Air Products Swings to a Loss on Write-Down

April 28 2016 - 8:01AM

Dow Jones News

By Austen Hufford

Air Products & Chemicals Inc. swung to a write-down driven

loss for the quarter and posted a sales decline Thursday, but also

raised its adjusted profit outlook for the year.

Chief executive Seifi Ghasemi cited, "challenging economic

conditions and a weak manufacturing environment."

Air Products upped its yearly profit forecast, now expecting

$7.40 to $7.55 in adjusted earnings per share, up from the $7.25 to

$7.50 it expected previously. For the current quarter, Air Products

expects adjusted per-share earnings of between $1.87 and $1.92.

Analysts polled by Thomson Reuters had expected earnings per share

of $1.90.

Earlier this month, Air Products said it would be shutting down

its troubled energy-from-waste business after it couldn't

efficiently resolve operational and design challenges. Air Products

couldn't figure out how to efficiently solve problems with the

technologically advanced project. During the quarter, Air Products

took a $945.7 million charge related to the closure.

The company swung to a loss of $473.3 million, or $2.17 a share,

from a profit of $290 million, or $1.33 a year prior. Excluding the

write-down from the energy-from-waste business and other charges ,

per-share earnings from continuing operations increased to $1.82

from $1.56.

Revenue declined 5.9% to $2.27 billion, as the company faced

currency headwinds and lower energy pass-through. Volumes were

unchanged, the company said.

Analysts had expected adjusted earnings per share of $1.81 on

revenue of $2.37 billion.

The company's cost of sales fell at a steeper pace than revenue,

decreasing 11% to $1.52 billion, as its selling and administrative

expenses decreased 14%. Operating margin for the quarter increased

to 22.6% from 15.6% during the same period last year.

Industrial gas sales decreased by 10% in the Americas and by

6.4% in the Europe, Middle East and Africa region. In Asia, sales

climbed 3.4%. Sales in the company's materials segment fell 7.3% to

$494.3 million.

The company said it intends to spin-off its materials

technologies business, to be known as Versum Materials, and is

currently "assessing market conditions to determine favorability

for a spin-off."

Shares, up 25% in the last three months, were inactive in

premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 28, 2016 07:46 ET (11:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

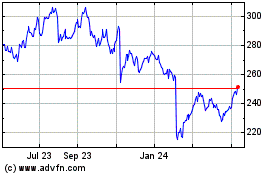

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Aug 2024 to Sep 2024

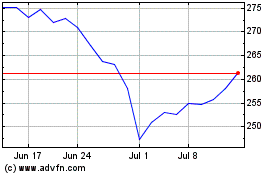

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Sep 2023 to Sep 2024