DELIVERING GOODS for THE GOOD of ALL TRINITY INDUSTRIES, INC. Quarterly Investor Presentation May 7, 2024 – for the period ended March 31, 2024 Exhibit 99.1

DELIVERING GOODS for THE GOOD of ALL /// 2 Forward Looking Statements and Other References Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements, including, but not limited to, future financial and operating performance, future opportunities and any other statements regarding events or developments that Trinity believes or anticipates will or may occur in the future. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “projected,” “outlook,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this material, and Trinity expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Trinity’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by federal securities laws. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to risks and uncertainties regarding economic, competitive, governmental, and technological factors affecting Trinity’s operations, markets, products, services and prices, and such forward-looking statements are not guarantees of future performance. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in Trinity’s Annual Report on Form 10-K for the most recent fiscal year, as may be revised and updated by Trinity’s Quarterly Reports on Form 10-Q, and Trinity’s Current Reports on Form 8-K. This presentation also includes references to calculations that are not based on generally accepted accounting principles (“GAAP”). Reconciliations of each of these non-GAAP measures to the most directly comparable GAAP measures have been included in the Appendix. When forward-looking non- GAAP measures are provided, Trinity does not provide quantitative reconciliations of forward-looking non-GAAP measures to the most directly comparable GAAP measures because it cannot, without unreasonable effort, predict the timing and amounts of certain items included in the computations of each of these measures. These factors include, but are not limited to: the product mix of expected railcar deliveries; the timing and amount of significant transactions and investments, such as lease portfolio sales, capital expenditures, and returns of capital to shareholders; and the amount and timing of certain other items outside the normal course of our core business operations. Our Reportable Segments Effective January 1, 2024, the Company modified its organizational structure to better leverage our maintenance services capabilities to support lease fleet optimization and to grow our services and parts businesses. The new structure resulted in a change to our reportable segments beginning in 2024. In connection with this organizational update, we aligned the maintenance services business, which was previously reported in the Rail Products Group, to now be presented within our leasing business. Consequently, beginning January 1, 2024, we report our operating results in two reportable segments: (1) the Railcar Leasing and Services Group, formerly the Railcar Leasing and Management Services Group, and (2) the Rail Products Group. These changes had no impact to our previously reported consolidated results of operations, financial position, or cash flows. All prior period segment results set forth herein have been recast to reflect these changes and present results on a comparable basis. The preliminary and unaudited financial information set forth herein is presented for illustrative purposes only. Except where noted, financial data is presented as of the Company’s most recent first quarter ending March 31, 2024. “LTM” represents Last Twelve Months(1) financial information from April 1, 2023 to March 31, 2024.

DELIVERING GOODS for THE GOOD of ALL /// Investor Presentation – May 2024 3 I. Trinity Industries, Inc. Overview . . . . . . . . . . . . . . . . . . Page 4 II. Trinity’s Value Proposition . . . . . . . . . . . . . . . . . . . . . . . . Page 9 III. Railcar Market Overview . . . . . . . . . . . . . . . . . . . . . . . . . . Page 16 IV. Financial Positioning and Strategic Objectives . . . . . Page 20 V. Appendix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Page 24

DELIVERING GOODS for THE GOOD of ALL TRINITY INDUSTRIES, INC. OVERVIEW (NYSE: TRN)

DELIVERING GOODS for THE GOOD of ALL /// Trinity’s Value Proposition 5

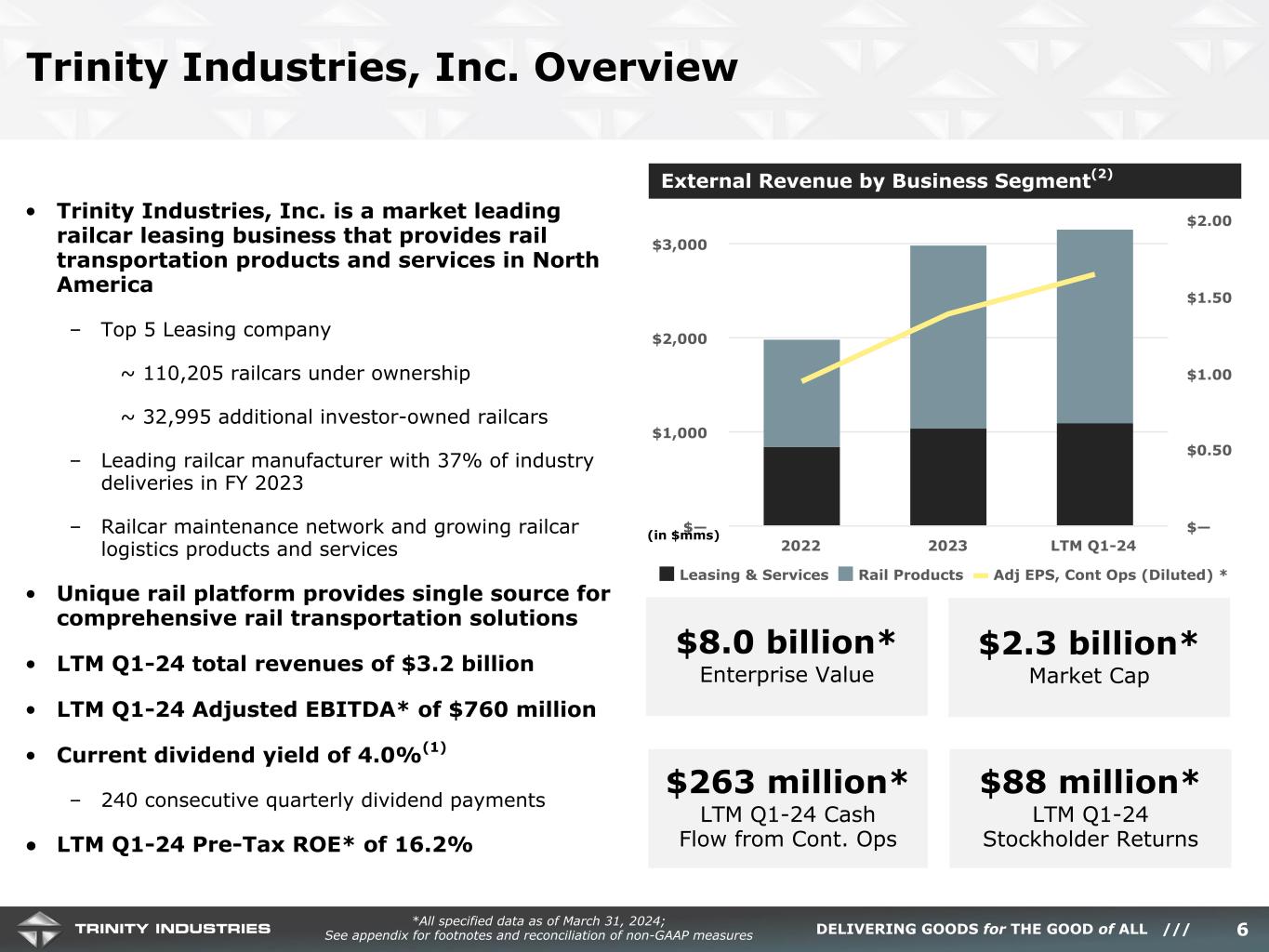

DELIVERING GOODS for THE GOOD of ALL /// • Trinity Industries, Inc. is a market leading railcar leasing business that provides rail transportation products and services in North America – Top 5 Leasing company ~ 110,205 railcars under ownership ~ 32,995 additional investor-owned railcars – Leading railcar manufacturer with 37% of industry deliveries in FY 2023 – Railcar maintenance network and growing railcar logistics products and services • Unique rail platform provides single source for comprehensive rail transportation solutions • LTM Q1-24 total revenues of $3.2 billion • LTM Q1-24 Adjusted EBITDA* of $760 million • Current dividend yield of 4.0%(1) – 240 consecutive quarterly dividend payments • LTM Q1-24 Pre-Tax ROE* of 16.2% Trinity Industries, Inc. Overview External Revenue by Business Segment(2) *All specified data as of March 31, 2024; See appendix for footnotes and reconciliation of non-GAAP measures $8.0 billion* Enterprise Value $88 million* LTM Q1-24 Stockholder Returns $263 million* LTM Q1-24 Cash Flow from Cont. Ops $2.3 billion* Market Cap 6 Leasing & Services Rail Products Adj EPS, Cont Ops (Diluted) * 2022 2023 LTM Q1-24 $— $1,000 $2,000 $3,000 $— $0.50 $1.00 $1.50 $2.00 (in $mms)

DELIVERING GOODS for THE GOOD of ALL /// A Differentiated Value Proposition for Our Customers Leasing • Rail Product Portfolio • Aftermarket Parts Manufacturing • Maintenance • Modifications • Repair • Mobile Units Maintenance • Logistics and Terminal Services • Data Analytics • Connected Railcar Services Cross-sell to deliver innovative solutions and a differentiated experience Optimize customers’ ownership and usage of railcar equipment Drive rail industry modal share through supply chain efficiency Aligned with industrial shippers through ownership and engineering 7 • Lease Portfolio • Fleet Management • Equipment Finance Solutions

DELIVERING GOODS for THE GOOD of ALL /// Trinity’s Business Segments * See appendix for reconciliation of non-GAAP measures $3.2B Total Revenues Trinity Industries Inc. (LTM Q1-24) $460M Adjusted Operating Profit* $152M Adjusted Income from Cont. Ops.* $760M Adjusted EBITDA* $1,093M Segment Revenue $453M Segment Operating Profit • Railcar leasing services • Asset management • Railcar investment vehicle (RIV) sales • Maintenance services • Digital solutions and logistics services • Segment operating profit includes gains from insurance recoveries of $5M Railcar Leasing and Services Group $2,559M Segment Revenue $132M Segment Operating Profit • Tank and freight railcars • Railcar parts and heads Rail Products Group $501M Segment Revenue $15M Segment Operating Profit • Intersegment Eliminations, primarily from the sale of railcars from the Rail Products Group to the Railcar Leasing and Services Group for new railcar equipment supported by a firm customer contract for the lease Intersegment Eliminations 8

DELIVERING GOODS for THE GOOD of ALL TRINITY’S VALUE PROPOSITION

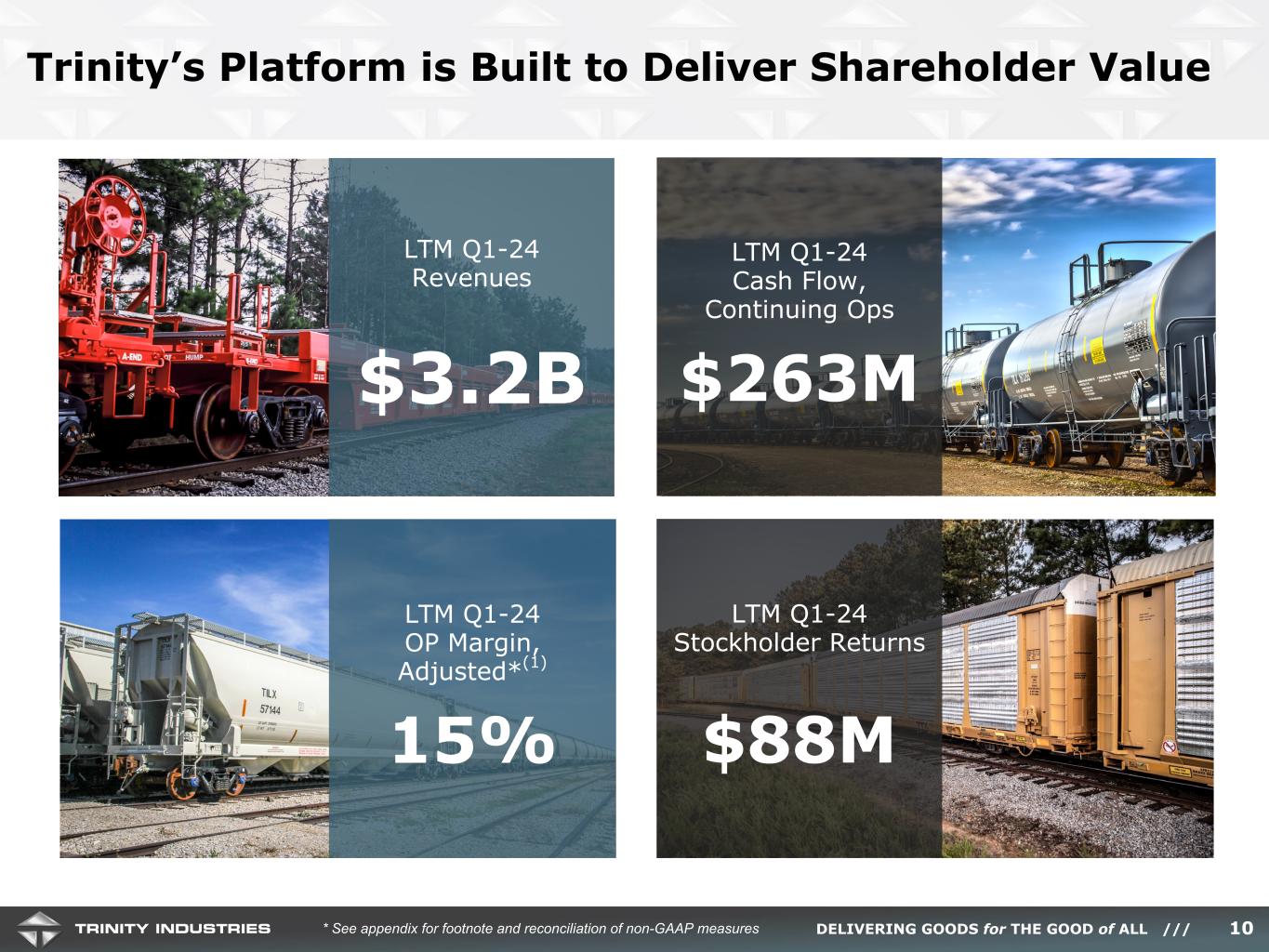

DELIVERING GOODS for THE GOOD of ALL /// Trinity’s Platform is Built to Deliver Shareholder Value LTM Q1-24 Revenues $3.2B LTM Q1-24 Cash Flow, Continuing Ops $263M LTM Q1-24 OP Margin, Adjusted*(1) 15% LTM Q1-24 Stockholder Returns $88M * See appendix for footnote and reconciliation of non-GAAP measures 10

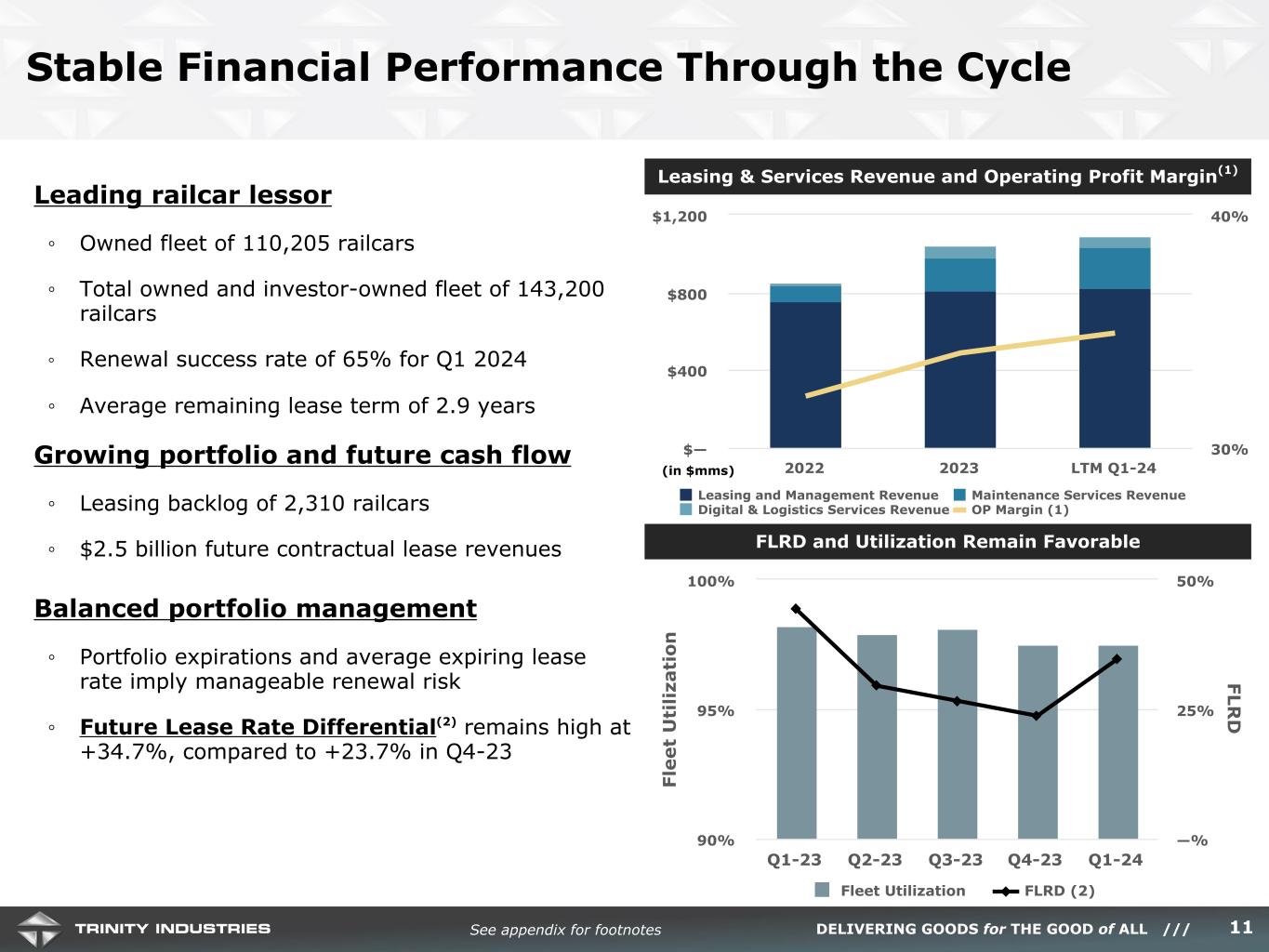

DELIVERING GOODS for THE GOOD of ALL /// Leasing and Management Revenue Maintenance Services Revenue Digital & Logistics Services Revenue OP Margin (1) 2022 2023 LTM Q1-24 $— $400 $800 $1,200 30% 40% Stable Financial Performance Through the Cycle FLRD and Utilization Remain Favorable Leasing & Services Revenue and Operating Profit Margin(1) (in $mms) See appendix for footnotes 11 Leading railcar lessor ◦ Owned fleet of 110,205 railcars ◦ Total owned and investor-owned fleet of 143,200 railcars ◦ Renewal success rate of 65% for Q1 2024 ◦ Average remaining lease term of 2.9 years Growing portfolio and future cash flow ◦ Leasing backlog of 2,310 railcars ◦ $2.5 billion future contractual lease revenues Balanced portfolio management ◦ Portfolio expirations and average expiring lease rate imply manageable renewal risk ◦ Future Lease Rate Differential(2) remains high at +34.7%, compared to +23.7% in Q4-23 Fl ee t U ti liz at io n FLR D Fleet Utilization FLRD (2) Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 90% 95% 100% —% 25% 50%

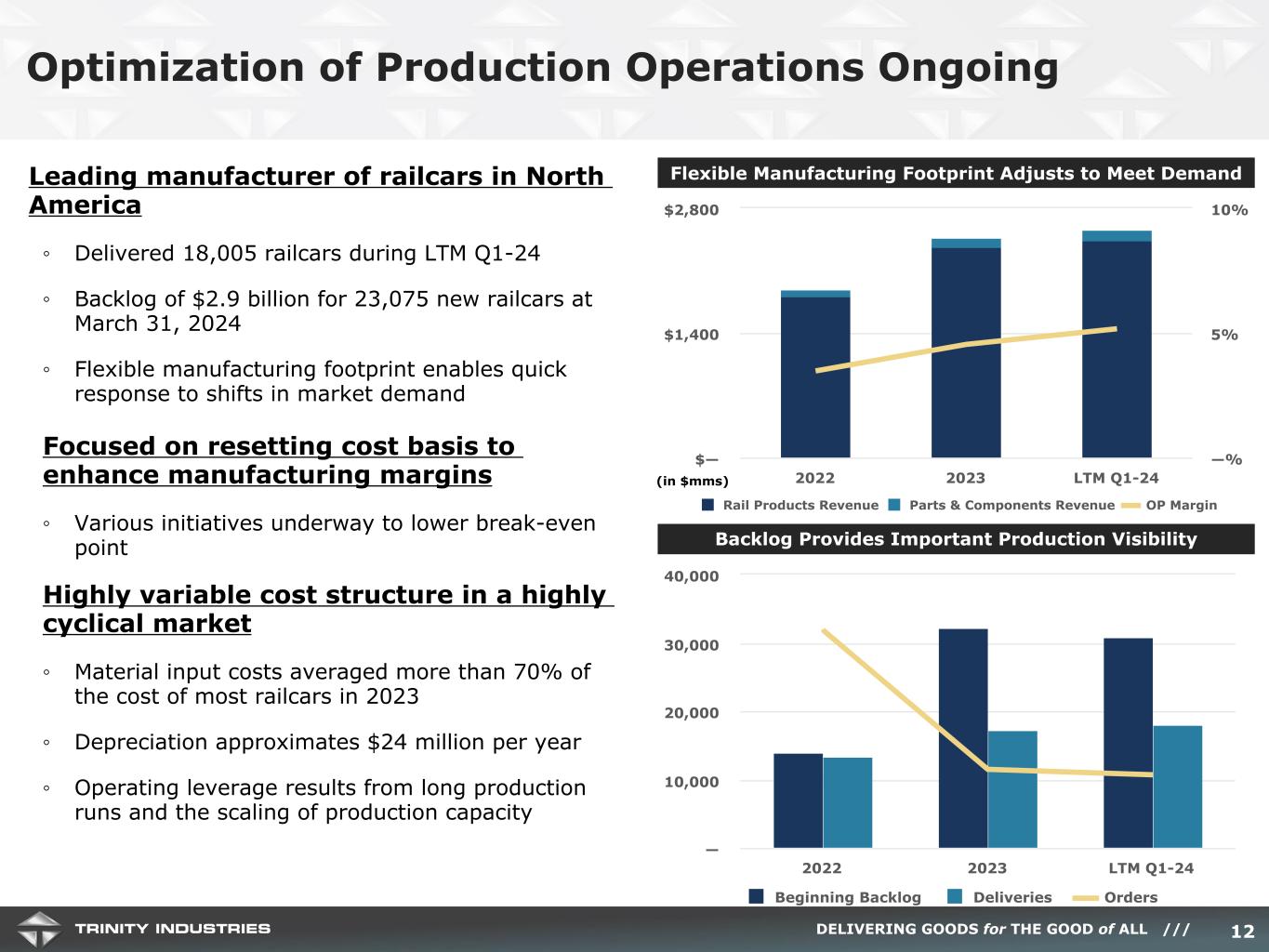

DELIVERING GOODS for THE GOOD of ALL /// Rail Products Revenue Parts & Components Revenue OP Margin 2022 2023 LTM Q1-24 $— $1,400 $2,800 —% 5% 10% Leading manufacturer of railcars in North America ◦ Delivered 18,005 railcars during LTM Q1-24 ◦ Backlog of $2.9 billion for 23,075 new railcars at March 31, 2024 ◦ Flexible manufacturing footprint enables quick response to shifts in market demand Focused on resetting cost basis to enhance manufacturing margins ◦ Various initiatives underway to lower break-even point Highly variable cost structure in a highly cyclical market ◦ Material input costs averaged more than 70% of the cost of most railcars in 2023 ◦ Depreciation approximates $24 million per year ◦ Operating leverage results from long production runs and the scaling of production capacity Optimization of Production Operations Ongoing Backlog Provides Important Production Visibility Flexible Manufacturing Footprint Adjusts to Meet Demand 12 Beginning Backlog Deliveries Orders 2022 2023 LTM Q1-24 — 10,000 20,000 30,000 40,000 (in $mms)

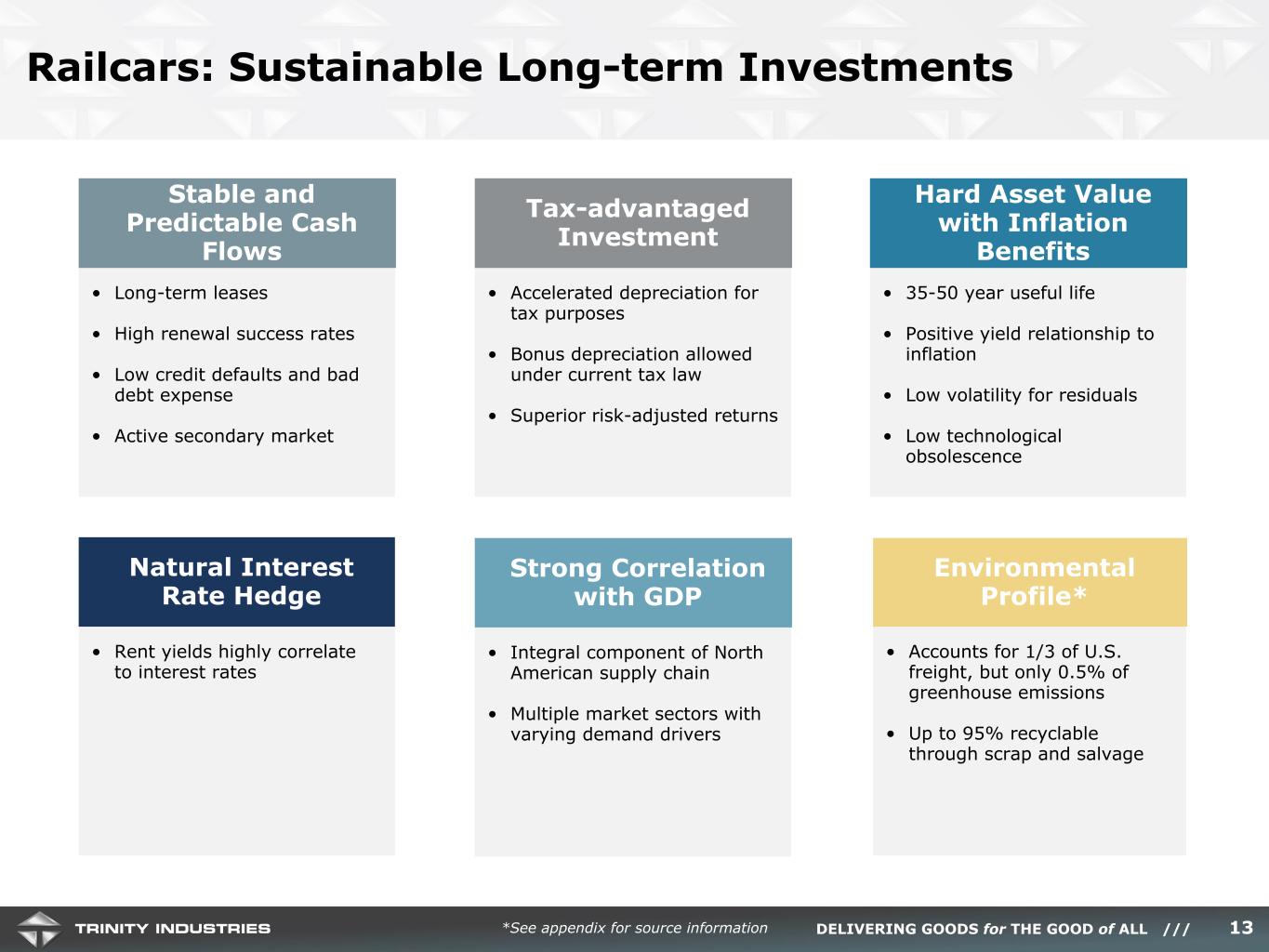

DELIVERING GOODS for THE GOOD of ALL /// Railcars: Sustainable Long-term Investments • Long-term leases • High renewal success rates • Low credit defaults and bad debt expense • Active secondary market Stable and Predictable Cash Flows • 35-50 year useful life • Positive yield relationship to inflation • Low volatility for residuals • Low technological obsolescence Hard Asset Value with Inflation Benefits • Integral component of North American supply chain • Multiple market sectors with varying demand drivers Strong Correlation with GDP • Rent yields highly correlate to interest rates Natural Interest Rate Hedge • Accelerated depreciation for tax purposes • Bonus depreciation allowed under current tax law • Superior risk-adjusted returns Tax-advantaged Investment • Accounts for 1/3 of U.S. freight, but only 0.5% of greenhouse emissions • Up to 95% recyclable through scrap and salvage Environmental Profile* *See appendix for source information 13

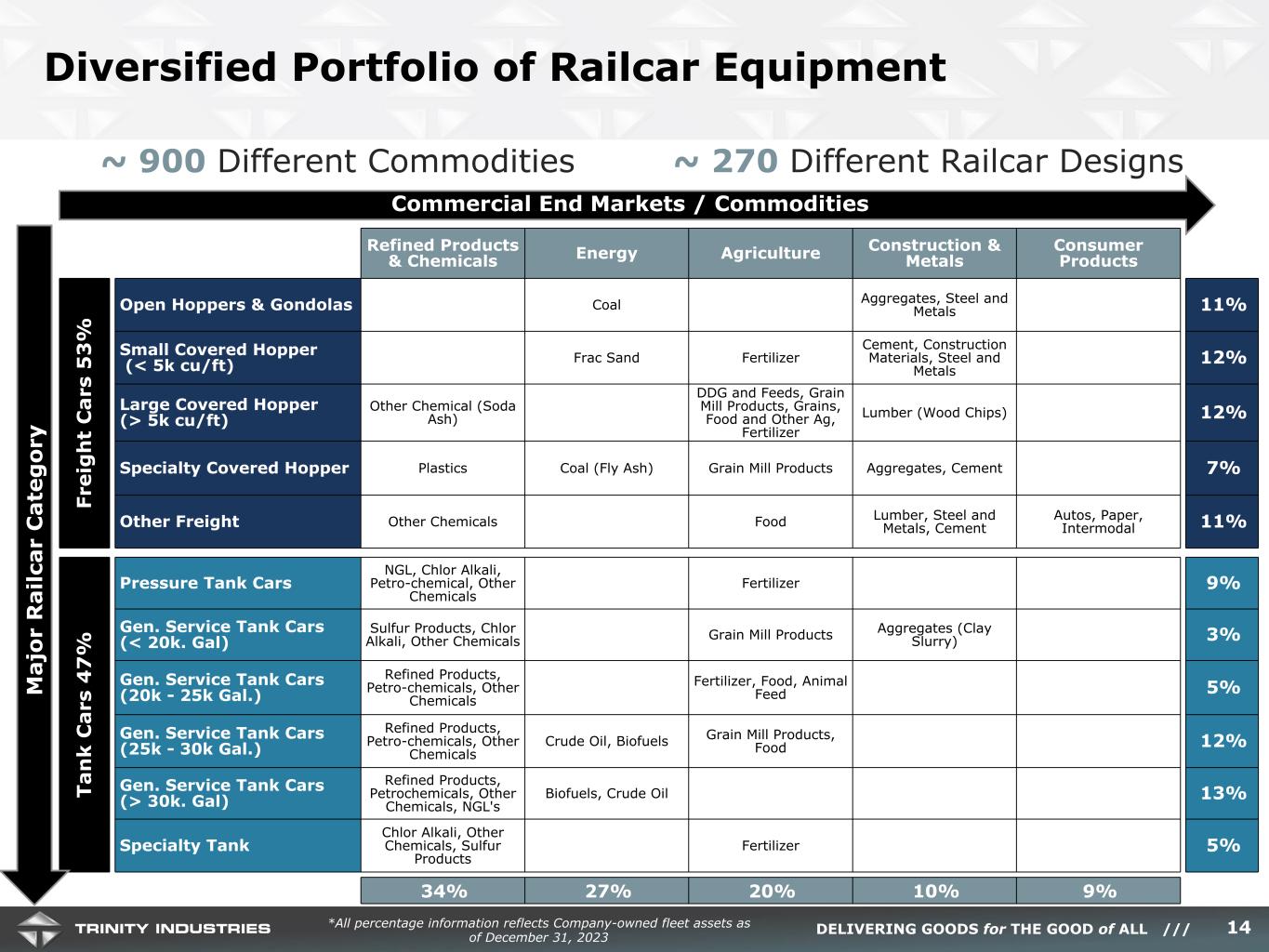

DELIVERING GOODS for THE GOOD of ALL /// Diversified Portfolio of Railcar Equipment ~ 900 Different Commodities ~ 270 Different Railcar Designs 14*All percentage information reflects Company-owned fleet assets as of December 31, 2023 Refined Products & Chemicals Energy Agriculture Construction & Metals Consumer Products Fr ei g h t C ar s 5 3 % Open Hoppers & Gondolas Coal Aggregates, Steel and Metals 11% Small Covered Hopper (< 5k cu/ft) Frac Sand Fertilizer Cement, Construction Materials, Steel and Metals 12% Large Covered Hopper (> 5k cu/ft) Other Chemical (Soda Ash) DDG and Feeds, Grain Mill Products, Grains, Food and Other Ag, Fertilizer Lumber (Wood Chips) 12% Specialty Covered Hopper Plastics Coal (Fly Ash) Grain Mill Products Aggregates, Cement 7% Other Freight Other Chemicals Food Lumber, Steel and Metals, Cement Autos, Paper, Intermodal 11% Ta n k C ar s 4 7 % Pressure Tank Cars NGL, Chlor Alkali, Petro-chemical, Other Chemicals Fertilizer 9% Gen. Service Tank Cars (< 20k. Gal) Sulfur Products, Chlor Alkali, Other Chemicals Grain Mill Products Aggregates (Clay Slurry) 3% Gen. Service Tank Cars (20k - 25k Gal.) Refined Products, Petro-chemicals, Other Chemicals Fertilizer, Food, Animal Feed 5% Gen. Service Tank Cars (25k - 30k Gal.) Refined Products, Petro-chemicals, Other Chemicals Crude Oil, Biofuels Grain Mill Products, Food 12% Gen. Service Tank Cars (> 30k. Gal) Refined Products, Petrochemicals, Other Chemicals, NGL's Biofuels, Crude Oil 13% Specialty Tank Chlor Alkali, Other Chemicals, Sulfur Products Fertilizer 5% 34% 27% 20% 10% 9% Commercial End Markets / Commodities M aj or R ai lc ar C at eg or y

DELIVERING GOODS for THE GOOD of ALL /// Commitment to Premier Performance and Sustainability 15 Environmental Commitment Social Responsibility Governance Excellence Risk Management Operating our business in a way that minimizes impact on natural resources and the environment • Leveraged Green Financing Framework, for financing of green-eligible railcars assets, supported by Sustainalytics • Sustainable railcar conversions allow for re-use of railcar components while still addressing a changing demand environment • Innovative products and services that enhance the rail modal supply chain advantage and reduce GHG emissions Attracting and retaining a diverse and empowered workforce • Fostering an inclusive and collaborative workplace • Hiring and retaining the best talent and providing opportunities for continuing professional development • Improving the well being of our employees and stakeholders • Contributing to the communities in which we operate Promoting the long-term interests of stakeholders, strengthening accountability and inspiring trust • Independent Chairman and Board of Directors with diverse backgrounds and experienced oversight • Incentive compensation programs aligned with shareholder interests • Board of Directors and Executive Leadership Team oversight of ESG initiatives Strong track record of operational excellence • All Trinity Rail manufacturing facilities and Trinity HQ achieved ISO 14001 (Environmental) and ISO 45001 (Safety) certification, the only railcar manufacturer in North America certified to both rigorous standards • Actively engage stakeholders in environmental, health, and safety (EHS) initiatives and continually improve EHS processes, practices, and operational performance

DELIVERING GOODS for THE GOOD of ALL RAILCAR MARKET OVERVIEW

DELIVERING GOODS for THE GOOD of ALL /// Integral Part of the North American Supply Chain • 1.7 million railcars in North America(1) • 1.4 trillion ton miles moved by rail in 2023(2) • 3,500+ commodities moved by rail(3) • Annual railcar loadings of 17 million in 2023(4), highly correlated to U.S. GDP U.S. Freight Ton Miles by Mode of Transportation(2) See appendix for footnotes 17 Truck, 48% Rail, 26% Water, 9% Pipe, 17% 5.4 trillion total ton miles

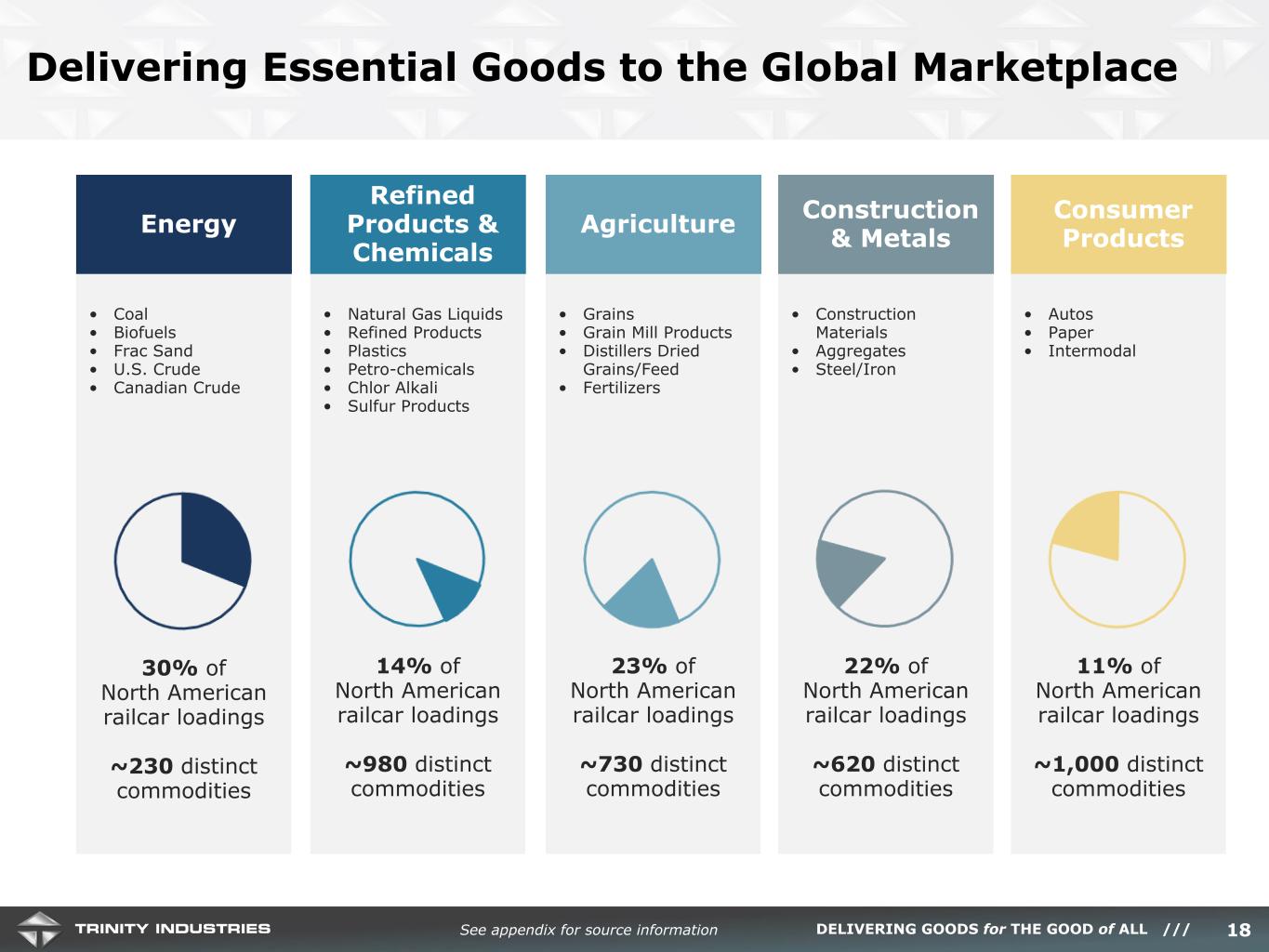

DELIVERING GOODS for THE GOOD of ALL /// Delivering Essential Goods to the Global Marketplace See appendix for source information • Coal • Biofuels • Frac Sand • U.S. Crude • Canadian Crude 30% of North American railcar loadings ~230 distinct commodities Energy • Natural Gas Liquids • Refined Products • Plastics • Petro-chemicals • Chlor Alkali • Sulfur Products 14% of North American railcar loadings ~980 distinct commodities Refined Products & Chemicals • Grains • Grain Mill Products • Distillers Dried Grains/Feed • Fertilizers 23% of North American railcar loadings ~730 distinct commodities Agriculture • Construction Materials • Aggregates • Steel/Iron 22% of North American railcar loadings ~620 distinct commodities Construction & Metals • Autos • Paper • Intermodal 11% of North American railcar loadings ~1,000 distinct commodities Consumer Products 18

DELIVERING GOODS for THE GOOD of ALL /// Capitalizing on Structural Change in the Rail Market The TrinityRail platform has grown at a 11% CAGR since 2003 Lessors Make Up A Growing Share of the North American Fleet Railcar Lessor Ownership Profile Presents Consolidation Opportunity Operating Lessors *Over 100 lessors own 242K railcars in “All other” 19 Financial Lessors 13% 13% 9% 26% 12% 13% TRN, 14% Wells Fargo CIT ITE All other * GATX UnionTank TRN 55% 19% 16% 10% Lessor Railroad Shipper TTX See appendix for source information

DELIVERING GOODS for THE GOOD of ALL FINANCIAL POSITIONING AND STRATEGIC OBJECTIVES

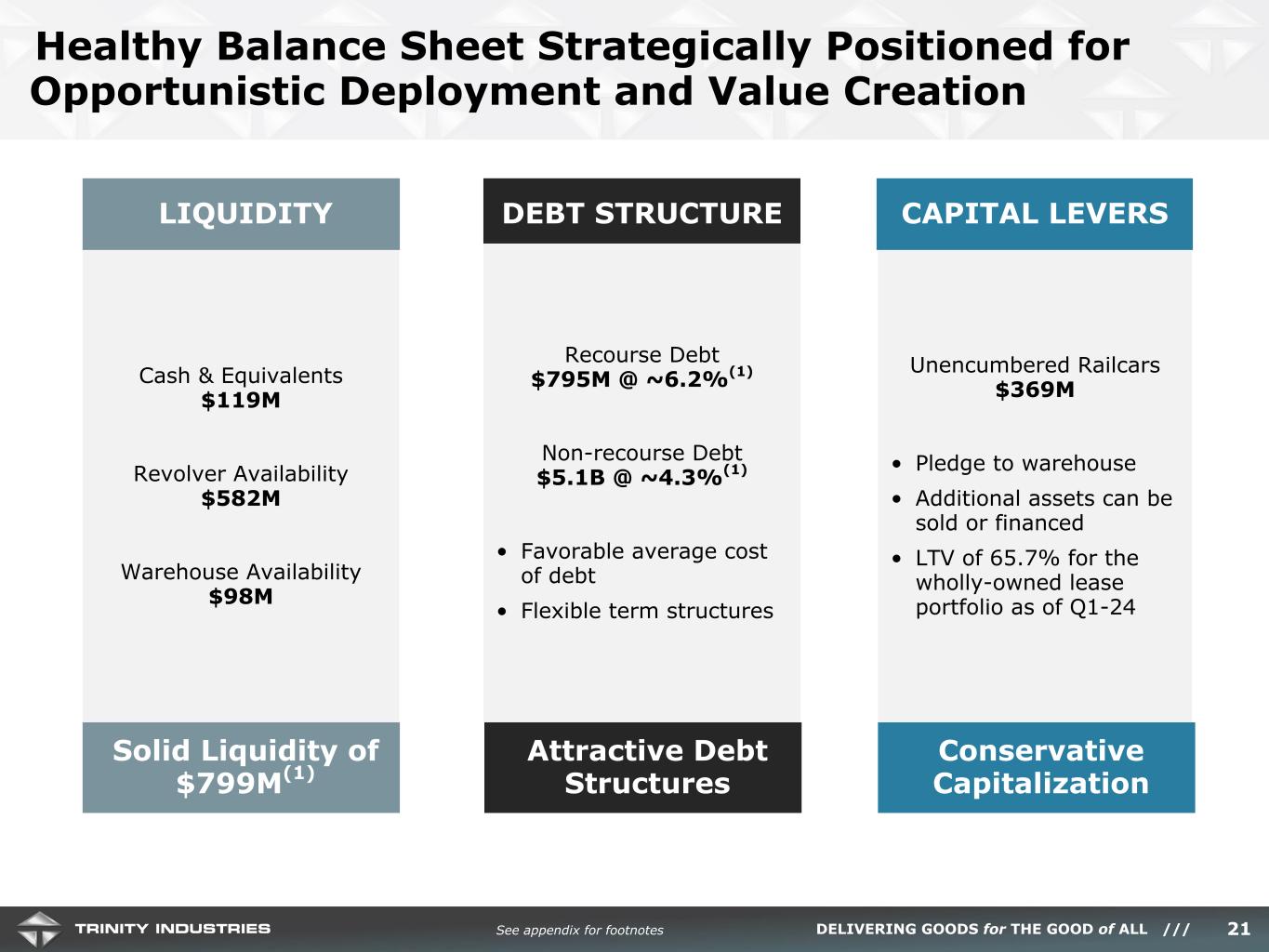

DELIVERING GOODS for THE GOOD of ALL /// Healthy Balance Sheet Strategically Positioned for Opportunistic Deployment and Value Creation 21 Unencumbered Railcars $369M • Pledge to warehouse • Additional assets can be sold or financed • LTV of 65.7% for the wholly-owned lease portfolio as of Q1-24 CAPITAL LEVERSDEBT STRUCTURE Cash & Equivalents $119M Revolver Availability $582M Warehouse Availability $98M LIQUIDITY Attractive Debt Structures Conservative Capitalization See appendix for footnotes Solid Liquidity of $799M(1) Recourse Debt $795M @ ~6.2%(1) Non-recourse Debt $5.1B @ ~4.3%(1) • Favorable average cost of debt • Flexible term structures

DELIVERING GOODS for THE GOOD of ALL /// ~ $20-25B TAM Revenue Opportunity for Services Expansion in Railcar Industry Positioned for Further Success in the Marketplace • Superior customer experience through “Anytime” access • Fleet Management Solutions • RailPulseTM consortium Digital Platforms • Commercialize fleet analytics capabilities • Develop GPS and telematics solutions for enhanced rail supply chain management Data Analytics • Tuck-in service solutions • Optimize rail maintenance network geographically • Opportunistic portfolio acquisitions/ alliances Scale & Consolidation • Moderating lease fleet investment • Increasing leverage of internal maintenance capacity • Expand RIV platform to extend commercial reach Disciplined Operating Model Trinity’s Leasing Company has a bright future and is leading the change for network efficiency to enhance the modal advantage of the railcar industry 22

DELIVERING GOODS for THE GOOD of ALL /// Operating Model and Company Purpose 23

DELIVERING GOODS for THE GOOD of ALL APPENDIX

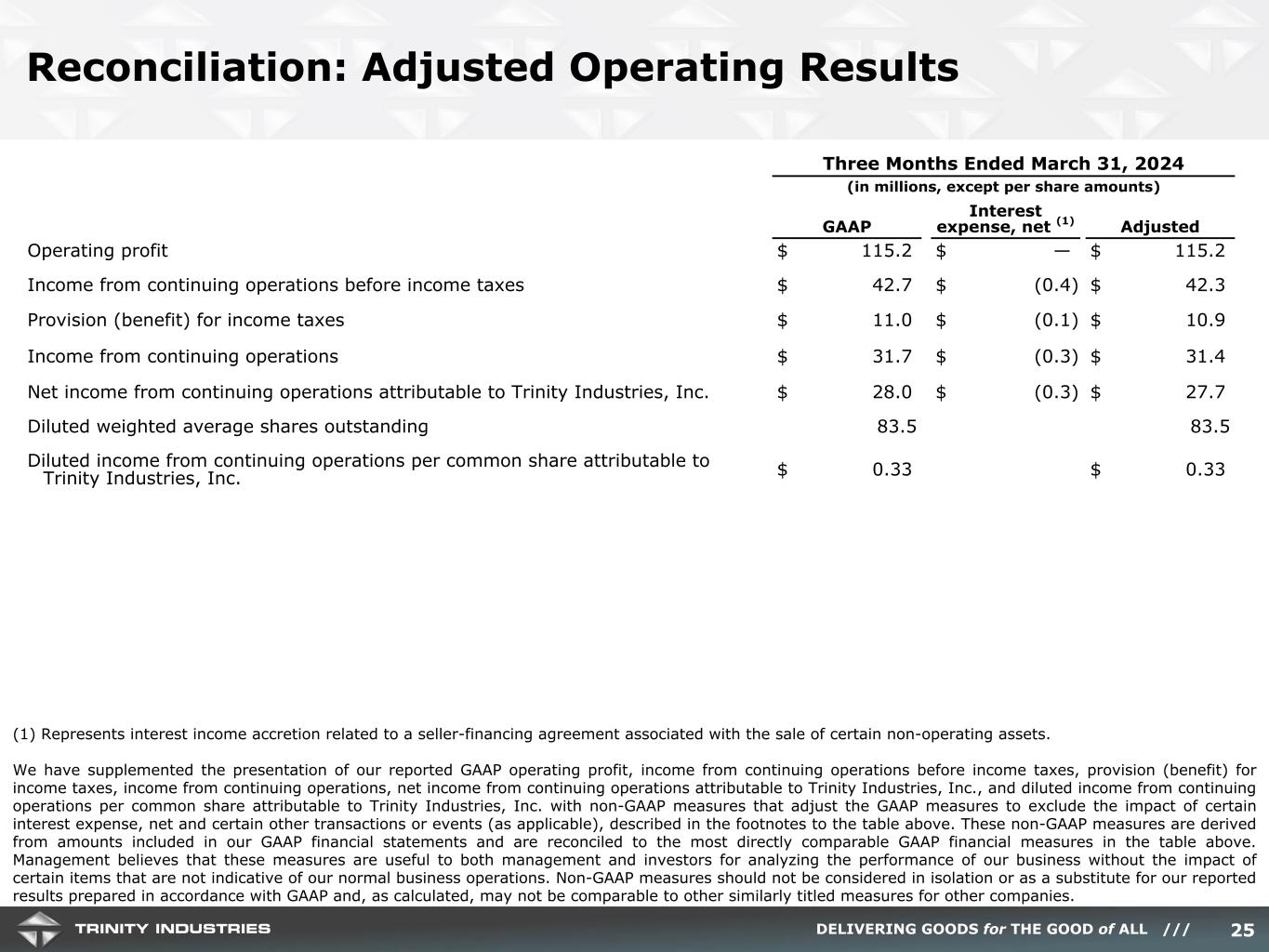

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Adjusted Operating Results 25 (1) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain interest expense, net and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. Three Months Ended March 31, 2024 (in millions, except per share amounts) GAAP Interest expense, net (1) Adjusted Operating profit $ 115.2 $ — $ 115.2 Income from continuing operations before income taxes $ 42.7 $ (0.4) $ 42.3 Provision (benefit) for income taxes $ 11.0 $ (0.1) $ 10.9 Income from continuing operations $ 31.7 $ (0.3) $ 31.4 Net income from continuing operations attributable to Trinity Industries, Inc. $ 28.0 $ (0.3) $ 27.7 Diluted weighted average shares outstanding 83.5 83.5 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 0.33 $ 0.33

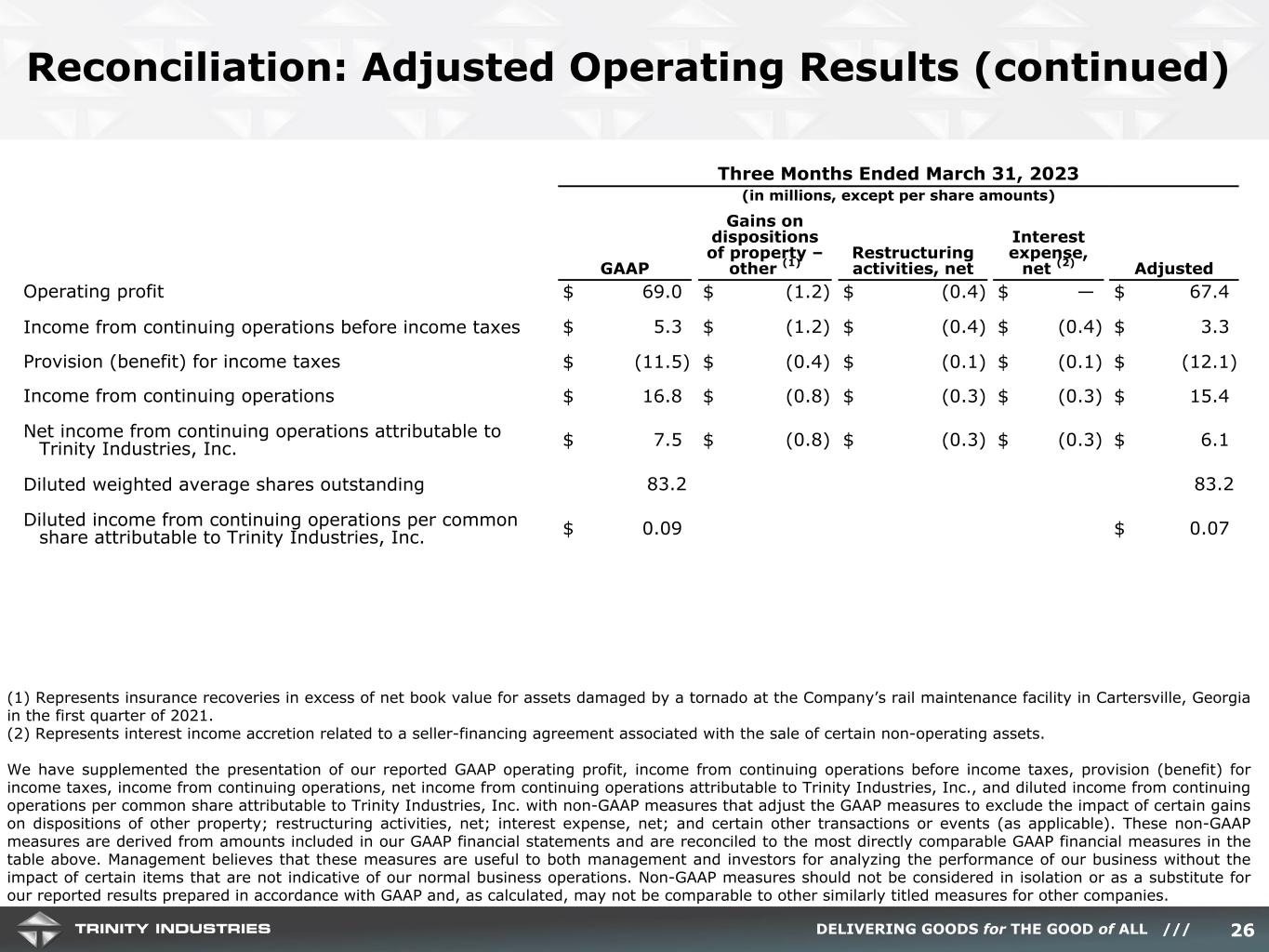

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Adjusted Operating Results (continued) (1) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (2) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain gains on dispositions of other property; restructuring activities, net; interest expense, net; and certain other transactions or events (as applicable). These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. 26 Three Months Ended March 31, 2023 (in millions, except per share amounts) GAAP Gains on dispositions of property – other (1) Restructuring activities, net Interest expense, net (2) Adjusted Operating profit $ 69.0 $ (1.2) $ (0.4) $ — $ 67.4 Income from continuing operations before income taxes $ 5.3 $ (1.2) $ (0.4) $ (0.4) $ 3.3 Provision (benefit) for income taxes $ (11.5) $ (0.4) $ (0.1) $ (0.1) $ (12.1) Income from continuing operations $ 16.8 $ (0.8) $ (0.3) $ (0.3) $ 15.4 Net income from continuing operations attributable to Trinity Industries, Inc. $ 7.5 $ (0.8) $ (0.3) $ (0.3) $ 6.1 Diluted weighted average shares outstanding 83.2 83.2 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 0.09 $ 0.07

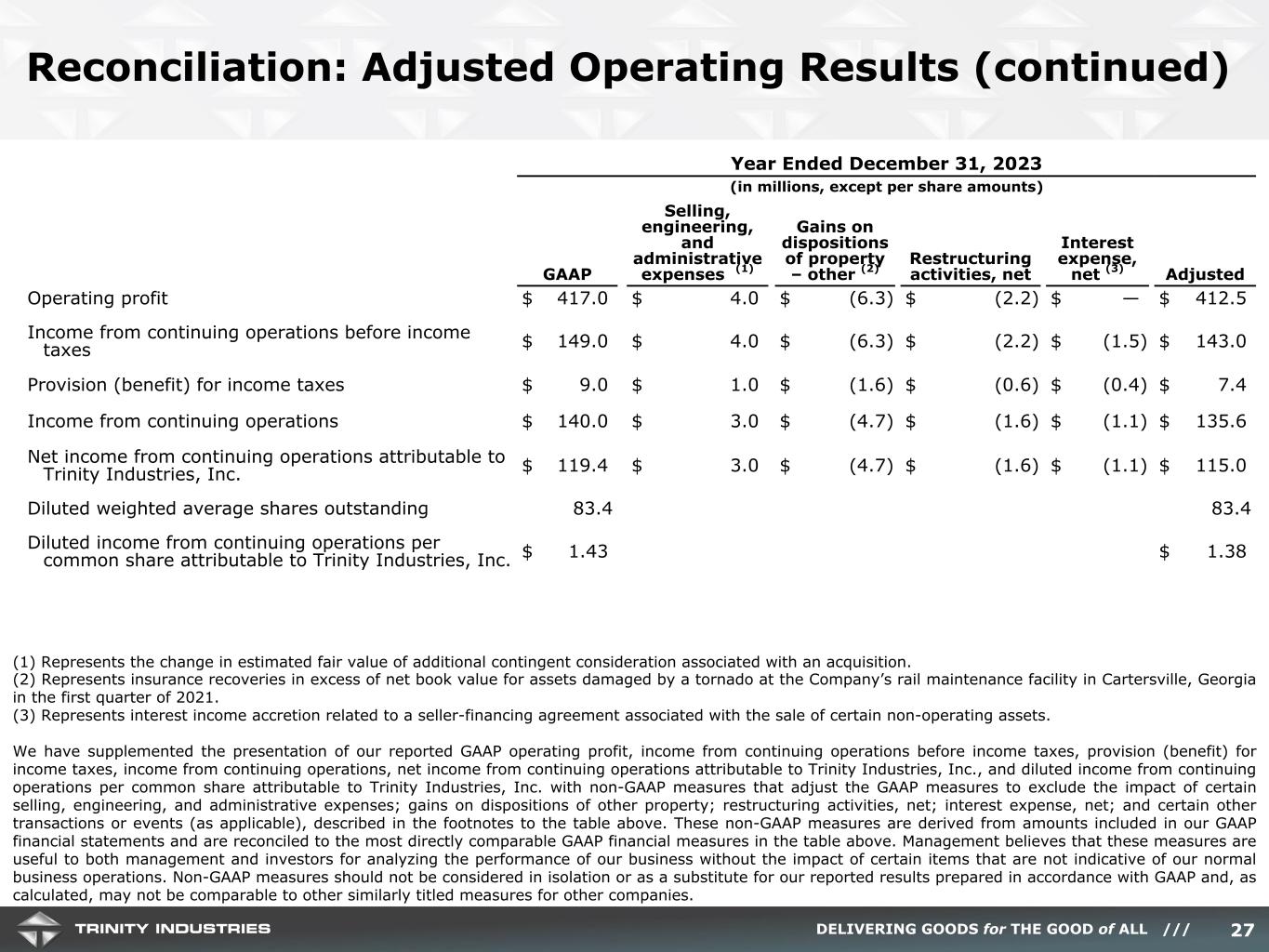

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Adjusted Operating Results (continued) 27 (1) Represents the change in estimated fair value of additional contingent consideration associated with an acquisition. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain selling, engineering, and administrative expenses; gains on dispositions of other property; restructuring activities, net; interest expense, net; and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. Year Ended December 31, 2023 (in millions, except per share amounts) GAAP Selling, engineering, and administrative expenses (1) Gains on dispositions of property – other (2) Restructuring activities, net Interest expense, net (3) Adjusted Operating profit $ 417.0 $ 4.0 $ (6.3) $ (2.2) $ — $ 412.5 Income from continuing operations before income taxes $ 149.0 $ 4.0 $ (6.3) $ (2.2) $ (1.5) $ 143.0 Provision (benefit) for income taxes $ 9.0 $ 1.0 $ (1.6) $ (0.6) $ (0.4) $ 7.4 Income from continuing operations $ 140.0 $ 3.0 $ (4.7) $ (1.6) $ (1.1) $ 135.6 Net income from continuing operations attributable to Trinity Industries, Inc. $ 119.4 $ 3.0 $ (4.7) $ (1.6) $ (1.1) $ 115.0 Diluted weighted average shares outstanding 83.4 83.4 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 1.43 $ 1.38

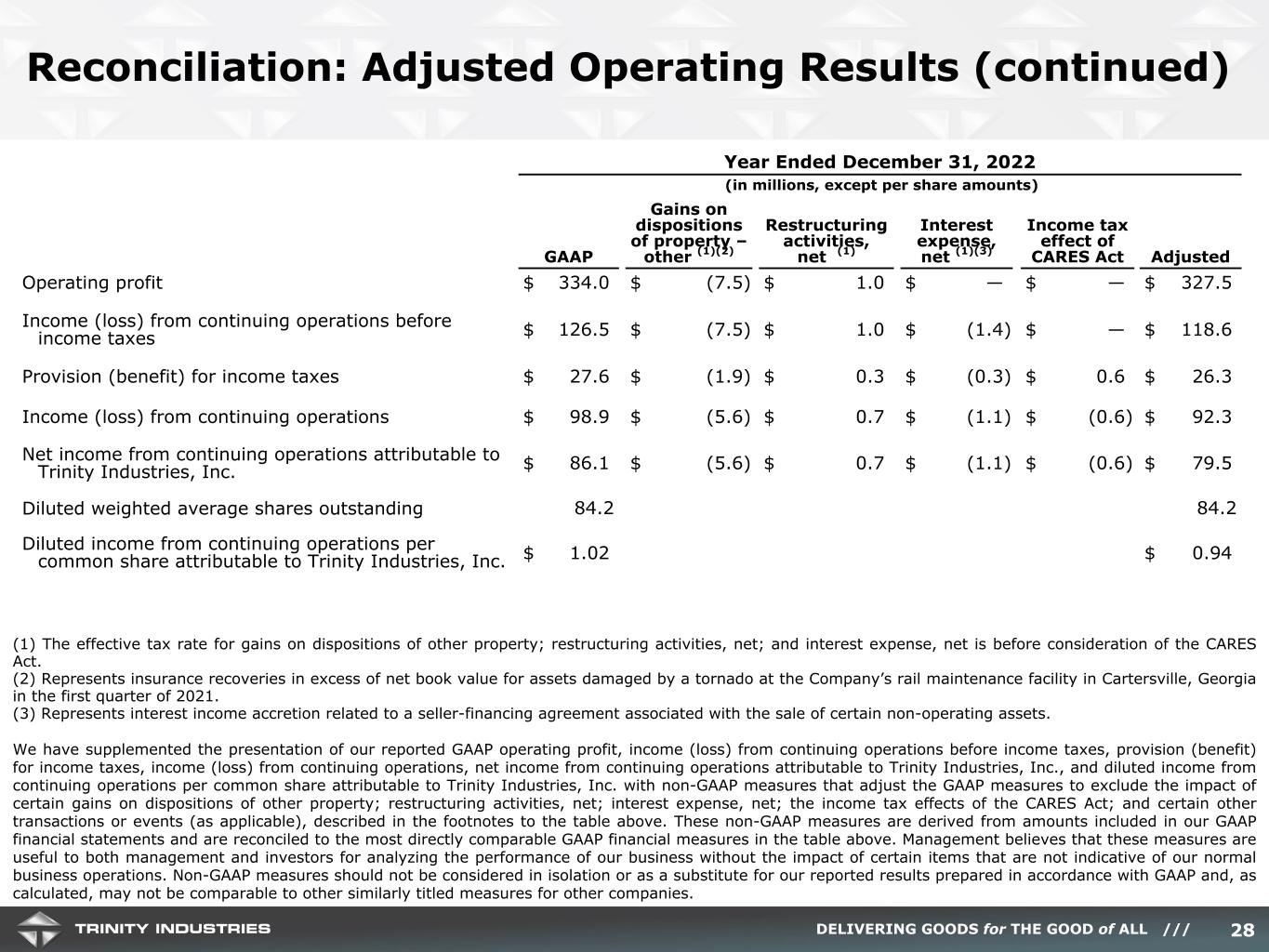

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Adjusted Operating Results (continued) (1) The effective tax rate for gains on dispositions of other property; restructuring activities, net; and interest expense, net is before consideration of the CARES Act. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income (loss) from continuing operations before income taxes, provision (benefit) for income taxes, income (loss) from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain gains on dispositions of other property; restructuring activities, net; interest expense, net; the income tax effects of the CARES Act; and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. 28 Year Ended December 31, 2022 (in millions, except per share amounts) GAAP Gains on dispositions of property – other (1)(2) Restructuring activities, net (1) Interest expense, net (1)(3) Income tax effect of CARES Act Adjusted Operating profit $ 334.0 $ (7.5) $ 1.0 $ — $ — $ 327.5 Income (loss) from continuing operations before income taxes $ 126.5 $ (7.5) $ 1.0 $ (1.4) $ — $ 118.6 Provision (benefit) for income taxes $ 27.6 $ (1.9) $ 0.3 $ (0.3) $ 0.6 $ 26.3 Income (loss) from continuing operations $ 98.9 $ (5.6) $ 0.7 $ (1.1) $ (0.6) $ 92.3 Net income from continuing operations attributable to Trinity Industries, Inc. $ 86.1 $ (5.6) $ 0.7 $ (1.1) $ (0.6) $ 79.5 Diluted weighted average shares outstanding 84.2 84.2 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 1.02 $ 0.94

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: EBITDA and Adjusted EBITDA “EBITDA” is defined as income from continuing operations plus interest expense, income taxes, and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA plus certain selling, engineering, and administrative expenses; gains on dispositions of other property; restructuring activities, net; and interest income. EBITDA and Adjusted EBITDA are non-GAAP financial measures; however, the amounts included in these calculations are derived from amounts included in our GAAP financial statements. EBITDA and Adjusted EBITDA are reconciled to net income, the most directly comparable GAAP financial measure, in the table above. This information is provided to assist management and investors in making meaningful comparisons of our operating performance between periods. We believe EBITDA is a useful measure for analyzing the performance of our business. We also believe that EBITDA is commonly reported and widely used by investors and other interested parties as a measure of a company’s operating performance and debt servicing ability because it assists in comparing performance on a consistent basis without regard to capital structure, depreciation or amortization (which can vary significantly depending on many factors). EBITDA and Adjusted EBITDA should not be considered as alternatives to net income as indicators of our operating performance, or as alternatives to operating cash flows as measures of liquidity. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. 29 LTM March 31, 2024 (in millions) Net income $ 140.3 Less: Loss from discontinued operations, net of income taxes (14.6) Income from continuing operations 154.9 Interest expense 285.2 Provision (benefit) for income taxes 31.5 Depreciation and amortization expense 292.6 EBITDA 764.2 Selling, engineering, and administrative expenses 4.0 Gains on dispositions of property – other (5.1) Restructuring activities, net (1.8) Interest income (1.5) Adjusted EBITDA $ 759.8

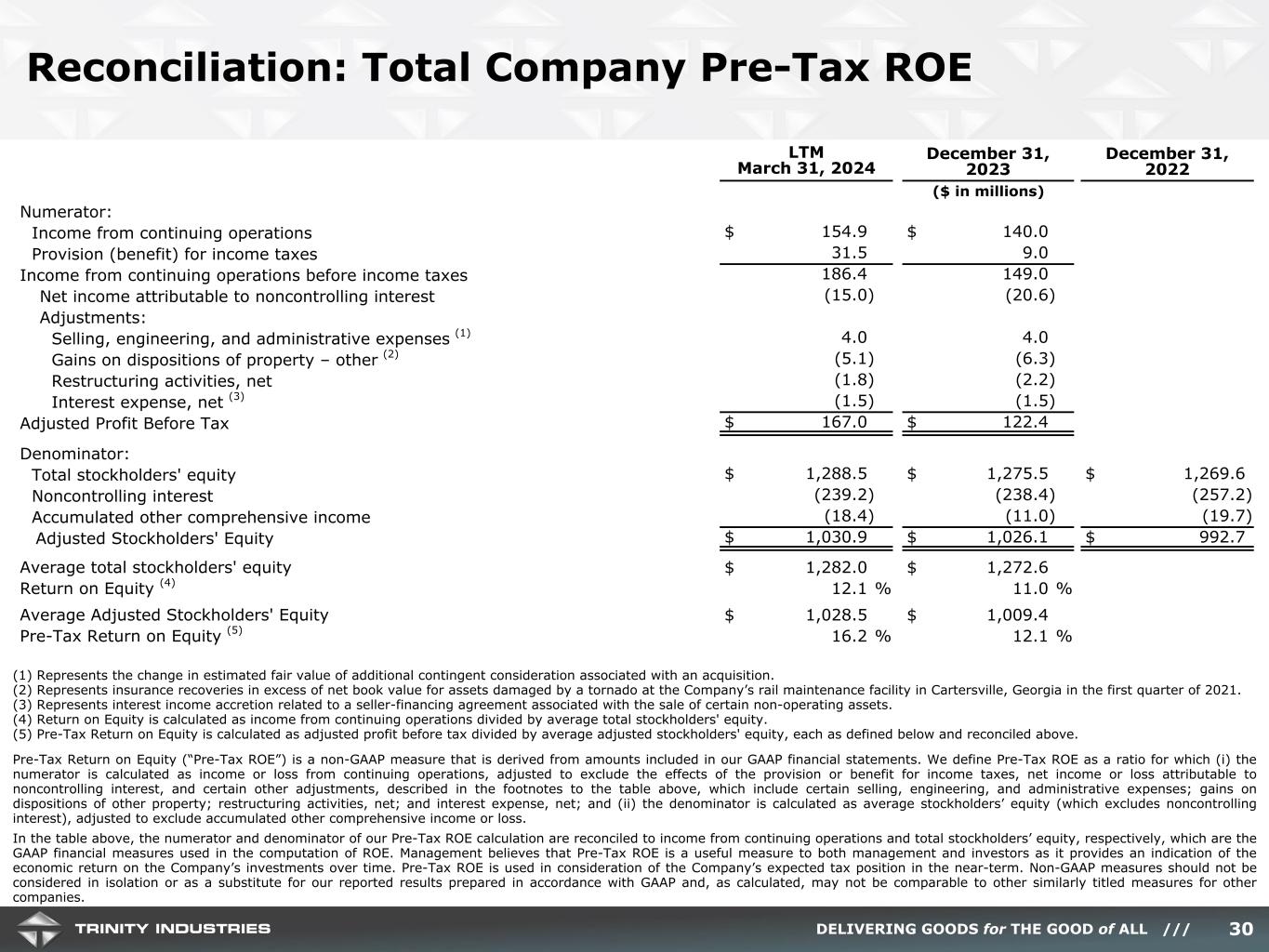

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Total Company Pre-Tax ROE 30 (1) Represents the change in estimated fair value of additional contingent consideration associated with an acquisition. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. (4) Return on Equity is calculated as income from continuing operations divided by average total stockholders' equity. (5) Pre-Tax Return on Equity is calculated as adjusted profit before tax divided by average adjusted stockholders' equity, each as defined below and reconciled above. Pre-Tax Return on Equity (“Pre-Tax ROE”) is a non-GAAP measure that is derived from amounts included in our GAAP financial statements. We define Pre-Tax ROE as a ratio for which (i) the numerator is calculated as income or loss from continuing operations, adjusted to exclude the effects of the provision or benefit for income taxes, net income or loss attributable to noncontrolling interest, and certain other adjustments, described in the footnotes to the table above, which include certain selling, engineering, and administrative expenses; gains on dispositions of other property; restructuring activities, net; and interest expense, net; and (ii) the denominator is calculated as average stockholders’ equity (which excludes noncontrolling interest), adjusted to exclude accumulated other comprehensive income or loss. In the table above, the numerator and denominator of our Pre-Tax ROE calculation are reconciled to income from continuing operations and total stockholders’ equity, respectively, which are the GAAP financial measures used in the computation of ROE. Management believes that Pre-Tax ROE is a useful measure to both management and investors as it provides an indication of the economic return on the Company’s investments over time. Pre-Tax ROE is used in consideration of the Company’s expected tax position in the near-term. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. LTM March 31, 2024 December 31, 2023 December 31, 2022 ($ in millions) Numerator: Income from continuing operations $ 154.9 $ 140.0 Provision (benefit) for income taxes 31.5 9.0 Income from continuing operations before income taxes 186.4 149.0 Net income attributable to noncontrolling interest (15.0) (20.6) Adjustments: Selling, engineering, and administrative expenses (1) 4.0 4.0 Gains on dispositions of property – other (2) (5.1) (6.3) Restructuring activities, net (1.8) (2.2) Interest expense, net (3) (1.5) (1.5) Adjusted Profit Before Tax $ 167.0 $ 122.4 Denominator: Total stockholders' equity $ 1,288.5 $ 1,275.5 $ 1,269.6 Noncontrolling interest (239.2) (238.4) (257.2) Accumulated other comprehensive income (18.4) (11.0) (19.7) Adjusted Stockholders' Equity $ 1,030.9 $ 1,026.1 $ 992.7 Average total stockholders' equity $ 1,282.0 $ 1,272.6 Return on Equity (4) 12.1 % 11.0 % Average Adjusted Stockholders' Equity $ 1,028.5 $ 1,009.4 Pre-Tax Return on Equity (5) 16.2 % 12.1 %

DELIVERING GOODS for THE GOOD of ALL /// SLIDE 2 1. LTM is calculated as the year ended December 31, 2023, less the three months ended March 31, 2023, plus the three months ended March 31, 2024, representing the financial information from April 1, 2023 to March 31, 2024. SLIDE 6 – Trinity Industries, Inc. Overview 1. Current dividend yield represents the Company’s most recent quarterly dividend, annualized, and the stock price (NYSE: TRN) as of March 31, 2024. 2. Intersegment revenues are eliminated. SLIDE 10 – Trinity’s Platform is Built to Deliver Shareholder Value 1. OP Margin, Adjusted is calculated as adjusted operating profit as reconciled on Slides 25, 26, and 27 divided by total revenues for the LTM March 31, 2024. SLIDE 11 – Stable Financial Performance Through the Cycle 1. OP Margin is calculated using the Railcar Leasing and Services Group revenues and operating profit, excluding lease portfolio sales, and includes gains from insurance recoveries of $5.1M for LTM March 31, 2024, $6.3M for 2023, and $7.5M for 2022. 2. Future Lease Rate Differential (FLRD) calculates the implied change in lease rates for railcar leases expiring over the next four quarters. The FLRD assumes that these expiring leases will be renewed at the most recent quarterly transacted lease rates for each railcar type. We believe the FLRD is useful to both management and investors as it provides insight into the near-term trend in lease rates. The FLRD is calculated as follows: (New Lease Rates — Expiring Lease Rates) x Expiring Railcar Leases (Expiring Lease Rates x Expiring Railcar Leases) SLIDE 13 – Railcars: Sustainable Long-term Investments https://www.aar.org/wp-content/uploads/2023/06/AAR-Climate-Change-Fact-Sheet.pdf SLIDE 17 – Integral Part of the North American Supply Chain 1. Umler® source data, January 1, 2024 report 2. FTR Associates 12/31/2023 3. Association of American Railroads (“AAR”), accessed on March 1, 2022 with data as of February 20, 2022 4. Association of American Railroads (“AAR”) 12/31/2023 SLIDE 18 - Delivering Essential Goods to the Global Marketplace Internal Carloads Data and Analysis, accessed on January 17, 2024 with data as of December 31, 2023 SLIDE 19 - Capitalizing on Structural Change in the Rail Market Umler® North American fleet ownership data as of January 1, 2024 SLIDE 21 – Healthy Balance Sheet Strategically Positioned for Opportunistic Deployment and Value Creation 1. Balances and blended average interest rate (including the effect of interest rate hedges, as applicable) as of March 31, 2024 Presentation Footnotes 31

DELIVERING GOODS for THE GOOD of ALL /// Contact Information 32 Contact Information: Leigh Anne Mann, Vice President of Investor Relations 214-631-4420 TrinityInvestorRelations@trin.net Investor Website: www.trin.net/investor-relations