I wrote a strong buy note on Aquarius Platinum (LSE:AQP)on Christmas Eve urging investors to buy at 55p. Well ho, ho, ho and a Merry Christmas to you all. I hope that you filled your stockings. I mean boots with that hot share tip. The shares are now 71.75p Why? Thank Anglo American (LSE:AAL) which today announced that it was mothballing some of its platinum output. The platinum price has already rallied strongly since Christmas ( ho, ho, ho once again) and this news is very positive indeed.

To read that buy tip and my analysis of the Aquarius metrics click here.

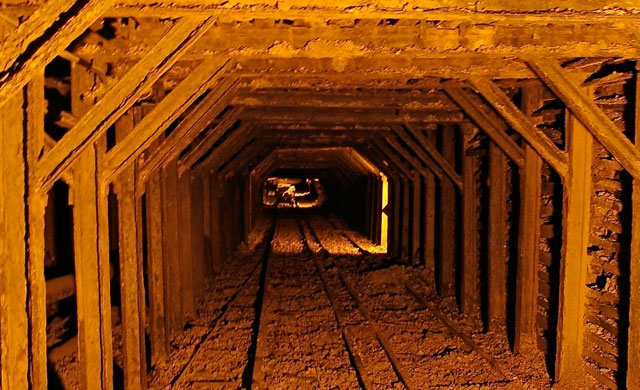

Anglo’s 79.8% owned Anglo Plats subsidiary has announced that four shafts are to be mothballed at the Rustenburg Platinum mine on the Bushveld of South Africa, with the Union mine nearby to be flogged off to anyone interested. The planned 400,000 ounce per annum (oz pa) reduction in production to 2.1-2.3 million ounces is also supportive for the platinum price, as the market was only expecting 200,000 oz per annum.

Of course Aquarius has also mothballed two if its smaller high cost mines and this is an industry trend. Even at PGM prices of a month ago Aquarius was delivering an EBITDA of $15-20 million but it has clear operational gearing.

At 71.75p the company is valued at £338 million. The company has cash or cash equivalents of £170 million. But the operational gearing is huge. At “normal” PGM prices which – thanks to Anglo – we are heading back to this company trades on an EV/EBITDA multiple even today of less than two. The shares are still cheap.

Tom Winnifrith served up 241 tips over 12 years while at t1ps.com which he founded in 2000. He and senior writer Steve Moore left that publication last Autumn and now run the Nifty Fifty premium share advice service. For more details on that click here

Tom can be followed on twitter @tomwinnifrith

Hot Features

Hot Features

Very interesting, Platinum looks like a good investment, baring political risks in South Africa. How does it compare with Jubilee Platinum? That seems to be cheap for its assets and is cutting political risk with an Australian tie up.