ADP to Offer $2 Billion in Debt, Boost Stock Buyback in Tweak to Capital Structure

August 28 2015 - 8:31AM

Dow Jones News

By Lisa Beilfuss

Automatic Data Processing Inc. said Friday it would offer $2

billion in debt and increase the size of its share-repurchase

program, a move to enhance its capital structure.

In a regulatory filing, the company said it would conduct one or

more debt offerings and use the net proceeds for general corporate

purposes.

Contingent upon the offering's completion, ADP said, its board

has authorized the purchase of an additional 25 million shares of

common stock. At Thursday's closing price of $78.83, a

25-million-share buyback would cost the company $1.95 billion.

The company has about 26 million shares remaining under the

previous share-repurchase program. The additional buybacks will be

completed within a 12- to 24-month time period following the

completion of the debt offering, subject to market conditions, ADP

said.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 28, 2015 08:16 ET (12:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

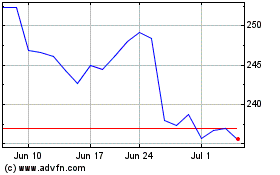

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Aug 2024 to Sep 2024

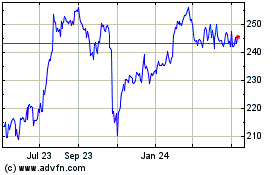

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Sep 2023 to Sep 2024