UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

May, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on the cessation of refining at CADE

—

Rio de Janeiro, May 22, 2024 - Petróleo Brasileiro S.A.- Petrobras,

in continuity to the Material Fact disclosed on May 20, 2024, informs that the Administrative Council for Economic Defense (CADE) decided

in favor of renegotiating the Terms of Cessation Commitment (TCC) for Refinery, signed on May 29, 2019, which was also approved today

by the Company's Board of Directors.

On May 29, 2019, the Term of Cessation Commitment for the Refining

Market (“TCC Refino”) was signed between Petrobras and CADE, which provided, among other commitments, the mandatory divestment

of 8 refineries (REPAR, RNEST, REGAP, REFAP, RLAM, REMAN, LUBNOR and SIX). These commitments were aligned with the guidelines of the Executive

Board at that time and National Energy Policy Council (“CNPE”) Resolution 09/2019, then in force, which established guidelines

for promoting free competition in refining activities in Brazil.

Petrobras had been complying with the commitments agreed in TCC Refino,

including the sale of its entire equity stakes in 3 assets (SIX, RLAM and REMAN) but faced obstacles during the execution of the divestment

processes which prevented the Company from concluding the sale of the remaining refineries within the scope of the TCC.

According to the Material Fact disclosed on March 29, 2023, upon

receipt of Official Letters 166/2023/GM-MME, 257/2023/GM-MME and 261/2023/GM-MME from the Ministry of Mines and Energy, the Company’s

Board of Directors understood that need to assess the Ministry's requests to review if the investments and divestments processes should

be carried out based on the Company's new Strategic Plan proposed by the newly elected Executive Board.

Subsequently, Resolution CNPE 05/2023 was published, which consolidated

the end of the guidelines related to the divestment of the assets, in addition to Petobras’ 2024-2028+ Strategic Plan, which has

among its objectives to act in a competitive and safe manner, maximizing the capturing of value by adapting and improving the refining

park and developing new products aimed at a low carbon market. Therefore, the terms of the TCC were reviewed to adapt it to the new market

reality and regulatory environment.

The amendment results from extensive debates between the technical

areas of both Petrobras and CADE and culminated in the cessation of the obligation to sell TBG, within the scope of the TCC, and established

new commitments, summarized as follows:

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9o andar

– 20231-030 – Rio de Janeiro, RJ.

Phone: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act), that reflect the expectations of the Company's management. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects", "aims",

"should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not

by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not

rely solely on the information included herein.

1. new behavioral obligations to provide CADE with mechanisms for

monitoring, within a controlled environment, data related to Petrobras' commercial activities in the derivatives and petroleum (crude

oil) market, in domestic territory, thus allowing it to verify the non-discriminatory nature of prices charged by Petrobras;

2. disclosure, by Petrobras, of general, non-discriminatory commercial

guidelines for deliveries of oil, by sea, to any independent refinery in the Brazilian territory;

3. the offering of Frame Contracts to any independent refinery, in

the Brazilian territory, for deliveries by sea. This contractual model defines the basic conditions for the negotiation, load by load,

of oil volumes ensuring that the purchase and sale requirements will only be applied if both parties reach an agreed price, guaranteeing

their alignment with market conditions at the time each transaction is concluded. These contracts must provide, during a period of 3 (three)

business days (“Negotiation Period”), the guarantee to supply a minimum monthly oil volume to be delivered, by sea, by Petrobras.

The obligations agreed in the Addendum to TCC Refino are valid for

3 years and can be extended for the same period, at CADE's sole discretion.

The new obligations also foresee investigations initiated after the

signing of the TCC and preserve the objective of maintaining competitiveness in the refining market, in addition to expanding independent

agents, in a period in which the Brazilian refining system is undergoing a transition.

In view of the above, the Executive Board of Petrobras removed REPAR,

RNEST, REGAP, REFAP and LUBNOR from the divestment portfolio.

The amendment reflects Petrobras’ respect for the antitrust

authority and the agreements signed, thus preserving the country's business environment.

Any facts deemed relevant to this matter will be timely disclosed

to the market.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9o andar

– 20231-030 – Rio de Janeiro, RJ.

Phone: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act), that reflect the expectations of the Company's management. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects", "aims",

"should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not

by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not

rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 22, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Carlos Alberto Rechelo Neto

______________________________

Carlos Alberto Rechelo Neto

Chief Financial Officer and Investor Relations

Officer

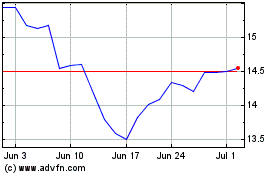

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From May 2024 to Jun 2024

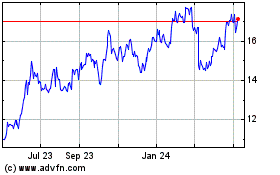

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Jun 2023 to Jun 2024