Arnault Family to Take Full Control of Christian Dior in $13 Billion Deal -- 2nd Update

April 25 2017 - 9:15AM

Dow Jones News

By Matthew Dalton

PARIS--French billionaire Bernard Arnault on Tuesday announced a

plan to take full control of Christian Dior SE, saying his family

is proposing to pay EUR12 billion ($13.04 billion) for the stake in

the fashion company it doesn't already own.

The plan will allow the French luxury conglomerate LVMH Moët

Hennessy Louis Vuitton SE to take control of Christian Dior

Couture, Christian Dior's operating subsidiary. The Arnault family

controls LVMH, the world's largest luxury company, and Mr. Arnault

is its founder and chief executive.

Christian Dior Couture is currently considered an independent

affiliate of LVMH despite having the same controlling

shareholder.

The proposed transaction would be the 68-year-old Mr. Arnault's

biggest acquisition in years, giving LVMH one of the most storied

brands in fashion. It also marks the culmination of Mr. Arnault's

decadeslong turnaround of Dior, which he purchased in the 1980s and

used to build his empire of luxury brands.

Though LVMH and Dior have routinely cooperated with each other,

LVMH executives said the companies can't share marketing, finance

and administrative resources because of their differing

shareholders. That should change once the deal is complete, they

said.

Mr. Arnault said the plan would simplify the structure of the

businesses, which had "long been requested by the market," as well

as strengthen LVMH's fashion and leather-goods division with the

addition of Christian Dior Couture.

Shares in Christian Dior soared 12% on the news in afternoon

trading in Paris, while LVMH was up about 4%.

The deal reshuffles LVMH's complex corporate relationship with

Christian Dior and the Arnault family. The family owns 74.1% of

Christian Dior, which in turn owns a controlling stake in LVMH.

Under the deal, the Arnault family is offering to buy the 25.9% of

Christian Dior it doesn't own for EUR260 a share, valuing that

stake at EUR12 billion. The price is a 14.7% premium to where

Christian Dior's shares closed on Monday.

"The price we're paying is perhaps a little expensive, but in 30

years we'll be happy we did it," Mr. Arnault said at a press

conference.

The transaction will also see Mr. Arnault reduce his holdings of

Hermès International SCA. Mr. Arnault had accumulated an 8.5% stake

in the French luxury house during an aborted attempt several years

ago to take over the company.

Mr. Arnault is proposing to buy Dior's shares in a mix of cash

and his Hermès shares. News that Mr. Arnault's shares would be

hitting the market pushed Hermès shares down by more than 4% in

afternoon trading.

In an internal transaction, LVMH will then buy Christian Dior

Couture, the fashion subsidiary of Christian Dior, in a deal that

values the unit at EUR6 billion.

Dior's results have surged in recent years, with the company

reporting a profit of EUR252 million on sales of EUR1.9 billion

last year, compared with EUR85 million on sales of EUR1 billion in

2011.

The brand has long been at the core of Mr. Arnault's luxury

empire, said Concetta Lanciaux, a former LVMH executive who worked

with Mr. Arnault for 25 years.

"Dior was the first one," Ms. Lanciaux said. "Your first one is

always the best."

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

April 25, 2017 09:00 ET (13:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

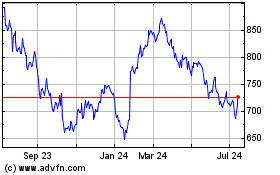

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Aug 2024 to Sep 2024

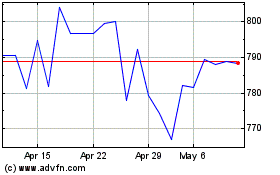

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Sep 2023 to Sep 2024