Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

March 27 2015 - 5:14PM

Edgar (US Regulatory)

Filed by The Dow Chemical Company

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: The Dow Chemical Company

Commission File No.: 001- 03433

|

Combination of The Dow Chemical Company’s “Dow

Chlorine Products” with Olin

March 27, 2015

Andrew N. Liveris Chairman and Chief Executive Officer

Joseph D. Rupp Chairman and Chief Executive Officer

|

|

|

SEC Disclosure Rules

Some of our comments today include statements about our

expectations for the future. Those expectations involve

risks and uncertainties. The parties cannot guarantee the

accuracy of any forecasts or estimates, and we do not plan

to update any forward-looking statements if our expectations

change. If you would like more information on the risks

involved in forward-looking statements, please see each

companies’ annual report and SEC filings.

In addition, some of our comments reference non-GAAP

financial measures. Where available, presentation of and

reconciliation to the most directly comparable GAAP

financial measures and other associated disclosures are

provided on the Internet at each companies’ website.

tm Trademark of The Dow Chemical Company or an affiliated

company of Dow. “EBITDA” is defined as earnings (i.e., “Net

Income”) before interest, income taxes, depreciation and

amortization.

2

|

|

|

SEC Disclosure Rules

Important Notices and Additional Information

In connection with the proposed transaction, Blue Cube

Spinco Inc. (“Spinco”) will file a registration statement on

Form S-4/S-1 containing a prospectus and Olin Corporation

will file a proxy statement on Schedule 14A and a

registration statement on Form S-4 containing a prospectus

with the Securities and Exchange Commission (the “SEC”).

INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE

REGISTRATION STATEMENTS/PROSPECTUSES AND PROXY STATEMENT

WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PARTIES AND THE PROPOSED

TRANSACTION. Investors and security holders may obtain a

free copy of the prospectuses and proxy statement (when

available) and other documents filed by The Dow Chemical

Company (“TDCC”), Spinco and Olin with the SEC at the SEC's

web site at http://www.sec.gov. Free copies of these

documents, once available, and each of the companies’ other

filings with the SEC may also be obtained from the

respective companies by directing a written request to Olin

at 190 Carondelet Plaza, Clayton, MO 63105 Attention:

Investor Relations or TDCC or Spinco at The Dow Chemical

Company, 2030 Dow Center, Midland, Michigan 48674,

Attention: Investor Relations.

This communication is not a solicitation of a proxy

from any investor or security holder. However, Olin,

TDCC, and certain of their respective directors,

executive officers and other members of management and

employees, may be deemed to be participants in the

solicitation of proxies from shareholders of Olin in

respect of the proposed transaction under the rules of

the SEC. Information regarding Olin directors and

executive officers is available in Olin 2014 Annual

Report on Form 10-K filed with the SEC on February 25,

2015, and in its definitive proxy statement for its

annual meeting of shareholders filed March 4, 2015.

Information regarding TDCC’s directors and executive

officers is available in TDCC’s Annual Report on Form

10-K filed with the SEC on February 13, 2015, and in

its definitive proxy statement for its annual meeting

of shareholders, which is expected to be filed on March

27, 2015. These documents can be obtained free of

charge from the sources indicated above. Other

information regarding the participants in the proxy

solicitation and a description of their direct and

indirect interests, by security holdings or otherwise,

will be contained in the registration statements,

prospectuses and proxy statement and other relevant

materials to be filed with the SEC when they become

available.

This communication shall not constitute an offer to

sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made

except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of

1933, as amended.

tm Trademark of The Dow Chemical Company or an affiliated

company of Dow. “EBITDA” is defined as earnings (i.e.,

“Net Income”) before interest, income taxes,

depreciation and amortization.

3

|

|

|

Agenda

Transaction Overview

Strategic Alignment

Details of “New Olin”

4

|

|

|

Strategic Benefits of Transaction

Creates ~$7B revenue industry leader in Chlor-Alkali and derivatives

Highly complementary to strategic objectives of both

companies, which significantly enhances shareholder and

customer value

Another step in Dow’s transformation to a more

focused and targeted portfolio while maintaining integration benefits

“New Olin” will have substantial operational cost

synergies, as well as significant growth potential

“New Olin” will have strong financial flexibility

to support growth, better serve customers and reward shareholders

Transaction Uniquely Unleashes Value to Deliver Win-Win-Win

For “New Olin”, for Dow and for Both Companies’ Shareholders

5

|

|

|

Dow’s Portfolio Evolution

Steady Drumbeat of Actions

Announced Plans to Restructure Costs and Shut Down Assets

Divestiture Actions Begin

Sale of PPL&C

Announced

Chlorine Carve-Out

Exceeded $500MM Cost Savings

$450MM Rail Car Sale

Expanded Divestiture Target to $7B - $8.5B

Sold Angus, SBH

Dow Chlorine Products Merger

Portfolio Management and Productivity Actions

2012

Board Commences Detailed Strategic Reviews

2013

Restart St. Charles Cracker

Sadara financial close

Break ground on PDH facility

2014

Break ground on USGC Ethylene facility

Enlist obtains USDA and EPA Approval

2015

Sadara to start up 2H15

PDH to start up mid-2015

DAS 2015-2019 New Product Launches

Proactive, Self-Help Actions Driving

Record Adjusted EBITDA, Cash From Operations and Shareholder Rewards

Excludes the impact of the K-Dow award in 2013

6

|

|

|

Significant Value Creation for All Shareholders

Transaction Overview

Formation of ~$7B revenue Chlor-Alkali and derivatives

leader Transaction based on $5B RMT structure for Dow

Chlorine Products (DCP) at 8x multiple “New Olin” to

benefit from a minimum of $200MM of operational

synergies Strong, long-term operator at Dow’s

integrated sites All contracts structured to deliver

value Highly complementary assets offer ability for

strategic growth, product expansion and improved

customer offerings and service

Dow Exceeds Divestiture Target

Pre-Tax Proceeds ($B)

Completed

In Progress

Kuwait and Other JV Optimization

Dow Chlorine Products

Sodium Borohydride (~$200MM)

Angus($1.2B)

~$450MM Asset Sales

(Railcars, Land, etc.)

~$850MM in 2013

PPL&C, others)

~$3B

~$3B Tax Eq.

$5B Pre-Tax

Taxable Equivalent Value

$8 B

>$7B?$8.5B

Completed

Dow Chlorine Products

Expanded Target

*Assumes 37% tax rate

7

|

|

|

Complementary Profiles

Chlor-Alkali History

Dow

Olin

118 yrs

123 yrs

Recent Chlorine Strategy

Rationalizing

Growing

Global Chlor-Alkali Capacity*

Top 10

Top 10

Asset Locations

Global

Regional US & Canada

Downstream Applications

18

3

Cultural Fit

Envelope Expertise

Experience at Shared Sites

Strong Operational and EH&S Stewardship

*Source: IHS

Creates premier company with the scope and expertise to

grow in the marketplace and generate significant

shareholder value

8

|

|

|

Transaction Overview

Structure and Considerations

Reverse Morris Trust structure - split-off intention

Total value of $5B at 8x multiple, consisting of ~$2.2B

in common stock, ~$2.0B in cash and cash equivalents,

~$0.8B in assumed debt and pension liabilities Separate

agreement on ethylene is additive and highly

value-creating for Dow

Ownership

Approximately 50.5% Dow shareholders

Approximately 49.5% existing Olin shareholders

80.6 million shares outstanding of “New Olin”

Governance

Olin’s existing Board of Directors plus three

additional directors designated by Dow Olin’s CEO and

combined executive team to lead “New Olin”

Conditions of Expected Closing

Simple majority from Olin shareholder vote Customary

closing conditions, relevant tax rulings and regulatory

authority approvals Expected closing year-end 2015

9

|

|

|

Merger of Dow Chlorine Products Business

with Olin Corporation

March 26, 2015

|

|

|

Diversifies Olin’s Business Mix

2014 pro forma EBITDA by business ($bn)

Dow Chlorine Products

Olin

Pro forma NewCo

Epoxy

12%

Global Chlorinated Organics

18%

0%

Chlor Alkali & Vinyl

70%

+

~$0.64bn

Olin

Winchester

37%

Chemical Distribution

4%

=

Chlor Alkali

59%

$0.34bn

Winchester

14%

Global Chlorinated Organics

12%

Epoxy

7%

Chemical Distribution

1%

Chlor-Alkali & Vinyl

66%

~$1.0bn

Source: Olin and Dow management

11

|

|

|

Creates a Leader in Chlorine-Based Products

Top chlorine producers worldwide (kMT)

Chlorine global capacity: ~90,000 kMT

5,647

3,730

3,430

2,363

2,249

2,249

1,917

1,886

1,719

+

DCP1

DCP1

Source: CMAI 2014 average capacities in kMT

1 Includes 50% of Dow Mitsui Chlor Alkali joint venture chlorine capacity

2 Capacity in Brazil, Germany and Australia not in scope of transaction

12

|

|

|

Significant Cost Synergies with Strategic Opportunities Upside

Synergies breakdown

Expected value

Logistics & procurement

Increased procurement efficiencies

Elimination of duplicate terminals and optimization of freight to terminals

Reduction of net acquisition cost for purchased caustic

Savings from trucking and rail fleet optimization

COGS reduction opportunities

$50mm

Operational efficiencies

SG&A

Cost optimization

Energy utilization

$70mm

Asset optimization

Consolidation of select operations and facilities across the business

Installation of new capacity

Relocation of select manufacturing processes

$80mm

Total cost synergies to be achieved by end of third year

$200mm

Accessing new segments and customers

Increased sales to new third-party customers

Access to new product segments

Potential upside to $300mm

13

|

|

|

Significant Cash Flow to Drive De-Leveraging

Total debt / Pro forma LTM EBITDA ($mm)1

2.0x

Current Olin

as of 12/31/14

3.0x

Pro forma at signing

2.5x

Pro forma at signing + $200mm of run-rate synergies

Commentary

Olin has long track-record of prudent capital structure management

Management remains committed to conservative financial policy

Opportunity to de-lever from ~3.0x total debt / pro

forma LTM EBITDA to ~2.5x by the end of year 2

Significant run-rate free cash flow conversion2 in

excess of 80% supporting de-levering and growth

Participate in co-producer ethylene economics

Reduced volatility and uncertainty of cash flow from

diversified portfolio and long-term partnership and

supply agreements with The Dow Chemical Company

Source: Olin management estimates

1 Pro forma LTM EBITDA of ~$1bn as of 12/31/2014

2 Free cash flow conversion defined as EBITDA

less capital expenditures / EBITDA

14

|

|

|

Summary of Dow Value Drivers

Dow exceeds its divestment target of $7B-$8.5B

Continued execution of ongoing strategic objectives to

deliver increasing returns through a narrower, more

targeted portfolio of market-aligned businesses

Enables Dow to maintain physical integration for all of

our key downstream businesses

Immediately enhances shareholder value through high

multiple in a tax efficient structure and ability to

share in synergies and growth of newly merged company

Dow can accelerate share buyback, reduce debt, and

shed a low-ROC business

Supplements Dow’s already strong cash position,

providing further financial flexibility for

shareholder-accretive cash deployment and dividends

New owner is best owner based on integrated chlorine envelope

Ongoing Portfolio Management Drives

Significant Shareholder Value Creation, Enhanced Financial Flexibility

15

|

|

|

Appendix

16

|

|

|

Pro Forma Global Operating Footprint

Freeport, TX

CA, VCM, EDC

Epi/Allyl, LER, CER BisA, Phenol/Acetone

CMP, Tric, VDC

Brine, Power

Plaquemine, LA CA, EDC

Perc

Brine, Power

Russellville, AR

Cell assembly and maintenance

Rheinmünster, Germany

CER

Terneuzen,

Netherlands

Cumene

Tacoma, WA

Niagara Falls, NY

Bécancour, QC

Stade, Germany

CMP, Perc, Tric

Epi/Allyl, LER,

CER, BisA

Henderson, NV

Pisticci, Italy

CER

Baltringen, Germany

CER

Gumi, South Korea

CER

Tracy, CA

Augusta, GA

Santa Fe Springs, CA

St Gabriel, LA

Roberta, GA

CER

Zhangjiagang, China

CER

McIntosh, AL

Charleston, TN

Guaruja, Sao Paulo, Brazil

LER, CER

Chlor-Alkali & Vinyl

Epoxy

Global Chlorinated Organics

Supporting assets

Source: Olin and Dow management

17

|

|

|

RMT Transaction Value Overview

Units = $ Billions

RMT Value

Consideration in Debt/Cash

$2.0

Assumptions of Pension and Debt

$0.8

Subtotal Cash/Debt/Pensions

$2.8

Consideration in stock*

$2.2

Pre-Tax Consideration for DCP

$5.0

2014 EBITDA Multiple

8x

Separate agreement on ethylene is additive and highly value creating

* Based on a share price as of March 25, 2015 market close

18

|

|

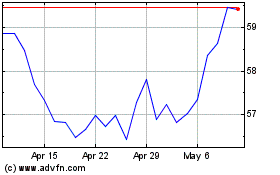

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2024 to May 2024

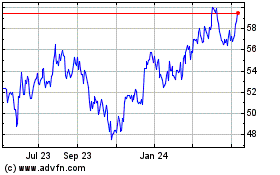

Dow (NYSE:DOW)

Historical Stock Chart

From May 2023 to May 2024