Some of the world's biggest telecommunications firms are this

week poised to win a round in their global slugfest with Silicon

Valley—at least in Europe.

The European Union's executive arm is expected this week to

propose subjecting online services like Microsoft Corp.'s Skype and

Facebook Inc.'s WhatsApp to some of the same rules that have long

regulated the telecoms business, according to tech and telecom

lobbyists briefed recently by EU officials.

Skype, for example, may have to offer emergency-calling services

for European customers who use its online-voice service to dial

traditional phone numbers. In cases where it assigns users

telephone numbers—allowing for the receipt of calls from

traditional phones—it could also be required to let those users

take their numbers with them if they decide to move to a different

provider.

Chat-service WhatsApp, meanwhile, could be subject to new

oversight from national telecom regulators on topics like network

security.

The draft proposals are still in flux. But what is clear is that

the EU is proposing to move in a direction telecom executives have

been pushing for years. The executives say they want a "level

playing field" with tech companies amid all the new, mostly free,

online communications services that they perceive to have

undermined telecoms' traditional voice and text services.

They have long wanted the EU to repeal some of the

industry-specific regulations they face, particularly on user

privacy. Failing that, they have pushed to extend some of the same

telecom rules to internet-based services.

"It would be better to remove rules for us," said one telecom

executive who has been briefed on the proposals. "But this is real

progress."

A European Commission spokeswoman said the proposed rules, which

also seek to spur improvement in the continent's

high-speed-internet networks and cellular-airwave-allocation

process, are part of the EU's strategy to "encourage investments in

next-generation networks, set the right conditions for modern

digital networks and provide a level playing field for all market

players."

The proposals still face potentially years of debate and changes

before adoption. But they represent a rare boost to

telecommunications companies in their skirmishes with Silicon

Valley's powerful lobbying machinery.

While telecom executives increasingly acknowledge that services

like Snapchat and WhatsApp help them sell more-expensive data

plans, in many parts of the world they have also been on the

defensive about how those so-called "over-the-top" services have

eaten into their traditional offerings.

The two sides have also clashed over regulatory issues including

net neutrality in the U.S., connecting the developing world, and

the question of who will profit from the detailed information both

sets of companies have on the online and offline habits of their

customers.

The battle lines are particularly clear in Europe, where

carriers were slower than those in the U.S. in switching to make

money from selling data rather than voice and texts. Telecom

giants, like Spain's Telefonica SA and Germany's Deutsche Telekom

AG, have long chafed that their services face industry-specific

taxes and restrictions that similar offerings from big tech firms

don't.

Big tech companies reject that notion. They argue that while

they sometimes offer comparable services, their businesses contrast

starkly—and need different rules.

"This isn't a level playing field—it's a layered playing field,

and the rules need to reflect that," said an executive at a

U.S.-based tech firm.

Tech firms say oversight from the EU's national telecom

regulators could raise costs and lead to jurisdictional disputes,

discouraging them from launching new services.

"You could see these cheaper calling options and video options

disappearing from the markets," said James Waterworth, vice

president for Europe at the U.S.-based Computer &

Communications Industry Association, a lobby group that represents

Microsoft, Facebook and Alphabet Inc.'s Google.

The new proposals are in part the fruit of telecommunications

industry lobbying over several years on issues that go beyond

relationships with tech firms.

Telecom lobbyists say they are optimistic the EU will propose

rules that would make it easier for big telecom firms to charge

more for access to new networks, something lobbyists for incumbent

telecom firms say will give them incentives to invest in faster

internet connections.

"We have high hopes and expectations that it will create the

right incentives to invest," said Steven Tas, chairman of the

European Telecommunications Network Operators' Association.

European telecom firms aren't getting everything they are

seeking. The EU, which had already passed legislation to eliminate

telecoms' lucrative roaming fees in the bloc, retreated last week

on a rule that would have limited such free roaming to 90 days a

year, after widespread outcry from consumer groups.

Another hot button is whether so-called lawful access rules,

which require telecommunications firms to allow police to install

wiretaps, should be expanded to tech firms. It isn't clear if the

EU's proposals would include such a change, but the possibility

raises the specter of renewed fighting over whether tech firms

should be forced to build in back doors to encrypted services, both

telecom and tech lobbyists say.

"There's a lot of money that operators invest in data access for

authorities," said one telecommunications executive. "It should be

same services, same obligations."

Write to Sam Schechner at sam.schechner@wsj.com and Stu Woo at

Stu.Woo@wsj.com

(END) Dow Jones Newswires

September 11, 2016 21:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

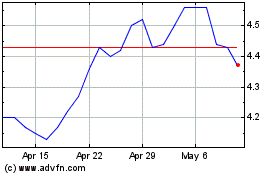

Telefonica (NYSE:TEF)

Historical Stock Chart

From Aug 2024 to Sep 2024

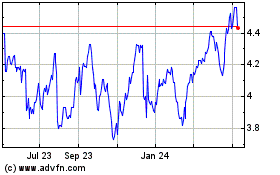

Telefonica (NYSE:TEF)

Historical Stock Chart

From Sep 2023 to Sep 2024