TIDMALBA

RNS Number : 6798W

Alba Mineral Resources PLC

21 August 2015

21 August 2015

ALBA MINERAL RESOURCES PLC

HALF-YEARLY REPORT

CHAIRMAN'S STATEMENT

The Board of Alba Mineral Resources plc (the "Company" or "Alba"

or collectively with its Subsidiary Companies, the "Group") is

pleased to report the Company's interim results for the six months

ended 31 May 2015. They incorporate the results of its subsidiary

companies Aurum Mineral Resources Limited ("AMR"), Mauritania

Ventures Limited ("MVL") and Alba Mineral Resources Sweden AB

("Alba Sweden") (collectively the "Subsidiary Companies").

INTRODUCTION

Alba is a committed, technically driven explorer. The Group's

overall corporate and exploration strategy will continue to be one

of developing a portfolio of well-researched, promising and

prospective exploration properties within the natural resources

sector that will be pursued further, either in the Group's own

right or in conjunction with other parties.

RESULTS FOR THE PERIOD

The Group made a loss attributable to equity holders of the

parent for the period, after taxation, of GBP232,118. The basic and

diluted loss per share was 0.04 pence.

REVIEW OF ACTIVITIES

Corporate

On 16 February 2015, the Company announced that it had raised

GBP270,000 (before expenses) in an oversubscribed placing, through

the issue of 108,000,000 new ordinary shares at a price of 0.25

pence per ordinary share.

On 16 March 2015, the Company announced that it had raised

GBP500,000 (before expenses) in an oversubscribed placing, through

the issue of 200,000,000 new ordinary shares at a price of 0.25

pence per ordinary share.

On 1 May 2015, the Company announced that it issued 18,000,000

new ordinary shares at a price of 0.50 pence per ordinary share in

settlement of fees for professional services.

Horse Hill

The Horse Hill-1 well ("HH-1") is located within onshore

exploration licence PEDL 137, on the northern side of the Weald

basin near Gatwick Airport. Alba owns a 10% direct interest in

Horse Hill Developments Limited ("HHDL"). HHDL is a special purpose

company that owns a 65% participating interest and operatorship of

Licence PEDL137 and the adjacent Licence PEDL246 in the UK Weald

Basin. The remaining 35% participating interests in the PEDL137 and

PEDL246 licences are held by US-based Magellan Petroleum

Corporation.

On 8 April 2015, the Company completed the acquisition of the 5%

shareholding in HHDL held by Regency Mines Plc ("Regency") for a

total cash consideration of GBP300,000. Additionally, on completion

the Company paid the outstanding cash calls issued to Regency by

HHDL, being a total of GBP60,000. During the period, a further cash

call payment of GBP60,000 to HHDL was made by the Company to HHDL

pursuant to the terms of the HHDL shareholders' agreement.

On 13 May 2015, the Company announced that it had been informed

by HHDL that the exploration stage of the PEDL137 licence had been

extended by the Oil & Gas Authority ("OGA", formerly the

Department of Energy & Climate Change) to 30 September

2016.

The exploration stage of the PEDL246 licence expires on 30 June

2019.

Ireland

As part of a review of our Irish project which is scheduled to

take place prior to the end of the financial year, the Board

intends to have all existing available data reviewed and placed in

a regional context, particularly with respect to Glencore Plc's

Pallas Green project.

Following completion of this review, an action plan will be

drawn up that will have three potential outcomes:

1) Continue investigation by drilling and downhole geophysics;

2) Look for potential JV partners; or

3) Relinquish the licence.

Mauritania

The Group holds one exploration permit, No 1328, in northern

Mauritania for uranium and other radioactive materials. The permit

covers an area of 545 km(2) and lies within the eastern half of a

former permit in relation to which Alba had previously announced

several high-tenor uranium anomalies.

The Board continues to review exploration models on the permit

area and intends to apply to the relevant Mauritanian Authorities

to take out a new permit over the reduced area when compared to the

original permit area which will include the centre of the

previously discovered anomaly. This will be the second time the

Company has reduced the permit area as our knowledge of the ground

increases. The Company will then consider its options with regards

to funding the next stage of exploration, either directly or with

the existing or a new JV partner.

Other Development Projects

Alba continues to review and discuss other project or investment

opportunities, which have been brought to us by the Board,

management, advisers or other contacts that may have

value-enhancing potential.

Post Period End

On 5 June 2015, the Company announced that Schlumberger, one of

the leading suppliers of technology, integrated project management

and information solutions to customers working in the global oil

and gas industry, had independently assessed the petrophysics of

HH-1, located in PEDL137.

On 8 June 2015, the Company announced that Chade van Hatch had

been appointed to the Board as Chief Financial Officer and Company

Secretary with immediate effect.

On 12 June 2015, the Company announced that it had raised

GBP355,000 (before expenses) in a placing through the issue of

71,000,000 new ordinary shares at a price of 0.50 pence per

ordinary share.

On 18 June 2015, the Company announced that Nutech had provided

an independent report of the oil initially in place ("OIP")

contained within 55 square miles covered by the Horse Hill licences

(PEDL137 and PEDL246).

Outlook

The positive developments in relation to Horse Hill over the

past several months - notably the publication of independent

reports by Schlumberger and Nutech and the extension granted in

respect of PEDL 137 - have provided further justification for

Alba's decision to invest further into Horse Hill in April.

Aside from Horse Hill, the Board continues to assess its

projects in Mauritania and Ireland and we are also actively

considering other projects and investment opportunities which may

bolster the Company's portfolio of assets and provide further value

and interest for our shareholders.

George Frangeskides

20 August 2015

Chairman

For further information please visit the Company's website,

www.albamineralresources.com or contact:

Alba Mineral Resources plc George Frangeskides, Chairman Tel: +44 (0) 20 3696 4616

Mike Nott, CEO

Chade van Hatch, CFO & Company Secretary

Cairn Financial Advisers LLP (Nominated Avi Robinson Tel: +44 (0) 20 7148 7900

Advisers) James Caithie

UNAUDITED CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHS ENDED 31 MAY 2015

Unaudited Unaudited Audited

6 months 6 months Year ended

ended 31 ended 31 30 Nov

May 2015 May 2014 2014

Revenue - - -

Cost of sales - - -

Gross loss - - -

------------------------------------ ---------- ---------- ------------

Other administrative expenses (232,594) (65,826) (235,751)

Exceptional items - - -

------------------------------------ ---------- ---------- ------------

Administrative expenses (232,594) (65,826) (235,751)

---------- ---------- ------------

Operating (loss)/profit (232,594) (65,826) (235,751)

Finance costs - (9) -

---------- ---------- ------------

(Loss)/profit before tax (232,594) (65,835) (235,751)

---------- ---------- ------------

Taxation - - -

---------- ---------- ------------

(Loss)/profit for the year (232,594) (65,835) (235,751)

---------- ---------- ------------

Attributable to:

Equity holders of the parent (232,118) (64,648) (234,001)

Non-controlling interests (476) (1,187) (1,750)

---------- ---------- ------------

(232,594) (65,835) (235,751)

---------- ---------- ------------

(Loss)/earnings per ordinary share

Basic and diluted (0.04) (0.02) (0.07)

pence pence pence

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

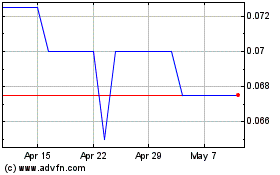

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Aug 2024 to Sep 2024

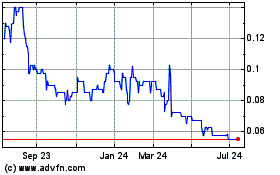

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Sep 2023 to Sep 2024