false

--12-31

Q1

2024

0000889609

0000889609

2024-01-01

2024-03-31

0000889609

2024-05-06

0000889609

2024-03-31

0000889609

2023-12-31

0000889609

us-gaap:PreferredStockMember

2024-03-31

0000889609

us-gaap:PreferredStockMember

2023-12-31

0000889609

us-gaap:SeriesAPreferredStockMember

2024-03-31

0000889609

us-gaap:SeriesAPreferredStockMember

2023-12-31

0000889609

us-gaap:SeriesBPreferredStockMember

2024-03-31

0000889609

us-gaap:SeriesBPreferredStockMember

2023-12-31

0000889609

2023-01-01

2023-03-31

0000889609

2022-12-31

0000889609

2023-03-31

0000889609

us-gaap:CommonStockMember

2023-12-31

0000889609

us-gaap:CommonStockMember

2022-12-31

0000889609

us-gaap:RetainedEarningsMember

2023-12-31

0000889609

us-gaap:RetainedEarningsMember

2022-12-31

0000889609

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0000889609

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000889609

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0000889609

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000889609

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0000889609

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000889609

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0000889609

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0000889609

us-gaap:CommonStockMember

2024-03-31

0000889609

us-gaap:CommonStockMember

2023-03-31

0000889609

us-gaap:RetainedEarningsMember

2024-03-31

0000889609

us-gaap:RetainedEarningsMember

2023-03-31

0000889609

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0000889609

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000889609

cpss:OriginationAndServicingFeesFromThirdPartyReceivablesMember

2024-01-01

2024-03-31

0000889609

cpss:OriginationAndServicingFeesFromThirdPartyReceivablesMember

2023-01-01

2023-03-31

0000889609

cpss:SalesTaxRefundsMember

2024-01-01

2024-03-31

0000889609

cpss:SalesTaxRefundsMember

2023-01-01

2023-03-31

0000889609

us-gaap:OtherIncomeMember

2024-01-01

2024-03-31

0000889609

us-gaap:OtherIncomeMember

2023-01-01

2023-03-31

0000889609

cpss:OperatingLeaseMember

2024-03-31

0000889609

cpss:FinanceLeaseMember

2024-03-31

0000889609

cpss:OptionsExercisedMember

2024-01-01

2024-03-31

0000889609

cpss:OptionsExercisedMember

2023-01-01

2023-03-31

0000889609

us-gaap:StockOptionMember

2023-12-31

0000889609

us-gaap:StockOptionMember

2024-01-01

2024-03-31

0000889609

us-gaap:StockOptionMember

2024-03-31

0000889609

cpss:Range1Member

2024-03-31

0000889609

cpss:Range1Member

2023-12-31

0000889609

cpss:Range2Member

2024-03-31

0000889609

cpss:Range2Member

2023-12-31

0000889609

cpss:Range3Member

2024-03-31

0000889609

cpss:Range3Member

2023-12-31

0000889609

cpss:Range4Member

2024-03-31

0000889609

cpss:Range4Member

2023-12-31

0000889609

cpss:Range5Member

2024-03-31

0000889609

cpss:Range5Member

2023-12-31

0000889609

cpss:Range6Member

2024-03-31

0000889609

cpss:Range6Member

2023-12-31

0000889609

cpss:OpenMarketPurchasesMember

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0000889609

cpss:OpenMarketPurchasesMember

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000889609

cpss:SharesRedeemedMember

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0000889609

cpss:SharesRedeemedMember

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000889609

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0000889609

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000889609

us-gaap:FinancingReceivables1To29DaysPastDueMember

2024-03-31

0000889609

us-gaap:FinancingReceivables1To29DaysPastDueMember

2023-12-31

0000889609

us-gaap:FinancingReceivables30To59DaysPastDueMember

2024-03-31

0000889609

us-gaap:FinancingReceivables30To59DaysPastDueMember

2023-12-31

0000889609

us-gaap:FinancingReceivables60To89DaysPastDueMember

2024-03-31

0000889609

us-gaap:FinancingReceivables60To89DaysPastDueMember

2023-12-31

0000889609

us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember

2024-03-31

0000889609

us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember

2023-12-31

0000889609

cpss:VintagePool2014Member

2024-03-31

0000889609

cpss:VintagePool2014Member

2023-12-31

0000889609

cpss:VintagePool2015Member

2024-03-31

0000889609

cpss:VintagePool2015Member

2023-12-31

0000889609

cpss:VintagePool2016Member

2024-03-31

0000889609

cpss:VintagePool2016Member

2023-12-31

0000889609

cpss:VintagePool2017Member

2024-03-31

0000889609

cpss:VintagePool2017Member

2023-12-31

0000889609

cpss:VintagePool2014Member

2024-01-01

2024-03-31

0000889609

cpss:VintagePool2014Member

2023-01-01

2023-03-31

0000889609

cpss:VintagePool2015Member

2024-01-01

2024-03-31

0000889609

cpss:VintagePool2015Member

2023-01-01

2023-03-31

0000889609

cpss:VintagePool2016Member

2024-01-01

2024-03-31

0000889609

cpss:VintagePool2016Member

2023-01-01

2023-03-31

0000889609

cpss:VintagePool2017Member

2024-01-01

2024-03-31

0000889609

cpss:VintagePool2017Member

2023-01-01

2023-03-31

0000889609

cpss:AppliedAgainstReposInInventoryMemberMember

2024-01-01

2024-03-31

0000889609

cpss:AppliedAgainstReposInInventoryMemberMember

2023-01-01

2023-03-31

0000889609

2023-01-01

2023-12-31

0000889609

cpss:CPS2019BMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2019BMember

2024-03-31

0000889609

cpss:CPS2019BMember

2023-12-31

0000889609

cpss:CPS2019CMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2019CMember

2024-03-31

0000889609

cpss:CPS2019CMember

2023-12-31

0000889609

cpss:CPS2019DMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2019DMember

2024-03-31

0000889609

cpss:CPS2019DMember

2023-12-31

0000889609

cpss:CPS2020AMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2020AMember

2024-03-31

0000889609

cpss:CPS2020AMember

2023-12-31

0000889609

cpss:CPS2020BMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2020BMember

2024-03-31

0000889609

cpss:CPS2020BMember

2023-12-31

0000889609

cpss:CPS2020CMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2020CMember

2024-03-31

0000889609

cpss:CPS2020CMember

2023-12-31

0000889609

cpss:CPS2021AMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2021AMember

2024-03-31

0000889609

cpss:CPS2021AMember

2023-12-31

0000889609

cpss:CPS2021BMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2021BMember

2024-03-31

0000889609

cpss:CPS2021BMember

2023-12-31

0000889609

cpss:CPS2021CMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2021CMember

2024-03-31

0000889609

cpss:CPS2021CMember

2023-12-31

0000889609

cpss:CPS2021DMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2021DMember

2024-03-31

0000889609

cpss:CPS2021DMember

2023-12-31

0000889609

cpss:CPS2022AMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2022AMember

2024-03-31

0000889609

cpss:CPS2022AMember

2023-12-31

0000889609

cpss:CPS2022BMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2022BMember

2024-03-31

0000889609

cpss:CPS2022BMember

2023-12-31

0000889609

cpss:CPS2022CMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2022CMember

2024-03-31

0000889609

cpss:CPS2022CMember

2023-12-31

0000889609

cpss:CPS2022DMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2022DMember

2024-03-31

0000889609

cpss:CPS2022DMember

2023-12-31

0000889609

cpss:CPS2023AMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2023AMember

2024-03-31

0000889609

cpss:CPS2023AMember

2023-12-31

0000889609

cpss:CPS2023BMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2023BMember

2024-03-31

0000889609

cpss:CPS2023BMember

2023-12-31

0000889609

cpss:CPS2023CMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2023CMember

2024-03-31

0000889609

cpss:CPS2023CMember

2023-12-31

0000889609

cpss:CPS2023DMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2023DMember

2024-03-31

0000889609

cpss:CPS2023DMember

2023-12-31

0000889609

cpss:CPS2024AMember

2024-01-01

2024-03-31

0000889609

cpss:CPS2024AMember

2024-03-31

0000889609

cpss:CPS2024AMember

2023-12-31

0000889609

cpss:SecuritizationTrustDebtMember

2024-03-31

0000889609

cpss:WarehouseLinesOfCredit1Member

2024-01-01

2024-03-31

0000889609

cpss:WarehouseLinesOfCredit1Member

2023-01-01

2023-12-31

0000889609

cpss:WarehouseLinesOfCredit1Member

2024-03-31

0000889609

cpss:WarehouseLinesOfCredit1Member

2023-12-31

0000889609

cpss:WarehouseLinesOfCredit2Member

2024-01-01

2024-03-31

0000889609

cpss:WarehouseLinesOfCredit2Member

2023-01-01

2023-12-31

0000889609

cpss:WarehouseLinesOfCredit2Member

2024-03-31

0000889609

cpss:WarehouseLinesOfCredit2Member

2023-12-31

0000889609

cpss:ResidualInterestFinancingMember

2024-01-01

2024-03-31

0000889609

cpss:ResidualInterestFinancingMember

2024-03-31

0000889609

cpss:ResidualInterestFinancingMember

2023-12-31

0000889609

cpss:ResidualInterestFinancing1Member

2024-01-01

2024-03-31

0000889609

cpss:ResidualInterestFinancing1Member

2024-03-31

0000889609

cpss:ResidualInterestFinancing1Member

2023-12-31

0000889609

cpss:SubordinatedRenewableNotesMember

2024-03-31

0000889609

cpss:SubordinatedRenewableNotesMember

2023-12-31

0000889609

cpss:SubordinatedRenewableNotesMember

2024-01-01

2024-03-31

0000889609

cpss:SubordinatedRenewableNotesMember

2023-01-01

2023-12-31

0000889609

cpss:AresAgentServicesLPMember

2024-03-28

2024-03-29

0000889609

cpss:AresAgentServicesLPMember

2024-01-01

2024-03-31

0000889609

2024-03-22

0000889609

2024-03-21

2024-03-22

0000889609

cpss:CitibankNAMember

srt:MinimumMember

srt:ScenarioForecastMember

2024-07-15

0000889609

cpss:CitibankNAMember

srt:MaximumMember

srt:ScenarioForecastMember

2024-07-15

0000889609

cpss:CitibankNAMember

2024-03-31

0000889609

cpss:WarehouseLinesOfCreditMember

2024-03-31

0000889609

cpss:WarehouseLinesOfCreditMember

2023-12-31

0000889609

cpss:SecuritizationTrustDebtMember

2024-01-01

2024-03-31

0000889609

cpss:SecuritizationTrustDebtMember

2023-01-01

2023-03-31

0000889609

cpss:WarehouseLinesOfCreditMember

2024-01-01

2024-03-31

0000889609

cpss:WarehouseLinesOfCreditMember

2023-01-01

2023-03-31

0000889609

cpss:ResidualInterestFinancingMember

2024-01-01

2024-03-31

0000889609

cpss:ResidualInterestFinancingMember

2023-01-01

2023-03-31

0000889609

cpss:SubordinatedRenewableNotesMember

2024-01-01

2024-03-31

0000889609

cpss:SubordinatedRenewableNotesMember

2023-01-01

2023-03-31

0000889609

us-gaap:DomesticCountryMember

2024-03-31

0000889609

us-gaap:StateAndLocalJurisdictionMember

2024-03-31

0000889609

2023-08-01

2023-08-31

0000889609

2021-09-01

2021-09-30

0000889609

us-gaap:FinancialAssetNotPastDueMember

2024-03-31

0000889609

us-gaap:FinancialAssetNotPastDueMember

2023-12-31

0000889609

cpss:RepossessedVehiclesMember

2024-03-31

0000889609

cpss:RepossessedVehiclesMember

2023-12-31

0000889609

us-gaap:VehiclesMember

2024-03-31

0000889609

us-gaap:InventoriesMember

2023-12-31

0000889609

cpss:CarryingValueMember

2024-03-31

0000889609

us-gaap:FairValueInputsLevel1Member

2024-03-31

0000889609

us-gaap:FairValueInputsLevel2Member

2024-03-31

0000889609

us-gaap:FairValueInputsLevel3Member

2024-03-31

0000889609

cpss:CarryingValueMember

2023-12-31

0000889609

us-gaap:FairValueInputsLevel1Member

2023-12-31

0000889609

us-gaap:FairValueInputsLevel2Member

2023-12-31

0000889609

us-gaap:FairValueInputsLevel3Member

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table

of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

☐

Commission file

number: 1-11416

CONSUMER PORTFOLIO SERVICES, INC.

(Exact name of registrant as specified in its

charter)

| California |

33-0459135 |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

| |

|

|

3800 Howard Hughes Parkway, Suite 1400,

Las Vegas, Nevada |

89169 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

Area Code: (949) 753-6800

Former name, former address and former fiscal year,

if changed since last report: N/A

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

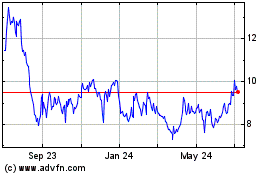

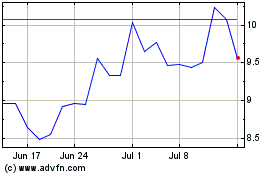

| Common Stock, no par value |

CPSS |

The NASDAQ Stock Market LLC (Global Market) |

Indicate by check mark whether the registrant

(1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated

filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☒ Non-Accelerated Filer ☐ Smaller Reporting Company ☒

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 6, 2024 the registrant had 21,021,354

common shares outstanding.

CONSUMER PORTFOLIO SERVICES, INC. AND SUBSIDIARIES

INDEX TO FORM 10-Q

For the Quarterly Period Ended March 31, 2024

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CONSUMER PORTFOLIO SERVICES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 13,249 | | |

$ | 6,174 | |

| Restricted cash and equivalents | |

| 137,706 | | |

| 119,257 | |

| Finance receivables measured at fair value | |

| 2,791,373 | | |

| 2,722,662 | |

| | |

| | | |

| | |

| Finance receivables | |

| 18,781 | | |

| 27,553 | |

| Less: Allowance for finance credit losses | |

| (1,890 | ) | |

| (2,869 | ) |

| Finance receivables, net | |

| 16,891 | | |

| 24,684 | |

| | |

| | | |

| | |

| Furniture and equipment, net | |

| 1,268 | | |

| 1,372 | |

| Deferred tax assets, net | |

| 3,485 | | |

| 3,736 | |

| Other assets | |

| 42,554 | | |

| 25,861 | |

| Total Assets | |

$ | 3,006,526 | | |

$ | 2,903,746 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 79,122 | | |

$ | 62,544 | |

| Warehouse lines of credit | |

| 249,522 | | |

| 234,025 | |

| Residual interest financing | |

| 98,968 | | |

| 49,875 | |

| Securitization trust debt | |

| 2,277,676 | | |

| 2,265,446 | |

| Subordinated renewable notes | |

| 22,140 | | |

| 17,188 | |

| Total Liabilities | |

| 2,727,428 | | |

| 2,629,078 | |

| COMMITMENTS AND CONTINGENCIES | |

| – | | |

| – | |

| Shareholders' Equity | |

| | | |

| | |

| Preferred stock, $1 par value; authorized 4,998,130 shares; none issued | |

| – | | |

| – | |

| Series A preferred stock, $1 par value; authorized 5,000,000 shares; none issued | |

| – | | |

| – | |

| Series B preferred stock, $1 par value; authorized 1,870 shares; none issued | |

| – | | |

| – | |

| Common stock, no par value; authorized 75,000,000 shares; 21,147,743 and 21,174,856 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | |

| 28,518 | | |

| 28,678 | |

| Retained earnings | |

| 252,447 | | |

| 247,857 | |

| Accumulated other comprehensive loss | |

| (1,867 | ) | |

| (1,867 | ) |

| Total stockholders' equity | |

| 279,098 | | |

| 274,668 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 3,006,526 | | |

$ | 2,903,746 | |

See accompanying Notes to Unaudited Condensed

Consolidated Financial Statements.

CONSUMER PORTFOLIO SERVICES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(In thousands, except per share data)

| | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Revenues: | |

| | |

| |

| Interest income | |

$ | 84,288 | | |

$ | 80,062 | |

| Mark to finance receivables measured at fair value | |

| 5,000 | | |

| – | |

| Other income | |

| 2,456 | | |

| 3,038 | |

| Total revenues | |

| 91,744 | | |

| 83,100 | |

| | |

| | | |

| | |

| Expenses: | |

| | | |

| | |

| Employee costs | |

| 24,416 | | |

| 22,033 | |

| General and administrative | |

| 13,753 | | |

| 11,396 | |

| Interest | |

| 41,968 | | |

| 32,759 | |

| Provision for credit losses | |

| (1,635 | ) | |

| (9,000 | ) |

| Sales | |

| 4,870 | | |

| 5,724 | |

| Occupancy | |

| 1,600 | | |

| 1,526 | |

| Depreciation and amortization | |

| 215 | | |

| 231 | |

| Total operating expenses | |

| 85,187 | | |

| 64,669 | |

| Income tax expense | |

| 1,967 | | |

| 4,608 | |

| Net income | |

$ | 4,590 | | |

$ | 13,823 | |

| | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | |

| Basic | |

$ | 0.22 | | |

$ | 0.68 | |

| Diluted | |

| 0.19 | | |

| 0.54 | |

| | |

| | | |

| | |

| Number of shares used in computing earnings per share: | |

| | | |

| | |

| Basic | |

| 21,143 | | |

| 20,418 | |

| Diluted | |

| 24,602 | | |

| 25,392 | |

See accompanying Notes to Unaudited Condensed

Consolidated Financial Statements.

CONSUMER PORTFOLIO SERVICES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

(In thousands)

| | |

| | |

| |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net income | |

$ | 4,590 | | |

$ | 13,823 | |

| | |

| | | |

| | |

| Other comprehensive income/(loss); change in funded status of pension plan | |

| – | | |

| – | |

| Comprehensive income | |

$ | 4,590 | | |

$ | 13,823 | |

See accompanying Notes to Unaudited Condensed

Consolidated Financial Statements.

CONSUMER PORTFOLIO SERVICES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(In thousands)

| | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 4,590 | | |

$ | 13,823 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Net interest income accretion on fair value receivables | |

| 54,247 | | |

| 47,472 | |

| Depreciation and amortization | |

| 215 | | |

| 231 | |

| Amortization of deferred financing costs | |

| (672 | ) | |

| 2,403 | |

| Mark to finance receivables measured at fair value | |

| (5,000 | ) | |

| – | |

| Provision for credit losses | |

| (1,635 | ) | |

| (9,000 | ) |

| Stock-based compensation expense | |

| 832 | | |

| 912 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Deferred tax assets, net | |

| 251 | | |

| 385 | |

| Other assets | |

| (16,702 | ) | |

| 4,511 | |

| Accounts payable and accrued expenses | |

| 16,579 | | |

| 4,404 | |

| Net cash provided by operating activities | |

| 52,705 | | |

| 65,141 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Payments received on finance receivables held for investment | |

| 9,428 | | |

| 24,746 | |

| Purchases of finance receivables measured at fair value | |

| (328,893 | ) | |

| (352,598 | ) |

| Payments received on finance receivables at fair value | |

| 210,935 | | |

| 206,626 | |

| Change in repossessions held in inventory | |

| 9 | | |

| 101 | |

| Purchase of furniture and equipment | |

| (111 | ) | |

| (34 | ) |

| Net cash used in investing activities | |

| (108,632 | ) | |

| (121,159 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of securitization trust debt | |

| 280,924 | | |

| 324,768 | |

| Proceeds from issuance of subordinated renewable notes | |

| 5,489 | | |

| – | |

| Payments on subordinated renewable notes | |

| (537 | ) | |

| (1,820 | ) |

| Net proceeds from (repayments of) warehouse lines of credit | |

| 17,176 | | |

| (7 | ) |

| Net Proceeds from (repayment of) residual interest financing debt | |

| 50,000 | | |

| – | |

| Repayment of securitization trust debt | |

| (268,710 | ) | |

| (258,224 | ) |

| Payment of financing costs | |

| (1,899 | ) | |

| (2,072 | ) |

| Purchase of common stock | |

| (1,697 | ) | |

| (7,293 | ) |

| Exercise of options and warrants | |

| 705 | | |

| 6,960 | |

| Net cash provided by financing activities | |

| 81,451 | | |

| 62,312 | |

| Increase in cash and cash equivalents | |

| 25,524 | | |

| 6,294 | |

| Cash and restricted cash at beginning of period | |

| 125,431 | | |

| 162,789 | |

| Cash and restricted cash at end of period | |

$ | 150,955 | | |

$ | 169,083 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 42,145 | | |

$ | 29,658 | |

| Income taxes | |

$ | 29 | | |

$ | 25 | |

| Non-cash financing activities: | |

| | | |

| | |

| Right-of-use asset, net | |

$ | (23,267 | ) | |

$ | (3,013 | ) |

| Lease liability | |

$ | 23,782 | | |

$ | 3,313 | |

| Deferred office rent | |

$ | (515 | ) | |

$ | (300 | ) |

See accompanying Notes to Unaudited Condensed

Consolidated Financial Statements.

CONSUMER PORTFOLIO SERVICES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF SHAREHOLDERS’ EQUITY

(In thousands)

| | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Common Stock (Shares Outstanding) | |

| | | |

| | |

| Balance, beginning of period | |

| 21,175 | | |

| 20,131 | |

| Common stock issued upon exercise of options and warrants | |

| 180 | | |

| 1,086 | |

| Repurchase of common stock | |

| (207 | ) | |

| (721 | ) |

| Balance, end of period | |

| 21,148 | | |

| 20,496 | |

| | |

| | | |

| | |

| Common Stock | |

| | | |

| | |

| Balance, beginning of period | |

$ | 28,678 | | |

$ | 28,906 | |

| Common stock issued upon exercise of options and warrants | |

| 705 | | |

| 6,960 | |

| Repurchase of common stock | |

| (1,697 | ) | |

| (7,293 | ) |

| Stock-based compensation | |

| 832 | | |

| 912 | |

| Balance, end of period | |

$ | 28,518 | | |

$ | 29,485 | |

| | |

| | | |

| | |

| Retained Earnings | |

| | | |

| | |

| Balance, beginning of period | |

$ | 247,857 | | |

$ | 202,514 | |

| Net income | |

| 4,590 | | |

| 13,823 | |

| Balance, end of period | |

$ | 252,447 | | |

$ | 216,337 | |

| | |

| | | |

| | |

| Accumulated Other Comprehensive Loss | |

| | | |

| | |

| Balance, beginning of period | |

$ | (1,867 | ) | |

$ | (3,031 | ) |

| Pension benefit obligation | |

| – | | |

| – | |

| Balance, end of period | |

$ | (1,867 | ) | |

$ | (3,031 | ) |

| Balance, beginning of period | |

| 274,668 | | |

| 228,389 | |

| Pension benefit obligation | |

| – | | |

| – | |

| | |

| | | |

| | |

| Total Shareholders' Equity | |

$ | 279,098 | | |

$ | 242,791 | |

See accompanying Notes to Unaudited Condensed

Consolidated Financial Statements.

CONSUMER PORTFOLIO SERVICES, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(1) Summary of Significant Accounting Policies

Description of Business

We were formed in California on March 8, 1991.

We specialize in purchasing and servicing retail automobile installment sale contracts (“automobile contracts” or “finance

receivables”) originated by licensed motor vehicle dealers located throughout the United States (“dealers”) in the sale

of new and used automobiles, light trucks and passenger vans. Through our purchases, we provide indirect financing to dealer customers

for borrowers with limited credit histories or past credit problems (“sub-prime customers”). We serve as an alternative source

of financing for dealers, allowing sales to customers who otherwise might not be able to obtain financing. In addition to purchasing installment

purchase contracts directly from dealers, we have also (i) lent money directly to consumers for loans secured by vehicles, (ii) purchased

immaterial amounts of vehicle purchase money loans from non-affiliated lenders, and (iii) acquired installment purchase contracts in four

merger and acquisition transactions. In this report, we refer to all of such contracts and loans as "automobile contracts."

Basis of Presentation

Our Unaudited Condensed Consolidated Financial

Statements have been prepared in conformity with accounting principles generally accepted in the United States of America, with the instructions

to Form 10-Q and with Article 10 of Regulation S-X of the Securities and Exchange Commission, and include all adjustments that are, in

management’s opinion, necessary for a fair presentation of the results for the interim periods presented. All such adjustments are,

in the opinion of management, of a normal recurring nature. Results for the nine-month period ended March 31, 2024 are not necessarily

indicative of the operating results to be expected for the full year.

Certain information and footnote disclosures normally

included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America

have been condensed or omitted from these Unaudited Condensed Consolidated Financial Statements. These Unaudited Condensed Consolidated

Financial Statements should be read in conjunction with the Consolidated Financial Statements and Notes to Consolidated Financial Statements

included in our Annual Report on Form 10-K for the year ended December 31, 2023.

Use of Estimates

The preparation of financial

statements in conformity with accounting principles generally accepted in the United States of America requires us to make estimates

and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, as well as the

reported amounts of income and expenses during the reported periods.

Finance Receivables Measured

at Fair Value

Effective January 1, 2018, we adopted the fair

value method of accounting for finance receivables acquired on or after that date. For each finance receivable acquired after 2017, we

consider the price paid on the purchase date as the fair value for such receivable. We estimate the cash to be received in the future

with respect to such receivables, based on our experience with similar receivables acquired in the past. We then compute the internal

rate of return that results in the present value of those estimated cash receipts being equal to the purchase date fair value. Thereafter,

we recognize interest income on such receivables on a level yield basis using that internal rate of return as the applicable interest

rate. Cash received with respect to such receivables is applied first against such interest income, and then to reduce the recorded value

of the receivables.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

We re-evaluate the fair value of such receivables

at the close of each measurement period. If the reevaluation were to yield a value materially different from the recorded value, an adjustment

would be required.

Anticipated credit

losses are included in our estimation of cash to be received with respect to receivables. In accordance with the fair value

accounting standards, credit losses are included in our computation of the appropriate level yield, therefore we do not thereafter

make periodic provision for credit losses, as our best estimate of the lifetime aggregate of credit losses is included in that

initial computation. Also, because we include anticipated credit losses in our computation of the level yield, the computed level

yield is materially lower than the average contractual rate applicable to the receivables. Because our initial recorded value is

fixed as the price we pay for the receivable, rather than as the contractual principal balance, we do not record acquisition fees as

an amortizing asset related to the receivables, nor do we capitalize costs of acquiring the receivables. Rather we recognize the

costs of acquisition as expenses in the period incurred.

Other Income

The following table presents

the primary components of Other Income for the three-month periods ending March 31, 2024 and 2023:

| Schedule of other income | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Origination and servicing fees from third party receivables | |

$ | 2,144 | | |

$ | 2,738 | |

| Sales tax refunds | |

| 289 | | |

| 260 | |

| Other | |

| 23 | | |

| 40 | |

| Other income for the period | |

$ | 2,456 | | |

$ | 3,038 | |

Leases

The Company has operating leases for corporate

offices, equipment, software and hardware. The Company has entered into operating leases for the majority of its real estate locations,

primarily office space. These leases are generally for periods of three to seven years with various renewal options. The depreciable life

of leased assets is limited by the expected lease term. Leases with an initial term of 12 months or less are not recorded on the balance

sheet and the related lease expense is recognized on a straight-line basis over the lease term.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

The following table presents

the supplemental balance sheet information related to leases:

| Schedule of supplemental balance sheet information related to leases | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Operating Leases | |

| | | |

| | |

| Operating lease right-of-use assets | |

$ | 51,093 | | |

$ | 29,575 | |

| Less: Accumulated amortization right-of-use assets | |

| (27,902 | ) | |

| (26,651 | ) |

| Operating lease right-of-use assets, net | |

$ | 23,191 | | |

$ | 2,924 | |

| | |

| | | |

| | |

| Operating lease liabilities | |

$ | (23,702 | ) | |

$ | (3,220 | ) |

| | |

| | | |

| | |

| Finance Leases | |

| | | |

| | |

| Property and equipment, at cost | |

| 3,474 | | |

| 3,474 | |

| Less: Accumulated depreciation | |

| (3,398 | ) | |

| (3,385 | ) |

| Property and equipment, net | |

$ | 76 | | |

$ | 89 | |

| | |

| | | |

| | |

| Finance lease liabilities | |

$ | (80 | ) | |

$ | (93 | ) |

| | |

| | | |

| | |

| Weighted Average Discount Rate | |

| | | |

| | |

| Operating lease | |

| 5.0% | | |

| 5.0% | |

| Finance lease | |

| 6.5% | | |

| 6.5% | |

| Schedule of maturities of lease liabilities | |

| | | |

| | |

| Maturities of lease liabilities were as follows: | |

$ | | |

| |

| (In thousands) | |

Operating | | |

Finance | |

| Year Ending December 31, | |

Lease | | |

Lease | |

| 2024 (excluding the three months ended March 31, 2024) | |

$ | 2,422 | | |

$ | 27 | |

| 2025 | |

| 5,233 | | |

| 45 | |

| 2026 | |

| 5,084 | | |

| 15 | |

| 2027 | |

| 5,242 | | |

| 15 | |

| 2028 | |

| 5,408 | | |

| 4 | |

| Thereafter | |

| 4,747 | | |

| – | |

| Total undiscounted lease payments | |

| 28,136 | | |

| 106 | |

| Less amounts representing interest | |

| (4,434 | ) | |

| (26 | ) |

| Lease Liability | |

$ | 23,702 | | |

$ | 80 | |

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

The following table presents

the lease expense included in General and administrative and Occupancy expense on our Unaudited Condensed Consolidated Statement of Operations:

| Schedule of lease expense | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| (In thousands) | |

| Operating lease cost | |

$ | 1,374 | | |

$ | 1,360 | |

| Finance lease cost | |

| 14 | | |

| 101 | |

| Total lease cost | |

$ | 1,388 | | |

$ | 1,461 | |

The following table presents

the supplemental cash flow information related to leases:

| Schedule of supplemental

cash flow information related to leases | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Cash paid for amounts included in the measurement of lease liabilities: | |

(In thousands) | |

| Operating cash flows from operating leases | |

$ | 1,374 | | |

$ | 1,360 | |

| Operating cash flows from finance leases | |

$ | 13 | | |

$ | 99 | |

| Financing cash flows from finance leases | |

$ | 1 | | |

$ | 2 | |

Stock-based Compensation

We recognize compensation costs in the financial

statements for all share-based payments based on the grant date fair value estimated in accordance with the provisions of ASC 718 “Stock

Compensation”.

For the three months ended March 31, 2024 and

2023, we recorded stock-based compensation costs in the amount of $832,000 and $912,000, respectively. As of March 31, 2024, unrecognized

stock-based compensation costs to be recognized over future periods equaled $5.1 million. This amount will be recognized as expense over

a weighted-average period of 1.5 years.

The following represents

stock option activity for the three months ended March 31, 2024:

| Schedule of stock option activity | |

| | | |

| | | |

|

| | |

| | |

| | |

Weighted |

| | |

Number of | | |

Weighted | | |

Average |

| | |

Shares | | |

Average | | |

Remaining |

| | |

(in thousands) | | |

Exercise Price | | |

Contractual Term |

| Options outstanding at the beginning of period | |

| 8,125 | | |

$ | 5.11 | | |

N/A |

| Granted | |

| – | | |

| – | | |

N/A |

| Exercised | |

| (180 | ) | |

| 3.92 | | |

N/A |

| Forfeited | |

| – | | |

| – | | |

N/A |

| Options outstanding at the end of period | |

| 7,945 | | |

$ | 5.14 | | |

2.95 years |

| | |

| | | |

| | | |

|

| Options exercisable at the end of period | |

| 6,070 | | |

$ | 4.51 | | |

2.47 years |

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

The following table presents

the price distribution of stock options outstanding and exercisable for the years ended March 31, 2024 and December 31, 2023:

| Schedule of price distribution

of stock options | |

| | | |

| | | |

| | | |

| | |

| | |

Number of shares as of | | |

Number of shares as of | |

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

Outstanding | | |

Exercisable | | |

Outstanding | | |

Exercisable | |

| Range of exercise prices: | |

(In thousands) | | |

(In thousands) | |

| $2.00 - $2.99 | |

| 1,410 | | |

| 1,083 | | |

| 1,410 | | |

| 1,082 | |

| $3.00 - $3.99 | |

| 2,383 | | |

| 2,383 | | |

| 2,473 | | |

| 2,473 | |

| $4.00 - $4.99 | |

| 2,450 | | |

| 1,839 | | |

| 2,539 | | |

| 1,929 | |

| $6.00 - $6.99 | |

| – | | |

| – | | |

| – | | |

| – | |

| $7.00 - $7.99 | |

| – | | |

| – | | |

| – | | |

| – | |

| $10.00 - $10.99 | |

| 1,702 | | |

| 765 | | |

| 1,703 | | |

| 578 | |

| Total shares | |

| 7,945 | | |

| 6,070 | | |

| 8,125 | | |

| 6,062 | |

At March 31, 2024 the aggregate intrinsic value

of options outstanding and exercisable was $23.9 million and $20.6 million, respectively. There were 180,000 options exercised for the

three months ended March 31, 2024 compared to 1,086,000 for the comparable period in 2023. The total intrinsic value of options exercised

was $716,000 and $3.8 million for the three-month periods ended March 31, 2024 and 2023. There were 2,684,000 shares available for future

stock option grants under existing plans as of March 31, 2024.

Purchases of Company Stock

The table below describes

the purchase of our common stock for the three months ended March 31, 2024 and 2023:

| Schedule of purchase of our

common stock | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, 2024 | | |

March 31, 2023 | |

| | |

Shares | | |

Avg. Price | | |

Shares | | |

Avg. Price | |

| Open market purchases | |

| 101,355 | | |

$ | 8.51 | | |

| 263,185 | | |

$ | 10.42 | |

| Shares redeemed upon net exercise of stock options | |

| 105,758 | | |

| 7.89 | | |

| 458,392 | | |

| 9.93 | |

| Total stock purchases | |

| 207,113 | | |

$ | 8.19 | | |

| 721,577 | | |

$ | 10.11 | |

Reclassifications

Some items in the prior year financial statements

were reclassified to conform to the current presentation. Reclassifications had no effect on net income or shareholders’ equity.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

Financial Covenants

Certain of our securitization

transactions, our warehouse credit facilities and our residual interest financing contain various financial covenants requiring minimum

financial ratios and results. Such covenants include maintaining minimum levels of liquidity and net worth and not exceeding maximum leverage

levels. As of March 31, 2024, we were in compliance with all such covenants. In addition, certain of our debt agreements other than our

term securitizations contain cross-default provisions. Such cross-default provisions would allow the respective creditors to declare a

default if an event of default occurred with respect to other indebtedness of ours, but only if such other event of default were to be

accompanied by acceleration of such other indebtedness.

Provision for Contingent

Liabilities

We are routinely involved

in various legal proceedings resulting from our consumer finance activities and practices, both continuing and discontinued. Our legal

counsel has advised us on such matters where, based on information available at the time of this report, there is an indication that it

is both probable that a liability has been incurred and the amount of the loss can be reasonably determined.

Recent Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07,

"Segment Reporting (Topic 280)," which is intended to enhance the disclosures on reportable segments. This new standard will

be effective for annual reporting periods beginning after December 15, 2023, with early adoption permitted. The Company is currently evaluating

the impact of ASU 2023-07; however, at the current time, the Company does not believe this ASU will have a material impact on its consolidated

financial statements.

In December 2023, the FASB issued ASU No. 2023-09,

"Income Taxes (Topic 740)," which is intended to provide greater transparency in various income tax components that affect the

rate reconciliation based on the applicable taxing jurisdictions, as well as the qualitative and quantitative aspects of those components.

This new standard will be effective for annual reporting periods beginning on or after December 15, 2024, with early adoption permitted.

The Company is currently evaluating the impact of ASU 2023-09; however, at the current time, the Company does not believe this ASU will

have a material impact on its consolidated financial statements.

(2) Finance

Receivables

Our portfolio of finance receivables

consists of small-balance homogeneous contracts comprising a single segment and class that is collectively evaluated for impairment on

a portfolio basis according to delinquency status. Our contract purchase guidelines are designed to produce a homogenous portfolio. For

key terms such as interest rate, length of contract, monthly payment and amount financed, there is relatively little variation from the

average for the portfolio. We report delinquency on a contractual basis. Once a contract becomes greater than 90 days delinquent, we do

not recognize additional interest income until the obligor under the contract makes sufficient payments to be less than 90 days delinquent.

Any payments received on a contract that is greater than 90 days delinquent are first applied to accrued interest and then to principal

reduction.

In January 2018 the Company

adopted the fair value method of accounting for finance receivables acquired after 2017. Finance receivables measured at fair value are

recorded separately on the Company’s Balance Sheet and are excluded from all tables in this footnote.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

We consider an automobile

contract delinquent when an obligor fails to make at least 90% of a contractually due payment by the following due date, which date may

have been extended within limits specified in the servicing agreements. The period of delinquency is based on the number of days payments

are contractually past due, as extended where applicable. Automobile contracts less than 31 days delinquent are not reported as delinquent.

In certain circumstances we will grant obligors one-month payment extensions. The only modification of terms is to advance the obligor’s

next due date by one month and extend the maturity date of the receivable by one month. In certain limited cases, a two-month extension

may be granted. There are no other concessions, such as a reduction in interest rate, forgiveness of principal or of accrued interest.

Accordingly, we consider such extensions to be insignificant delays in payments. The following table summarizes the delinquency status

of finance receivables as of March 31, 2024 and December 31, 2023:

| Schedule of delinquency status

of finance receivables | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Delinquency Status | |

(In thousands) | |

| Current | |

$ | 12,629 | | |

$ | 17,771 | |

| 31-60 days | |

| 3,618 | | |

| 5,626 | |

| 61-90 days | |

| 2,065 | | |

| 3,087 | |

| 91 + days | |

| 469 | | |

| 1,069 | |

| | |

$ | 18,781 | | |

$ | 27,553 | |

Finance receivables totaling

$469,000 and $1.1 million at March 31, 2024 and December 31, 2023, respectively, have been placed on non-accrual status as a result of

their delinquency status.

Allowance for Credit Losses

– Finance Receivables

The allowance for credit losses

is a valuation account that is deducted from the amortized cost basis of finance receivables to present the net amount expected to be

collected. Charge offs are deducted from the allowance when management believes that collectability is unlikely.

Management estimates the allowance

using relevant available information, from internal and external sources, relating to past events, current conditions and, reasonable

and supportable forecasts. We believe our historical credit loss experience provides the best basis for the estimation of expected credit

losses. Consequently, we use historical loss experience for older receivables, aggregated into vintage pools based on their calendar quarter

of origination, to forecast expected losses for less seasoned quarterly vintage pools.

We measure the weighted average

monthly incremental change in cumulative net losses for the vintage pools in the relevant historical period. For the pools in the relevant

historical period, we consider each pool’s performance from its inception through the end of the current period. We then apply the

results of the historical analysis to less seasoned vintage pools beginning with each vintage pool’s most recent actual cumulative

net loss experience and extrapolating from that point based on the historical data. We believe the pattern and magnitude of losses on

older vintages allows us to establish a reasonable and supportable forecast of less seasoned vintages.

Our contract purchase guidelines

are designed to produce a homogenous portfolio. For key credit characteristics of individual contracts such as obligor credit history,

job stability, residence stability and ability to pay, there is relatively little variation from the average for the portfolio. Similarly,

for key structural characteristics such as loan-to-value, length of contract, monthly payment and amount financed, there is relatively

little variation from the average for the portfolio. Consequently, we do not believe there are significant differences in risk characteristics

between various segments of our portfolio.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

Our methodology incorporates

historical pools that are sufficiently seasoned to capture the magnitude and trends of losses within those vintage pools. Furthermore,

the historical period encompasses a substantial volume of receivables over periods that include fluctuations in the competitive landscape,

the Company’s rates of growth, size of our managed portfolio and fluctuations in economic growth and unemployment.

In consideration of the depth

and breadth of the historical period, and the homogeneity of our portfolio, we generally do not adjust historical loss information for

differences in risk characteristics such as credit or structural composition of segments of the portfolio or for changes in environmental

conditions such as changes in unemployment rates, collateral values or other factors. Throughout our history we have observed how events

such as extreme weather, political unrest, and other qualitative factors have influenced the performance of our portfolio. Consequently,

we have considered how such qualitative factors may affect future credit losses and have incorporated our judgement of the effect of those

factors into our estimates.

The following table presents

the amortized cost basis of our finance receivables by annual vintage as of March 31, 2024 and December 31, 2023:

| Schedule of annual vintage | |

| | |

| |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Annual Vintage Pool | |

| | |

| |

| 2014 and prior. | |

$ | 237 | | |

$ | 370 | |

| 2015 | |

| 1,141 | | |

| 1,788 | |

| 2016 | |

| 4,991 | | |

| 7,673 | |

| 2017 | |

| 12,412 | | |

| 17,722 | |

| | |

$ | 18,781 | | |

$ | 27,553 | |

The following table presents

a summary of the activity for the allowance for finance credit losses for the three-month periods ended March 31, 2024 and 2023:

| Schedule of allowance for finance credit losses | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Balance at beginning of period | |

$ | 2,869 | | |

$ | 21,753 | |

| Provision for credit losses on finance receivables | |

| (1,635 | ) | |

| (9,000 | ) |

| Charge-offs | |

| (1,001 | ) | |

| (3,018 | ) |

| Recoveries | |

| 1,657 | | |

| 4,993 | |

| Balance at end of period | |

$ | 1,890 | | |

$ | 14,728 | |

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

The following table presents

the gross charge-offs by year of origination of our finance receivables for the three-month periods ended March 31, 2024 and 2023:

| Schedule of gross charge-off | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Annual Vintage Pool | |

(In thousands) | |

| 2014 and prior | |

$ | 70 | | |

$ | 141 | |

| 2015 | |

| 115 | | |

| 444 | |

| 2016 | |

| 377 | | |

| 1,321 | |

| 2017 | |

| 481 | | |

| 1,502 | |

| Applied against repos in inventory (net) | |

| (42 | ) | |

| (390 | ) |

| | |

$ | 1,001 | | |

$ | 3,018 | |

Excluded from finance receivables

are contracts that were previously classified as finance receivables but were reclassified as other assets because we have repossessed

the vehicle securing the Contract. The following table presents a summary of such repossessed inventory together with the allowance for

losses in repossessed inventory that is not included in the allowance for finance credit losses:

| Schedule of allowance for

losses in repossessed inventory | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Gross balance of repossessions in inventory | |

$ | 546 | | |

$ | 597 | |

| Allowance for losses on repossessed inventory | |

| (429 | ) | |

| (472 | ) |

| Net repossessed inventory included in other assets | |

$ | 117 | | |

$ | 125 | |

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(3) Securitization Trust Debt

We have completed many securitization

transactions that are structured as secured borrowings for financial accounting purposes. The debt issued in these transactions is shown

on our Unaudited Condensed Consolidated Balance Sheets as “Securitization trust debt,” and the components of such debt are

summarized in the following table:

| Schedule of securitization trust debt | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Weighted | |

| | |

| | |

| | |

| | |

| | |

| | |

Average | |

| | |

Final | | |

Receivables | | |

| | |

Outstanding | | |

Outstanding | | |

Contractual Debt | |

| | |

Scheduled | | |

Pledged at | | |

| | |

Principal at | | |

Principal at | | |

Interest Rate at | |

| | |

Payment | | |

March 31, | | |

Initial | | |

March 31, | | |

December 31, | | |

March 31, | |

| Series | |

Date (1) | | |

2024 (2) | | |

Principal | | |

2024 | | |

2023 | | |

2024 | |

| | |

(Dollars in thousands) | | |

| |

| CPS 2019-B | |

| June 2026 | | |

$ | – | | |

$ | 228,275 | | |

$ | – | | |

$ | 15,742 | | |

| – | |

| CPS 2019-C | |

| September 2026 | | |

| 20,050 | | |

| 243,513 | | |

| 15,489 | | |

| 19,725 | | |

| 5.26% | |

| CPS 2019-D | |

| December 2026 | | |

| 27,023 | | |

| 274,313 | | |

| 21,811 | | |

| 27,445 | | |

| 4.50% | |

| CPS 2020-A | |

| March 2027 | | |

| 26,213 | | |

| 260,000 | | |

| 21,459 | | |

| 26,382 | | |

| 4.95% | |

| CPS 2020-B | |

| June 2027 | | |

| 31,296 | | |

| 202,343 | | |

| 20,745 | | |

| 24,197 | | |

| 7.38% | |

| CPS 2020-C | |

| November 2027 | | |

| 44,231 | | |

| 252,200 | | |

| 37,586 | | |

| 43,487 | | |

| 4.25% | |

| CPS 2021-A | |

| March 2028 | | |

| 48,164 | | |

| 230,545 | | |

| 34,383 | | |

| 39,039 | | |

| 1.90% | |

| CPS 2021-B | |

| June 2028 | | |

| 61,128 | | |

| 240,000 | | |

| 47,473 | | |

| 55,684 | | |

| 2.71% | |

| CPS 2021-C | |

| September 2028 | | |

| 93,137 | | |

| 291,000 | | |

| 73,693 | | |

| 85,563 | | |

| 2.16% | |

| CPS 2021-D | |

| December 2028 | | |

| 126,773 | | |

| 349,202 | | |

| 110,294 | | |

| 126,059 | | |

| 2.71% | |

| CPS 2022-A | |

| April 2029 | | |

| 141,660 | | |

| 316,800 | | |

| 120,884 | | |

| 137,479 | | |

| 2.93% | |

| CPS 2022-B | |

| October 2029 | | |

| 218,246 | | |

| 395,600 | | |

| 191,200 | | |

| 213,779 | | |

| 5.07% | |

| CPS 2022-C | |

| April 2030 | | |

| 253,043 | | |

| 391,600 | | |

| 205,529 | | |

| 230,273 | | |

| 5.97% | |

| CPS 2022-D | |

| June 2030 | | |

| 211,067 | | |

| 307,018 | | |

| 185,573 | | |

| 205,583 | | |

| 8.10% | |

| CPS 2023-A | |

| August 2030 | | |

| 251,394 | | |

| 324,768 | | |

| 208,585 | | |

| 231,906 | | |

| 6.41% | |

| CPS 2023-B | |

| November 2030 | | |

| 275,600 | | |

| 332,885 | | |

| 241,966 | | |

| 268,172 | | |

| 6.66% | |

| CPS 2023-C | |

| February 2031 | | |

| 259,928 | | |

| 291,732 | | |

| 236,937 | | |

| 257,568 | | |

| 6.70% | |

| CPS 2023-D | |

| May 2031 | | |

| 275,342 | | |

| 286,149 | | |

| 252,383 | | |

| 271,939 | | |

| 7.29% | |

| CPS 2024-A | |

| August 2031 | | |

| 287,710 | | |

| 280,924 | | |

| 266,246 | | |

| – | | |

| 6.09% | |

| | |

| – | | |

$ | 2,652,004 | | |

$ | 5,498,867 | | |

$ | 2,292,235 | | |

$ | 2,280,021 | | |

| | |

_________________

Debt issuance costs of $14.6

million as of March 31, 2024 and December 31, 2023 have been excluded from the table above. These debt issuance costs are presented as

a direct deduction to the carrying amount of the Securitization trust debt on our Consolidated Balance Sheets.

All of the securitization trust

debt was sold in private placement transactions to qualified institutional buyers. The debt was issued through our wholly-owned bankruptcy

remote subsidiaries and is secured by the assets of such subsidiaries, but not by our other assets.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

The terms of the securitization

agreements related to the issuance of the securitization trust debt and the warehouse credit facilities require that we meet certain delinquency

and credit loss criteria with respect to the pool of receivables, and certain of the agreements require that we maintain minimum levels

of liquidity and not exceed maximum leverage levels. As of March 31, 2024, we were in compliance with all such covenants.

We are responsible for the administration

and collection of the automobile contracts. The securitization agreements also require certain funds be held in restricted cash accounts

to provide additional collateral for the borrowings, to be applied to make payments on the securitization trust debt or as pre-funding

proceeds from a term securitization prior to the purchase of additional collateral. As of March 31, 2024, restricted cash under the various

agreements totaled approximately $137.7 million. Interest expense on the securitization trust debt consists of the stated rate of interest

plus amortization of additional costs of borrowing. Additional costs of borrowing include facility fees, amortization of deferred financing

costs and discounts on notes sold. Deferred financing costs and discounts on notes sold related to the securitization trust debt are amortized

using a level yield method. Accordingly, the effective cost of the securitization trust debt is greater than the contractual rate of interest

disclosed above.

Our wholly-owned bankruptcy remote subsidiaries

were formed to facilitate the above asset-backed financing transactions. Similar bankruptcy remote subsidiaries issue the debt outstanding

under our credit facilities. Bankruptcy remote refers to a legal structure in which it is expected that the applicable entity would not

be included in any bankruptcy filing by its parent or affiliates. All of the assets of these subsidiaries have been pledged as collateral

for the related debt. All such transactions, treated as secured financings for accounting and tax purposes, are treated as sales for all

other purposes, including legal and bankruptcy purposes. None of the assets of these subsidiaries are available to pay other creditors.

(4) Debt

The terms and amounts of

our other debt outstanding at March 31, 2024 and December 31, 2023 are summarized below:

| Schedule of debt outstanding | |

| |

| |

| | | |

| | |

| | |

| |

| |

Amount Outstanding at | |

| | |

| |

| |

March 31, | | |

December 31, | |

| | |

| |

| |

2024 | | |

2023 | |

| | |

| |

| |

(In thousands) | |

| Description | |

Interest Rate | |

Maturity | |

| | |

| |

| | |

| |

| |

| | |

| |

| Warehouse lines of credit | |

3.00% over CP yield rate (Minimum 3.75%) 8.42% and 8.58% at March 31, 2024 and December 31 2023, respectively | |

July 2024 | |

$ | 184,079 | | |

$ | 165,628 | |

| | |

| |

| |

| | | |

| | |

| | |

4.50% over a commercial paper rate (Minimum 7.50%) 9.94% and 9.63% at March 31 2024, and December 31 2023, respectively | |

March 2026 | |

| 67,721 | | |

| 68,997 | |

| | |

| |

| |

| | | |

| | |

| Residual interest financing | |

7.86% | |

June 2026 | |

| 50,000 | | |

| 50,000 | |

| | |

| |

| |

| | | |

| | |

| Residual interest financing | |

11.50% | |

March 2029 | |

| 50,000 | | |

| – | |

| | |

| |

| |

| | | |

| | |

| Subordinated renewable notes | |

Weighted average rate of 9.01% and 8.45% at March 31, 2024 and December 31, 2023, respectively | |

Weighted average maturity of May 2026 and February 2026 at March 31, 2024 and December 31, 2023, respectively | |

| 22,140 | | |

| 17,188 | |

| | |

| |

| |

| | | |

| | |

| | |

| |

| |

$ | 373,940 | | |

$ | 301,813 | |

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

On March 29, 2024, we renewed our two-year $200

million revolving credit agreement with Ares Agent Services, L.P. The revolving period for this facility was extended to March 2026 followed

by an amortization period through March 2028 for any receivables pledged at the end of the revolving period. There was $67.7 million outstanding

under this facility at March 31, 2024.

On March 22, 2024, we completed a $50 million

securitization of residual interests from previously issued securitizations. In the transaction, a qualified institutional buyer purchased

$50.0 million of asset-backed notes secured by an 80% interest in a CPS affiliate that owns the residual interests in five CPS securitizations

issued from January 2022 through January 2023. The sold notes (“2024-1 Notes”), issued by CPS Auto Securitization Trust 2024-1,

consist of a single class with a coupon of 11.50%. At March 31, 2024 there was $50.0 million outstanding under this facility.

On July 15, 2022, we renewed our two-year revolving

credit agreement with Citibank, N.A., and doubled the capacity from $100 million to $200 million. The revolving period for this facility

was extended to July 2024 followed by an amortization period through July 2025 for any receivables pledged at the end of the revolving

period. There was $184.1 million outstanding under this facility at March 31, 2024.

Unamortized debt issuance costs of $1.0 million

and $125,000 as of March 31, 2024 and December 31, 2023, respectively, have been excluded from the amount reported above for residual

interest financing. Similarly, unamortized debt issuance costs of $2.3 million and $599,000 as of March 31, 2024 and December 31, 2023,

respectively, have been excluded from the Warehouse lines of credit amounts in the table above. These debt issuance costs are presented

as a direct deduction to the carrying amount of the debt on our Unaudited Condensed Consolidated Balance Sheets.

(5) Interest Income and Interest Expense

The following table presents

the components of interest income:

| Schedule of interest income | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Interest on finance receivables | |

$ | 2,337 | | |

$ | 4,662 | |

| Interest on finance receivables at fair value | |

| 80,505 | | |

| 74,058 | |

| Other interest income | |

| 1,446 | | |

| 1,342 | |

| | |

| | | |

| | |

| Interest income | |

$ | 84,288 | | |

$ | 80,062 | |

The following table presents

the components of interest expense:

| Schedule of interest expense | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(In thousands) | |

| Securitization trust debt | |

$ | 35,932 | | |

$ | 26,353 | |

| Warehouse lines of credit | |

| 4,321 | | |

| 4,848 | |

| Residual interest financing | |

| 1,209 | | |

| 1,050 | |

| Subordinated renewable notes | |

| 506 | | |

| 508 | |

| | |

| | | |

| | |

| Interest expense | |

$ | 41,968 | | |

$ | 32,759 | |

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(6) Earnings Per Share

Earnings per share for the

three-month periods ended March 31, 2024 and 2023 were calculated using the weighted average number of shares outstanding for the related

period. The following table reconciles the number of shares used in the computations of basic and diluted earnings per share for the

three-month periods ended March 31, 2024 and 2023:

| Schedule of earnings per share | |

| | | |

| | |

| |

Three Months Ended | |

| |

March 31, | |

| | |

2024 | | |

2023 | |

| |

(In thousands) | |

| Weighted average number of common shares outstanding during the period used to compute basic earnings per share | |

| 21,143 | | |

| 20,418 | |

| Incremental common shares attributable to exercise of outstanding options and warrants | |

| 3,459 | | |

| 4,974 | |

| Weighted average number of common shares used to compute diluted earnings per share | |

| 24,602 | | |

| 25,392 | |

If the anti-dilutive effects

of common stock equivalents were considered, shares included in the diluted earnings per share calculation for the three-months ended

March 31, 2024 and 2023 would have included an additional 1.7 million shares attributable to the exercise of outstanding options and warrants.

(7) Income Taxes

We file numerous consolidated

and separate income tax returns with the United States and with many states. With few exceptions, we are no longer subject to U.S. federal,

state, or local examinations by tax authorities for years before 2015.

As of March 31,2024 and December

31, 2023, we had no unrecognized tax benefits for uncertain tax positions. We do not anticipate that total unrecognized tax benefits will

significantly change due to any settlements of audits or expirations of statutes of limitations over the next 12 months.

The Company and its subsidiaries

file a consolidated federal income tax return and combined or stand-alone state franchise tax returns for certain states. We utilize the

asset and liability method of accounting for income taxes, under which deferred income taxes are recognized for the future tax consequences

attributable to the differences between the financial statement values of existing assets and liabilities and their respective tax bases.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. The effect on deferred taxes of a change in tax rates is recognized in

income in the period that includes the enactment date.

Deferred tax assets are recognized

subject to management’s judgment that realization is more likely than not. A valuation allowance is recognized for a deferred tax

asset if, based on the weight of the available evidence, it is more likely than not that some portion of the deferred tax asset will not

be realized. In making such judgments, significant weight is given to evidence that can be objectively verified. Although realization

is not assured, we believe that the realization of the recognized net deferred tax asset of $3.5 million as of March 31, 2024 is more

likely than not based on forecasted future net earnings. Our net deferred tax asset of $3.5 million consists of approximately $2.2 million

of net U.S. federal deferred tax assets and $1.3 million of net state deferred tax assets.

CONSUMER PORTFOLIO SERVICES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

Income tax expense was $2.0

million for the three months ended March 31, 2024, representing effective income tax rates of 30%. For the prior year period, income tax

expense was $4.6 million for the three months ended March 31, 2023 representing an effective tax rate of 25%.

(8) Legal Proceedings

Consumer

Litigation. We are routinely involved in various legal proceedings resulting from our consumer finance

activities and practices, both continuing and discontinued. Consumers can and do initiate lawsuits against us alleging violations of law

applicable to collection of receivables, and such lawsuits sometimes allege that resolution as a class action is appropriate. For the

most part, we have legal and factual defenses to consumer claims, which we routinely contest or settle (for immaterial amounts) depending

on the particular circumstances of each case.

Following

our filing of a complaint for a deficiency judgment in the Superior Court at Waterbury, Connecticut, the defendant filed a cross-claim

on October 16, 2019 alleging that our deficiency notices were not compliant with Connecticut law, and seeking relief on behalf of a class

of Connecticut obligors whose vehicles we had repossessed. The complaint seeks primarily damages, injunctive relief, waiver of contract

deficiencies, and attorney fees and interest. The defendant’s contract provided for resolution of disputes exclusively by arbitration,

and exclusively on an individual basis, not a class basis. Nevertheless, in August 2021, the court denied our motion to compel arbitration,

without opinion. In April 2024, a motion for certification of a class was filed but has not been ruled upon. It is reasonable to expect

that resolution of these claims will be on a class basis.

Wage

and Hour Claim. On September 24, 2018, a former employee filed a lawsuit against us in the Superior Court

of Orange County, California, alleging that we incorrectly classified our sales representatives as outside salespersons exempt from overtime

wages, mandatory break periods and certain other employee protective provisions of California and federal law. The complaint seeks injunctive

relief, an award of unpaid wages, liquidated damages, and attorney fees and interest. The plaintiff purports to act on behalf of a class

of similarly situated employees and ex-employees. We believe that our compensation practices with respect to our sales representatives

are compliant with applicable law. In August 2023, the parties settled by agreement the claims of the plaintiff and a California settlement

class for $1.1 million. The settlement was preliminarily approved by the court on March 1, 2024 and remains subject to final court approval.

Massachusetts