Donna Karan Label Sold To U.S. Apparel Firm G-III -- WSJ

July 26 2016 - 3:04AM

Dow Jones News

By Saabira Chaudhuri

LVMH Moët Hennessy Louis Vuitton SE agreed to sell Donna Karan

International Inc. to apparel company G-III Apparel Group Ltd. for

$650 million including debt, an unusual retreat for the French

luxury giant.

The Donna Karan and DKNY lines delivered lackluster growth for

years amid stiff competition and capped investment from LVMH, which

focused more on its eponymous brand, Céline and other labels it saw

as being higher potential.

About two years ago LVMH decided to restructure Donna Karan,

cutting costs and simplifying the branding. During its latest

effort at the end 2015, the French company pulled lines like DK

Jeans and DKNYC in a bid to focus on the brand's core collections.

The Donna Karan line has remained suspended since last summer when

the brand's eponymous founder resigned.

In an interview, LVMH Fashion Group Chairman Pierre-Yves Roussel

said the moves had begun to pay off, but that energizing the DKNY

brand was a journey that would have taken time.

When G-III Chief Executive Morris Goldfarb expressed interest in

buying Donna Karan about six weeks ago, LVMH decided to sell, its

first divestiture of a big brand since 2005. LVMH and New

York-based G-III didn't break out details of the price tag, giving

only the $650 million "enterprise value."

"We knew the potential for reenergizing the brand would be

around a business model that is probably more suited for G-III than

for us," said Mr. Roussel. He said DKNY was slated for broader,

wholesale distribution at a more accessible price point, while LVMH

tends to sell its brands at higher prices through its own

stores.

The deal is expected to close in late 2016 or early 2017.

LVMH, which owns a bevy of brands including flagship fashion

label Louis Vuitton, champagne house Moët & Chandon and cognac

label Hennessy, bought Donna Karan in 2002 for about $243

million.

Founded in 1984 by American designer Donna Karan, the brand's

clothes, shoes and bags quickly gained in popularity. The company

went public 12 years later.

Donna Karan was the first major American designer label for

LVMH. It was also the biggest foray into the ready-to-wear apparel

business by the company's founder, French fashion mogul Bernard

Arnault. The brand's ubiquitous presence in department stores

didn't square perfectly with LVMH's ultraluxury image, but Mr.

Arnault snapped it up on the grounds that it was one of the world's

best-known brands.

Monday's sale is a stark departure for LVMH, where Mr. Arnault

has built a reputation for sticking with the brands he has

purchased over the firm's nearly 30 years. The last time Mr.

Arnault parted ways with a major brand was in 2005, when LVMH sold

Christian Lacroix to the Falic Group, a U.S. duty-free-store

operator. Christian Lacroix eventually filed for bankruptcy after

Falic failed to find a buyer for it and was unable to stem mounting

losses at the brand.

Citigroup analyst Thomas Chauvet said Monday's sale could

indicate LVMH is open to selling other brands, like Marc Jacobs,

which he has highlighted as an underperformer. LVMH declined to

comment. Mr. Arnault has previously suggested LVMH could spin off

and publicly list the brand -- 80% of which is owned by LVMH, 10%

by designer Marc Jacobs and 10% by Mr. Jacobs's business partner

Robert Duffy -- once it begins growing more strongly.

Mr. Roussel said Marc Jacobs is "a very different story" to

Donna Karan since LVMH has long been in control of the brand and

Marc Jacobs has "always done well." Still, he said "we think it

could be doing much better."

The company is working to subsume the Marc by Marc Jacobs brand

into the Marc Jacobs brand -- combing shows, stores and marketing

campaigns. Mr. Roussel said directing spending toward one brand

rather than two, would allow Marc Jacobs to grow more quickly.

Mr. Chauvet, of Citigroup, said the Donna Karan sale aligns with

his view "that the brand no longer fits within LVMH's portfolio

owing to their difficult positioning in the market and high capital

requirements." He estimated that LVMH's efforts to reposition and

invest in Donna Karan and Marc Jacobs had cost the company EUR116

million ($127 million) in operating losses in fiscal 2015.

G-III, which makes licensed apparel for brands such as Calvin

Klein, said it saw a significant market opportunity for Donna

Karan. "Donna Karan brings increased scale and diversification,

while providing incremental growth on top of our portfolio of some

of the best fashion brands in the world," said Mr. Goldfarb.

The U.S.-based company expects the deal to be dilutive to

earnings in fiscal 2018 and to add to earnings thereafter.

Citigroup said the divestiture is "largely immaterial" to LVMH's

group earnings.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 26, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

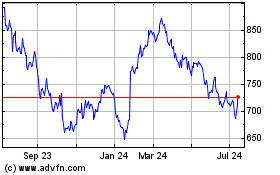

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Aug 2024 to Sep 2024

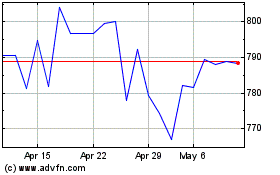

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Sep 2023 to Sep 2024