Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 07 2024 - 3:42PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of May,

2024

IRSA

Inversiones y Representaciones Sociedad

Anónima

(Exact name of Registrant as specified in its charter)

IRSA

Investments and Representations Inc.

(Translation of registrant´s name into English)

Republic

of Argentina

(Jurisdiction of incorporation or organization)

Carlos Della Paolera

261

(C1001ADA)

Buenos

Aires, Argentina

(Address of principal

executive offices)

Form 20-F ⌧ Form

40-F ☐

Indicate by

check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ☐ No

x

IRSA

INVERSIONES Y REPRESENTACIONES SOCIEDAD

ANÓNIMA

(THE

“COMPANY”)

REPORT

ON FORM 6-K

By letter dated May

7, 2024, the Company reported that in compliance with Section 63 of

the Regulations issued by the Buenos Aires Stock Exchange, this is

to report the following information:

|

1. Results of the period

|

in million ARS

|

|

|

03/31/2024

|

03/31/2023

|

|

Results of the period (nine-month period)

|

(111,728)

|

123,217

|

|

Attributable to: |

|

|

|

Shareholders

of the controlling company

|

(104,926)

|

119,339

|

|

Non-controlling

interest

|

(6,802)

|

3,878

|

|

|

|

|

|

2. Other comprehensive income for the results of the

period

|

in million ARS

|

|

|

03/31/2024

|

03/31/2023

|

|

Other comprehensive income for

the period (nine-month period)

|

(3,292)

|

(4,170)

|

|

Attributable to:

|

|

|

|

Shareholders

of the controlling company

|

(3,388)

|

(4,186)

|

|

Non-controlling

interest

|

96

|

16

|

|

|

|

|

|

3. Total

comprehensive income for the

results of the period

|

in million ARS

|

|

|

03/31/2024

|

03/31/2023

|

|

Total integral results of the period (nine-month

period)

|

(115,020)

|

119,047

|

|

Attributable to:

|

|

|

|

Shareholders

of the controlling company

|

(108,314)

|

115,153

|

|

Non-controlling interest

|

(6,706)

|

3,894

|

|

|

|

|

|

4. Equity details

|

in million ARS

|

|

|

03/31/2024

|

03/31/2023

|

|

Share

Capital

|

7,265

|

800

|

|

|

124

|

11

|

|

Comprehensive adjustment of capital stock and of treasury

shares

|

274,023

|

236,309

|

|

Warrants

|

19,122

|

19,636

|

|

Share Premium

|

402,378

|

445,406

|

|

Premium for trading of treasury shares

|

(8,691)

|

1,618

|

|

Legal Reserve

|

40,432

|

31,450

|

|

Special Reserve (Resolution CNV 609/12)

|

|

156,428

|

|

Cost of treasury share

|

(17,161)

|

(8,807)

|

Reserve

for future dividends

|

61,532

|

28,151

|

|

Reserve

for conversion

|

(2,796)

|

(181)

|

|

Special Reserve

|

97,493

|

182,428

|

|

Other reserves

|

|

(78,707)

|

|

Retained

earnings

|

(78,628)

|

140,353

|

|

Shareholders’ Equity attributable to controlling

company’s shareholders

|

872,520

|

1,154,895

|

|

Non-controlling

interest

|

59,637

|

71,397

|

|

Total shareholder's equity

|

932,157

|

1,226,292

|

Pursuant to

Article 63 paragraph l) sections 6) and 8) of the next Regulation,

we inform that at the closing date of the financial statements, the

share capital of the Company is ARS 7,389,022,820 (including

treasury shares) represented by 738,902,282

non-endorsable

nominative ordinary shares of Nominal

Value ARS 10 each with the right

to 1 vote each which are as of

today duly registered. The amount of outstanding shares is

726,505,142.

The Company's

market capitalization as of March 31, 2024, was approximately USD

692 million. (73,890,228 GDS with a price per GDS of USD

9.36)

The main

shareholder of the Company is Cresud S.A.C.I.F. y A. (Cresud) with

397,831,498 shares directly and indirectly (through Helmir S.A.),

which represents 54.76% of the share capital (the treasury shares

are subtracted). Cresud is our ultimate controlling entity and is a

company incorporated and domiciled in the Argentine Republic. The

address of its registered office is Carlos Della Paolera 261, 9th

floor, Autonomous City of Buenos Aires, Argentina.

We also inform that

as of March 31, 2024, subtracting the direct and indirect ownership

of Cresud and the treasury shares, the remaining shareholders held

the amount of 328,673,644 nominative non-endorsable ordinary shares

of Nominal Value 10 ARS each with the right to 1 vote each from the

Company that represents 45.24% of the issued share

capital.

It should be

considered that in May 2021 the company increased its share capital

by 80 million shares. For each subscribed share, each shareholder

received at no additional cost 1 warrant, that is, 80 million

warrants were issued. The options expire on May 12, 2026 and are

listed on the Buenos Aires Stock Exchange under the symbol

“IRS2W” and on the NYSE under the symbol

“IRSWS”. As of today, the amount outstanding of

warrants is 77,624,512.

In the case that

all warrants were converted, the number of shares issued and

subscribed would increase to 834,163,083 (considering the current

ratio of 1,2272 ordinary shares per warrant). We also inform that

if Cresud, through its subsidiary Helmir S.A., were to exercise its

warrants like the rest of the shareholders, its stake would

increase by 60,923,885 ordinary shares, which would mean a 55.83%

stake on the share capital (excluding treasury shares), that is,

458,755,383 shares.

Among the news of

the period ended on March 31, 2024 and subsequent, the following

can be highlighted:

●

The net result for

the nine-month period of fiscal year 2024 recorded a loss of ARS

111,728 million compared to a gain of ARS 123,217 million in the

same period of the previous year, mainly explained by the impact of

inflation exposure on the fair value of investment

properties.

●

The rental adjusted

EBITDA reached ARS 112,911 million in the nine months of fiscal

year 2024, 9.1% higher than the same period of the previous year,

ARS 86,475 million coming from the Shopping Malls segment, ARS

8,776 million from the office segment and ARS 17,660 million from

the Hotels. Total adjusted EBITDA reached ARS 128,826 million,

increasing 6.3% compared to the same period of the previous

year.

●

Real tenant sales

in shopping malls fell 18.5% in the third quarter of fiscal year

2024 as a result of the acceleration of inflation and a drop in

consumption. In the accumulated nine-month period of the year,

sales grew by 0.9% compared to the same period in

2023.

●

We maintained high

occupancy rates in the three rental segments: 97.9% in shopping

centers, 92.8% in our premium offices and 68.7% in the hotel

portfolio.

●

During the quarter

and subsequently, we repurchased approximately 1.7% of the stock

capital and in May 2024, we approved a new cash dividend for ARS

55,000 million (ARS/share 76.1457 and ARS/GDS 761.4575), which will

be distributed since May 9.

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized, in the city of

Buenos Aires, Argentina.

|

|

IRSA

Inversiones y Representaciones Sociedad

Anónima

|

|

|

|

|

|

By:

|

/S/ Saúl

Zang

|

|

|

|

|

Name:

Saúl Zang

|

|

|

|

|

Title:

Responsible for the Relationship with the Markets

|

|

Dated: May 7,

2024

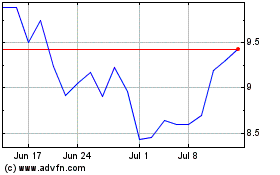

IRSA Inversiones and Rep... (NYSE:IRS)

Historical Stock Chart

From Apr 2024 to May 2024

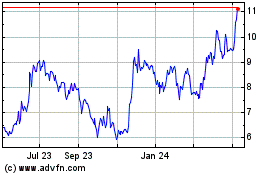

IRSA Inversiones and Rep... (NYSE:IRS)

Historical Stock Chart

From May 2023 to May 2024