SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2015

Commission File Number: 1-13368

POSCO

(Translation of registrant’s name into English)

POSCO Center, 892 Daechi 4-dong, Kangnam-gu, Seoul, Korea, 135-777

(Address of principal executive office)

(Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form20-F x Form 40-F ¨

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b) : 82- .]

POSCO is furnishing under cover of Form 6-K:

Exhibit 99.1: An English-language translation of documents with respect to Performance in 1Q 2015 of POSCO

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POSCO |

|

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

| Date: |

|

April 21, 2015 |

|

|

|

By |

|

/s/ Noh, Min-Yong |

|

|

|

|

|

|

|

|

(Signature)* |

| * Print the name and title under the signature of the signing officer. |

|

|

|

Name: |

|

Noh, Min-Yong |

|

|

|

Title: |

|

Senior Vice President |

Exhibit 99.1

posco

2015 1Q Earnings

Release

April 21, 2015

1Q Operating Performance

Major Business Activities

2015 Business Plan

Figures in this presentation are based on unaudited financial statements of the company. Certain contents in this presentation are subject to change during the course of auditing

process.

1Q Operating Performance

Consolidated Income

OP remained flat YoY as steel, trade, and energy

improved, while E&C sector struggled

Revenue

(in billion KRW)

15,440 16,685 15,101

2014.1Q 2014.4Q 2015.1Q

Operating Profit

(in billion KRW)

4.7% 4.6% 4.8%

OP

Margin

731 764 731

2014.1Q 2014.4Q 2015.1Q

Net Profit

(in billion KRW)

ROE 0.5% 1.3% 3.3%

56 210 370

2014.1Q 2014.4Q 2015.1Q

(in billion KRW) Revenue Operating Profit Net Profit

2014.1Q 2014.4Q 2015.1Q 2014.1Q 2014.4Q

2015.1Q 2014.1Q 2014.4Q 2015.1Q

Steel 11,945 12,467 11,764 519 593 551 93 44 352

Trade 7,338 8,143 7,003 71 141 114 29 25 95

E & C 2,682 2,720 2,435 144 71 29 42 14 47

Energy 691 697 584 50 26 89 24 50 62

I C T 272 275 218 8 14 5 5 - 2

Chem/Mat’l

/Others 822 899 756 35 18 20 22 21 2

* Based on figures prior to consolidation adjustments

POSCO Earnings Release April 21, 2015

posco

3

1Q Operating Performance

Parent Income

Enhanced profitability by expanding high-end product sales,

despite product price decline

Production

(in thousand tons)

9,302 9,565 9,183

Crude Steel

8,589 9,068 8,600

Steel Product

2014.1Q 2014.4Q 2015.1Q

2014.1Q 2014.4Q 2015.1Q

Carbon Steel

8,837 9,118 8,700

S T S

465 447 483

* (Pohang) No.2 BF revamping : Feb.6~May.15

(Pohang) No.2 Steelmaking rationalization :

Feb.6~May.17

Sales

(in thousand tons, thousand KRW/ton)

755 696 670

Carbon Steel Price

8,408 8,708 8,530

2014.1Q 2014.4Q 2015.1Q

2014.1Q 2014.4Q 2015.1Q

Domestic 4,679 4,528 4,222

Exports 3,729 4,180 4,308

Invento-ries 979 1,280 1,276

Income

(in billion KRW)

OP Margin 7.0% 8.8% 9.2%

7,364 7,145 6,788

Revenue

518 632 622

Operating Profit

2014.1Q 2014.4Q 2015.1Q

ROE 1.1% 2.4% 4.7%

Net Profit 112 259 500

2014.1Q 2014.4Q 2015.1Q

POSCO Earnings Release | April 21, 2015

4

posco

1Q Operating Performance

Consolidated Financial Structure

Liabilities to equity ratio rose as equity

decreased due to dividend payment and stake sale of POSCO Specialty Steel

Assets

(in billion KRW)

86,099 85,252 84,665

2014.1Q 2014.4Q 2015.1Q

Liabilities

(in billion KRW)

90.2% 88.2% 89.8%

Liabilities to Equity

40,788, 39,961 40,058

2014.1Q 2014.4Q 2015.1Q

Equity

(in billion KRW)

45,311 45,291 44,607

2014.1Q 2014.4Q 2015.1Q

POSCO Earnings Release | April 21, 2015

5

posco

1Q Operating Performance

Major Business Activities

2015 Business Plan

Major Business Activities

Stronger Steel Competitiveness

Actively responded to market trend by

increasing high-end product sales

Added value to the product

with solution

marketing

[Product Sales through Solution

Marketing activities]

Sales Volume 425 +9% 465 (thousand tons)

2014.4Q 2015.1Q

[WP* Product Sales Portion]

WP Portion 33.1 36.0 (thousand tons, %)

Sales Volume 2,635 +8% 2,843

2014.4Q 2015.1Q

*World Premium: POSCO’s high-value added product

[Cases for Solution Marketing]

Home Appliances

“Erosion/welding solution for heating pipe for Chiller

“

· Replaced Cu product to STS product for heat conduction pipe for chiller used in power plants of a client

(company “L”) and improved formability by providing heating treatment solution in welding parts · Material cost reduced by 66% to Cu

Shipbuilding

“World first steel product to approve BCA*”

· Large container ships are obliged to use BCA guaranteed steel since 2014

· To

the needs of the customer (DSME), POSCO developed world-first product that contains BCA and won recognition from IACS**

*Brittle Crack Arrest

**International Association of Classification Societies

Construction

“Technology/financing solution for steel used for bridges”

· Co-developed

SBarch synthetic girder* with a client (Hye-Dong Bridge, expert in bridge-making)and enhanced quality and reduced steel used, by 30%

· Provided financing

solution for client’s initial involvement in the PJT through Steel Loan of POSCO Capital

* Arch-type Girder made of grinded concrete for bridge

“Ideas for construction steel materials and cost-reduction solutions ”

·

P-P&S supported cost-reduction of a client (GS E&C) by providing POSCO’s high-quality, low-cost materials and rationalized logistics

· Supplied

structure steel to Doha Link bridge project in Kuwait

POSCO Earnings Release April 21, 2015

POSCO 7

Major Business Activities

Stronger Steel Competitiveness

Led the global automotive steel market by

combining marketing, quality, and technology

Auto steel sales volume went up from the year before, including volume to Japanese and European carmakers

[thousand tons]

1,960 +6% 2.071

2014.1Q 2015.1Q

1 Marketing

2 Quality

3 Technology

1 Ssangyong

· Covered 72% of the body of Tivoli with high-strength steel

· Expand sales to South American/European market, major markets for SUV

Porsche

· Reduced roof weight of “911 GT3 RS”, by 30%, with POSCO’s magnesium steel

Renault

· Applied magnesium auto inner materials to mass-produced model, “New

SM7”

2 Changcheng (China)

· Received R&D award from the

largest SUV-producer in China (first time for a foreign steelmaker)

- Processing solutions for new products

Toyota

· Won this year’s best supplier award for 2 consecutive years (solely among

foreign steelmakers)

G M

· Won this year’s best supplier award

3 Developed tech. for light weight :

New material that outweigh titanium

(Feb)

· Cost reduction by 90%, weight down by 15%, while keeping the strength of titanium (high strength, low weight)

· Excellent formability allows adaptation to existing steelmaking facilities (pushing for commercialization)

POSCO Earnings Release | April 21, 2015

8

POSCO

Major Business Activities

Select and Focus New Businesses

Discovered new profit sources using

POSCO’s own technology in steel and materials

Global POIST*

Signed MOA

to sell existing FINEX (Mar)

- Built ground for selling FINEX technology and building the facilities through deal with Mesco Steel, India (No.1 Finex,

600 thousand tons capa.)

Change in steel hegemony and key tech.

18C 20C

21C

Key Tech.

Ingot-making, Cokes process

Bessemer/Thomas process, Continuous Rolling

LD steelmaking, Continuous Casting

FINEX (Innovative Tech.)

[FINEX]

Fine Ore Semi-soft coking coal/Thermal Coal Exclude Sintering & Coking Processes

HCI

Coal Briquetting

Fluidized Bed Reactor Molten Iron

* POSCO Innovative Steel Making Technology

Secondary Battery Materials

Run large-sized pilot plant with applying Lithium direct extraction technology

- Proved its

ability to mass-produce lithium by reaching over its full capacity and extracting Lithium with purity of 99.98%

BOLIVIA CHILE ARGENTINA Salar de Cauchari

Stabilized the secondary battery materials business by winning more orders (POSCO ESM)

- Revenue and profitability to improve as it landed high-end product orders from overseas clients (3 years, around 60 billion KRW)

- Sales volume : (’14) 1,400 tons (’15) 2,500 tons

POSCO Earnings Release | April

21, 2015

posco 9

Major Business Activities

Improved Business Structure

Proceed restructuring and non-core asset sales

2014 2015. 1Q 2015. 2Q~ (mid/long term)

Set priorities and concluded several

deals

POSCO Specialty Steel

-Sold 72.1% stake to SeAhBesteel (52.1% sold

first)

Vietnam IBC/Masan Dept.

- Sold non-core assets of DWI and P-E&C to

Lotte

PosFine

- Sold 69.2% of stakes to Hahn & Company

Restructuring & Non-core asset sales

POSCO Plantec restructuring

- Took extreme measures, as rationalizing workforces and pulling out from loss-making biz. (shipbuilding/offshore plants) - After closing troubled deals, change to focusing mainly

on steel facility maintenance

USP sell-out (Feb)

- Sold to Evraz, Russian

steelmaker

Preliminary deal for selling POSCO Uruguay (Mar)

- As CER* gained

overseas do not apply domestically**, POSCO sold it with Eagon (JV partner for the project)

Partial stake sales of P-E&C (Mar)

- Signed MOU with PIF, Saudi sovereign fund

Review profitability and select more candidates

Speed up restructuring and exit businesses on the line

- Poreka, New Altec,

etc.

Review overseas loss-making businesses for restructuring Review selling non-core investments

- Sandfire mines, etc.

* Carbon emission Reduction : emission unit

**The Allocation and Trade of Emission Allowance of Greenhouse Gas Act

POSCO Earnings Release

| April 21, 2015

posco

10

Major Business Activities

Subsidiaries Performance

Daewoo International

Stabilized profitability of Myanmar gasfield

- Despite oil price drop, OP remained steady as

the field reached full production (OP down by 3% QoQ)

Continued effort to find “The next Myanmar gasfield”

- Start drilling AD-7 mine lot in Myanmar (~’16.1H)

- Evaluate reserves and marketability

of Gorae D structure in the East Sea (~’15.1H)

POSCO Energy

Started

operating Incheon No.9 plant (Jan)

- Set LNG power capacity of 3,412MW (capable to supply 12% of power needed in metropolitan area)

Began commercial production of No.1 plant in Mong Duong II in Vietnam (Mar)

- Expect for

stable profit (No.2 plant, to be finished by 1H)

*Mong Duong II Coal-fired plant (1,200MW)

- US)AES 51%, P-Energy) 30%, China)CIC 19%

- Signed 25-years PPA* with VietNam Electricity

* Power Purchase Agreement : Trade electricity on a price that guarantees certain amount of profit

POSCO ChemTech

Built production line for natural graphite cathode materials (Mar)

- Largest domestic mass-production of 5,400 tons/yr

[Production Capacity] (ton)

3,600 +1,800 5,400

2014 2015

SNNC

Built SNNC No.2 plant with own tech. (Mar)

- Nickel self-sufficiency ratio to reach 80% with stable procurement of ferronickel

[Production Capacity] (ton)

30,000 +24,000 54,000

2014 2015

POSCO Earnings Release | April 21, 2015

posco

11

1Q Operating Performance

Major Business Activities

2015 Business Plan

2015 Business Plan

Consolidated Business Target

2014 2015(F)

Revenue (trillion KRW) 65.1 67.4

- POSCO Revenue (“) 29.2 29.3

Crude Steel Production (million tons) 37.7 38.4

Product Sales (“) 34.3 35.9

Investment (trillion KRW) 5.4 4.2

- POSCO Investment (“) 3.0 2.9

POSCO Earnings Release | April 21, 2015

posco

13

Appendix

1. Business

Environment

– Steel Demand, Raw Materials

2. Financial Statements

Appendix 1. Business Environment

Global Steel Demand

China’s Steel Economy

“Downtrend in price will ease as capacity reduction effect is seen”

1Q crude steel

production decreased by 1.7% YoY due to slow demand and environmental regulations

- Major steel mills cut production : Baoshan Steel 4%, Angang 10% (Jan~Feb, YoY)

Imbalance between supply and demand will improve and price will bottom out as 2Q faces seasonal peak and capacity cuts take effect

- Auto demand is to remain firm, construction demand will pick up as regulation on real estate eases

[China’s Crude Steel Production and Steel PMI]

48.3 Steel PMI

44.2 43.6 44.1 43.0

208.6 202.8 204.8 198.9 200.0

Crude Steel Production

(in million tons)

‘14.1Q 2Q 3Q 4Q ‘15.1Q

* World Steel Association, Mysteel, China Federation of

Logistics & Purchasing

Steel Demand in Major Countries

“While

demand in US/China declines, developing countries’ demand is to stay firm”

China : Demand lowered by 3.3% in 2014 due to the slow construction market. In

2015, demand fall will ease by economic stimulus plan and auto sales pushing demand US : Against early expectations, demand turned downward as fall in oil price pressured energy pipe demand Developing Countries : Offset sluggish US/China demand by

maintaining firm growth of 4~6%

- While China/US demand drop by 4 million tons, India, SEA, and MENA increase by 11 million tons

[Outlook for Demand in Major Countries] (in million tons)

2012 2013 2014 YoY 2015 YoY

US 96.2 95.7 106.9 11.7% 106.5 -0.4%

EU 139.2 140.4 146.8 4.5% 149.9 2.1%

China 660.1 735.1 710.8 -3.3% 707.2 -0.5%

India 72.4 73.7 75.3 2.2% 80.0 6.2%

SEA 58.9 63.2 65.3 3.2% 68.9 5.5%

MENA 66.2 66.8 70.1 5.0% 72.9 4.1%

Global 1,439.3 1,528.4 1,537.3 0.6% 1,544.4 0.5%

* World Steel

Association(April 2015)

POSCO Earnings Release | April 21, 2015

posco

Appendix 1. Business Environment

Domestic Steel Demand

Outlook for Demand Industries

Automobile

1Q domestic/exports decreased, 2Q will rise slightly QoQ

Domestic (thousand units): 1,464 (’14) 1,481 (’15), 345 (1Q) 380 (2Q)

Exports

(thousand units): 3,063 (’14) 2,969 (’15), 736 (1Q) 777 (2Q)

Shipbuilding

1H building will continue to go up as new orders won in 2013 kicks in

Building (million GT):

22.1 (’14) 24.0 (’15), 5.9 (1Q) 6.5 (2Q)

Order (million GT): 23.4 (’14) 18.0 (’15), 4.9 (1Q) 4.1 (2Q)

Construction

2Q investment will dramatically increase QoQ as the peak season arrives

Construction (trillion KRW): 126.6 (’14) 131.0 (’15), 25.9 (1Q) 35.5 (2Q)

Engineering (trillion KRW) : 71.8 (’14) 73.3 (’15), 14.1 (1Q) 20.0 (2Q)

*

POSRI(April 2015)

(thousand units)

Production 976 1,206 1,108 1,157

(million GT)

Building 5.6 5.1 5.9 6.5

(trillion KRW)

Investment 51.9 53.2 40.0 55.5

2014.3Q 4Q 2015.1Q 2Q

Outlook for Supply/Demand

“1Q consumption dropped YoY as customers had high inventories, 2Q consumption will improve as auto/construction demands upturn

(in thousand tons) 2013 2014 2015 1Q 2Q QoQ

Nominal Consumption 51,762 55,521 54,710 13,150

14,115 +7.3%

Export 29,191 32,257 32,890 7,890 8,125 +3.0%

Production 69,146

74,109 74,688 17,828 18,890 +6.0%

Import 11,807 13,669 12,912 3,212 3,350 +4.3%

Incld. Semi-products 19,393 22,749 22,153 5,553 5,560 +0.1%

* POSRI(April

2015)

POSCO Earnings Release | April 21, 2015

posco

Appendix 1. Business Environment

Raw Materials

Iron Ore

2015.1Q

Price fell to the lowest since 2008 financial crisis, due to the oversupply and

sluggish trading as China’s demand shows slow recovery Jan: US$68/ton Mar: US$57/ton

“Fine Ore CFR within US$50/ton”

2015.2Q

Weak price will continue as purchasing sentiment shrank due to price plunge, depressed

China’s steel economy lingers, and major miners continue to add new supply into the market

[Iron Ore Price] (US$/ton)

126 133 135 120 103 90 74 62 50

2013 2013 2013 2014 2014 2014 2014 2015 2015

2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q(f)

*Platts 62% Fe IODEX CFR China (Quarter Average Spot)

Coking Coal

2015. 1Q

Weak price seen as market sentiment turned sour due to the lower-than-expected benchmark price agreement and low coking coal demand, a result of decrease in China’s crude

steel production

“Hard Coking Coal to fall to FOB U$90/ton”

2015.2Q

Price is expected to stay weak as imported coal price is pressured downwards due to the China’s announcement to lower the domestic coal price and Australian

miners, which end fiscal year during 2Q, are likely to release more volume

[Coking Coal Price] (US$/ton)

143 142 142 122 113 112 111 105 90

2013 2013 2013 2014 2014 2014 2014 2015 2015

2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q(f)

*Platts HCC Peak Downs Region FOB Australia (Quarter Average

Spot)

POSCO Earnings Release | April 21, 2015

posco

Appendix 2. Financial Statements

Summarized Statements of Income

(in billion KRW)

2014.1Q 2014.4Q 2015.1Q QoQ

Revenue 15,440 16,685 15,101 1,584

Gross Profit 1,688 1,924 1,815 109

(Gross Margin) (10.9%) (11.5%) (12.0%) -

Selling & Admin. Expenses 957 1,159 1,083 76

Operating Profit 731 764 731 33

(Operating Margin) (4.7%) (4.6%) (4.8%) -

Other Operating Profit 240 119 89

+208

Share of Profit (loss) of Equity-accounted investees 87 134 63 +71

Finance Items Gains 136 452 122 +330

Foreign Currency Transaction &

Translation Gains (loss) 99 99 9 +90

Net Profit 56 210 370 +580

(Net Margin)

(0.4%) (1.3%) (2.4%) -

Owners of the Controlling Company 70 193 373 +566

POSCO Earnings Release | April 21, 2015

posco

Appendix 2. Financial Statements

Consolidated Statements of Financial Position

(in billion KRW)

2014.1Q 2014.4Q 2015.1Q QoQ

Current Assets 32,988 32,627 31,979 648

Cash & Financial Goods* 6,725 5,274 6,577 +1,303

Account Receivable 12,348 11,786

11,653 133

Inventories 10,760 10,471 10,046 425

Non-Current Assets 53,111

52,625 52,686 +61

Other Long-term Financial Assets** 5,079 3,600 3,514 86

PP&E 36,015 35,241 35,210 31

Total Assets 86,099 85,252 84,665 587

Liabilities 40,788 39,961 40,058 +97

Current Liabilities 22,019 21,877 22,565

+688

Non-Current Liabilities 18,769 18,084 17,493 591

(Interest-bearing Debt)

28,087 27,428 28,089 +661

Equity 45,311 45,291 44,607 684

Owners of the

Controlling Company 41,541 41,587 41,272 315

Total Liabilities & Equity 86,099 85,252 84,665 587

* Cash & Financial Goods : Cash and cash equivalents, Short-term financial goods, Short-term available for sale securities, Current portion of held-to-maturity securities,

and Derivatives asset held for trading **Including Other bonds

POSCO Earnings Release | April 21, 2015

posco

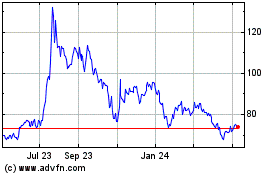

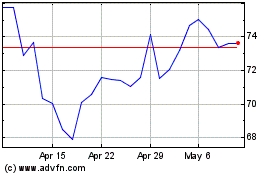

POSCO (NYSE:PKX)

Historical Stock Chart

From Aug 2024 to Sep 2024

POSCO (NYSE:PKX)

Historical Stock Chart

From Sep 2023 to Sep 2024