RNS Number:1998M

Games Workshop Group PLC

22 January 2008

GAMES WORKSHOP GROUP PLC

HALF-YEARLY REPORT

Games Workshop Group PLC ("Games Workshop" or the "Group") announces its

half-yearly results for the six months to 2 December 2007.

Highlights:

* Revenue at �54.6m (2006: �54.6m)

* Pre-exceptional gross margin at 69.9% (2006: 70.9%)

* Exceptional items - cost reduction programme �(0.6)m (2006: �nil)

* Pre-exceptional operating profit up �0.6m to �1.1m (2006: �0.5m)

* Operating profit at �0.5m (2006: �0.5m)

* (Loss)/earnings per share of (0.4)p (2006: 0.2p)

Tom Kirby, Chairman, and Mark Wells, Chief Executive of Games Workshop, said:

"These half-year results are encouraging; we have re-established constant

currency sales growth in the UK, the Americas and Asia Pacific, our gross

margins remain strong, and our cost reduction programme is delivering the

overhead reductions we expected.

We remain a growth business and are now getting benefits from the efforts our

staff have been making. There is still much to do, and we are united in our

determination to do it."

For further information, please contact:

Games Workshop Group PLC Today only: 01756 770 376

Tom Kirby, Chairman Thereafter: 0115 900 4001

Mark Wells, Chief Executive 0115 900 4001

Michael Sherwin, Finance Director 0115 900 4001

Investor relations website investor.games-workshop.com

General website www.games-workshop.com

Rawlings Financial PR Limited Tel: 01756 770 376

Catriona Valentine

FIRST HALF HIGHLIGHTS

Six months to Six months to

2 December 26 November

2007 2006

Revenue �54.6m �54.6m

Pre-exceptional operating profit �1.1m �0.5m

Exceptional items - cost reduction programme �(0.6)m -

Operating profit �0.5m �0.5m

(Loss)/profit before tax �(0.2)m �0.1m

Basic (loss)/earnings per share (0.4)p 0.2p

INTERIM MANAGEMENT REPORT

Preamble

Our half-yearly report does not usually have a Chairman's preamble. The reason

it does this time is because for the first time this is the Chairman's preamble

alone and not that of the Chairman and Chief Executive. In late November 2007

the board invited long-time Head of Sales, Mark Wells, to take on the role of

CEO. This move recognises Mark's increasing influence and allows him to take

control of the day to day affairs of the business giving me more time to spend

with senior staff in general, helping them, and him, achieve the long-term

ambitions we all share.

Getting the business back on track after several difficult years has been, and

continues to be, hard work. Progress towards top line growth has not been as

fast as any of us would like, but progress there has been. We remain a growth

business and are now getting benefits from the efforts our staff have been

making. There is still much to do, and we are united in our determination to do

it.

T H F Kirby

Chairman

Results

These half-year results are encouraging; we have re-established constant

currency sales growth in the UK, the Americas and Asia Pacific, our gross

margins remain strong and our cost reduction programme is delivering the

overhead reductions we expected. We still have work to do in Continental Europe

to re-establish sales growth. However, we believe that the right managerial and

operational steps are being taken.

In the UK and the Americas our constant currency sales growth has been driven by

higher sales to independent retailers and stronger internet sales, while sales

through our Hobby stores have remained flat as we have restructured the store

chains. In Continental Europe most of the sales decline has been from sales to

independent retailers and we are beginning to see some improved performance from

our Hobby stores.

We have opened five Hobby stores and closed 18 during the period, leaving us

with 335 at the end of November 2007.

The pre-exceptional gross margin, at 69.9%, remains strong. We believe this to

be sustainable.

Compared to November 2006, sterling has strengthened by 8.5% against the US

dollar and weakened by 1.2% against the euro. We have shown below our sales

progression in constant currency terms so that readers can better understand the

figures.

Cost reduction programme

Our cost reduction programme, announced in May 2007, has three key areas:

* Closing loss-making stores

* Rationalisation of the manufacturing and supply chain

* Simplification of the support infrastructure

In the first half of this year we have shut over half of the stores identified

for closure, nine in the Americas, four in the UK, four in Continental Europe

and one in Asia Pacific.

We have closed our tool making facility at Wisbech, UK and this activity has

been relocated to our Nottingham site. Our programme to rationalise inventory

management is being rolled out across our UK Hobby stores and it is also being

introduced in the Americas.

We have completed the removal of the former divisional management structures and

service centres have been established in Nottingham to remove unnecessary

duplication of back office functions. The service centres support the IT,

accounting, HR, production planning and supplier development functions across

the majority of the Group's activities.

We still expect the cost reduction programme to result in annualised cost

reductions of �7m.

The costs associated with this programme are shown as exceptional costs.

Prospects

The principal risks and uncertainties for the balance of the year lie in the

ability of each of our individual sales businesses to establish and maintain

sales growth. Our gross margins are strong, our costs and working capital are

under control, so sales delivery remains an area of key focus.

Nevertheless these half-year results are encouraging, and the directors firmly

believe that the prospects for the business remain very good.

Dividend

We are using the cash which would have otherwise been applied in paying

dividends this year to finance the cost reduction programme described above. The

board remains confident in the future growth and profitability of the Group and

will resume paying dividends when appropriate.

Statement of directors' responsibilities

The directors confirm that this condensed set of financial statements has been

prepared in accordance with IAS 34 as adopted by the European Union, and that

the interim management report herein includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8.

The directors of Games Workshop Group PLC are listed in the annual report for

the 53 weeks to 3 June 2007, with the exception of M N Wells who was appointed

to the board on 3 December 2007. A list of the current directors is maintained

on the investor relations website at investor.games-workshop.com.

By order of the board

M N Wells

Chief Executive

M Sherwin

Finance Director

REVENUE BY GEOGRAPHICAL AREA OF SALES OPERATION IN

LOCAL CURRENCY

Six months to Six months to

2 December 2007 26 November

2006

Continental Europe Euro28.6m Euro32.0m

United Kingdom �18.8m �17.0m

The Americas US$24.2m US$22.9m

Asia Pacific Aus$9.2m Aus$8.9m

CONSOLIDATED INCOME STATEMENT

Restated Restated

Six months to Six months to 53 weeks to

2 December 26 November 3 June

2007 2006 2007

Notes �000 �000 �000

Revenue 2 54,630 54,620 111,041

Cost of sales (16,695) (15,888) (32,694)

---------- ---------- ----------

Gross profit 37,935 38,732 78,347

Operating expenses (38,062) (38,742) (81,845)

Other operating income -

royalties receivable 670 466 1,423

---------- ---------- ----------

Operating profit/(loss) 2 543 456 (2,075)

-------------------------------------------------------------------------------

Operating profit -

pre-exceptional 1,104 456 1,953

Exceptional items - cost

reduction programme (561) - (4,028)

-------------------------------------------------------------------------------

Finance income 163 107 326

Finance costs (898) (436) (1,110)

---------- ---------- ---------

(Loss)/profit before taxation (192) 127 (2,859)

Tax 4 77 (51) (622)

---------- ---------- ---------

(Loss)/profit attributable to

equity shareholders (115) 76 (3,481)

========== ========== =========

Basic (loss)/earnings per

ordinary share 5 (0.4)p 0.2p (11.2)p

Diluted (loss)/earnings per

ordinary share 5 (0.4)p 0.2p (11.2)p

The restatement of the prior period results is to reflect the reclassification

of certain costs from cost of sales to operating expenses following the

establishment of the service centres (Nov 2006: �406,000; May 2007: �787,000).

There are also reclassifications from cost of sales (Nov 2006: �110,000; May

2007: �216,000) and operating expenses (Nov 2006: �106,000; May 2007: �226,000)

to revenue following the standardisation of trading terms to independent

retailers within Europe. Although these reclassifications are not material, they

are being reclassified to aid comparison to the current period.

CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE

Six months to Six months to 53 weeks to

2 December 26 November 3 June

2007 2006 2007

�000 �000 �000

(Loss)/profit attributable to equity

shareholders (115) 76 (3,481)

Exchange differences on translation of

foreign operations 107 (473) (614)

Cash flow hedges:

- fair value (losses)/gains (219) 122 (88)

- transferred to the income

statement 29 (26) (86)

Tax on items recognised directly

in equity 52 (29) 52

---------- ---------- ----------

Total recognised expense for the

period (146) (330) (4,217)

========== ========== ==========

CONSOLIDATED BALANCE SHEET

As at As at As at

2 December 26 November 3 June

2007 2006 2007

Notes �000 �000 �000

Non-current assets

Goodwill 2,355 2,412 2,390

Other intangible assets 9 5,545 4,375 4,963

Property, plant and equipment 10 27,053 28,859 27,986

Trade and other receivables 1,122 1,015 1,204

Deferred tax assets 2,420 2,075 2,314

---------- ---------- ----------

38,495 38,736 38,857

---------- ---------- ----------

Current assets

Inventories 11,623 12,824 11,260

Trade and other receivables 12,691 11,766 8,351

Current tax assets 1,515 1,496 1,056

Financial assets - derivative

financial instruments - 304 24

Cash and cash equivalents 6,722 5,669 6,103

---------- ---------- ----------

32,551 32,059 26,794

---------- ---------- ----------

Total assets 71,046 70,795 65,651

---------- ---------- ----------

Current liabilities

Financial liabilities - 8 (6,889) (8,417) (6,461)

borrowings

Financial liabilities -

derivative (463) (19) (120)

financial instruments

Trade and other payables (15,208) (14,841) (13,889)

Current tax liabilities (218) (122) (38)

Provisions 11 (1,459) (397) (3,225)

---------- ---------- ----------

(24,237) (23,796) (23,733)

---------- ---------- ----------

Net current assets 8,314 8,263 3,061

---------- ---------- ----------

Non-current liabilities

Financial liabilities - 8 (15,004) (9,989) (9,820)

borrowings

Other non-current liabilities (842) (757) (958)

Provisions 11 (1,173) (951) (1,283)

---------- ---------- ----------

(17,019) (11,697) (12,061)

---------- ---------- ----------

Net assets 29,790 35,302 29,857

========== ========== ==========

Capital and reserves

Called up share capital 15 1,556 1,556 1,556

Share premium account 15 7,822 7,822 7,822

Other reserves 15 (1,103) (1,069) (1,210)

Retained earnings 15 21,515 26,993 21,689

---------- ---------- ----------

Total shareholders' equity 29,790 35,302 29,857

========== ========== ==========

CONSOLIDATED CASH FLOW STATEMENT

Six months to Six months to 53 weeks to

2 December 26 November 3 June

2007 2006 2007

Notes �000 �000 �000

Cash flows from operating

activities

Cash generated from operations 6 623 782 10,341

UK corporation tax paid (3) (458) (503)

Overseas tax paid (142) (1,057) (1,345)

---------- ---------- ----------

Net cash from operating

activities 478 (733) 8,493

---------- ---------- ----------

Cash flows from investing

activities

Purchases of property, plant

and equipment (2,887) (3,306) (5,813)

Proceeds on disposal of

property, plant and equipment 9 26 13

Purchases of other intangible

assets (802) (260) (951)

Expenditure on product

development (1,138) (1,391) (2,937)

Interest received 162 114 336

---------- ---------- ----------

Net cash from investing

activities (4,656) (4,817) (9,352)

---------- ---------- ----------

Cash flows from financing

activities

Proceeds from borrowings 5,190 3,070 2,908

Repayment of principal under

finance leases (6) (34) (41)

Equity dividends paid - (4,364) (5,904)

Interest paid (792) (504) (1,113)

---------- ---------- ----------

Net cash from financing

activities 4,392 (1,832) (4,150)

---------- ---------- ----------

Effects of foreign exchange

rates (24) (125) (107)

---------- ---------- ----------

Net increase/(decrease) in

cash and cash equivalents 190 (7,507) (5,116)

========== ========== ==========

Opening cash and cash

equivalents (344) 4,772 4,772

---------- ---------- ----------

Closing cash and cash

equivalents 7 (154) (2,735) (344)

========== ========== ==========

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The half-year results for the six months to 2 December 2007 and for the

comparative six months to 26 November 2006 are unaudited and do not constitute

statutory accounts within the meaning of section 240 of the Companies Act 1985.

Statutory accounts for the 53 weeks to 3 June 2007 have been delivered to the

Registrar of Companies. The auditors' report on those accounts was unqualified,

did not contain an emphasis of matter paragraph and did not contain any

statement under section 237 of the Companies Act 1985.

The financial information has been prepared in accordance with the accounting

policies under International Financial Reporting Standards ('IFRS') detailed in

the financial statements for the 53 weeks to 3 June 2007 which are expected to

be followed in the full financial statements for the year ending 1 June 2008.

This half-yearly report has been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Services Authority and with IAS 34 'Interim

Financial Reporting' as adopted by the European Union.

Changes to accounting standards and interpretations and their likely impact on

the Group's future accounting policies are set out below:

IFRS 7 'Financial instruments: disclosures' is effective for accounting periods

beginning on or after 1 January 2007, and will therefore be applicable for the

year ending 1 June 2008, and IFRS 8 'Operating segments', effective for

accounting periods beginning on or after 1 January 2009, will be applicable in

the year ending May 2010. These amendments to disclosure requirements will have

no effect on the Group's reported results. The Group does not consider that any

other standards or interpretations issued by the IASB, but not yet applicable,

will have a significant impact on the Group's results.

The half-yearly report is available to shareholders and members of the public on

the Company's website at investor.games-workshop.com.

2. Segmental analysis

Six months to 2 December 2007

Rest

of Design

Continental United The Asia the Central/ Service and Royalty

Europe Kingdom Americas Pacific world unallocated centres development income Group

�000 �000 �000 �000 �000 �000 �000 �000 �000 �000

Total gross

segment sales

by operation 19,705 18,822 12,192 3,911 - - - - - 54,630

------- ------- ------- ------ ------ ------- ------ ------- ------ ------

Total gross

segment sales

by location of

customers 20,092 16,681 13,497 4,208 152 - - - - 54,630

------- ------- ------- ------ ------ ------- ------ ------- ------ ------

Pre-exceptional

operating

profit/

segment result

by location of

customers 3,520 2,817 346 192 75 (2,854) (2,158) (1,504) 670 1,104

Exceptional

items (20) (322) (89) - - (130) - - - (561)

------- ------- ------- ------ ------ ------- ------ ------- ------ ------

Operating

profit/

segment result

by location of

customers 3,500 2,495 257 192 75 (2,984) (2,158) (1,504) 670 543

------- ------- ------- ------ ------ ------- ------ ------- ------ ------

Restated

Six months to 26 November 2006

Rest

of Design

Continental United The Asia the Central/ Service and Royalty

Europe Kingdom Americas Pacific world unallocated centres development income Group

�000 �000 �000 �000 �000 �000 �000 �000 �000 �000

Total

gross

segment

sales by

operation 21,734 16,947 12,348 3,591 - - - - - 54,620

------- ------- ------- ------- ------ ------- ------ ------- ------ ------

Total

gross

segment

sales by

location of

customers 23,165 14,414 13,178 3,752 111 - - - - 54,620

------- ------- ------- ------- ------ ------- ------ ------- ------ ------

Operating

profit/

segment

result by

location of

customers 4,271 2,047 440 74 56 (2,801) (2,261) (1,836) 466 456

------- ------- ------- ------- ------ ------- ------ ------- ------ ------

Restated

53 weeks to 3 June 2007

Rest

of Design

Continental United The Asia the Central/ Service and Royalty

Europe Kingdom Americas Pacific world unallocated centres development income Group

�000 �000 �000 �000 �000 �000 �000 �000 �000 �000

Total gross

segment sales

by operation 44,832 34,051 24,540 7,618 - - - - - 111,041

------- ------- ------- ------- ------ ------- ------ ------- ------ -------

Total gross

segment sales

by location of

customers 45,600 30,481 26,640 8,121 199 - - - - 111,041

------- ------- ------- ------- ------ ------- ------ ------- ------ -------

Pre-exceptional

operating

profit/segment

result by

location of

customers 8,930 5,347 (515) 376 97 (5,179) (4,895) (3,631) 1,423 1,953

Exceptional

items (800) (2,084) (1,120) (24) - - - - - (4,028)

------- ------- ------- ------- ------ ------- ------ ------- ------ ------

Operating

(loss)/segment

result by

location of

customers 8,130 3,263 (1,635) 352 97 (5,179) (4,895) (3,631) 1,423 (2,075)

------- ------- ------- ------- ------ ------- ------ ------- ------ ------

The restatement of prior periods is to disclose costs for IT, accounting,

payroll, HR, production planning and supplier development services as costs

relating to the service centres and to reflect these changes in the allocation

of operating profits to the geographic segments. This is following the

establishment of service centres covering these areas in the six months to 2

December 2007.

3. Dividends

No dividend was paid in the six months to 2 December 2007. In addition, no

interim dividend is proposed for the year ending 1 June 2008 (2006: 4.95p).

4. Tax

The taxation credit for the six months to 2 December 2007 is based on an

estimate of the full year effective rate of 40% (2006: 40%) for the year ending

1 June 2008.

5. (Loss)/earnings per share

Basic (loss)/earnings per share is calculated by dividing the (loss)/profit

attributable to equity shareholders by the weighted average number of ordinary

shares in issue throughout the relevant period, excluding ordinary shares

purchased by the Company and held as treasury shares.

Six months to Six months to 53 weeks to

2 December 26 November 3 June

2007 2006 2007

(Loss)/profit attributable to

equity shareholders (�000) (115) 76 (3,481)

---------- ---------- ---------

Weighted average number of

ordinary shares in issue

(thousands) 31,117 31,116 31,116

---------- ---------- ---------

Basic (loss)/earnings per

share (pence per share) (0.4) 0.2 (11.2)

========== ========== =========

Diluted (loss)/earnings per share

The calculation of diluted (loss)/earnings per share has been based on the

(loss)/profit attributable to equity shareholders and the weighted average

number of shares in issue during the relevant period, excluding treasury shares,

adjusted for the dilution effect of share options outstanding at the end of the

period.

Six months to Six months to 53 weeks to

2 December 26 November 3 June

2007 2006 2007

(Loss)/profit attributable

to equity shareholders

(�000) (115) 76 (3,481)

---------- ---------- ---------

Weighted average number of

ordinary shares in issue

(thousands) 31,117 31,116 31,116

Adjustment for share options

(thousands) - 293 -

---------- ---------- ---------

Weighted average number of

ordinary shares in issue for

diluted (loss)/earnings per

share (thousands) 31,117 31,409 31,116

---------- ---------- ---------

Diluted (loss)/earnings per

share (pence per share) (0.4) 0.2 (11.2)

========== ========== =========

There is no impact on the diluted EPS for the six months to 2 December 2007 and

the 53 weeks to 3 June 2007 for the share options in existence as, due to

losses, these options are anti-dilutive.

6. Reconciliation of (loss)/profit attributable to equity shareholders to

net cash from operations

Six months to Six months to 53 weeks to

2 December 26 November 3 June

2007 2006 2007

�000 �000 �000

(Loss)/profit attributable to

equity shareholders (115) 76 (3,481)

Tax (77) 51 622

Depreciation of property, plant

and equipment 3,377 3,294 6,925

Impairment loss on property,

plant and equipment - - 306

Loss on disposal of property,

plant and equipment 116 29 95

Amortisation of capitalised

development costs 1,009 1,237 2,525

Amortisation of other intangibles 372 348 720

Finance income (163) (107) (326)

Finance costs 898 436 1,168

Net fair value losses/(gains) on

derivative financial instruments 61 (24) 88

Share-based payments 79 60 42

Exchange losses/(gains) on

borrowings - 63 (58)

Changes in working capital:

- (Increase)/decrease in inventories (437) (611) 901

- (Increase)/decrease in trade and

other receivables (3,988) (3,134) 128

- Increase/(decrease) in trade and

other payables 1,393 (767) (2,326)

- (Decrease)/increase in provisions (1,902) (169) 3,012

---------- ---------- ----------

Net cash from operating activities 623 782 10,341

========== ========== ==========

The cash outflow relating to exceptional items in the six months to 2 December

2007 was �2,088,000.

7. Cash and cash equivalents

Cash and cash equivalents and bank overdrafts include the following for the

purposes of the cash flow statement:

2 December 26 November 3 June

2007 2006 2007

�000 �000 �000

Cash and cash equivalents 6,722 5,669 6,103

Bank overdraft (6,876) (8,404) (6,447)

---------- ---------- ----------

(154) (2,735) (344)

========== ========== ==========

8. Financial liabilities - borrowings

2 December 26 November 3 June

2007 2006 2007

�000 �000 �000

Current

Bank overdraft 6,876 8,404 6,447

Obligations under finance leases 13 13 14

---------- ---------- ----------

6,889 8,417 6,461

---------- ---------- ----------

Non-current

Bank loans 15,000 9,971 9,811

Obligations under finance leases 4 18 9

---------- ---------- ----------

15,004 9,989 9,820

---------- ---------- ----------

Total borrowings 21,893 18,406 16,281

========== ========== ==========

9. Other intangible assets

2 December 26 November 3 June

2007 2006 2007

�000 �000 �000

Net book value at beginning of period 4,963 4,320 4,320

Additions 1,957 1,651 3,888

Exchange differences 6 (11) -

Amortisation charge (1,381) (1,585) (3,245)

--------- ---------- ----------

Net book value at end of period 5,545 4,375 4,963

========= ========== ==========

10. Property, plant and equipment

2 December 26 November 3 June

2007 2006 2007

�000 �000 �000

Net book value at beginning of period 27,986 29,475 29,475

Additions 2,569 2,882 6,031

Exchange differences - (149) (181)

Disposals (125) (55) (108)

Charge for the period (3,377) (3,294) (6,925)

Impairment loss - - (306)

---------- ---------- ----------

Net book value at end of period 27,053 28,859 27,986

========== ========== ==========

11. Provisions

Employee

benefits Property Total

�000 �000 �000

As at 29 May 2006 615 896 1,511

Charged/(credited) to the income

statement 29 (75) (46)

Exchange differences (6) (8) (14)

Utilised (1) (102) (103)

---------- ---------- ----------

As at 26 November 2006 637 711 1,348

========== ========== ==========

Employee

Redundancy benefits Property Total

�000 �000 �000 �000

As at 29 May 2006 - 615 896 1,511

Charged to the

income statement 1,573 293 1,374 3,240

Exchange differences - (4) (14) (18)

Increase in provision -

discount unwinding - - 27 27

Utilised (17) (16) (219) (252)

---------- ---------- ---------- ----------

As at 3 June 2007

and 4 June 2007 1,556 888 2,064 4,508

Charged to the income

statement 415 44 35 494

Exchange differences 29 28 (4) 53

Utilised (1,657) (42) (724) (2,423)

---------- ---------- ---------- ----------

As at 2 December 2007 343 918 1,371 2,632

========== ========== ========== ==========

12. Seasonality

The Group's monthly sales profile demonstrates an element of seasonality around

the Christmas period. This impacts sales in the months of September and

December.

13. Related-party transactions

There were no material related-party transactions during the period.

14. Exceptional items

The exceptional item relates to the cost reduction programme announced in May

2007. As part of this programme, in the six months to 2 December 2007, �42,000

has been incurred in closing loss making stores, �356,000 in rationalising the

manufacturing and supply chain and �163,000 in simplifying the support

infrastructure. There were no exceptional items in the six months to 26 November

2006.

Continuing Continuing Six months to Six months to

pre-exceptional exceptional 2 December 26 November

items 2007 2006

�000 �000 �000 �000

Revenue 54,630 - 54,630 54,620

Cost of sales (16,434) (261) (16,695) (15,888)

---------- --------- ---------- ---------

Gross profit 38,196 (261) 37,935 38,732

Operating expenses (37,762) (300) (38,062) (38,742)

Other operating

income-royalties

receivable 670 - 670 466

---------- --------- ---------- ---------

Operating

profit/(loss) 1,104 (561) 543 456

========== ========= ========== =========

Continuing Continuing 53 weeks to

pre-exceptional exceptional 3 June

items 2007

�000 �000 �000

Revenue 111,041 - 111,041

Cost of sales (32,472) (222) (32,694)

---------- --------- ----------

Gross profit 78,569 (222) 78,347

Operating expenses (78,039) (3,806) (81,845)

Other operating income-royalties

receivable 1,423 - 1,423

---------- --------- ----------

Operating profit/(loss) 1,953 (4,028) (2,075)

========== ========= ==========

15. Consolidated statement of changes in shareholders' equity

Other reserves Retained earnings

---------------------------------- ---------------------------

Called

up Share Capital Profit

share premium redemption Translation Other Hedging Treasury and Total

capital account reserve reserve reserve reserve shares loss equity

�000 �000 �000 �000 �000 �000 �000 �000 �000

As at 29 May 2006 1,556 7,822 101 353 (1,050) 60 (49) 31,143 39,936

Exchange

adjustments - - - (473) - - - - (473)

Profit for the

period - - - - - - - 76 76

Dividends paid - - - - - - - (4,364) (4,364)

Share-based payments - - - - - - - 60 60

Current tax - - - - - (29) - - (29)

Cash flow hedges:

- fair value gains

in the period - - - - - 122 - - 122

- transferred to

net profit - - - - - (26) - - (26)

-------- ------- ---------- ---------- -------- ------ -------- ------ ------

As at 26

November 2006 1,556 7,822 101 (120) (1,050) 127 (49) 26,915 35,302

======== ======= ========== ========== ======== ====== ======== ====== ======

Other reserves Retained earnings

---------------------------------- ---------------------------

Called

up Share Capital Profit

share premium redemption Translation Other Hedging Treasury and Total

capital account reserve reserve reserve reserve shares loss equity

�000 �000 �000 �000 �000 �000 �000 �000 �000

As at 29 May 2006 1,556 7,822 101 353 (1,050) 60 (49) 31,143 39,936

Exchange

adjustments - - - (614) - - - - (614)

Loss for the year - - - - - - - (3,481) (3,481)

Dividends paid - - - - - - - (5,904) (5,904)

Share-based payments - - - - - - - 42 42

Current tax - - - - - 26 - - 26

Deferred tax - - - - - 26 - - 26

Cash flow hedges:

- fair value losses

in the period - - - - - (88) - - (88)

- transferred to

net profit - - - - - (86) - - (86)

-------- ------- ---------- ---------- -------- ------ -------- ------ ------

As at 3 June 2007

and 4 June 2007 1,556 7,822 101 (261) (1,050) (62) (49) 21,800 29,857

Exchange

adjustments - - - 107 - - - - 107

Loss for the period - - - - - - - (115) (115)

Shares vested - - - - - - 49 (49) -

Share-based payments - - - - - - - 79 79

Deferred tax - - - - - 52 - - 52

Cash flow hedges:

- fair value losses

in the period - - - - - (219) - - (219)

- transferred to

net profit - - - - - 29 - - 29

-------- ------- ---------- ---------- -------- ------ -------- ------ ------

As at 2 December

2007 1,556 7,822 101 (154) (1,050) (200) - 21,715 29,790

======== ======= ========== ========== ======== ====== ======== ====== ======

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR XFLFLVFBZBBF

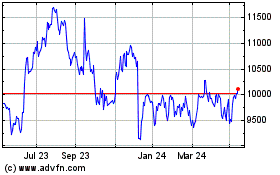

Games Workshop (LSE:GAW)

Historical Stock Chart

From Apr 2024 to May 2024

Games Workshop (LSE:GAW)

Historical Stock Chart

From May 2023 to May 2024