue in the fourth quarter of 2015, compared to 4.2% of total closing revenue in the previous year, reflecting greater leverage from higher closing revenue and various cost reductions. |

| |

• | Interest expense increased to $4.0 million or 0.5% of total closing revenue in the fourth quarter of 2015, compared to $0.6 million or 0.1% of total closing revenue in the fourth quarter of 2014, mainly due to higher long-term debt balances in 2015. |

| |

• | Earnings before income taxes increased 15% to $76.1 million in the fourth quarter of 2015 compared to $66.4 million in the fourth quarter of 2014, equating to pretax margins of 9.7% in 2015 and 9.5% in 2014. The effective tax rate increased to 30% in the fourth quarter of 2015 from 26% in 2014. |

FULL YEAR RESULTS

| |

• | Net income for the full year decreased 9% to $128.7 million in 2015 compared to $142.2 million in 2014 as higher revenue was offset by a lower gross margin on home closings, $2.9 million of incremental real estate related impairments compared to 2014, and a $4.1 million litigation-related charge in the third quarter of 2015. |

| |

• | Home closings and closing revenue increased 11% and 18%, respectively, for 2015 over 2014, led by higher volumes and average prices in the east region, which grew home closing revenue 45% in 2015, followed by 13% and 3% increases in the west and central (Texas) regions, respectively. |

| |

• | Full year home closing gross margin of 19.0% compared to 21.2% in 2014 reflects price inflation in both land and construction costs, which was only partially offset by home price increases. Gross margin was also reduced by $6.6 million of real estate related impairments in 2015, compared to $3.7 million in 2014. |

| |

• | Despite lower gross margin, home closing profits increased 6% over 2014 on higher closing revenue in 2015. |

| |

• | Financial services profit increased 19% in 2015 to $19.3 million from $16.2 million in 2014. |

| |

• | Net orders for the year increased 19% in 2015 over 2014, and total order value increased 26% year over year, aided by a 6% increase in average sales prices in addition to a full year of orders from Legendary Communities, acquired in August 2014. |

| |

• | The total value of orders in backlog at year-end 2015 was 34% higher than the prior year’s ending backlog, reflecting a 27% increase in units in backlog coupled with a 6% increase in average price. |

BALANCE SHEET

| |

• | Cash and cash equivalents at December 31, 2015, totaled $262.2 million, compared to $103.3 million at December 31, 2014, reflecting the issuance of $200 million of new senior notes in early June 2015, a portion of which was deployed during the year to fund the company’s growth. |

| |

• | Real estate assets increased by $220.6 million during the year, ending at $2.1 billion at December 31, 2015. Approximately 58% of that increase was attributable to additional work-in-process inventory for homes in backlog that were under construction. The company invested a total of approximately $709 million in land and development during 2015, less than originally planned due to high land prices in the west, slowing in the Houston market and repositioning of assets in the east. |

| |

• | Meritage ended the year 2015 with approximately 27,800 total lots under control, compared to approximately 30,300 total lots at December 31, 2014, representing 4.3 and 5.2 years’ supply of lots, respectively, based on trailing twelve months’ closings. Much of the reduction was due to strategic sales of excess assets in certain markets, as well as the termination of certain lot purchase options in southeastern markets. |

| |

• | Net debt-to-capital ratio at December 31, 2015 decreased to 40.7% from 42.9% at December 31, 2014. |

CONFERENCE CALL

Management will host a conference call today to discuss the Company's results at 1:00 p.m. Eastern Time (11:00 a.m. Arizona Time). The call will be webcast with an accompanying slideshow available on the "Investor Relations" page of the Company's web site at http://investors.meritagehomes.com. Telephone participants may avoid any delays by pre-registering for the call using the following link to receive a special dial-in number and PIN.

Conference Call registration link: http://dpregister.com/10078808.

Telephone participants who are unable to pre-register may dial in to 866-226-4948 on the day of the call. International dial-in number is 1-412-902-4125 or 1-855-669-9657 for Canada.

A replay of the call will be available until February 15, beginning at 2:00 p.m. ET on January 29, 2016 on the website noted above, or by dialing 877-344-7529, 1-412-317-0088 for international or 1-855-669-9658 for Canada, and referencing conference number 10078808.

For more information, visit www.meritagehomes.com.

Meritage Homes Corporation and Subsidiaries

Consolidated Income Statements

(Unaudited)

(In thousands, except per share data)

|

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | | 2015 | | 2014 | | 2015 | | 2014 |

Homebuilding: | | | | | | | | |

| Home closing revenue | | $ | 761,372 |

| | $ | 688,288 |

| | $ | 2,531,556 |

| | $ | 2,142,391 |

|

| Land closing revenue | | 20,241 |

| | 10,630 |

| | 36,526 |

| | 27,252 |

|

| Total closing revenue | | 781,613 |

| | 698,918 |

| | 2,568,082 |

| | 2,169,643 |

|

| Cost of home closings | | (614,794 | ) | | (548,371 | ) | | (2,049,637 | ) | | (1,688,676 | ) |

| Cost of land closings | | (14,744 | ) | | (10,266 | ) | | (29,736 | ) | | (28,350 | ) |

| Total cost of closings | | (629,538 | ) | | (558,637 | ) | | (2,079,373 | ) | | (1,717,026 | ) |

| Home closing gross profit | | 146,578 |

| | 139,917 |

| | 481,919 |

| | 453,715 |

|

| Land closing gross profit/(loss) | | 5,497 |

| | 364 |

| | 6,790 |

| | (1,098 | ) |

| Total closing gross profit | | 152,075 |

| | 140,281 |

| | 488,709 |

| | 452,617 |

|

Financial Services: | | | | | | | | |

| Revenue | | 3,101 |

| | 3,022 |

| | 11,377 |

| | 10,121 |

|

| Expense | | (1,289 | ) | | (1,368 | ) | | (5,203 | ) | | (4,812 | ) |

| Earnings from financial services unconsolidated entities and other, net | | 3,942 |

| | 3,588 |

| | 13,097 |

| | 10,869 |

|

| Financial services profit | | 5,754 |

| | 5,242 |

| | 19,271 |

| | 16,178 |

|

Commissions and other sales costs | | (53,542 | ) | | (49,492 | ) | | (188,418 | ) | | (156,742 | ) |

General and administrative expenses | | (26,775 | ) | | (29,138 | ) | | (112,849 | ) | | (104,598 | ) |

Income/(loss) from other unconsolidated entities, net | | 77 |

| | (83 | ) | | (338 | ) | | (447 | ) |

Interest expense | | (4,003 | ) | | (594 | ) | | (15,965 | ) | | (5,163 | ) |

Other income/(loss), net | | 2,499 |

| | 177 |

| | (946 | ) | | 6,572 |

|

Earnings before income taxes | | 76,085 |

| | 66,393 |

| | 189,464 |

| | 208,417 |

|

Provision for income taxes | | (23,188 | ) | | (17,185 | ) | | (60,726 | ) | | (66,176 | ) |

Net earnings | | $ | 52,897 |

| | $ | 49,208 |

| | $ | 128,738 |

| | $ | 142,241 |

|

| | | | | | | | |

Earnings per share: | | | | | | | | |

| Basic | | | | | | | | |

| Earnings per share | | $ | 1.33 |

| | $ | 1.26 |

| | $ | 3.25 |

| | $ | 3.65 |

|

| Weighted average shares outstanding | | 39,667 |

| | 39,133 |

| | 39,593 |

| | 39,017 |

|

| Diluted | | | | | | | | |

| Earnings per share | | $ | 1.26 |

| | $ | 1.19 |

| | $ | 3.09 |

| | $ | 3.46 |

|

| Weighted average shares outstanding | | 42,214 |

| | 41,696 |

| | 42,164 |

| | 41,614 |

|

Meritage Homes Corporation and Subsidiaries

Consolidated Balance Sheets

(In thousands)

(unaudited)

|

| | | | | | | | |

| | December 31, 2015 | | December 31, 2014 |

Assets: | | | | |

Cash and cash equivalents | | $ | 262,208 |

| | $ | 103,333 |

|

Other receivables | | 57,296 |

| | 56,763 |

|

Real estate (1) | | 2,098,302 |

| | 1,877,682 |

|

Real estate not owned | | — |

| | 4,999 |

|

Deposits on real estate under option or contract | | 87,839 |

| | 94,989 |

|

Investments in unconsolidated entities | | 11,370 |

| | 10,780 |

|

Property and equipment, net | | 33,970 |

| | 32,403 |

|

Deferred tax asset | | 59,147 |

| | 64,137 |

|

Prepaids, other assets and goodwill | | 80,390 |

| | 71,052 |

|

Total assets | | $ | 2,690,522 |

| | $ | 2,316,138 |

|

Liabilities: | | | | |

Accounts payable | | $ | 106,440 |

| | $ | 83,619 |

|

Accrued liabilities | | 161,163 |

| | 154,144 |

|

Home sale deposits | | 36,197 |

| | 29,379 |

|

Liabilities related to real estate not owned | | — |

| | 4,299 |

|

Loans payable and other borrowings | | 23,867 |

| | 30,722 |

|

Senior and convertible senior notes | | 1,103,918 |

| | 904,486 |

|

Total liabilities | | 1,431,585 |

| | 1,206,649 |

|

Stockholders' Equity: | | | | |

Preferred stock | | — |

| | — |

|

Common stock | | 397 |

| | 391 |

|

Additional paid-in capital | | 559,492 |

| | 538,788 |

|

Retained earnings | | 699,048 |

| | 570,310 |

|

Total stockholders’ equity | | 1,258,937 |

| | 1,109,489 |

|

Total liabilities and stockholders’ equity | | $ | 2,690,522 |

| | $ | 2,316,138 |

|

(1) Real estate – Allocated costs: | | | | |

Homes under contract under construction | | $ | 456,138 |

| | $ | 328,931 |

|

Unsold homes, completed and under construction | | 307,425 |

| | 302,288 |

|

Model homes | | 138,546 |

| | 109,614 |

|

Finished home sites and home sites under development | | 1,196,193 |

| | 1,136,849 |

|

Total real estate | | $ | 2,098,302 |

| | $ | 1,877,682 |

|

Supplemental Information and Non-GAAP Financial Disclosures (Dollars in thousands – unaudited):

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Depreciation and amortization | $ | 3,947 |

| | $ | 3,460 |

| | $ | 14,241 |

| | $ | 11,614 |

|

| | | | | | | |

Summary of Capitalized Interest: | | | | | | | |

Capitalized interest, beginning of period | $ | 61,396 |

| | $ | 50,455 |

| | $ | 54,060 |

| | $ | 32,992 |

|

Interest incurred | 17,877 |

| | 15,041 |

| | 67,542 |

| | 58,374 |

|

Interest expensed | (4,003 | ) | | (594 | ) | | (15,965 | ) | | (5,163 | ) |

Interest amortized to cost of home and land closings | (14,068 | ) | | (10,842 | ) | | (44,435 | ) | | (32,143 | ) |

Capitalized interest, end of period | $ | 61,202 |

| | $ | 54,060 |

| | $ | 61,202 |

| | $ | 54,060 |

|

| | | | | | | |

| December 31, 2015 | | December 31, 2014 | | | | |

Notes payable and other borrowings | $ | 1,127,785 |

| | $ | 935,208 |

| | | | |

Stockholders' equity | 1,258,937 |

| | 1,109,489 |

| | | | |

Total capital | 2,386,722 |

| | 2,044,697 |

| | | | |

Debt-to-capital | 47.3 | % | | 45.7 | % | | | | |

| | | | | | | |

Notes payable and other borrowings | $ | 1,127,785 |

| | $ | 935,208 |

| | | | |

Less: cash and cash equivalents | (262,208 | ) | | (103,333 | ) | | | | |

Net debt | 865,577 |

| | 831,875 |

| | | | |

Stockholders’ equity | 1,258,937 |

| | 1,109,489 |

| | | | |

Total net capital | $ | 2,124,514 |

| | $ | 1,941,364 |

| | | | |

Net debt-to-capital | 40.7 | % | | 42.9 | % | | | |

|

Meritage Homes Corporation and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands) (unaudited) |

| | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2015 | | 2014 |

Cash flows from operating activities: | | | | |

Net earnings | | $ | 128,738 |

| | $ | 142,241 |

|

Adjustments to reconcile net earnings to net cash used in operating activities: | | | | |

Depreciation and amortization | | 14,241 |

| | 11,614 |

|

Stock-based compensation | | 15,781 |

| | 12,211 |

|

Excess income tax benefit from stock-based awards | | (2,043 | ) | | (2,297 | ) |

Equity in earnings from unconsolidated entities | | (12,759 | ) | | (10,422 | ) |

Distribution of earnings from unconsolidated entities | | 12,650 |

| | 11,613 |

|

Other | | 11,530 |

| | 10,149 |

|

Changes in assets and liabilities: | | | | |

Increase in real estate | | (209,407 | ) | | (338,594 | ) |

Decrease/(Increase) in deposits on real estate under option or contract | | 6,316 |

| | (42,278 | ) |

Increase in receivables, prepaids and other assets | | (7,083 | ) | | (25,032 | ) |

Increase in accounts payable and accrued liabilities | | 31,883 |

| | 14,688 |

|

Increase in home sale deposits | | 6,818 |

| | 4,859 |

|

Net cash used in operating activities | | (3,335 | ) | | (211,248 | ) |

Cash flows from investing activities: | | | | |

Investments in unconsolidated entities | | (481 | ) | | (515 | ) |

Distributions of capital from unconsolidated entities | | — |

| | 65 |

|

Purchases of property and equipment | | (16,092 | ) | | (20,788 | ) |

Proceeds from sales of property and equipment | | 86 |

| | 262 |

|

Maturities/sales of investments and securities | | 1,555 |

| | 124,599 |

|

Payments to purchase investments and securities | | (1,555 | ) | | (35,813 | ) |

Cash paid for acquisitions | | — |

| | (130,677 | ) |

Net cash used in by investing activities | | (16,487 | ) | | (62,867 | ) |

Cash flows from financing activities: | | | | |

Repayment of loans payable and other borrowings | | (23,226 | ) | | (10,447 | ) |

Proceeds from issuance of senior notes | | 200,000 |

| | — |

|

Proceeds from issuance of common stock, net | | — |

| | 110,420 |

|

Debt issuance costs | | (3,006 | ) | | — |

|

Excess income tax benefit from stock-based awards | | 2,043 |

| | 2,297 |

|

Proceeds from stock option exercises | | 2,886 |

| | 1,042 |

|

Net cash provided by financing activities | | 178,697 |

| | 103,312 |

|

Net increase/(decrease) in cash and cash equivalents | | 158,875 |

| | (170,803 | ) |

Beginning cash and cash equivalents | | 103,333 |

| | 274,136 |

|

Ending cash and cash equivalents | | $ | 262,208 |

| | $ | 103,333 |

|

Meritage Homes Corporation and Subsidiaries

Operating Data

(Dollars in thousands)

(unaudited)

|

| | | | | | | | | | | | | | |

| | | | | | | | |

| | Three Months Ended |

| | December 31, 2015 | | December 31, 2014 |

| | Homes | | Value | | Homes | | Value |

Homes Closed: | | | | | | | | |

Arizona | | 291 |

| | $ | 98,004 |

| | 225 |

| | $ | 73,101 |

|

California | | 323 |

| | 175,601 |

| | 239 |

| | 122,851 |

|

Colorado | | 131 |

| | 57,211 |

| | 146 |

| | 64,696 |

|

West Region | | 745 |

| | 330,816 |

| | 610 |

| | 260,648 |

|

Texas | | 559 |

| | 194,879 |

| | 713 |

| | 227,342 |

|

Central Region | | 559 |

| | 194,879 |

| | 713 |

| | 227,342 |

|

Florida | | 254 |

| | 106,520 |

| | 217 |

| | 87,503 |

|

Georgia | | 72 |

| | 23,735 |

| | 53 |

| | 17,734 |

|

North Carolina | | 162 |

| | 66,921 |

| | 138 |

| | 55,870 |

|

South Carolina | | 83 |

| | 24,217 |

| | 75 |

| | 24,747 |

|

Tennessee | | 44 |

| | 14,284 |

| | 57 |

| | 14,444 |

|

East Region | | 615 |

| | 235,677 |

| | 540 |

| | 200,298 |

|

Total | | 1,919 |

| | $ | 761,372 |

| | 1,863 |

| | $ | 688,288 |

|

Homes Ordered: | | | | | | | | |

Arizona | | 253 |

| | $ | 86,887 |

| | 173 |

| | $ | 55,489 |

|

California | | 215 |

| | 118,370 |

| | 173 |

| | 96,335 |

|

Colorado | | 105 |

| | 51,033 |

| | 113 |

| | 49,958 |

|

West Region | | 573 |

| | 256,290 |

| | 459 |

| | 201,782 |

|

Texas | | 465 |

| | 171,938 |

| | 401 |

| | 133,282 |

|

Central Region | | 465 |

| | 171,938 |

| | 401 |

| | 133,282 |

|

Florida | | 200 |

| | 80,929 |

| | 168 |

| | 71,692 |

|

Georgia | | 73 |

| | 25,704 |

| | 41 |

| | 12,996 |

|

North Carolina | | 159 |

| | 67,492 |

| | 127 |

| | 46,900 |

|

South Carolina | | 65 |

| | 20,071 |

| | 55 |

| | 18,952 |

|

Tennessee | | 33 |

| | 11,757 |

| | 21 |

| | 5,395 |

|

East Region | | 530 |

| | 205,953 |

| | 412 |

| | 155,935 |

|

Total | | 1,568 |

| | $ | 634,181 |

| | 1,272 |

| | $ | 490,999 |

|

Meritage Homes Corporation and Subsidiaries

Operating Data

(Dollars in thousands)

(unaudited) |

| | | | | | | | | | | | | | |

| | Twelve Months Ended |

| | December 31, 2015 | | December 31, 2014 |

| | Homes | | Value | | Homes | | Value |

Homes Closed: | | | | | | | | |

Arizona | | 1,008 |

| | $ | 325,371 |

| | 924 |

| | $ | 307,282 |

|

California | | 888 |

| | 478,174 |

| | 785 |

| | 395,105 |

|

Colorado | | 495 |

| | 224,125 |

| | 464 |

| | 206,702 |

|

West Region | | 2,391 |

| | 1,027,670 |

| | 2,173 |

| | 909,089 |

|

Texas | | 2,025 |

| | 705,318 |

| | 2,224 |

| | 683,717 |

|

Central Region | | 2,025 |

| | 705,318 |

| | 2,224 |

| | 683,717 |

|

Florida | | 843 |

| | 361,127 |

| | 699 |

| | 277,045 |

|

Georgia | | 228 |

| | 72,913 |

| | 90 |

| | 29,633 |

|

North Carolina | | 551 |

| | 215,642 |

| | 386 |

| | 157,989 |

|

South Carolina | | 330 |

| | 101,847 |

| | 112 |

| | 36,241 |

|

Tennessee | | 154 |

| | 47,039 |

| | 178 |

| | 48,677 |

|

East Region | | 2,106 |

| | 798,568 |

| | 1,465 |

| | 549,585 |

|

Total | | 6,522 |

| | $ | 2,531,556 |

| | 5,862 |

| | $ | 2,142,391 |

|

Homes Ordered: | | | | | | | | |

Arizona | | 1,133 |

| | $ | 377,059 |

| | 838 |

| | $ | 276,261 |

|

California | | 965 |

| | 538,357 |

| | 772 |

| | 411,605 |

|

Colorado | | 559 |

| | 264,643 |

| | 530 |

| | 235,951 |

|

West Region | | 2,657 |

| | 1,180,059 |

| | 2,140 |

| | 923,817 |

|

Texas | | 2,109 |

| | 746,471 |

| | 2,290 |

| | 747,103 |

|

Central Region | | 2,109 |

| | 746,471 |

| | 2,290 |

| | 747,103 |

|

Florida | | 893 |

| | 376,563 |

| | 728 |

| | 290,343 |

|

Georgia | | 270 |

| | 89,755 |

| | 72 |

| | 22,443 |

|

North Carolina | | 626 |

| | 258,952 |

| | 438 |

| | 171,843 |

|

South Carolina | | 348 |

| | 105,838 |

| | 99 |

| | 33,177 |

|

Tennessee | | 197 |

| | 65,147 |

| | 177 |

| | 49,391 |

|

East Region | | 2,334 |

| | 896,255 |

| | 1,514 |

| | 567,197 |

|

Total | | 7,100 |

| | $ | 2,822,785 |

| | 5,944 |

| | $ | 2,238,117 |

|

| | | | | | | | |

Order Backlog: | | | | | | | | |

Arizona | | 317 |

| | $ | 117,906 |

| | 192 |

| | $ | 66,218 |

|

California | | 289 |

| | 184,146 |

| | 212 |

| | 123,963 |

|

Colorado | | 332 |

| | 162,151 |

| | 268 |

| | 121,633 |

|

West Region | | 938 |

| | 464,203 |

| | 672 |

| | 311,814 |

|

Texas | | 942 |

| | 350,194 |

| | 858 |

| | 309,041 |

|

Central Region | | 942 |

| | 350,194 |

| | 858 |

| | 309,041 |

|

Florida | | 287 |

| | 118,006 |

| | 237 |

| | 102,570 |

|

Georgia | | 95 |

| | 33,426 |

| | 53 |

| | 16,584 |

|

North Carolina | | 260 |

| | 111,478 |

| | 185 |

| | 68,168 |

|

South Carolina | | 88 |

| | 30,111 |

| | 70 |

| | 26,120 |

|

Tennessee | | 82 |

| | 30,263 |

| | 39 |

| | 12,155 |

|

East Region | | 812 |

| | 323,284 |

| | 584 |

| | 225,597 |

|

Total | | 2,692 |

| | $ | 1,137,681 |

| | 2,114 |

| | $ | 846,452 |

|

Meritage Homes Corporation and Subsidiaries

Operating Data

(unaudited)

|

| | | | | | | | | | | | |

| | | | | | | | |

| | Three Months Ended |

| | December 31, 2015 | | December 31, 2014 |

| | Ending | | Average | | Ending | | Average |

Active Communities: | | | | | | | | |

Arizona | | 41 |

| | 41.0 |

| | 41 |

| | 41.5 |

|

California | | 24 |

| | 25.0 |

| | 24 |

| | 23.0 |

|

Colorado | | 16 |

| | 15.5 |

| | 17 |

| | 16.5 |

|

West Region | | 81 |

| | 81.5 |

| | 82 |

| | 81.0 |

|

Texas | | 72 |

| | 71.0 |

| | 59 |

| | 62.0 |

|

Central Region | | 72 |

| | 71.0 |

| | 59 |

| | 62.0 |

|

Florida | | 31 |

| | 31.0 |

| | 29 |

| | 27.5 |

|

Georgia | | 17 |

| | 17.0 |

| | 13 |

| | 12.0 |

|

North Carolina | | 26 |

| | 25.5 |

| | 21 |

| | 20.5 |

|

South Carolina | | 18 |

| | 17.5 |

| | 20 |

| | 19.5 |

|

Tennessee | | 9 |

| | 8.5 |

| | 5 |

| | 4.5 |

|

East Region | | 101 |

| | 99.5 |

| | 88 |

| | 84.0 |

|

Total | | 254 |

| | 252.0 |

| | 229 |

| | 227.0 |

|

|

| | | | | | | | | | | | |

| | Twelve Months Ended |

| | December 31, 2015 | | December 31, 2014 |

| | Ending | | Average | | Ending | | Average |

Active Communities: | | | | | | | | |

Arizona | | 41 |

| | 41.0 |

| | 41 |

| | 40.5 |

|

California | | 24 |

| | 24.0 |

| | 24 |

| | 23.0 |

|

Colorado | | 16 |

| | 16.5 |

| | 17 |

| | 15.5 |

|

West Region | | 81 |

| | 81.5 |

| | 82 |

| | 79.0 |

|

Texas | | 72 |

| | 65.5 |

| | 59 |

| | 64.5 |

|

Central Region | | 72 |

| | 65.5 |

| | 59 |

| | 64.5 |

|

Florida | | 31 |

| | 30.0 |

| | 29 |

| | 24.5 |

|

Georgia | | 17 |

| | 15.0 |

| | 13 |

| | 6.5 |

|

North Carolina | | 26 |

| | 23.5 |

| | 21 |

| | 19.0 |

|

South Carolina | | 18 |

| | 19.0 |

| | 20 |

| | 10.0 |

|

Tennessee | | 9 |

| | 7.0 |

| | 5 |

| | 5.0 |

|

East Region | | 101 |

| | 94.5 |

| | 88 |

| | 65.0 |

|

Total | | 254 |

| | 241.5 |

| | 229 |

| | 208.5 |

|

About Meritage Homes Corporation

Meritage Homes is the seventh-largest public homebuilder in the United States, based on homes closed in 2014. Meritage builds and sells single-family homes for first-time, move-up, luxury and active adult buyers across the Western, Southern and Southeastern United States. Meritage builds in markets including Sacramento, San Francisco Bay area, southern coastal and Inland Empire markets in California; Houston, Dallas-Ft. Worth, Austin and San Antonio, Texas; Phoenix/Scottsdale, Green Valley and Tucson, Arizona; Denver and Fort Collins, Colorado; Orlando and Tampa, Florida; Raleigh and Charlotte, North Carolina; Greenville-Spartanburg and York County, South Carolina; Nashville, Tennessee and Atlanta, Georgia.

Meritage has designed and built more than 90,000 homes in its 30-year history, and has a reputation for its distinctive style, quality construction, and positive customer experience. Meritage is the industry leader in energy-efficient homebuilding and has received the U.S. Environmental Protection Agency's ENERGY STAR Partner of the Year for Sustained Excellence Award in 2013, 2014 and 2015, for innovation and industry leadership in energy efficient homebuilding.

For more information, visit investors.meritagehomes.com.

This press release and the accompanying comments during our analyst call contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include management's belief about its prospects for 2016 and beyond, including that the Company will achieve better results in the east region, expectations with respect to community count and closings for 2016, as well as its goal for 2018 deliveries (closings).

Such statements are based upon the current beliefs and expectations of Company management, and current market conditions, which are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. The Company makes no commitment, and disclaims any duty, to update or revise any forward-looking statements to reflect future events or changes in these expectations. Meritage's business is subject to a number of risks and uncertainties. As a result of those risks and uncertainties, the Company's stock and note prices may fluctuate dramatically. These risks and uncertainties include, but are not limited to, the following: the availability of finished lots and undeveloped land; interest rates and changes in the availability and pricing of residential mortgages; fluctuations in the availability and cost of labor; changes in tax laws that adversely impact us or our homebuyers; the ability of our potential buyers to sell their existing homes; cancellation rates; fluctuations in home prices in our markets; weakness in the homebuilding market resulting from

a setback in the current economic recovery due to lower energy prices or other factors; inflation in the cost of materials used to develop communities and construct homes; the adverse effect of slower order absorption rates; a change to the feasibility of projects under option or contract that could result in the write-down or write-off of option deposits; our ability to successfully integrate acquired companies and achieve anticipated benefits from these acquisitions; our potential exposure to natural disasters or severe weather conditions; competition; construction defect and home warranty claims; adverse legal rulings; our success in prevailing on contested tax positions; our ability to obtain performance bonds in connection with our development work; the loss of key personnel; changes in, or our failure to comply with, laws and regulations; limitations of our geographic diversification; fluctuations in quarterly operating results; our financial leverage and level of indebtedness; our ability to take certain actions because of restrictions contained in the indentures for our senior notes; our ability to raise additional capital when and if needed; our credit ratings; our compliance with government regulations and the effect of legislative or other initiatives that seek to restrain growth of new housing construction or similar measures; expiration or non-renewal of current or anticipated tax credits available to us; acts of war; the replication of our "Green" technologies by our competitors; our exposure to information technology failures and security breaches; and other factors identified in documents filed by the company with the Securities and Exchange Commission, including those set forth in our Form 10-K for the year ended December 31, 2014 and subsequent quarterly reports on Forms 10-Q under the caption "Risk Factors," which can be found on our website.

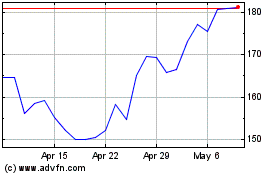

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2024 to May 2024

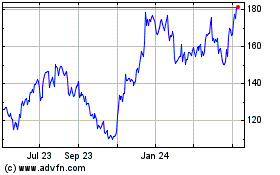

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From May 2023 to May 2024