As filed with the Securities and Exchange Commission on May 8, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MERCURY SYSTEMS, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| | | |

| Massachusetts | | 04-2741391 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

| 50 Minuteman Road | | |

| Andover, Massachusetts | | 01810 |

| (Address of Principal Executive Offices) | | (Zip Code) |

MERCURY SYSTEMS, INC.

2024 Employee Stock Purchase Plan

(Full title of the plan)

Stuart H. Kupinsky

Executive Vice President, Chief Legal Officer, and Corporate Secretary

Mercury Systems, Inc.

50 Minuteman Road

Andover, Massachusetts 01810

(Name and address of agent for service)

(978) 256-1300

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

| | | |

Large accelerated filer [X] | | Accelerated filer [ ] |

| | |

Non-accelerated filer [ ] | | Smaller reporting company [ ] |

| | |

| | Emerging growth company [ ] |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

|

EXPLANATORY NOTE

This Registration Statement is being filed solely for the purpose of registering 1,000,000 shares of common stock, par value $0.01 per share (the “Common Stock”), of Mercury Systems, Inc. (the “Company”) to be offered to participants under the Company’s 2024 Employee Stock Purchase Plan (“ESPP”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

ITEMS 1 AND 2.

The documents containing the information for the ESPP specified by Part I of this Registration Statement will be sent or given to the employees as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). Such documents need not be filed with the Securities and Exchange Commission (the “Commission”) either as a part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. Such documents and the documents incorporated by reference pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The following documents are incorporated herein by reference:

| | | | | |

| (a) | |

| (b) | The Company’s Definitive Proxy Statement on Schedule 14A, as filed with the Commission on September 21, 2023, to the extent specifically incorporated by reference into the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023; |

| (c) | The Company’s Quarterly Reports on Form 10-Q for the fiscal quarter ended September 29, 2023, as filed with the Commission on November 7, 2023, for the fiscal quarter ended December 29, 2023, filed with the Commission on February 6, 2024, and for the fiscal quarter ended March 29, 2024, filed with the Commission on May 7, 2024; and |

| (d) | The Company’s Current Reports on Form 8-K filed with the Commission on July 7, 2023 (Items 1.01, 5.02 and 9.01 only), July 20, 2023, August 15, 2023 (Items 2.05, 5.02 and 9.01 only), October 31, 2023, November 7, 2023 (Items 1.01 and 2.03 only), November 15, 2023, January 17, 2024, and February 8, 2024. |

| |

All reports and documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Securities Exchange Act of 1934, as amended, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of the filing of such documents.

For the purposes of this Registration Statement, any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or

superseded to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

ITEM 4. DESCRIPTION OF SECURITIES.

Not applicable.

ITEM 5. INTERESTS OF NAMED EXPERTS AND COUNSEL.

None.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Section 2.02(b)(4) of Chapter 156D of the Massachusetts General Laws allows a corporation to eliminate or limit the personal liability of a director of a corporation to the corporation or its shareholders for monetary damages for a breach of fiduciary duty as a director notwithstanding any provision of law imposing such liability, except where the director breached his duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of an improper distribution or obtained an improper personal benefit. The Company has included a similar provision in its articles of organization.

Section 8.51(a) of Chapter 156D of the Massachusetts General Laws provides that a corporation may indemnify its directors against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement reasonably incurred in connection with any litigation or other legal proceeding brought against any director by virtue of his position as a director of the corporation unless he is deemed to have not acted in good faith in the reasonable belief that his action was in the best interest of the corporation. As noted below, the Company has provided for director indemnification in its articles of organization and bylaws.

Section 8.52 of Chapter 156D of the Massachusetts General Laws provides that a corporation must indemnify a director who is wholly successful, on the merits or otherwise, in the defense of any proceeding to which the director was a party because he was a director of the corporation against reasonable expenses incurred by him in connection with the proceeding.

Section 8.56(a) of Chapter 156D of the Massachusetts General Laws (“Section 8.56”) provides that a corporation may indemnify its officers to the same extent as its directors and, for officers that are not directors, to the extent provided by (i) the articles of organization, (ii) the bylaws, (iii) a vote of the board of directors or (iv) a contract. In all instances, the extent to which a corporation provides indemnification to its officers under Section 8.56 is optional. As noted below, the Company has provided for officer indemnification in its bylaws.

The Company’s bylaws, as amended, provide that the Company shall indemnify its directors and the officers that have been appointed by the Board of Directors to the fullest extent permitted by law.

The Company maintains directors’ and officers’ liability insurance.

The Company has entered into indemnification agreements with its directors. The indemnification agreements require, among other matters, that the Company indemnify its directors to the fullest extent permitted by law and advance to directors certain expenses, subject to reimbursement if it is subsequently determined that indemnification is not permitted.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED.

None.

ITEM 8. EXHIBITS.

| | | | | |

| Exhibit | Description |

| 4.1 | |

| 4.2 | |

| 4.3 | |

| 4.4 | |

| 4.5 | |

| 4.6 | |

| 4.7 | |

| 5.1* | |

| 23.1* | |

| 23.2 | Consent of Dechert LLP (contained in the opinion filed as Exhibit 5.1 to this Registration Statement) |

| 24.1 | Power of Attorney (included in signature page to this Registration Statement) |

| 99.1* | |

| 107* | |

| * | Filed herewith |

ITEM 9. UNDERTAKINGS.

(a) The Company hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Table” in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-8, and if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement;

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The Company hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Company’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Company pursuant to the provisions described under Item 6 above, or otherwise, the Company has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Town of Andover, the Commonwealth of Massachusetts on this 8th day of May, 2024.

MERCURY SYSTEMS, INC.

By: /s/ David E. Farnsworth

David E. Farnsworth

Executive Vice President, Chief Financial Officer

Power of Attorney

KNOW ALL MEN BY THESE PRESENTS that each person whose signature appears below constitutes and appoints William L. Ballhaus, David E. Farnsworth, and Stuart H. Kupinsky as his or her true and lawful attorneys-in-fact and agents, each acting alone, with full powers of substitution and resubstitution, for him or her or in his or her name, place and stead, in any and all capacities to sign any and all amendments or post-effective amendments to this Registration Statement (or any Registration Statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, each acting alone, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, each acting alone, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

/s/ William L. Ballhaus William L. Ballhaus |

President, Chief Executive Officer, and Chairman of the Board (Principal Executive Officer) |

May 8, 2024 |

/s/ David E. Farnsworth David E. Farnsworth |

Executive Vice President, Chief Financial Officer (Principal Financial Officer) |

May 8, 2024 |

/s/ Douglas D. Munro Douglas D. Munro |

Vice President, Chief Accounting Officer (Principal Accounting Officer) |

May 8, 2024 |

| | | | | | | | |

/s/ Orlando P. Carvalho Orlando P. Carvalho |

Director |

May 8, 2024 |

/s/ Gerard J. DeMuro Gerard J. DeMuro |

Director |

May 8, 2024 |

/s/ Lisa S. Disbrow Lisa S. Disbrow |

Director |

May 8, 2024 |

/s/ Roger A. Krone Roger A. Krone |

Director |

May 8, 2024 |

/s/ Howard L. Lance Howard L. Lance |

Director |

May 8, 2024 |

/s/ Scott Ostfeld Scott Ostfeld |

Director |

May 8, 2024 |

/s/ Barry R. Nearhos Barry R. Nearhos |

Director |

May 8, 2024 |

/s/ Debora A. Plunkett Debora A. Plunkett |

Director |

May 8, 2024 |

Exhibit 107

Calculation of Filing Fee Table

FORM S-8

(Form Type)

Mercury Systems, Inc.

(Exact Name of the Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 1: Newly Registered Securities |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Share (2) | Maximum

aggregate offering

price (2) | Fee Rate | Amount of registration fee |

| Equity | Common stock, par value $0.01 per share | Other | 1,000,000 | $29.37 | $29,370,000.00 | 0.00014760 | $4,335.01 |

| Total Offering Amounts | $29,370,000.00 | 0.00014760 | $4,335.01 |

| Total Fee Offsets | $0.00 |

| Net Fee Due | $4,335.01 |

| | | | | |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement on Form S-8 also covers an indeterminate number of additional shares of Common Stock to be offered or sold as a result of the anti-dilution provisions of the Mercury Systems, Inc. 2024 Employee Stock Purchase Plan, including to prevent dilution resulting from any reorganization, recapitalization, reclassification, stock dividend, stock split, or other similar change. |

| (2) | Calculated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of determining the amount of the registration fee, based on the average of the high and low prices of our Common Stock on the Nasdaq Global Select Market on May 3, 2024. |

KPMG LLP Two Financial Center 60 South Street Boston, MA 02111 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Consent of Independent Registered Public Accounting Firm We consent to the use of our report dated August 15, 2023, with respect to the consolidated financial statements of Mercury Systems, Inc. and subsidiaries, and the effectiveness of internal control over financial reporting, incorporated herein by reference. Boston, Massachusetts May 7, 2024

MERCURY SYSTEMS, INC.

2024 EMPLOYEE STOCK PURCHASE PLAN

1. PURPOSE.

It is the purpose of this 2024 Employee Stock Purchase Plan (the “Plan”) to provide a means whereby Eligible Employees (as defined below) may purchase Common Stock (as defined below) of Mercury Systems, Inc. (the “Company”) through after-tax payroll deductions. It is intended to provide a further incentive for Eligible Employees to promote the best interests of the Company and to encourage stock ownership by Eligible Employees in order that they may participate in the Company’s economic growth.

It is the intention of the Company that the Plan qualify as an “employee stock purchase plan” within the meaning of Section 423 of the Code (as defined below) and the provisions of this Plan shall be construed in a manner consistent with the Code and Treasury Regulations promulgated thereunder.

2. DEFINITIONS.

The following words or terms, when used herein, shall have the following respective meanings:

(a)“Account” shall mean the Employee Stock Purchase Account established for a Participant under Section 7 hereunder.

(b)“Basic Compensation” shall mean the regular rate of salary or wages in effect during a Purchase Period, before any deductions or withholdings, and including overtime, bonuses and sales commissions, but excluding amounts paid in reimbursement of expenses.

(c)“Board of Directors” shall mean the Board of Directors of Mercury Systems, Inc.

(d)“Code” shall mean the Internal Revenue Code of 1986, as amended.

(e)“Committee” shall mean the Human Capital and Compensation Committee appointed by the Board of Directors.

(f)“Common Stock” shall mean shares of the Company’s common stock, $.01 par value per share.

(g) “Eligible Employees” shall mean all persons employed by the Company or its Subsidiaries, but excluding:

(1)Persons whose customary employment is less than twenty hours per week or five months or less per year; and

(2)Persons who are deemed for purposes of Section 423(b)(3) of the Code to own stock possessing 5% or more of the total combined voting power or value of all classes of stock of the Company or a Subsidiary.

For purposes of the Plan, employment will be treated as continuing intact while a Participant is on military leave, sick leave, or other bona fide leave of absence, for up to 90 days or so long as the Participant’s right to re-employment is guaranteed either by statute or by contract, if longer than 90 days.

(h)“Exercise Date” shall mean the last day of a Purchase Period; provided, however, that if such date is not a business day, “Exercise Date” shall mean the immediately preceding business day.

(i)“Participant” shall mean an Eligible Employee who elects to participate in the Plan under Section 6 hereunder.

(j)There shall be two “Purchase Periods” in each full calendar year during which the Plan is in effect. The first Purchase Period shall commence on May 15 and continue through November 14, and the second Purchase Period shall commence on November 15 and continue through May 14. Notwithstanding the foregoing, the last Purchase Period shall end on November 14, 2033.

(k)“Purchase Price” shall mean the lower of (i) 85% of the fair market value of a share of Common Stock for the first business day of the relevant Purchase Period, or (ii) 85% of such value on the relevant Exercise Date. If the shares of Common Stock are listed on any national securities exchange, including without limitation the Nasdaq Stock Market, the fair market value per share of Common Stock on a particular day shall be the closing price, if any, on the largest such exchange on such day, and, if there are no sales of the shares of Common Stock on such particular day, the fair market value of a share of Common Stock shall be determined by taking the weighted average of the means between the highest and lowest sales on the nearest date before and the nearest date after the particular day in accordance with Treasury Regulations Section 25.2512-2. If the shares of Common Stock are not then listed on any such exchange, the fair market value per share of Common Stock on a particular day shall be the mean between the closing “Bid” and the closing “Asked” prices, if any, as reported in the National Daily Quotation Service for such day. If the fair market value cannot be determined under the preceding sentences, it shall be determined in good faith by the Plan Administrator.

(l)“Subsidiary” shall mean any present or future corporation which (i) would be a “subsidiary corporation” of the Company as that term is defined in Section 424(f) of the Code and (ii) is designated as a participating employer in the Plan by the Plan Administrator.

3. GRANT OF OPTION TO PURCHASE SHARES.

Each Eligible Employee shall be granted an option effective on the first business day of each Purchase Period to purchase shares of Common Stock subject to shareholder approval as set forth in Section 19 hereunder). The term of the option shall be the length of the Purchase Period. The number of shares subject to each option shall be the quotient of the aggregate payroll deductions in the Purchase Period authorized by each Participant in accordance with Section 6 divided by the Purchase Price, but in no event greater than 2,200 shares per option, or such other

number as determined from time to time by the Plan Administrator prior to the date the option is granted (the “Share Limitation”). Notwithstanding the foregoing, no employee shall be granted an option which permits their right to purchase shares under the Plan to accrue at a rate which exceeds in any one calendar year $25,000 of the fair market value of the Common Stock as of the date the option is granted.

4. SHARES.

There shall be 1,000,000 shares of Common Stock reserved for issuance to and purchase by Participants under the Plan, subject to adjustment as herein provided. The shares of Common Stock subject to the Plan shall be either shares of authorized but unissued Common Stock or shares of Common Stock reacquired by the Company and held as treasury shares. Shares of Common Stock not purchased under an option terminated pursuant to the provisions of the Plan may again be subject to options granted under the Plan.

The aggregate number of shares of Common Stock which may be purchased pursuant to options granted hereunder, the number of shares of Common Stock covered by each outstanding option, and the purchase price for each such option shall be appropriately adjusted for any increase or decrease in the number of outstanding shares of Common Stock resulting from a stock split or other subdivision or consolidation of shares of Common Stock or for other capital adjustments or payments of stock dividends or distributions or other increases or decreases in the outstanding shares of Common Stock effected without receipt of consideration by the Company.

5. ADMINISTRATION.

The Plan shall be administered by the Board of Directors or the Committee appointed from time to time by the Board of Directors. Notwithstanding the foregoing, the Board of Directors or the Committee, if one has been appointed, may at any time delegate administrative tasks under the Plan to one or more persons (including the power to further redelegate such authority in whole or in part to one or more persons) in order to assist in the administration of the Plan. References herein to the “Plan Administrator” shall mean the Board of Directors, the Committee, or to any person exercising authority delegated in accordance with the foregoing. The Plan Administrator is vested with full authority to make, administer and interpret such equitable rules and regulations regarding the Plan as it may deem advisable. The Plan Administrator’s determinations as to the interpretation and operation of the Plan shall be final and conclusive. No member of the Board of Directors or the Committee or any other person or persons acting as the Plan Administrator shall be liable for any action or determination made in good faith with respect to the Plan or any option granted under the Plan.

6. ELECTION TO PARTICIPATE.

An Eligible Employee may elect to become a Participant in the Plan for a Purchase Period by completing a “Stock Purchase Agreement” form prior to the enrollment deadline established for such Purchase Period by the Plan Administrator, which shall be prior to the first day of the Purchase Period for which the election is made. Such Stock Purchase Agreement shall be in such form as shall be determined by the Plan Administrator. The election to participate shall be effective for the Purchase Period for which it is made, and if provided for in the Stock Purchase Agreement, may carry over to successive Purchase Periods. There is no limit on the number of Purchase Periods for which an Eligible Employee may participate. In the Stock

Purchase Agreement, the Eligible Employee shall authorize regular payroll deductions of any full percentage of their Basic Compensation, but in no event less than one percent (1%) nor more than ten percent (10%) of their Basic Compensation, not to exceed $25,000 per year. An Eligible Employee may not change their authorization except as otherwise provided in Section 9. Options granted to Eligible Employees who have failed to execute a Stock Purchase Agreement within the time periods prescribed in the Plan will automatically lapse.

7. EMPLOYEE STOCK PURCHASE ACCOUNT.

An Employee Stock Purchase Account will be established for each Participant in the Plan for bookkeeping purposes, and payroll deductions made under Section 6 will be credited to such Accounts. However, prior to the purchase of shares in accordance with Section 8 or withdrawal from or termination of the Plan in accordance with provisions hereof, the Company may use for any valid corporate purpose all amounts deducted from a Participant’s wages under the Plan and credited for bookkeeping purposes to their Account.

The Company shall be under no obligation to pay interest on funds credited to a Participant’s Account, whether upon purchase of shares in accordance with Section 8 or upon distribution in the event of withdrawal from or termination of the Plan as herein provided.

8. PURCHASE OF SHARES.

Each Eligible Employee who is a Participant in the Plan automatically and without any act on their part will be deemed to have exercised their option on each Exercise Date to the extent that the balance then in their Account under the Plan is sufficient to purchase at the Purchase Price whole shares of the Common Stock subject to their option, subject to the Share Limitation and the Section 423(b)(8) limitation described in Section 3. Any balance remaining in the Participant’s Account shall be retained in the Participant’s Account and added to the aggregate payroll deductions during the next Purchase Period for purposes of determining the number of shares which may be acquired by such Participant pursuant to Section 3, unless a refund is requested by the Participant. No interest shall be paid on the balance remaining in any Participant’s Account.

9. WITHDRAWAL.

A Participant who has elected to authorize payroll deductions for the purchase of shares of Common Stock may cancel their election by written notice of cancellation (“Cancellation”) in such form as shall be determined by the Plan Administrator delivered to the office or person designated by the Company to receive Stock Purchase Agreements, but any such notice of Cancellation must be so delivered not later than ten (10) days before the relevant Exercise Date.

A Participant will receive in cash, as soon as practicable after delivery of the notice of Cancellation, the amount credited to their Account. Any Participant who so withdraws from the Plan may again become a Participant at the start of the next Purchase Period in accordance with Section 6.

Upon dissolution or liquidation of the Company every option outstanding hereunder shall terminate, in which event each Participant shall be refunded the amount of cash then in their Account. If the Company shall at any time merge into or consolidate with another corporation, the holder of each option then outstanding will thereafter be entitled to receive at the next

Exercise Date, upon exercise of such option and for each share as to which such option was exercised, the securities or property which a holder of one share of Common Stock was entitled upon and at such time of such merger or consolidation. In accordance with this paragraph and this Plan, the Plan Administrator shall determine the kind or amount of such securities or property which such holder of an option shall be entitled to receive. A sale of all or substantially all of the assets of the Company shall be deemed a merger or consolidation for the foregoing purposes.

10. ISSUANCE OF SHARES.

The shares of Common Stock purchased by a Participant shall, for all purposes, be deemed to have been issued and sold at the close of business on the Exercise Date. Prior to that date none of the rights or privileges of a shareholder of the Company, including the right to vote or receive dividends, shall exist with respect to such shares.

Within a reasonable time after the Exercise Date, the Company shall notify the transfer agent and registrar of the Common Stock of the Participant’s ownership of the number of shares of Common Stock purchased by a Participant for the Purchase Period, which shall be registered either in the Participant’s name or jointly in the names of the Participant and their spouse with right of survivorship as the Participant shall designate in their Stock Purchase Agreement. Such designation may be changed at any time by filing notice thereof with the party designated by the Company to receive such notices.

11. ESPP BROKER ACCOUNT.

The Company may require that the shares purchased on behalf of each Participant shall be deposited directly into a brokerage account which the Company shall establish for the Participant at a Company-designated brokerage firm. The account will be known as the ESPP Broker Account. Except as otherwise provided below, the Plan Administrator may prohibit the deposited shares from being transferred from the ESPP Broker Account until the later of the following two periods: (i) the end of the two (2)-year period measured from the first business day of the Purchase Period in which those shares were acquired (or in the case of the initial Purchase Period under this Plan that commences on May 15, 2024, the two (2)-year period measured from the date that the shareholder approval requirement contemplated under Section 19 hereunder is satisfied) and (ii) the end of the one (1)-year period measured from the actual Exercise Date of those shares. Such limitation, if applicable, shall apply both to transfers to different accounts with the same broker and to transfers to other brokerage firms. Any shares held for the required holding period may thereafter be transferred to other accounts or to other brokerage firms.

The foregoing procedures shall not in any way limit when the Participant may sell the Participant’s shares. Those procedures are designed solely to assure that any sale of shares prior to the satisfaction of the required holding period is made through the ESPP Broker Account. In addition, the Participant may request a share transfer from the Participant’s ESPP Broker Account prior to the satisfaction of the required holding period should the Participant wish to make a gift of any shares held in that account.

The foregoing procedures shall apply to all shares purchased by each Participant in the United States, whether or not that Participant continues in Eligible Employee status.

12. TERMINATION OF EMPLOYMENT.

(a) Upon a Participant’s termination of employment for any reason, other than death, no payroll deduction may be made from any compensation due to them and the entire balance credited to their Account shall be automatically refunded, and their rights under the Plan shall terminate.

(b) Upon the death of a Participant, no payroll deduction shall be made from any compensation due to them at time of death, the entire balance in the deceased Participant’s Account shall be paid in cash to the Participant’s designated beneficiary, if any, under a group insurance plan of the Company covering such employee, or otherwise to their estate, and their rights under the Plan shall terminate.

13. RIGHTS NOT TRANSFERABLE.

The right to purchase shares of Common Stock under this Plan is exercisable only by the Participant during their lifetime and is not transferable by them. If a Participant attempts to transfer their right to purchase shares under the Plan, they shall be deemed to have requested withdrawal from the Plan and the provisions of Section 9 hereof shall apply with respect to such Participant.

14. NO GUARANTEE OF CONTINUED EMPLOYMENT.

Granting of an option under this Plan shall imply no right of continued employment with the Company for any Eligible Employee.

15. NOTICE.

Any notice which an Eligible Employee or Participant files pursuant to this Plan shall be in writing and shall be delivered personally or by mail addressed to Mercury Systems, Inc., 50 Minuteman Road, Andover, MA 01810, Attn: ESPP Administrator. Any notice to a Participant or an Eligible Employee shall be sent by email to the account maintained on behalf of the Participant or Eligible Employee by the Company (or such other email address as they may designate for such notices pursuant to such procedures as may be established by the Plan Administrator) or shall be delivered by mail to the Participant or Eligible Employee at the address designated in the Stock Purchase Agreement or in a subsequent writing pursuant to such procedures as may be established by the Plan Administrator.

16. APPLICATION OF FUNDS.

All funds deducted from a Participant’s wages in payment for shares purchased or to be purchased under this Plan may be used for any valid corporate purpose provided that the Participant’s Account shall be credited with the amounts of all payroll deductions as provided in Section 7.

17. GOVERNMENT APPROVALS OR CONSENTS.

This Plan and any offering and sales to Eligible Employees under it are subject to any governmental approvals or consents that may be or become applicable in connection therewith. Subject to the provisions of Section 18, the Plan Administrator may make such changes in the Plan and include such terms in any offering under this Plan as may be necessary or desirable, in

the opinion of counsel, to comply with the rules or regulations of any governmental authority, or to be eligible for tax benefits under the Code or the laws of any state.

18. AMENDMENT OF THE PLAN.

The Board of Directors may, without the consent of the Participants, amend the Plan at any time, provided that no such action shall adversely affect options theretofore granted hereunder, and provided that no such action by the Board of Directors without approval of the Company’s shareholders may (a) increase the total number of shares of Common Stock which may be purchased by all Participants, (b) change the class of employees eligible to receive options under the Plan, or (c) make any changes to the Plan which require shareholder approval under applicable law or regulations, including Section 423 of the Code and the regulations promulgated thereunder.

For purposes of this Section 18, termination of the Plan by the Board of Directors pursuant to Section 19 shall not be deemed to be an action which adversely affects options theretofore granted hereunder.

19. TERM OF THE PLAN.

The Plan shall become effective on the date on which it has been adopted by the Board of Directors, provided that it is approved on or prior to November 14, 2024 by the affirmative vote of holders of a majority of the stock of the Company present or represented and entitled to vote at a duly held shareholders’ meeting; provided, that in the event such shareholder approval is not timely obtained, then no shares of Common Stock shall be issued hereunder, any balance held in the Participant’s account shall be refunded to the Participant without interest, and the Plan shall automatically terminate immediately thereafter. The Plan shall continue in effect through November 14, 2033, provided, however, that the Board of Directors shall have the right to terminate the Plan at any time, but such termination shall not affect options then outstanding under the Plan. It will terminate in any case when all or substantially all of the unissued shares of Common Stock reserved for the purposes of the Plan have been purchased. If at any time shares of Common Stock reserved for the purposes of the Plan remain available for purchase but not in sufficient number to satisfy all then unfilled purchase requirements, the available shares shall be apportioned among Participants in proportion to the amount of payroll deductions accumulated on behalf of each Participant that would otherwise be used to purchase Common Stock and the Plan shall terminate. Upon such termination or any other termination of the Plan, all payroll deductions not used to purchase stock will be refunded, without interest.

20. NOTICE TO COMPANY OF DISQUALIFYING DISPOSITION.

By electing to participate in the Plan, each Participant agrees to notify the Company in writing immediately after the Participant transfers Common Stock acquired under the Plan, if such transfer occurs within two years after the first business day of the Purchase Period in which such Common Stock was acquired. Each Participant further agrees to provide any information about such a transfer as may be requested by the Company or any subsidiary corporation in order to assist it in complying with the tax laws. Such dispositions generally are treated as “disqualifying dispositions” under Sections 421 and 424 of the Code, which have certain tax consequences to Participants and to the Company and its participating Subsidiaries. The Participant acknowledges that the Company may send a Form W-2, or substitute therefor, as

appropriate, to the Participant with respect to any income recognized by the Participant upon a disqualifying disposition of Common Stock.

21. WITHHOLDING OF ADDITIONAL INCOME TAXES.

By electing to participate in the Plan, each Participant acknowledges that the Company and its participating Subsidiaries are required to withhold taxes with respect to the amounts deducted from the Participant’s compensation and accumulated for the benefit of the Participant under the Plan and each Participant agrees that the Company and its participating Subsidiaries may deduct additional amounts from the Participant’s compensation, when amounts are added to the Participant’s account, used to purchase Common Stock or refunded, in order to satisfy such withholding obligations.

22. INTERNATIONAL SUB-PLANS.

The Plan Administrator may authorize one or more offerings under the Plan that are not designed to comply with the requirements of Section 423 of the Code but are intended to comply with the requirements of the foreign jurisdictions in which those offerings are conducted. Such offerings shall be separate from any offerings designed to comply with the Section 423 of the Code requirements but may be conducted concurrently with those offerings.

23. GENERAL.

Whenever the context of this Plan permits, the masculine gender shall include the feminine and neuter genders.

Approved by the Board of Directors: April 24, 2024

Approved by the Shareholders:

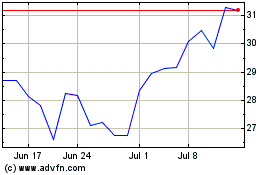

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Apr 2024 to May 2024

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From May 2023 to May 2024