false

0001581091

0001581091

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 9, 2024

RE/MAX

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36101 |

|

80-0937145 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5075

South Syracuse Street

Denver,

Colorado 80237

(Address of principal executive offices, including

Zip code)

(303)

770-5531

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Class

A Common Stock $0.0001 par value per share |

|

RMAX |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

7.01 Regulation FD Disclosure.

On

May 9, 2024, the United States District Court for the Western District of Missouri (the “District Court”) granted final

approval of the Settlement Agreement that RE/MAX, LLC (“RE/MAX”) entered into on October 5, 2023 (the “Settlement

Agreement”).

As

previously disclosed, RE/MAX, a subsidiary of RE/MAX Holdings, Inc. (the “Company”), entered into a Settlement Term

Sheet on September 15, 2023, and the Settlement Agreement on October 5, 2023. The District Court granted preliminary approval

of the Settlement Agreement on November 20, 2023.

The

Settlement Agreement resolves actual or potential claims by persons who sold a home that was listed on a multiple listing service

anywhere in the United States where a commission was paid to any brokerage in connection with the sale of the home during date ranges

specified in the Settlement Agreement (the “Settlement Class”). In addition, the Settlement Agreement releases claims that a class member paid an excessive

commission or home price due to the claims at issue in these actions. The Settlement Class includes the claims in class action lawsuits

brought by: (i) Scott and Rhonda Burnett et al. (United States District Court for the Western District of Missouri Case No. 4:19-cv-00332-SRB),

(ii) Christopher Moehrl et al. (United States District Court for the Northern District of Illinois Case No. 1:19-cv-01610-ARW),

(iii) Jennifer Nosalek et al. (United States District Court for the District of Massachusetts Case No. 1:20-cv-12244-PBS),

and (iv) others that allege similar claims against RE/MAX.

The

Settlement Agreement will become effective following any appeals process, if applicable.

Under

the Settlement Agreement, RE/MAX agreed to pay a total settlement amount of $55.0 million

(the “Settlement Amount”) into a qualified settlement fund. RE/MAX paid one half of the Settlement Amount during

2023 and expects to pay the remaining half within ten business days of the District Court’s final approval of the Settlement

Agreement. In 2023, the Company recorded a pre-tax charge for the full Settlement Amount within its Consolidated Statements of

Income (Loss) with a corresponding liability recorded to accrued liabilities within its Consolidated Balance Sheets. In addition,

RE/MAX agreed to make certain previously disclosed changes to its business practices. Apart from the payment of the Settlement

Amount, the Company does not expect the terms of the Settlement Agreement to have a material impact on its results of

operations and cash flows.

The

Settlement Agreement and any actions taken to carry out the Settlement Agreement are not an admission or concession of liability, or

of the validity of any claim, defense, or point of fact or law on the part of any party. RE/MAX continues to deny the material allegations

of the complaints in the Lawsuits.

On

May 9, 2024, RE/MAX issued a press release regarding the preliminary approval of the Settlement Agreement, which is furnished herewith

as Exhibit 99.1.

Item 9.01.

Financial Statements and Exhibits.*

*

The information contained in Items 7.01 and 9.01 and Exhibit 99.1 of this Current Report on Form 8-K is being “furnished”

and shall not be deemed “filed” for purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration

statement or other filings of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be set forth

by specific reference in such filing.

Forward-Looking

Statements

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are often

identified by the use of words such as “believe,” “intend,” “expect,” “estimate,”

“plan,” “outlook,” “project,” “anticipate,” “may,” “will,”

“would” and other similar words and expressions that predict or indicate future events or trends that are not statements

of historical matters. Forward-looking statements include statements related to the Settlement Agreement, the lawsuits addressed in

the Settlement Agreement, any appeals process, changes to the business practices of RE/MAX and the impact that such changes may have

on the business or results of operations of RE/MAX or the Company. Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily accurately indicate the times at which such performance or results may be

achieved. Forward-looking statements are based on information available at the time those statements are made and/or

management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that

could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking

statements. These risks and uncertainties include, without limitation, (1) changes in the real estate market or interest rates

and availability of financing, (2) changes in business and economic activity in general, (3) the Company’s ability

to attract and retain quality franchisees, (4) the Company’s franchisees’ ability to recruit and retain real estate

agents and mortgage loan originators, (5) changes in laws and regulations, (6) the Company’s ability to enhance,

market, and protect its brands, including the RE/MAX and Motto Mortgage brands, (7) the Company’s ability to implement

its technology initiatives, (8) risks related to the Company’s CEO transition, (9) fluctuations in foreign currency

exchange rates, (10) potential appeals of the Settlement Agreement and (11) those risks and uncertainties described in the

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with

the Securities and Exchange Commission (“SEC”) and similar disclosures in subsequent periodic and current reports filed

with the SEC, which are available on the investor relations page of the Company’s website at www.remaxholdings.com and on

the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as

of the date on which they are made. Except as required by law, the Company does not intend, and undertakes no obligation, to update

this information to reflect future events or circumstances.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

RE/MAX

HOLDINGS, INC. |

| |

|

|

| Date:

May 9, 2024 |

By: |

/s/

Susie Winders |

| |

|

Susie

Winders |

| |

|

Executive

Vice President, General Counsel |

Exhibit

99.1

| Contact:

Keri

Henke

Sr. Manager, External Communications

khenke@remax.com | 303.796.3424

|

| | |

| FOR

IMMEDIATE RELEASE | |

RE/MAX,

LLC SETTLEMENT AGREEMENT GRANTED FINAL APPROVAL IN ANTITRUST CLASS ACTION LAWSUITS

The

approved settlement resolves the claims asserted against RE/MAX, LLC and releases RE/MAX affiliates on a nationwide basis

DENVER – RE/MAX,

the #1 name in real estate*, received final approval of the settlement agreement in the class action lawsuits known as Burnett, Moehrl

and Nosalek, and any similar claims on a nationwide basis. The approved settlement resolves the claims asserted against RE/MAX, LLC and

includes releases for all U.S. RE/MAX independent regions, franchisees and agents.

To

address the pending litigation and mitigate the uncertainties and costs associated with prolonged legal proceedings, RE/MAX, LLC entered

into a settlement agreement with plaintiffs on October 5, 2023. RE/MAX, LLC agreed to pay $55 million and make certain

changes to business practices as part of the settlement.

“Since

entering into the settlement last fall, RE/MAX has been committed to obtaining final approval,” says RE/MAX Holdings CEO Erik Carlson.

“We are thrilled to be leading the way in moving forward, maintaining our focus on supporting RE/MAX affiliates and continuing

to foster greater transparency in the industry on behalf of homebuyers and sellers.”

The

settlement agreement will become effective following any appeals process, if applicable.

The

settlement agreement is not an admission or concession of liability, or of the validity of any claim, defense, or point of fact or law

on the part of any party. RE/MAX continues to deny the material allegations of the complaints in the lawsuits.

*

Source: MMR Strategy Group study of unaided awareness

#

# #

About

the RE/MAX Network

As

one of the leading global real estate franchisors, RE/MAX, LLC is a subsidiary of RE/MAX Holdings (NYSE: RMAX) with more than 140,000

agents in nearly 9,000 offices and a presence in more than 110 countries and territories. Nobody in the world sells more real estate

than RE/MAX, as measured by residential transaction sides. RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial

culture affording its agents and franchisees the flexibility to operate their businesses with great independence. RE/MAX agents have

lived, worked and served in their local communities for decades, raising millions of dollars every year for Children’s Miracle

Network Hospitals® and other charities. To learn more about RE/MAX, to search home listings or find an agent in your community, please

visit www.remax.com. For the latest news about RE/MAX, please visit news.remax.com.

Forward-Looking

Statements

This

Press Release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the

United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such

as “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,”

“project,” “anticipate,” “may,” “will,” “would” and other similar words and

expressions that predict or indicate future events or trends that are not statements of historical matters. Forward-looking statements

include statements related to antitrust class action lawsuits and the settlement of such lawsuits, changes to the business practices

of RE/MAX, and greater transparency in the industry. Forward-looking statements should not be read as a guarantee of future performance

or results and will not necessarily accurately indicate the times at which such performance or results may be achieved. Forward-looking

statements are based on information available at the time those statements are made and/or management’s good faith belief as of

that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to

differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include, without

limitation, (1) changes in the real estate market or interest rates and availability of financing, (2) changes in business

and economic activity in general, (3) the Company’s ability to attract and retain quality franchisees, (4) the Company’s

franchisees’ ability to recruit and retain real estate agents and mortgage loan originators, (5) changes in laws and regulations,

(6) the Company’s ability to enhance, market, and protect its brands, including the RE/MAX and Motto Mortgage brands, (7) the

Company’s ability to implement its initiatives, (8) risks related to the Company’s leadership transitions, (9) fluctuations

in foreign currency exchange rates, (10) potential appeals of the Settlement Agreement and (11) those risks and uncertainties described

in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the

Securities and Exchange Commission (“SEC”) and similar disclosures in subsequent periodic and current reports filed with

the SEC, which are available on the investor relations page of the Company’s website at www.remaxholdings.com and on the SEC

website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date

on which they are made. Except as required by law, the Company does not intend, and undertakes no obligation, to update this information

to reflect future events or circumstances.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

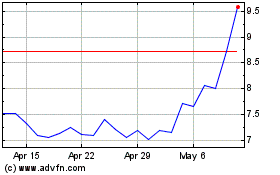

RE MAX (NYSE:RMAX)

Historical Stock Chart

From Apr 2024 to May 2024

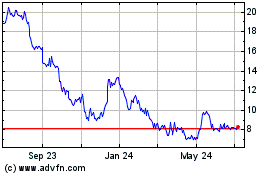

RE MAX (NYSE:RMAX)

Historical Stock Chart

From May 2023 to May 2024