TIDMPRV

RNS Number : 4377R

Porvair PLC

29 June 2015

For immediate release 29 June 2015

Porvair plc

Half yearly results for the six months ended 31 May 2015

Porvair plc ("Porvair" or "the Group"), the specialist

filtration and environmental technology group, today announces its

half yearly results for the six months ended 31 May 2015.

Highlights

-- Encouraging financial performance:

o As expected, revenue was lower at GBP46.3m (2014: GBP51.0m)

due to the impact of large projects in the prior period.

o Lower revenue from large projects offset by 8% underlying

growth(1) .

o Profit before tax up by 10% to GBP4.2m (2014: GBP3.8m).

o Earnings per share up 15% to 6.9 pence (2014: 6.0 pence).

o Net cash increased to GBP6.2m (31 May 2014: net debt of

GBP1.0m; 30 November 2014: net cash of GBP5.3m).

-- Microfiltration:

o Underlying revenues up 9%.

o Large contracts running smoothly including first contribution

from CNOOC contract.

o Strong growth in the US - revenue up 44%.

o New facilities in UK and USA opened on schedule and

budget.

o Order book healthy.

-- Metals Filtration:

o Revenues up 6% (2% lower in constant currency) compared with a

strong 2014.

o Superior performance of patented products continues to support

growth.

o Acquisition in June of Fiber Ceramics will improve product

capabilities and add capacity.

o New facility in China expected to be operational in the third

quarter.

-- Interim dividend increased over 8% to 1.3 pence (2014: 1.2 pence).

Commenting on the outlook, Ben Stocks, Chief Executive,

said:

"Overall market demand is encouraging and order books continue

to be healthy. We are winning market share with new products,

notably in Metals Filtration and Seal Analytical. The Group has a

strong balance sheet, a promising project pipeline and has made a

good start to 2015."

Note 1. Underlying growth: Revenue growth excluding the impact of large projects.

For further information please contact:

Porvair plc 0207 466 5000 today

Ben Stocks, Chief Executive 01553 765 500 thereafter

Chris Tyler, Group Finance Director

Buchanan Communications 0207 466 5000

Charles Ryland / Stephanie Watson

A copy of the presentation that accompanies these results is

available at www.porvair.com

Operating Review

Overview

Profit before tax for the six months ended 31 May 2015 was up

10% to GBP4.2m (2014: GBP3.8m). Earnings per share grew 15% to 6.9p

(2014: 6.0p). Cash generation was strong again with the Group

holding a net cash balance of GBP6.2m (31 May 2014: net debt of

GBP1.0m) at the end of the period, GBP7.2m higher than the previous

year.

As anticipated in previous statements, revenue at GBP46.3m

(2014: GBP51.0m) was GBP4.7m lower than the prior year due to

revenue from large projects being GBP8.1m lower than in the first

half of 2014. Underlying growth was 8% reflecting encouraging

progress against financial and strategic targets.

The second half of 2015 has started well and order books are

healthy, notably in Seal Analytical which is having a good

year.

Progress towards key operating objectives in the period

include:

-- Large projects running to plan;

-- Expanded facilities attracting new customers;

-- New products introduced in both Seal Analytical and Selee Corp; and

-- A promising pipeline of future work.

Strategic statement

Porvair's strategy has remained consistent for a number of

years. It is to generate shareholder value through the development

of specialist filtration and environmental technology businesses,

both organically and by acquisition. Such businesses have certain

key characteristics in common:

-- specialist design or engineering skills are required;

-- product use and replacement is mandated by regulation,

quality accreditation or a maintenance cycle; and

-- products are often designed into a specification and will typically have long life cycles.

Over the last five years to 31 May 2015 this strategy delivered

11% compound annual revenue growth and cash generated from

operations of GBP53 million. Over the same period, the Group has

invested GBP19 million in capital expenditure and acquisitions and

turned a net debt of GBP14 million into a net cash position of over

GBP6 million.

Business model outline

Our customers require filtration or emission control products

that perform to a given specification; for a minimum amount of

time; often with prescribed physical attributes such as size or

weight. We win business by offering the best technical solutions

for these requirements at an acceptable commercial cost. Filtration

expertise is applicable across all markets with new products

generally being adaptations of existing designs. Experience in

particular markets or applications is valuable in building customer

confidence. Domain knowledge is important, as is deciding where to

focus resources.

This leads us to:

1. Focus on end-markets where we see long term growth potential.

2. Look for applications where product use is mandated and

replacement demand is therefore regular.

3. Make new product development a core business activity.

4. Establish geographic presence where end-markets require.

5. Maintain a conservative balance sheet while re-investing in both organic and acquired growth.

Therefore:

-- We focus on four end-markets: aviation; energy and

industrial; environmental laboratories; and molten metals. All have

clear structural growth drivers.

-- Our products are specialist in nature and typically protect

costly or complex downstream systems. As a result they are replaced

regularly. A high proportion of our annual revenue is from repeat

orders.

-- We encourage new product development in order to generate

growth rates in excess of the underlying market. Where possible we

build robust intellectual property around our product developments.

About 30% of our revenues are derived from patent protected

products.

-- Our geographic presence follows the markets we serve.

Aviation and metals filtration revenues are strong in the Americas.

In Asia, water analysis markets are growing and the demand for

gasification plants is strongest.

-- We aim to maintain a conservative balance sheet, meeting

dividend and investment needs from free cash flow. Porvair is a

cash generative business. In the last three years we have expanded

manufacturing capacity in the UK, Germany, US and China and made

five small acquisitions.

Operating structure

-- The Group has two divisions. The Microfiltration division

serves the aviation, environmental laboratory, and

energy/industrial markets. The Metals Filtration division focuses

on filtration of molten metals, principally aluminium.

-- The Group manufactures in the UK, US, Germany and China.

Plans for investment and future development

As noted in January 2015, the Group is actively investing in

capacity expansion and new product development:

-- The new UK site at New Milton was formally opened in March.

Old facilities have now been sold or handed back. In addition to

generally upgraded facilities, the new plant offers growth capacity

for industrial filters.

-- The new building at Caribou, US is open. Further investment

on this site is planned for the second half of 2015, notably in

clean manufacturing capabilities.

-- The Group is considering plans to expand its US industrial filtration facility in Virginia.

-- Seal Analytical consolidated its US operations by expanding its facility in Wisconsin.

-- The Metals filtration division expansion in China is proceeding on time and to budget.

-- Gasification projects remain on plan. During the period,

commissioning work started in the first of these in Gwangyang,

South Korea. The next stage, running the plant up to operating

conditions, is expected to start in the second half of 2015. Almost

all systems have been shipped to Reliance for assembly on site and

the first revenue has been recognised on the CNOOC project.

-- New product development projects remain central to Porvair's

day to day activities. A new formulation for the filtration of

aluminium is testing well and patent protection is pending. Two

further customers qualified the new aluminium lithium filter.

Bioscience filtration projects continue to show promise.

Metals Filtration

2015 2014 Growth

GBPm GBPm %

Revenue 15.7 14.8 6

----- ----- -------

Operating profit 1.2 1.2 3

----- ----- -------

Revenue was up 6% to GBP15.7m (2014: GBP14.8m). The division is

having a good year despite the strong dollar making export sales

more challenging. Moreover, the prior year included a large

equipment sale to a Chinese customer that, as noted at the time,

will not repeat in 2015.

Despite these issues, Metals Filtration continues to build

market share with its suite of patented products, and as a result

revenue in constant currency is only 2% lower than in a record

2014. In two side-by-side competitive product performance tests in

an aluminium customer's facilities this year, our product

performance was compelling and supports the value-added sales

approach that we prefer. Our rivals compete on price not

performance and while this is occasionally painful, we feel it

positions the business well for the longer term.

In the niche areas of metals filtration we continue to do well

with unusual formulations and technical expertise. Our carbon foam

products are selling steadily, as are our structured products,

which are slowly developing into a higher margin line of work.

The acquisition of the trade and assets of Fiber Ceramics in

June is expected to add annual revenue of around $1m to the

division. More importantly, its range of products improves both the

technical capability of the business in steel filtration and the

production capacity for high temperature products.

Building of our second factory in China finished early in the

year and manufacturing equipment is starting to be assembled. We

expect to start production during the third quarter and have a new

formulation with which to launch in Asia.

Microfiltration

2015 2014 Growth

GBPm GBPm %

Revenue 30.6 36.3 (16)

----- ----- -------

Operating profit 4.3 4.0 8

----- ----- -------

Revenue was GBP30.6m, (2014: GBP36.3m) with large projects

contributing GBP8.1m less than the prior year. Underlying growth

was therefore 9%, close to our five year average. A first set of

patented longer life gasification spares has been shipped; coolant

filtration units for the Boeing 787-9 and 787-10 are in

manufacture; and new filters for both aero inerting and bioscience

are in development. In the US, revenue growth has continued

strongly in most markets, with our plant in Caribou performing

well.

Large projects continue to be a focus. The installation in Korea

is now assembled with only minor modifications required. Final

acceptance testing will start, as planned, later in the year. Most

shipments to the installation in India have been made, and the new

project in China is in the planning and early manufacturing stage.

Discussions on local operational support for these installations

are progressing. Further shipments for the GBP11 million UK

Government nuclear remediation contract are planned for the second

half of the year. The pipeline of future projects is promising.

Seal Analytical sales remained level against the prior year.

Throughout the period Seal Analytical's order book was at record

levels but a three month parts delay from a key supplier held

revenue back. The situation is now resolved and the business had a

strong May and June, with July also looking promising.

Tax

The Group tax charge was GBP1.1 million (2014: GBP1.1 million).

This is an effective rate of 26% (2014: 30%), in line with the rate

recorded for the full year ended 30 November 2014 and higher than

the UK standard corporate tax rate because tax rates are higher on

profits made in Germany and the US.

Earnings per share and dividends

The basic earnings per share for the period increased 15% to 6.9

pence (2014: 6.0 pence). The Board is declaring an increased

interim dividend of 1.3 pence (2014: 1.2 pence) per share, an

increase of over 8%.

Cash flow and net debt

Cash generated from operations in the six months to 31 May 2015

was GBP3.1m (2014: GBP2.7m). Working capital increased in the

period by GBP2.8m (2014: GBP3.0m) principally as a result of strong

revenue in May and a high inventory of gasification spares for

delivery in June.

Interest paid was GBP0.1m (2014: GBP0.2m). Tax payments reduced

to GBP0.6m (2014: GBP1.2m) following a repayment in relation to

2013.

Capital expenditure was GBP1.4m (2014: GBP2.9m), mainly spent on

completing the expansion of facilities in US, UK and China. GBP0.5m

(2014: GBPnil) was received on the disposal of a UK facility and

GBP0.5m (2014: GBPnil) was paid in relation to acquisitions

completed in 2013.

Closing net cash at 31 May 2015 was GBP6.2m (30 November 2014:

net cash of GBP5.3m; 31 May 2014 net debt of GBP1.0m).

Return on capital employed

The Group's return on capital employed was 15% (2014:13%).

Excluding the impact of goodwill and the pension liability the

return on operating capital employed was 47% (2014: 40%).

Current trading and outlook

Overall market demand is encouraging and order books continue to

be healthy. We are winning market share with new products, notably

in Metals Filtration and Seal Analytical. The Group has a strong

balance sheet, a promising project pipeline and has made a good

start to 2015.

Ben Stocks

Group Chief Executive

Related parties

There were no related party transactions in the six months ended

31 May 2015 (2014: none).

Principal risks

Each division considers strategic, operational and financial

risks and identifies actions to mitigate those risks. These risk

profiles are reviewed by the Board and updated at least annually.

The principal risks and uncertainties for the remaining six months

of the financial year are discussed below. Further details of the

Group's risk profile analysis can be found in the Strategic Report

section of the Annual Report for the year ended 30 November

2014.

Certain elements of the Group's order position, although healthy

at 31 May 2015, can change quickly in the face of changing economic

circumstances. The Metals Filtration division and environmental

laboratory supplies and general industrial filtration within the

Microfiltration division all have relatively short lead times and

order cycles and, therefore, revenues are subject to fluctuations,

which could have a material effect on the Group's results for the

balance of 2015.

The Microfiltration division serves several customers whose

orders are large relative to Porvair's overall order book. Should

any of these be cancelled or delayed it may affect the Group's

results for the balance of 2015.

Forward looking statements

Certain statements in this half yearly financial information are

forward-looking. Although the Group believes that the expectations

reflected in these forward-looking statements are reasonable, it

can give no assurance that these expectations will prove to have

been correct. Because these statements involve risks and

uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

We undertake no obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Consolidated income statement

For the six months ended 31 May

Six months ended 31

May

----------------------

2015 2014

Note Unaudited Unaudited

GBP'000 GBP'000

Revenue 1 46,261 51,024

Cost of sales (30,560) (36,130)

---------- ----------

Gross profit 15,701 14,894

Other operating expenses (11,218) (10,699)

---------- ----------

Operating profit 1 4,483 4,195

Interest payable and similar charges (319) (413)

Profit before income tax 4,164 3,782

Income tax expense (1,062) (1,149)

Profit for the period attributable to

shareholders 3,102 2,633

---------- ----------

Earnings per share (basic) 2 6.9p 6.0p

Earnings per share (diluted) 2 6.9p 5.9p

Consolidated statement of comprehensive income

For the six months ended 31 May

Six months ended 31

May

------------------------

2015 2014

Unaudited Unaudited

GBP'000 GBP'000

Profit for the period 3,102 2,633

----------- -----------

Other comprehensive income:

Items that may be subsequently reclassified to

profit or loss

Exchange differences on translation of foreign

subsidiaries 409 (794)

Changes in fair value of interest rate swaps

held as a cash flow hedge - 20

Changes in the fair value of foreign exchange

contracts held as a cash flow hedge (160) 11

----------- -----------

249 (763)

Net other comprehensive income 249 (763)

----------- -----------

Total comprehensive income for the period attributable

to shareholders of Porvair plc 3,351 1,870

----------- -----------

The accompanying notes are an integral part of this interim

financial information.

Consolidated balance sheet

As at 31 May

As at 30

As at 31 May November

------------------------ ----------

Note 2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 4 12,539 10,865 12,336

Goodwill and other intangible

assets 4 43,331 41,766 43,209

Deferred tax asset 2,900 3,710 3,240

58,770 56,341 58,785

Current assets

Inventories 13,060 12,733 11,363

Trade and other receivables 18,373 18,570 17,067

Derivative financial instruments - 985 66

Cash and cash equivalents 5 8,218 6,428 7,891

----------- ----------- ----------

39,651 38,716 36,387

Current liabilities

Trade and other payables (25,919) (24,230) (24,910)

Current tax liabilities (1,432) (1,103) (919)

Bank overdraft and loans (244) (984) (727)

Derivative financial instruments (151) - (118)

(27,746) (26,317) (26,674)

Net current assets 11,905 12,399 9,713

Non-current liabilities

Bank loans (1,794) (6,440) (1,900)

Deferred tax liability (1,173) (1,242) (1,494)

Retirement benefit obligations (12,732) (11,787) (12,833)

Other payables - (298) -

Provisions for other liabilities

and charges (144) (132) (138)

(15,843) (19,899) (16,365)

----------- ----------- ----------

Net assets 54,832 48,841 52,133

----------- ----------- ----------

Capital and reserves

Share capital 6 896 883 887

Share premium account 6 35,344 35,155 35,334

Cumulative translation reserve 7 1,225 (1,103) 816

Retained earnings 7 17,367 13,906 15,096

----------- ----------- ----------

Total equity 54,832 48,841 52,133

----------- ----------- ----------

The interim financial information on pages 7 to 18 was approved

by the Board of Directors on 26 June 2015 and was signed on its

behalf by:

Ben Stocks Chris Tyler

Group Chief Executive Group Finance Director

The accompanying notes are an integral part of this interim

financial information.

Consolidated cash flow statement

For the six months ended 31 May

Six months ended 31

May

--------------------------------

Note 2015 Unaudited 2014 Unaudited

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 8 3,055 2,658

Interest paid (91) (207)

Tax paid (591) (1,195)

--------------- ---------------

Net cash generated from operating activities 2,373 1,256

--------------- ---------------

Cash flows from investing activities

Acquisition of subsidiaries (net of (490) -

cash acquired)

Purchase of property, plant and equipment 4 (1,385) (2,866)

Purchase of intangible assets 4 (6) (12)

Proceeds from sale of property, plant

and equipment 475 9

Net cash used in investing activities (1,406) (2,869)

--------------- ---------------

Cash flows from financing activities

Net proceeds from the issue of ordinary

shares 6 19 16

(Repayment of)/increase in borrowings 9 (637) 1,333

Net cash (used in)/generated from financing

activities (618) 1,349

--------------- ---------------

Net increase/(decrease) in cash and

cash equivalents 9 349 (264)

Effects of exchange rate changes (22) (81)

--------------- ---------------

327 (345)

Cash and cash equivalents at the beginning

of the period 7,891 6,773

--------------- ---------------

Cash and cash equivalents at the end

of the period 5 8,218 6,428

--------------- ---------------

The accompanying notes are an integral part of this interim

financial information.

Consolidated statement of changes in equity

For the six months ended 31 May (Unaudited)

Share Cumulative

Share premium translation Retained

capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 December 2013 875 35,147 (309) 11,967 47,680

---------- --------- ------------- ----------- ----------

Profit for the period - - - 2,633 2,633

Other comprehensive income

for the period:

Exchange differences on

translation of foreign subsidiaries - - (794) - (794)

Changes in fair value of

interest rate swaps held

as a cash flow hedge - - - 20 20

Changes in the fair value

of foreign exchange contracts

held as a cash flow hedge - - - 11 11

---------- --------- ------------- ----------- ----------

Total comprehensive income

for the period - - (794) 2,664 1,870

---------- --------- ------------- ----------- ----------

Transactions with owners:

Proceeds from shares issued,

net of costs 8 8 - - 16

Employee share option schemes:

Value of employee services

net of tax - - - 70 70

Dividends approved as final

or paid - - - (795) (795)

---------- --------- ------------- ----------- ----------

Balance at 31 May 2014 883 35,155 (1,103) 13,906 48,841

---------- --------- ------------- ----------- ----------

Balance at 1 December 2014 887 35,334 816 15,096 52,133

---------- --------- ------------- ----------- ----------

Profit for the period - - - 3,102 3,102

Other comprehensive income

for the period:

Exchange differences on

translation of foreign subsidiaries - - 409 - 409

Changes in the fair value

of foreign exchange contracts

held as a cash flow hedge - - - (160) (160)

---------- --------- ------------- ----------- ----------

Total comprehensive income

for the period - - 409 2,942 3,351

---------- --------- ------------- ----------- ----------

Transactions with owners:

Proceeds from shares issued,

net of costs 9 10 - - 19

Employee share option schemes:

Value of employee services

net of tax - - - 225 225

Dividends approved as final

or paid - - - (896) (896)

---------- --------- ------------- ----------- ----------

Balance at 31 May 2015 896 35,344 1,225 17,367 54,832

---------- --------- ------------- ----------- ----------

The accompanying notes are an integral part of this interim

financial information.

Notes to the financial information

1. Segmental analyses

The chief operating decision maker has been identified as the

Board of Directors. The Board of Directors review the Group's

internal reporting in order to assess performance and allocate

resources. Management have determined the operating segments based

on this reporting.

As at 31 May 2015, the Group is organised on a worldwide basis

into two operating segments:

1) Metals Filtration

2) Microfiltration

The segment results for the period ended 31 May 2015 are as

follows:

Six months ended 31 May Metals Microfiltration Other unallocated Group

2015 - Unaudited Filtration

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 15,690 30,571 - 46,261

------------ ---------------- ------------------ --------

Operating profit/(loss) 1,206 4,294 (1,017) 4,483

Interest payable and

similar charges - - (319) (319)

------------ ---------------- ------------------ --------

Profit/(loss) before

income tax 1,206 4,294 (1,336) 4,164

Income tax expense - - (1,062) (1,062)

------------ ---------------- ------------------ --------

Profit/(loss) for the

period 1,206 4,294 (2,398) 3,102

------------ ---------------- ------------------ --------

The segment results for the period ended 31 May 2014 are as

follows:

Six months ended 31 May Metals Microfiltration Other unallocated Group

2014 -Unaudited Filtration

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 14,755 36,269 - 51,024

------------ ---------------- ------------------ --------

Operating profit/(loss) 1,166 3,963 (934) 4,195

Interest payable and

similar charges - - (413) (413)

------------ ---------------- ------------------ --------

Profit/(loss) before

income tax 1,166 3,963 (1,347) 3,782

Income tax expense - - (1,149) (1,149)

------------ ---------------- ------------------ --------

Profit/(loss) for the

period 1,166 3,963 (2,496) 2,633

------------ ---------------- ------------------ --------

Other Group operations are included in "Other unallocated".

These mainly comprise Group corporate costs, including new business

development costs, some research and development costs, general

financial costs, and income tax expense.

Segment assets and liabilities

At 31 May 2015 - Unaudited Metals Filtration Microfiltration Other unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 28,269 57,791 4,143 90,203

Cash and cash equivalents - - 8,218 8,218

------------------ ---------------- ------------------ ---------

Total assets 28,269 57,791 12,361 98,421

------------------ ---------------- ------------------ ---------

Segmental liabilities (3,929) (20,748) (4,142) (28,819)

Retirement benefit

obligations - - (12,732) (12,732)

Borrowings - - (2,038) (2,038)

------------------ ---------------- ------------------ ---------

Total liabilities (3,929) (20,748) (18,912) (43,589)

------------------ ---------------- ------------------ ---------

At 31 May 2014 - Unaudited Metals Filtration Microfiltration Other unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 24,920 57,987 5,722 88,629

Cash and cash equivalents - - 6,428 6,428

------------------ ---------------- ------------------ ---------

Total assets 24,920 57,987 12,150 95,057

------------------ ---------------- ------------------ ---------

Segmental liabilities (3,832) (18,561) (4,612) (27,005)

Retirement benefit

obligations - - (11,787) (11,787)

Borrowings - - (7,424) (7,424)

------------------ ---------------- ------------------ ---------

Total liabilities (3,832) (18,561) (23,823) (46,216)

------------------ ---------------- ------------------ ---------

At 30 November 2014 Metals Filtration Microfiltration Other unallocated Group

- Audited

GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 27,119 55,481 4,681 87,281

Cash and cash equivalents - - 7,891 7,891

------------------ ---------------- ------------------ ---------

Total assets 27,119 55,481 12,572 95,172

------------------ ---------------- ------------------ ---------

Segmental liabilities (3,249) (20,379) (3,951) (27,579)

Retirement benefit

obligations - - (12,833) (12,833)

Borrowings - - (2,627) (2,627)

------------------ ---------------- ------------------ ---------

Total liabilities (3,249) (20,379) (19,411) (43,039)

------------------ ---------------- ------------------ ---------

Geographical analysis

Revenue

Six months ended 31 May

--------------------------------------------------------

2015 2014

Unaudited Unaudited

By destination By origin By destination By origin

GBP'000 GBP'000 GBP'000 GBP'000

United Kingdom 6,407 17,985 8,515 25,639

Continental Europe 6,367 3,819 6,339 4,014

United States of America 18,602 23,782 15,845 20,631

Other NAFTA 3,514 - 3,232 -

South America 817 - 834 -

Asia 10,006 675 15,579 740

Africa 548 - 680 -

--------------- ---------- --------------- ----------

46,261 46,261 51,024 51,024

--------------- ---------- --------------- ----------

2. Earnings per share

Six months ended 31 May

--------------------------------------------------------------

2015 2014

Unaudited Unaudited

Earnings Weighted Per share Earnings Weighted Per share

average amount average amount

number number

GBP'000 of shares Pence GBP'000 of shares Pence

--------- ------------- ---------- --------- ------------- ----------

Basic EPS - Earnings

attributable to

ordinary shareholders 3,102 44,659,379 6.9 2,633 44,017,345 6.0

Effect of dilutive

securities - share

options - 146,675 - - 283,053 (0.1)

--------- ------------- ---------- --------- ------------- ----------

Diluted EPS 3,102 44,806,054 6.9 2,633 44,300,398 5.9

--------- ------------- ---------- --------- ------------- ----------

3. Dividends per share

Six months ended 31 May

------------------------------------------

2015 2014

Unaudited Unaudited

Per share GBP'000 Per share GBP'000

Final dividend approved 2.00p 896 1.80p 795

---------- -------- ---------- --------

The final dividend approved was paid to shareholders on 6 June

2015.

The Directors have declared an interim dividend of 1.3 pence

(2014: 1.2 pence) per share to be paid on 4 September 2015 to

shareholders on the register at the close of business on 31 July

2015. The ex-dividend date for the shares is 30 July 2015.

4. Property, plant and equipment and goodwill and other intangible assets

Six months ended 31 May 2015 Property, Goodwill Total

- Unaudited plant and other

and equipment intangible

assets

--------------- ------------ --------

GBP'000 GBP'000 GBP'000

Opening net book amount at 1

December 2014 12,336 43,209 55,545

Additions 1,385 6 1,391

Disposals (397) - (397)

Depreciation and amortisation (912) (182) (1,094)

Exchange movements 127 298 425

Closing net book amount at 31

May 2015 12,539 43,331 55,870

--------------- ------------ --------

Six months ended 31 May 2014 Property, Goodwill Total

- Unaudited plant and other

and equipment intangible

assets

--------------- ------------ --------

GBP'000 GBP'000 GBP'000

Opening net book amount at 1

December 2013 9,006 42,535 51,541

Additions 2,866 12 2,878

Disposals (18) - (18)

Depreciation and amortisation (849) (177) (1,026)

Exchange movements (140) (604) (744)

Closing net book amount at 31

May 2014 10,865 41,766 52,631

--------------- ------------ --------

5. Cash and cash equivalents

As at

As at 31 May 30 November

------------------------ -------------

2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 8,218 6,428 7,891

Cash and cash equivalents 8,218 6,428 7,891

----------- ----------- -------------

6. Share capital and premium

Number Ordinary Share premium

of shares shares account Total

(thousands) Unaudited Unaudited Unaudited

------------- ----------- -------------- ------------

GBP'000 GBP'000 GBP'000

At 1 December 2013 43,734 875 35,147 36,022

Employee share options

schemes:

Exercise of options under

share option schemes 433 8 8 16

------------- ----------- -------------- ------------

At 31 May 2014 44,167 883 35,155 36,038

------------- ----------- -------------- ------------

At 1 December 2014 44,363 887 35,334 36,221

Employee share options

schemes:

Exercise of options under

share option schemes 450 9 10 19

------------- ----------- -------------- ------------

At 31 May 2015 44,813 896 35,344 36,240

------------- ----------- -------------- ------------

The authorised number of ordinary shares is 75 million (2014: 75

million) shares with a par value of 2.0 pence (2014: 2.0 pence) per

share. All issued shares are fully paid. 450,221 (2014: 433,345)

ordinary shares of 2p each were issued in the period on the

exercise of employee share options for a cash consideration of

GBP19,000 (2014: GBP16,000).

7. Other reserves

Cumulative

translation Retained

reserve earnings

Unaudited Unaudited

------------- ------------

GBP'000 GBP'000

At 1 December 2013 (309) 11,967

Profit for the period attributable

to shareholders - 2,633

Direct to equity:

Final dividends approved - (795)

Share based payments - 238

Tax on share based payments - (168)

Interest rate swap cash flow hedge - 20

Foreign exchange contract cash

flow hedge - 11

Exchange differences (794) -

At 31 May 2014 (1,103) 13,906

------------- ------------

At 1 December 2014 816 15,096

Profit for the period attributable

to shareholders - 3,102

Direct to equity:

Final dividends approved - (896)

Share based payments - 238

Tax on share based payments - (13)

Foreign exchange contract cash

flow hedge - (160)

Exchange differences 409 -

At 31 May 2015 1,225 17,367

------------- ------------

8. Cash generated from operations

Six months ended 31

May

------------------------

2015 2014

Unaudited Unaudited

GBP000 GBP000

Operating profit 4,483 4,195

Non-cash pension charge 166 120

Share based payments 238 238

Depreciation and amortisation 1,094 1,026

(Profit)/loss on disposal of property,

plant and equipment (78) 9

----------- -----------

Operating cash flows before movement

in working capital 5,903 5,588

----------- -----------

Increase in inventories (1,694) (1,273)

Increase in trade and other receivables (1,338) (4,558)

Increase in payables 184 2,901

Increase in working capital (2,848) (2,930)

----------- -----------

Cash generated from operations 3,055 2,658

----------- -----------

9. Reconciliation of net cash flow to movement in net debt

Six months ended 31

May

------------------------

2015 2014

Unaudited Unaudited

GBP'000 GBP'000

Net increase/(decrease) in cash and cash equivalents 349 (264)

Effects of exchange rate changes (70) 22

Repayment of / (increase in) borrowings 637 (1,333)

Net cash at the beginning of the period 5,264 579

----------- -----------

Net cash/(debt) at the end of the period 6,180 (996)

----------- -----------

10. Financial risk management and financial instruments

The Group's finance department includes a team that performs the

valuations of financial assets and liabilities required for

financial reporting purposes, including Level 3 fair values. This

team reports directly to the Group Finance Director and the Audit

Committee. Discussions of valuation processes and results are held

between the Group Finance Director, the Audit Committee and the

valuation team at least twice a year, in line with the Group's

external reporting dates.

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

below:

-- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1).

-- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that

is, as prices) or indirectly (that is, derived from prices) (Level

2).

-- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level

3).

Level Level Level Total

1 2 3

--------- -------- -------- --------

GBP'000 GBP'000 GBP'000 GBP'000

Financial assets and (liabilities)

at fair value through profit

or loss:

* Trading derivatives - (57) - (57)

Deferred and contingent consideration - - (328) (328)

Foreign exchange contracts

used for hedging - (94) - (94)

---------- -------- -------- --------

At 31 May 2015 - (151) (328) (479)

---------- -------- -------- --------

Financial assets and (liabilities)

at fair value through profit

or loss:

* Trading derivatives - (118) - (118)

Deferred and contingent consideration - - (924) (924)

Foreign exchange contracts

used for hedging - 66 - 66

---------- -------- -------- --------

At 30 November 2014 - (52) (924) (976)

---------- -------- -------- --------

There were no transfers between levels during the period, and

there were no changes in valuation techniques in the period.

11. Post balance sheet event - Acquisition

Agreement has been reached to acquire the goodwill, business and

trading assets of Fiber Ceramics, Inc on 29 June 2015. This small

acquisition provides filtration products for steel foundry

applications.

12. Exchange rates

Exchange rates for the US dollar during the period were:

Average rate Average rate Closing rate Closing rate

to 31 May to 31 May at 31 May at 30 Nov

15 14 15 14

Unaudited Unaudited Unaudited Unaudited

US dollar 1.53 1.66 1.53 1.57

13. Seasonality

The results for the six months ended 31 May 2015 are impacted by

a lower number of working days in the first six months of the year

than in the second half of the year.

14. Basis of preparation

Porvair plc is a public limited company registered in the UK and

listed on the London Stock Exchange.

This unaudited condensed half-yearly consolidated financial

information for the six months ended 31 May 2015 has been prepared

in accordance with the Disclosure and Transparency Rules ('DTR') of

the Financial Conduct Authority and with IAS 34, 'Interim financial

reporting' as adopted by the European Union. The condensed

half-yearly consolidated financial information should be read in

conjunction with the annual financial statements for the year ended

30 November 2014, which were approved by the Board of Directors on

23 January 2015 and which have been prepared in accordance with

IFRSs as adopted by the European Union.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 November 2014, as

described in those financial statements.

Taxes on income in the interim period are accrued using the tax

rate that would be applicable to expected total annual

earnings.

This condensed half-yearly consolidated financial information

has been prepared on a going concern basis under the historical

cost convention, as modified by the revaluation of certain current

assets, financial assets and financial liabilities held for trading

and derivative contracts, which are held at fair value.

The preparation of condensed half-yearly consolidated financial

information in conformity with generally accepted accounting

principles requires the use of estimates and assumptions that

affect the reported amounts of assets and liabilities at the date

of the condensed half-yearly consolidated financial information and

the reported amounts of revenues and expenses during the reporting

period. Although these estimates are based on management's best

knowledge of the amount, event or actions, actual results may

ultimately differ from those estimates.

After having made appropriate enquiries, including a review of

progress against the Group's budget for 2015, its medium term plans

and taking into account the banking facilities available until

January 2018, the Directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing this condensed half-yearly

consolidated financial information.

This condensed half-yearly consolidated financial information

and the comparative figures does not constitute full accounts

within the meaning of Section 434 of the Companies Act 2006.

Statutory accounts for the year ended 30 November 2014, which

include an unqualified audit report, no emphasis of matter

paragraph and no statements under sections 498(2) or (3) of the

Companies Act 2006, have been delivered to the Registrar of

Companies.

The condensed half-yearly consolidated financial information

does not include all financial risk management information and

disclosures required in the annual financial statements; it should

be read in conjunction with the Group's annual financial statements

for the year ended 30 November 2014. There have been no changes in

any risk management policies since the year end.

This report will be available at Porvair plc's registered office

at 7 Regis Place, Bergen Way, King's Lynn, PE30 2JN and on the

Company's website www.porvair.com.

Statement of directors' responsibilities

The Directors confirm that this condensed half-yearly

consolidated financial information has been prepared in accordance

with IAS 34 as adopted by the European Union and that the interim

management report herein includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months of the year, their impact on the condensed

half-yearly consolidated financial information and a description of

the principal risks and uncertainties for the remaining six months

of the financial year; and

-- material related party transactions in the first six months

of the year and any material changes in the related party

transactions described in the last annual report.

The Directors of Porvair plc are listed in the Porvair plc

Annual Report for the year ended 30 November 2014. A list of

current Directors is maintained on the Porvair plc website

www.porvair.com.

By order of the board

Ben Stocks

Group Chief Executive

Chris Tyler

Group Finance Director

26 June 2015

Independent review report to Porvair plc

Report on the condensed half-yearly consolidated financial

information

Our conclusion

We have reviewed the condensed half-yearly consolidated

financial information defined below, in the half-yearly results of

Porvair plc for the six months ended 31 May 2015. Based on our

review, nothing has come to our attention that causes us to believe

that the condensed half-yearly consolidated financial information

is not prepared, in all material respects, in accordance with

International Accounting Standard 34 as adopted by the European

Union and the Disclosure and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

This conclusion is to be read in the context of what we say in

the remainder of this report.

What we have reviewed

The condensed half-yearly consolidated financial information

which is prepared by Porvair plc comprises:

-- the consolidated balance sheet as at 31 May 2015;

-- the consolidated income statement and consolidated statement

of comprehensive income for the period then ended;

-- the consolidated statement of cash flows for the period then ended;

-- the consolidated statement of changes in equity for the period then ended; and

-- the explanatory notes to the condensed half-yearly consolidated financial information.

As disclosed in note 14, the financial reporting framework that

has been applied in the preparation of the full annual financial

statements of the group is applicable law and International

Financial Reporting Standards (IFRSs) as adopted by the European

Union.

The condensed half-yearly consolidated financial information

included in the half-yearly results have been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as adopted by the European Union and the

Disclosure and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

What a review of condensed half-yearly consolidated financial

information involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and, consequently, does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the half-yearly

results and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed half-yearly consolidated financial information.

Responsibilities for the condensed half-yearly consolidated

financial information and the review

Our responsibilities and those of the directors

The half-yearly results, including the condensed half-yearly

consolidated financial information, is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly results in accordance with the

Disclosure and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

Our responsibility is to express to the company a conclusion on

the condensed half-yearly consolidated financial information in the

half-yearly results based on our review. This report, including the

conclusion, has been prepared for and only for the company for the

purpose of complying with the Disclosure and Transparency Rules of

the Financial Conduct Authority and for no other purpose. We do

not, in giving this conclusion, accept or assume responsibility for

any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

26 June 2015

Cambridge

Notes

(a) The maintenance and integrity of the Porvair plc website is

the responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the condensed half-yearly consolidated

financial information since it was initially presented on the

website.

(b) Legislation in the United Kingdom governing the preparation

and dissemination of condensed half-yearly consolidated financial

information may differ from legislation in other jurisdictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDLGGDBGUI

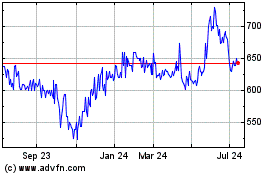

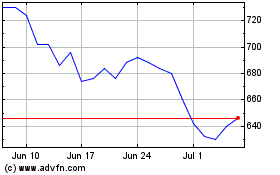

Porvair (LSE:PRV)

Historical Stock Chart

From Aug 2024 to Sep 2024

Porvair (LSE:PRV)

Historical Stock Chart

From Sep 2023 to Sep 2024