What's News: Business & Finance -- WSJ

October 19 2017 - 3:02AM

Dow Jones News

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 19, 2017).

The Dow powered past 23000, rising 160.16 points to 23157.60 as

IBM shares surged. But some investors and analysts are concerned

about the outflows from U.S. stock funds.

GE's chief is expected next month to unveil results of a global

review that includes thousands of job cuts and a global

retrenchment.

Chenault will step down as American Express chairman and CEO

next year. He will be succeeded by Vice Chairman Squeri.

Reckitt is splitting its business into two separate divisions as

the consumer-goods firm struggles with an industrywide

slowdown.

Anthem is launching its own pharmacy-benefits manager, dealing a

blow to partner Express Scripts.

Hedge funds that bet on declines in the dollar, pound and

government-bond yields have been stung by the prospect of rate

increases.

Sweden's EQT agreed to pay Pritzker about $250 million for

medical-device firm Clinical Innovations.

The FDA cleared Gilead's cell-therapy treatment for advanced

lymphoma.

Ascent Resources is preparing for an IPO or sale of the

oil-and-gas driller.

U.S. Bancorp's profit rose 4% to a record $1.56 billion, but

analysts raised concerns about loan growth.

Hearst is buying magazine publisher Rodale, giving it a major

presence in the health and wellness area.

(END) Dow Jones Newswires

October 19, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

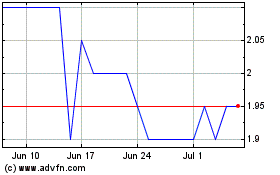

Ascent Resources (LSE:AST)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Sep 2023 to Sep 2024