Low Carbon Investments Tied To Dimming Fate Of Climate Bill

April 26 2010 - 6:03PM

Dow Jones News

Capitol Hill politics aren't just bogging down a climate bill in

the Senate, but also investment in low-carbon energy.

Portfolio managers, investment firms and businesses are counting

on a carbon-constrained future, under legislation that curbs

greenhouse gases, to grow the demand for green and clean-tech

projects. But after the Senate Majority Leader said last week he's

planning to bring a controversial immigration bill to the floor

before climate bill. One of its key authors--and a rare Republican

backer of climate legislation--nixed plans to unveil a proposal

Monday.

"Unless their plan substantially changes this weekend, I will be

unable to move forward on energy independence legislation at this

time," said South Carolina Republican Lindsey Graham in a

letter.

Nearly every sector of the energy industry is in some way

affected by the climate bill's fate, whether its wind turbines and

solar plants, nuclear power or companies that make natural gas

generators and clean coal technology. While some want to see a

carbon market that will create demand for their products, others

just want to know the investment parameters and clarity on the new

emission rules.

"The U.S. faces a critical moment that will determine whether we

will be able to unleash billions in energy investments or remain

mired in the economic status quo," the U.S. Climate Action

Partnership said after the meltdown in negotiations over the

weekend. USCAP represents nearly two dozen Fortune-500 companies

that have urged Congress to pass a climate bill, including General

Electric Co. (GE), Duke Energy (DUK), and NRG Energy (NRG).

The American Business for Clean Energy (ABCE), a group

representing 3,000 businesses that support passage of a climate

bill, urged lawmakers to keep pushing it as a legislative priority.

"American businesses, large and small, are urging Congress to act

in order to make the United States a world leader in clean energy

technology, reduce our dependence on foreign energy sources, and

create millions of new jobs," the group said.

Graham and his partners, Sens. John Kerry (D., Mass.) and Joe

Liebermann (I., Conn.) have been crafting the proposal with

industry for months. But he said he fears adding controversial

immigration legislation to an already jammed legislative calendar

would crowd out a climate bill. "I will not allow our hard work to

be rolled out in a manner that has no chance of success," he

said.

That leaves utilities that have worked with the Senate trio to

craft climate legislation, such as Exelon Corp. (EXC) and American

Electric Power Co. (AEP), and FPL Group (FPL), flummoxed.

"We are disappointed by this temporary setback, we remain

hopeful that the issues will be resolved quickly, and that the U.S.

Senate will make passage of an energy and climate bill an urgent

priority," said Exelon spokeswoman Judy Rader.

A senior lobbyist that works for a large utility said the

political intervention is frustrating because, "We thought progress

had been made and we were moving in the right direction."

With businesses fearing their work on the bill will have been in

vain, he said there's "an effort to try to get many people to weigh

in with Graham, and say, 'please go back to the table.'"

The setback--which some say may be fatal for the bill this

year--happens as the White House has been ramping up the rhetoric

about how vital passing the climate bill is to invigorate the U.S.

economy and compete with China. President Barack Obama's top

economic advisor, energy czar and energy secretary have been

hitting the public speaking circuit to whip up support for the

climate bill.

Obama himself will Tuesday travel to a Siemens Corp. wind

turbine facility in Fort Madison, Iowa, Tuesday as part of an

orchestrated effort to tout the economic, environmental and

national security benefits of clean energy investments. The company

expanded the plant, adding over 600 jobs with capital from the

stimulus package and tax credits.

Siemens., a unit of the German parent company Siemens AG (SI,

SIE.XE), is representative of thousands of companies looking to

capitalize on a carbon-constrained economy. It's building a range

of products that would be attractive if there was a cost to

emitting carbon. Besides efficient motors and generators, they're

also developing technology to capture emissions from coal plants,

have a retro-fitting business that installs energy efficient

equipment in buildings, and plan to expand their solar power unit

in the U.S.

-By Ian Talley, Dow Jones Newswires; (202) 862 9285;

ian.talley@dowjones.com;

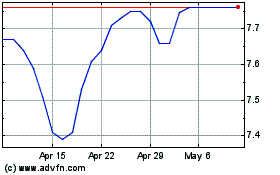

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Aug 2024 to Sep 2024

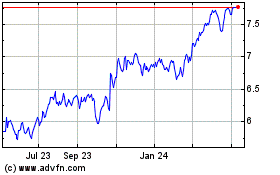

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Sep 2023 to Sep 2024