Visa Plans to Speed up Chip-Card Certification Process

June 16 2016 - 9:50AM

Dow Jones News

Visa Inc. on Thursday announced plans to speed up the process by

which merchants certify equipment to start accepting chip cards, a

move intended to help businesses accept more secure plastic and

reduce fraud.

The changes come as delays in the certification process have

drawn complaints from merchants, including a group in Florida that

has sued Visa over the issue.

"Visa recognizes the importance of having the industry help

merchants get their chip terminal solutions up and running

quickly," so that everyone, especially consumers, can benefit from

the powerful security protection of chip technology," said Oliver

Jenkyn, an executive in the company's North America segment. He

noted Visa has "taken steps to simplify the process as much as

possible and help reduce any challenges so merchants can move

forward with chip adoption quickly."

Retailers who haven't made the transition to chip cards have

been responsible since last October for counterfeit transactions

that used to be covered by card-issuing banks. Before a merchant

can activate a new chip terminal, it has had to navigate varying

implementation and testing methods since such methods differ and

depend on businesses' complexity.

To reduce that friction, Visa said it has streamlined its

testing requirements to cut the complexity, time and cost of

implementation. Further, the card company is giving banks

flexibility to self-certify their clients.

Visa also said it would step up in investment to support banks

and the resellers that develop the software behind chip terminals.

It said Thursday that it would provide funding to help acquirers

"with any specific resource constraints they may be facing."

Since Visa shifted the burden of counterfeit costs to the party

responsible for not yet having the chip, the merchant or the bank,

costs have mounted from many merchants. The company said Thursday

that it would modify its policy to block all U.S. counterfeit fraud

chargebacks under $25, effective July 22, noting that smaller

chargebacks "generate a great deal of work and expense for

merchants and acquirers."

Home Depot Inc. recently filed an antitrust lawsuit against Visa

and MasterCard Inc., saying merchants pay too much for debit- and

credit-card transactions and adding new contentions about the

effectiveness of chip-based cards to reduce fraud. It also alleged

that Visa and MasterCard had colluded to prevent adoption of the

chip-based cards.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

June 16, 2016 09:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

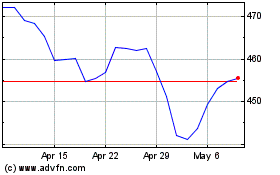

MasterCard (NYSE:MA)

Historical Stock Chart

From Aug 2024 to Sep 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Sep 2023 to Sep 2024